[ad_1]

Photographs By Tang Ming Tung

The SPDR S&P Retail ETF (NYSEARCA:XRT) gives focused publicity to the main U.S. retailers. The fund does a great job of capturing the high-level developments in shopper spending.

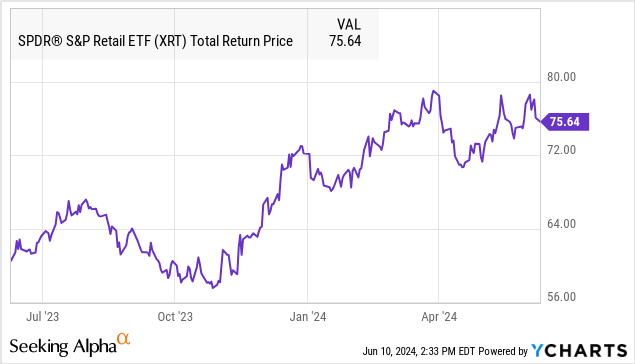

This phase has gained momentum over the previous 12 months amid the resiliency of the U.S. financial system, shifting previous the tougher interval between 2022 and 2023 outlined by rising rates of interest and elevated inflation. Certainly, XRT has returned greater than 25% over the previous 12 months, benefiting alongside the improved sentiment within the broader inventory market.

As we method the second half of the 12 months, it is honest to query whether or not the current momentum can proceed. We’re seeing blended indicators from key retailers, including a layer of warning to the outlook. We’ll try and dissect the themes at play and our view on the place XRT is headed subsequent.

What’s the XRT ETF?

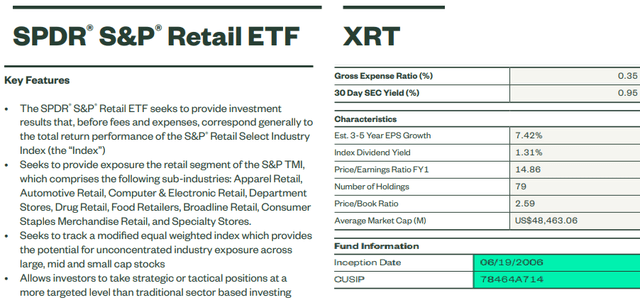

The XRT ETF is meant to passively monitor the “S&P Retail Choose Business Index” masking the next sub-industries: Attire, Automotive, Laptop & Digital, Division Shops, Pharmacies, Meals Retailers, Broadline Retail, Client Staples Merchandise, and Specialty Shops.

The time period retail has a broad definition with the notable exception right here in that the fund doesn’t embody home-improvement or furnishings retailers as that phase follows extra of the developments within the housing market than shopper spending.

supply: State Avenue

What’s fascinating concerning the XRT is that the fund makes use of a modified equal-weighting method throughout all its 79 holdings.

Which means that smaller specialty retailers like Foot Locker (FL), Hole (GPS), and even car dealerships reminiscent of AutoNation (AN) have an identical contribution to the general portfolio as mega-cap names reminiscent of Amazon (AMZN), and Walmart (WMT).

This dynamic is essential because it makes XRT a possible portfolio diversifier in distinction to a market-cap-weighted technique that will be dominated by prime holdings in AMZN or Costco Wholesale Corp. (COST).

Given the in depth portfolio, with the typical inventory representing lower than 1.5% of the general publicity, no single identify will dominate the efficiency.

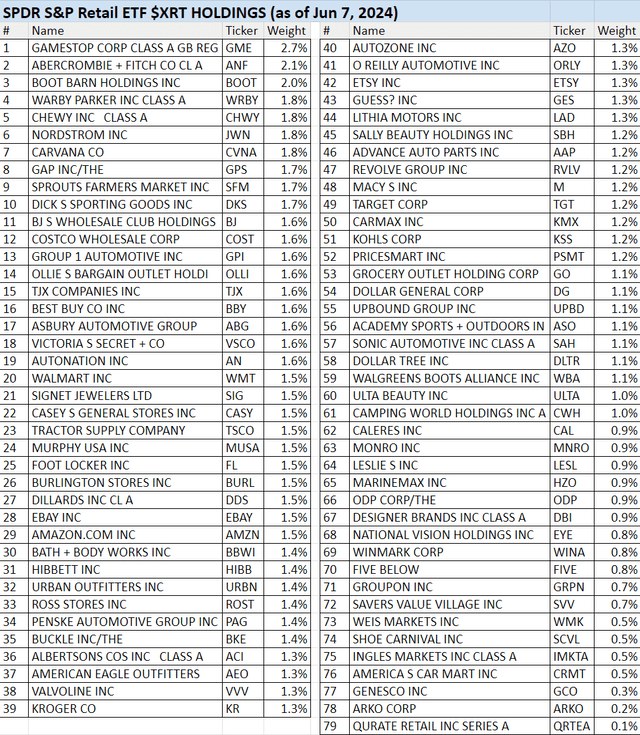

supply: State Avenue (desk by creator)

XRT Efficiency

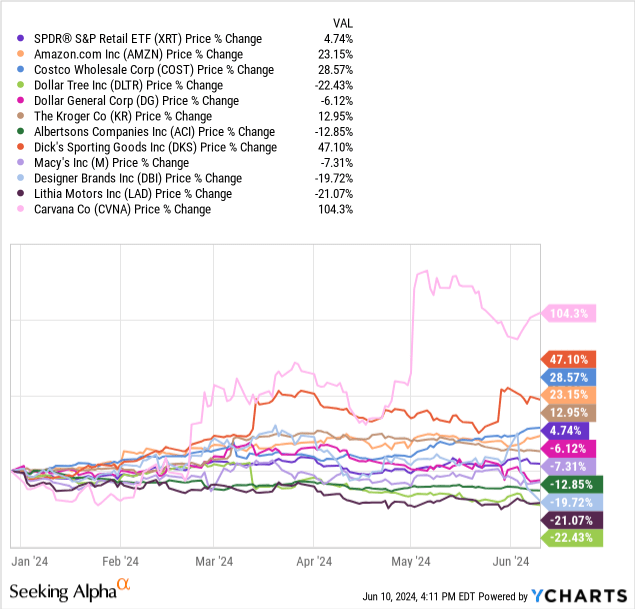

We talked about the blended indicators from main retailers. That theme is clear after we take a look at the current inventory worth efficiency, with a large divergence amongst winners and losers to start out 2024.

Carvana (CVNA) stands out as an outperformer, with shares greater than doubling year-to-date. Then again, its peer group with names like Lithia Motors (LAD) or Penske Automotive Group (PAG) have fared worse with a decline in 2024.

Grocery chain Kroger (KR) has a constructive achieve this 12 months, whereas shares from its competitor in Albertsons Firms (ACI) are down. Low cost shops reminiscent of Greenback Tree (DLTR) and Greenback Common (DG) have typically lagged.

The understanding is that whereas your complete trade faces related macro situations impacting progress and demand, company-specific fundamentals play a key position in driving every inventory’s efficiency. Naturally, the XRT ETF finally ends up as the typical from this group.

A number of feedback from administration groups in the course of the Q1 earnings seasons describe the blended developments corporations are dealing with.

Goal (TGT) famous shopper “discretionary softness” in explaining its Q1 comparable gross sales weak point. Shares of Walmart are benefiting from an obvious inflow of bargain-hunting high-income customers. Abercrombie & Fitch (ANF) is buying and selling at an all-time excessive following report outcomes and an upbeat outlook. Dillard’s (DDS) pointed to a “difficult” gross sales surroundings in explaining its gross sales decline final quarter.

A majority of these conflicting reviews spotlight the issue in forecasting the trade, significantly amongst risky macro situations.

What’s Subsequent For XRT?

With the inventory market as measured by the S&P 500 Index (SP500) at an all-time excessive, there is a sense of optimism towards the ahead financial outlook.

The bullish case for retailers is {that a} resilient labor market represents a tailwind for shopper spending, whereas a path for the Fed to chop rates of interest into 2025 might result in the beginning of a brand new credit score progress cycle. Firms have made efforts to streamline operations in help of margins as a response to inflationary value pressures lately. A situation the place demand from customers sees a brand new spherical of momentum may very well be a strong driver for larger earnings.

Then again, that very same rosy outlook is much from sure. Current information together with a stronger-than-expected jobs report for Could together with stubbornly excessive inflation above 3% has pushed again on any timetable for these long-awaited Fed price cuts.

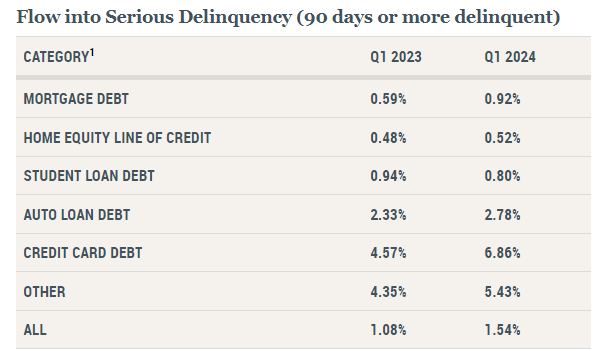

Different indicators reminiscent of climbing shopper credit score delinquency charges might level to what stays extra fragile situations. Based on the Federal Reserve Financial institution of New York Family Credit score and Debt report for Q1 2024, delinquencies have climbed throughout main credit score classes like bank card debt, and auto loans to start out the 12 months. Additional weak point right here might pose a menace to retailers on the demand facet.

supply: New York Fed

Ultimate Ideas

We price XRT as a maintain, balancing the confirmed potential of main shares within the group to navigate potential macro headwinds towards the extra sophisticated outlook.

The following a number of months of financial indicators together with developments for inflation, the labor market, and retail gross sales will likely be crucial to set the tone for the trade into 2025. On the upside, confidence that the Fed has room to chop charges whereas shopper spending stays sturdy might jump-start a brand new spherical of constructive trade sentiment.

[ad_2]

Source link