[ad_1]

That is the handbook for the Zone Commerce EA out there right here: https://www.mql5.com/en/market/product/127753

The EA is a handbook buying and selling software for trades to mechanically take trades at assist and resistance or provide and demand zones utilizing value motion entries inside these areas. It’s designed for use as a place buying and selling software that means there are not any fastened cease losses used. Trades that work out are merely banked and the revenue taken, commerce that don’t work out are became place trades utilizing DCA scaling in strategies to regulate the common value stage, the goal zone is then adjusted to the following logical space value will goal above the common value.

Advisable timeframes to be traded are the hourly timeframe and above as that is meant as a swing buying and selling software/technique, however you would use the EA on any timeframe. Simply bear in mind the decrease you go the extra “chop” you’ll expertise in day by day market motion and the much less dependable buying and selling zones will turn out to be.

The EA has a number of options which shall be lined right here and can also be designed for use as a coaching software within the technique tester in MT4 so you’ll be able to observe buying and selling zone bounces and place buying and selling strategies to hone your abilities at figuring out apparent ranges to commerce from and in direction of.

WHAT THE BUTTONS DO

Every button has a selected operate designed to permit you to both draw zones or shut current trades you’ve open.The purchase and promote restrict buttons when pressed will place the zone above or beneath present value and offset the closest fringe of the zone no matter you’ve enter because the a number of of ATR away from present value. Hitting this once more if a zone is in place will mechanically reset the zone to the identical distance it was initially drawn. If a zone has been disabled because it’s already been traded and also you need a new dwell zone drawn you merely hit the button once more.

BUY LIMIT – It will place the purchase zone beneath the present value

SELL LIMIT – It will place the promote zone above the present value

CLOSE – It will shut ALL trades which are open on the instrument you’re buying and selling

CL OLD – It will shut the OLDEST commerce on the instrument you’re buying and selling. Used for drawdown management when a place could also be pushing towards you and also you wish to scale out of the older components of the place and take a loss on these trades

USE IN THE STRATEGY TESTER

Content material wll seem right here shortly

USE IN LIVE TRADING

Content material wll seem right here shortly

INPUTS EXPLAINED

<<<< MAIN SETTINGS >>>>

EA works when bars shut (false = on each tick) – This accelerates again testing and ensures calculations and test for value targets are finished solely when candles shut, not on each tick. For dwell buying and selling, you might have considered trying this to work on tick, however not essential.

All the time In Mode (Exit when reverse zone trades) – When set to true, the EA will shut lengthy trades when a promote zone is reached and value triggers and entry after which mechanically get into a brief commerce so you’re “at all times in” a commerce in a single route or the opposite. Reverse performance for brief trades. Should you set this to false, the EA will simply exit the present commerce(s) when the zone is reached and value motion triggers however not enter a brand new commerce in the wrong way.

Lengthen zones if value exceeds them (deletes if false) – If set to true when value reaches a zone and a candle closes the alternative facet of a block (goes via it) the EA will mechanically develop the scale of the zone to incorporate the candle that closed outdoors the zone. Then look ahead to value motion to reverse to take a commerce. Should you set this to false and value goes via a zone with out a sign, the EA will delete the zone and wait so that you can draw a brand new one.

Zone width in candles – That is the width of the zone the EA attracts on the chart, counted in variety of candles again from present value.

Zone top as ATR proportion – That is the peak of the zone drawn with the buttons as a proportion of the ATR setting you employ (inputs beneath) and it is advisable to make use of the day by day timeframe (ADR – common day by day vary) for this which the EA is about to as default.

Zone distance from present value as ATR proportion – That is how distant from present value as a proportion of the ATR determine you employ to attract the closest fringe of the zone. Set this to one thing that you recognize value won’t attain shortly relying on the timeframe you’re buying and selling on. Round 1/4 of ADR is an effective stage initially to provide you loads of time to regulate the zone earlier than value strikes into it.

**** PRICE ACTION SIGNALS ****

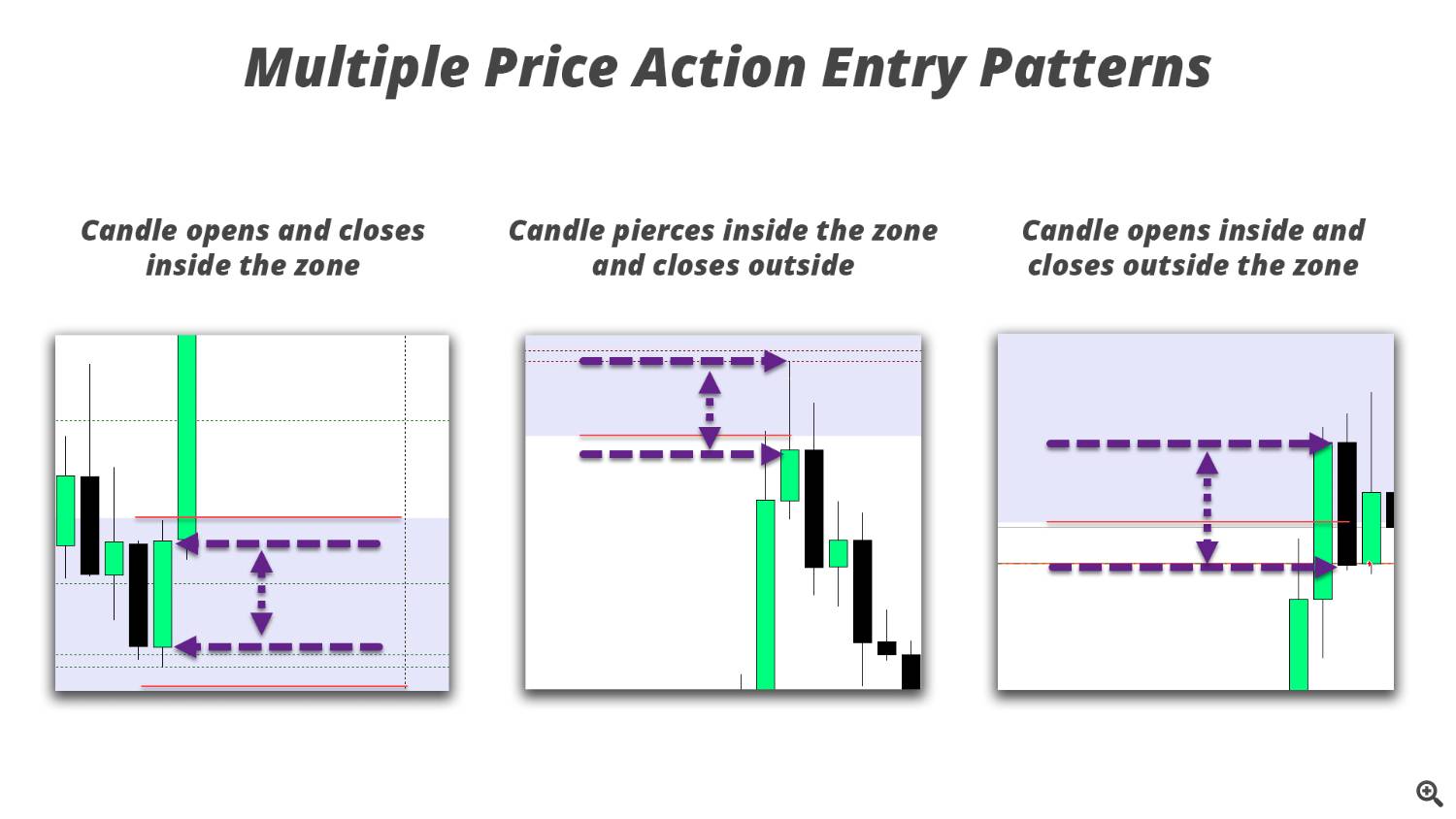

Enter if piercing into zone – For a promote zone the final closed candle will need to have a excessive above the low of the zone and the shut of the candle beneath the low of the zone. Reverse for a purchase zone.

Enter if open inside and shut outdoors zone – For a promote zone the final closed candle will need to have the open above the low of the zone and the shut of the candle beneath the low of the zone. Reverse for a purchase zone.

Enter on value motion inside zone – For a promote zone the final closed candle will need to have the open above the low of the zone and the shut of the candle additionally above the low of the zone. Reverse for a purchase zone.

**** RISK SETTINGS ****

Quantity to danger over 1 ATR (0 = use tons) – If NOT set to 0 this would be the sum of money the EA dangers over 1 measurement of the ATR you’ve chosen within the inputs beneath. It is strongly recommended to make use of ADR (day by day vary) as this ensures your trades have room to breathe. When set to 0 the EA will default to utilizing a set lot measurement.

Mounted lot measurement for first commerce – That is the preliminary lot measurement the EA will use to commerce with.

Martingale lot multiplier for added trades (tons solely) – That is the multiplier to extend extra trades taken able by. e.g. in case your preliminary commerce is 1.00 lot and also you set this to 1.5 then your second commerce shall be taken at 1.50 tons. The following at 2.25 and so forth till all trades in a single route are closed out both manually with the buttons or by hitting the alternative zone. This solely works when fastened tons are chosen as an alternative of financial danger.

Min distance between entries as a number of of ATR – That is the minimal spacing between every commerce and the EA won’t commerce if the candle closes inside this distance. Ideally you’d use a proportion of ADR (common day by day vary) to house your trades out so there may be not an excessive amount of drawdown however your common value can also be not stored too distant. The EA will draw this stage on the chart to help you in putting your subsequent zone for added entries outsize this space. A visible warning is displayed on the chart if the zone you’ve drawn is just too shut. Somethere between 0.5 and 1 ADR are good guides for buying and selling day by day ranges utilizing H1 timeframe and above.

**** ATR CALCULATIONS ****

ATR timframe – That is the ATR timeframe used for all ATR calculations for distancing, trailing cease and danger within the EA. The default is day by day so the EA makes use of ADR (common day by day vary) as a information for spacing and danger parameters.

ATR interval – That is the variety of durations (candles) again to calculate the ATR. If utilizing day by day something from 2 weeks to a couple months is an effective measure to information you as to what the instrument you’re buying and selling strikes every day. The upper the quantity the extra smoothed and fewer change you will note within the calculation and ranges/danger getting used.

**** TRAILING STOP LOSS ****

Exit utilizing a trailing cease based mostly on ATR – If set to true every particular person commerce will begin to path a cease loss both on tick or candle shut (based mostly on the enter in important settings) utilizing no matter inputs you employ beneath.

A number of of ATR for trailing cease – It is a a number of of the ATR determine you employ (ADR really useful) so as to add and path a cease by as value strikes in your route.

A number of of ATR to start out trailing cease – The trailing cease won’t begin till value has moved this far into revenue. Ideally set each of those to the identical setting to permit your commerce room to breathe.

Path cease loss to breakeven solely – If set to true the EA will cease trailing as soon as the cease is above your entry value. NOTE: If utilizing candle shut this will likely lock in revenue for you additionally relying on the scale of the candle that closed above your entry.

**** EXIT AT END OF DAY OR CANDLE ****

Exit trades at set time every single day – When set to true the EA will mechanically shut out your trades at a set time. That is helpful for these buying and selling intraday on decrease timeframes that don’t wish to maintain in a single day.

Time on chart to shut trades at every single day – Enter the time you need the EA to shut your positions if the above is about to true. Format is HH:MM, e.g. 22:30 could be 10:30pm.

Exit trades at shut of candle on particular timeframe – If set to true the EA will test on the shut of each candle on the timeframe you select and shut trades.

Timeframe to exit trades at candle shut – Choose the timeframe you wish to shut commerce on if the above is about to true.

Solely exit if trades are in revenue – If set to true the above choices for closing trades will solely occur if a selected revenue quantity has been reached. This enter is especially helpful for scalping methods and permits you to set and overlook the EA and take no matter revenue is obtainable each hour or 4 hour interval.

Minimal revenue to shut at – That is the sum of money you want to as a MINIMUM when the candle time or finish of day time above is reached.

**** EXIT AT MONEY TARGET AMOUNTS ****

Exit at an sum of money in revenue – If set to true the EA will monitor your open trades and mechanically shut them out individually if they’re above the set quantity. That is used for closing losses in addition to earnings.

Amount of cash to exit commerce in revenue – Enter the sum of money in revenue for a person commerce to be closed out at.

Amount of cash to exit commerce in loss (- neg quantity) – Enter the sum of money in loss for a person commerce to be closed out at. NOTE: This ought to be entered as a damaging quantity. e.g. -200 will shut out if you end up 200 in drawdown on the commerce.

**** EXIT AFTER AMOUNT OF TIME ****

Exit after a set period of time passes – If set to true particular person trades shall be closed out after they’ve been open for a selected period of time. That is helpful for exiting trades that stagnate and the specified motion or motion has not occurred inside a set time.NOTE: use just one and probably the most related to the timeframe you’re buying and selling on.

Variety of days – Variety of days to exit

Variety of hours – Variety of hours to exit

Variety of minutes – Variety of minutes to exit

**** TRADING TIMES ****

Use a time of day filter to restrict opening trades – If set to true the EA will solely open new trades inside these occasions. That is designed to cease the EA taking entries throughout in a single day swap durations when the unfold can get extraordinarily massive and slippage can happen as a consequence of low liquidity. It’s also possible to use this to solely commerce throughout sure market periods.

Time on chart to start out monitoring for brand spanking new entries – Time to start out buying and selling within the format HH:MM

Time on chart to cease monitoring for brand spanking new entries – Time to cease buying and selling within the format HH:MM

**** DRAWING & COLOURS ****

Present revenue & ATR knowledge on chart – When true shows the ATR, spacing, account stability and open revenue knowledge within the high proper of the chart

Show swap knowledge on chart – When true will present the swap value info for the instrument being traded. Holding swing positions for lengthy durations can turn out to be pricey so chances are you’ll wish to use this to resolve on a bias to commerce the instrument

Most damaging swap you deem too costly to commerce – If the above is true that is the utmost damaging swap which determines if the information shows nearly as good or unhealthy. This doesn’t have an effect on buying and selling finished with the EA. Enter as a damaging quantity, e.g. -5.50

Week begin line color – The color of the vertical line displayed at the beginning of the week. That is significantly helpful within the technique tester so you’ll be able to simply see time handed in positions to situation your self to how lengthy trades might soak up dwell buying and selling. Set to none if you wish to conceal this

Width of weekly begin line – Width of the above line

Zone buttons textual content color – Color for the textual content displayed on the purchase and promote zone buttons

Promote color – Color of the promote components on the chart together with the common line, textual content, subsequent entry line and the button itself

Purchase color – Color of the purchase components on the chart together with the common line, textual content, subsequent entry line and the button itself

Shut buttons color – Color of the shut buttons

Traded zone color – Color a zone turns as soon as it has been traded

Present earlier weekly ranges – Show the latest weekly ranges in your chart, that is the weekly excessive and low and infrequently value reacts round these ranges.

Variety of earlier ranges to attract – The variety of earlier weekly ranges to point out on the chart

Delete drawn objects when EA eliminated – If set to true the Ea will mechanically take away all components it creates when it’s faraway from the chart. That is useful to show to false when within the tester so you’ll be able to see revenue info and components created whereas testing.

Textual content offset in hours to proper of present candle – What number of hours sooner or later from present value the labels are shifted to the best for the common value and subsequent entry textual content.

Magic Quantity – Can be utilized to permit the Ea to take over trades you’ll have positioned with different EAs ot if you happen to use this identical EA on a couple of occasion of the identical instrument.

[ad_2]

Source link