[ad_1]

Cunaplus_M.Faba/iStock by way of Getty Photos

Intro

Zeo Vitality Corp. (NASDAQ:ZEO) prides itself on being a differentiated vertically built-in residential photo voltaic firm. The corporate is a residential photo voltaic vitality system supplier, presently servicing markets in Florida, Arkansas, Missouri & Texas. Given the latest profitable mixture between ESGEN Acquisition Corp. and Sunergy Renewables, administration now expects that sturdy trade tailwinds coupled with the benefits of the brand new entity (Zeo Vitality) going public will finally drive development ahead.

In regards to the pricing of conventional electrical energy, price inflation has wreaked havoc within the residential house in recent times, particularly for the reason that aftermath of the pandemic. Moreover, when one combines the above pattern with local weather change & the proliferation of renewable vitality know-how, it stands to motive that there ought to be ample runway for development for Zeo Vitality’s renewable choices. Then you may have the vertically built-in mannequin, which is a significant plus because the lion’s share of Zeo’s competitors will contain a number of exterior corporations or subcontractors, whether or not they be roofers or plumbers, alongside the worth chain, and many others.

Trade Tailwinds Gaining Traction

Due to this fact from a governmental standpoint (the place local weather change & decreasing carbon emissions have develop into paramount), plus the not too long ago enacted Inflation Discount Act within the US, we consider loads of sources will proceed to be thrown at renewable applied sciences within the hope the general public will make the ‘change’ on mass. In Zeo Vitality’s case, a robust promoting level is the potential for promoting unused vitality again to the grid or charging an electrical car with mounted photo voltaic panels. Suffice it to say, that sturdy causes for making the change to inexperienced applied sciences will solely amplify over the following couple of years. As we now have seen with ‘electrical autos’ nonetheless, excessive costs & lack of charging infrastructure imply that clients ‘in the primary’ proceed to attend on the sidelines.

Due to this fact, as buyers, it’s this ‘important mass’ an infection level concerning gross sales development (that we now have not arrived at but) that we would want to see in Zeo Vitality’s financials earlier than placing capital to work on the lengthy aspect right here. This inflection level can happen if conventional vitality costs had been to proceed to rise however a fall in worth was forthcoming in Zeo’s photo voltaic panel choices. This might imply that the client’s ‘payback’ time or ‘return on funding’ can be significantly extra enticing than what it’s at current. Due to this fact, the 2 preliminary causes we might give for our warning in Zeo Vitality can be the next.

As we see from the motion of the inventory’s share worth beneath, Zeo inventory is in agency bear market territory having seen its share worth fall by nearly 70% already this 12 months. Though bullish buyers might even see this as a chance (given how low-cost the corporate’s gross sales are presently to what they had been), we would want to see technical affirmation of a agency backside adopted by moving-average power earlier than getting lengthy on the inventory. We did witness a 50%+ rally in Zeo in mid-March this 12 months after making its public debut however the rally sadly was short-lived. Given Zeo’s low margins, economies of scale will probably be wanted to enhance the corporate’s earnings for the higher. To the purpose, Zeo’s first quarter numbers for this current fiscal 12 months (the place we witnessed a rolling quarter top-line development charge of a mere 4%) did little to show that strong top-line development is simply across the nook.

Zeo Vitality Chart (Searching for Alpha)

Q1 Earnings

In Zeo’s first quarter of this current fiscal 12 months, the corporate reported as talked about 4% top-line development with gross sales coming in at $19.5 million for the quarter. The significant contraction in gross revenue nonetheless led to a unfavorable GAAP bottom-line printo of -$1.9 million for the quarter. The CEO acknowledged that the short-term ramifications of the merger with ESGEN Acquisition Company regarding prices & the anticipated easing off of excessive tools pricing ought to now imply the mixed entity (Zeo Vitality Corp) ought to now begin a robust development path.

This stays to be seen however the growth of the corporate’s gross sales & set up capability into Illinois & Ohio within the first quarter is encouraging for the next motive. The next two quarters of the 12 months (Q2 & Q3) are when photo voltaic installations will probably be at their peak which implies the market will probably be acutely anticipating a lot better financials throughout this era. Because the CEO acknowledged within the Q1 earnings launch, a drop in inflation mixed with a fall in rates of interest would do wonders for buyer affordability so right here is the place Zeo wants the macro image to cooperate to a large diploma.

We see optimistic indicators that the headwinds dealing with our trade are beginning to dissipate in lots of areas across the nation and anticipate extra favorable tools pricing all year long in addition to secure or declining rates of interest. Historically, our gross sales drive drives the most important share of our yearly set up quantity in the summertime months from Might to September. We’re already returning a major variety of profitable gross sales managers in addition to new representatives to the sector, indicating development in our general numbers for 2024 throughout gross sales and installations. With transaction prices from our profitable enterprise mixture behind us, we count on that our profitability will return to historic ranges of development all through the rest of the 12 months as properly.

Dangers

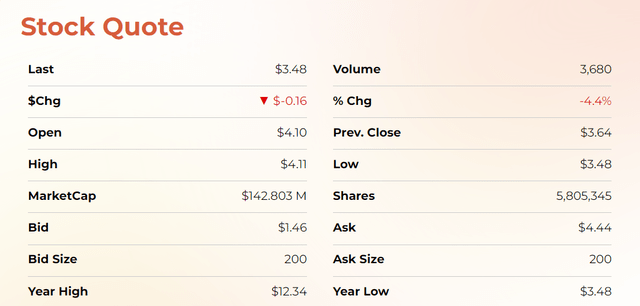

Given trailing 12-month gross sales are available in at $110.8 million & Zeo’s current market cap is available in at $142.8 million, we are able to state that the corporate’s trailing gross sales a number of is available in at 1.29. This valuation is an efficient place to begin though the micro-cap nature of Zeo Vitality plus the inventory’s below-average buying and selling quantity inherently means volatility might certainly stay elevated till a convincing change in pattern is confirmed.

Moreover, though Zeo’s vertically built-in mannequin is extra enticing to clients, gross sales personnel nonetheless must persistently run the numbers regarding knocking on as many doorways as potential to generate prospects. So far, the dearth of a excessive variety of ‘repeat’ clients means many offers stay ‘one-off’ purchases regardless that profitable installs can be utilized as highly effective testimonials, particularly in native areas. For this reason as talked about, the macro image should stack up for Zeo Vitality to make sure its merchandise may be scaled & put in on mass (which is what will probably be wanted for margins to develop in earnest)

ZEO Inventory Quote (Firm Web site)

Conclusion

Due to this fact, to sum up, we charge Zeo Vitality Corp a ‘Maintain’ at this juncture- Though the latest merger has arrange the corporate for development in a number of markets, the market is acutely awaiting extra scale so income may be ratcheted up considerably. Let’s examine what Q2 numbers deliver. We sit up for continued protection.

[ad_2]

Source link