[ad_1]

SDI Productions/E+ by way of Getty Photographs

MidCap Monetary (NASDAQ:MFIC) continues to report Internet Asset Money stream above its dividend at $0.38 per share with the final quarter reporting sustained earnings at $0.44. Greater rates of interest positively contributed to the outcome, but administration believes that the present dividend is sustainable for a number of quarters underneath any and all rate of interest situations. We publish articles quarterly on MidCap, primarily as a result of that is our second-largest enterprise growth (BDC) holding. Additionally it is our favourite. Our final printed article in March, MidCap Monetary Went Conservative However Nonetheless Presents Buyers A Compelling Alternative, mentioned excessive yields at current inventory costs. We proceed that dialogue with a caveat, the value moved considerably larger signaling a possibility door is perhaps closing. The ATM is simply throughout the road. Cross with me in the event you wish to make a transaction.

Quarter

Famous above, MidCap Monetary is a BDC focused at mid-range dimension alternatives whereas investing in solely very excessive senior debt. On the name, administration famous,

“We consider MFIC has one of the vital senior company lending portfolios amongst BDCs as evidenced by our weighted common attachment level of primarily zero. We consider we’ve got constructed a company lending portfolio that may carry out properly even throughout a possible financial downturn.”

As well as, the reported enterprise parameters embrace:

Company lending at 92%. 97% 1st lien. 2nd lien publicity at lower than 0.7%, virtually zero. Investments in Merx plane now totals lower than $190 million. PIK earnings stays low at 3%. A web asset worth of $15.42. Internet leverage of 1.35. Paying a de minimis quantity of excise tax in March. Non-accruals remaining very low, totaling $14.4 million, or 0.6%.One entity, Naviga, is now in liquidation with the proper market worth said in firm stories. Undistributable taxable earnings of $67.3 million or $1.03 per share.

Up to now, administration reported no indicators of credit score weak spot.

The worth of the inventory has been within the $16s however fell into the low $15s.

On this article, we listed a number of key parameters marking a final reference earlier than the corporate most certainly merges.

The Merger

A number of months prior, MidCap introduced a merger with two different Apollo Group investments, Apollo Senior Floating Charge Fund Inc. (AFT) and Apollo Tactical Earnings Fund Inc. (AIF). The senior floating fee fund invests in company senior notes rated beneath funding grade. Tactical Earnings blends senior loans with excessive yield company bonds. Administration of the three teams introduced that MidCap reached the mandatory 50% plus for merging, however that the opposite two had been a couple of proportion factors quick, roughly 48%, on the finish of Could. A further month was added for buyers to vote.

After the Merger View

With a merger probably coming, Kyle Joseph of Jefferies requested, “However did you give a way or professional forma leverage or ballpark space post-merger?” Tanner Powell, firm CEO, answered, “We’ll be someplace round between 1.15 and 1.2 occasions levered.” It is a far cry from the present 1.35 degree. Additionally, with the 2 different entities possessing largely senior liens, dangers stay low. At previous conferences, when requested about timing for changing the merged entities into the MidCap devices, administration said occasions from simply greater than a 12 months to some years. It relies upon upon market power. With the anticipated conversion strategy, dividend yields will stay unchanged for all holders. As soon as accomplished, the mixed group could have lots of dry powder from which to speculate leaving open potentialities for future dividend will increase.

The Market

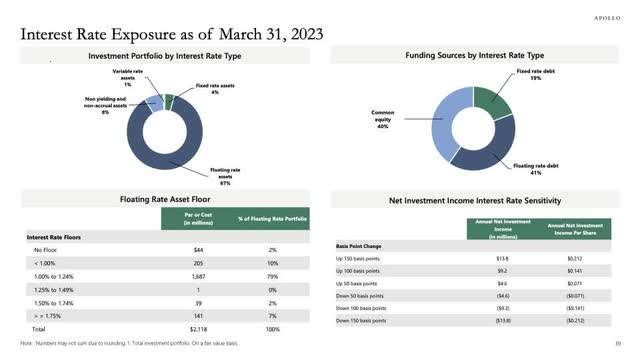

The corporate addressed a number of essential market circumstances. We start with the elephant within the room. A number of BDCs use floating fee loans which have barely constructive biased returns at larger charges. MidCap is one which has benefited. The following slide from March of 2023 exhibits a relative relationship.

MidCap Presentation

At a 150-basis level change, the portfolio losses roughly $0.20 per share per 12 months or $0.05 per quarter. A number of essential elements come into play for figuring out dividend security. First, present earnings which common $0.45 per quarter, are properly above the dividend. Second, the power to generate larger earnings by way of will increase in leverage from its 1.35 to 1.50 nonetheless exists. And third, a 12 months in the past, administration minimize its payment schedule. Greater investor yields from decrease charges continues to be within the early inning. At $0.38 per quarter, the dividend is clearly protected even with considerably decrease charges.

However the query stays, what is going to the Fed do? At 12 months’s starting, most believed that the Fed would possibly minimize charges a number of occasions. On the name, the corporate reported that Apollo’s Chief Economist believed that zero cuts had been extra probably in 2024. Maria Bartiromo hosted visitor Peter Anderson on a current present. His remark, 4% – 5% charges. are the long-term norms and would possibly by no means be lowered besides in uncommon circumstances. That may be a arduous argument to counter in our view.

On the opposite aspect of the coin, the latest employment report claimed vital job development with the headline of 272,000 new jobs. However once more, the underlining Family Survey confirmed extreme weak spot at a lack of 406,000. Unemployment jumped to 4% indicating how dangerously shut a recession is. However the so-called red-hot headlining quantity probably took any minimize in September off the desk.

After which at Could assembly, Chairman Powell supplied buyers a state of affairs which cuts as soon as or 0.25% in 2024. This can have a minor unfavorable have an effect on on MidCap’s earnings.

Persevering with, administration mentioned the ever-important weighted common web leverage of latest commitments being at a powerful 3.9 occasions. Additionally they famous {that a} degree of market power appeared within the quarter stating,

“We consider the danger return on these new commitments could be very compelling. Our pipeline of funding alternatives stays robust.”

For buyers, MFIC deal with the center market, makes it “much less vulnerable to competitors from the syndicated mortgage market.” Final quarter, the corporate averaged 624 foundation factors for spreads unchanged from the earlier quarter. The OID unfold represents asset yields at 12%.

{The marketplace} has weakened some however generates nonetheless profitable returns. That is additionally a parameter to fastidiously comply with.

Dividend

The corporate held the dividend fixed, which is considerably lower than earnings. It additionally continues to carry-over excesses. Administration reminded analysts that after the merger is permitted, MidCap buyers will obtain a $0.20 particular dividend.

A Chart

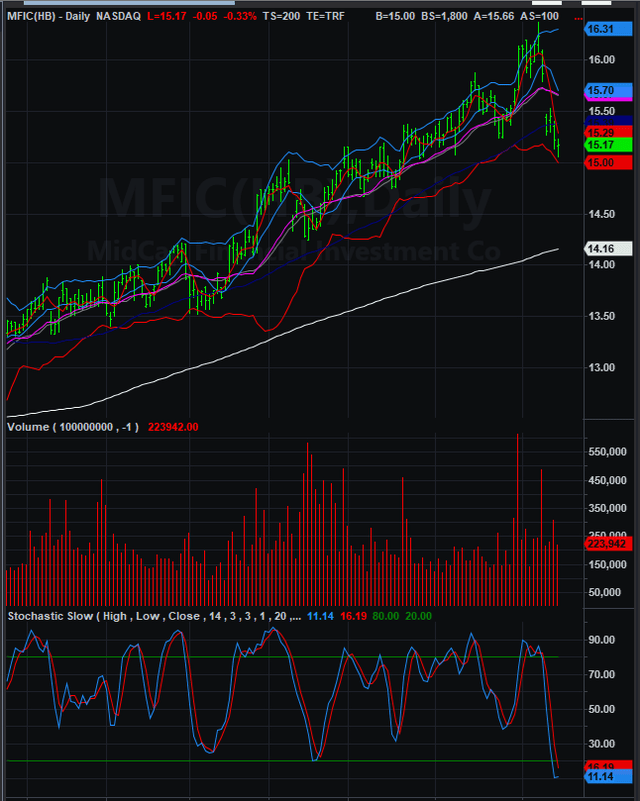

Included subsequent is a MidCap chart generated utilizing TradeStation Securities.

TradeStation Securities

The worth had a pleasant long term from the $12s eight months in the past, to the low $16s. A break within the worth upward motion was clearly warranted. With the value now decrease by over a $1 and the day stochastic underbought, buyers would possibly take note of purchase.

Dangers

We mentioned a threat from decrease charges, which may decrease efficiency. Additionally, the price of borrowing elevated barely from 6.94% to 7.09% as a result of current issued CLO being totally included. On the opposite aspect with decrease charges, debt prices can even fall in a comparatively correlated vogue. A recession, which appears a lot nearer than ever, additionally may put downward strain on funding yields, besides the corporate now has minimal 2nd liens and cyclical enterprise publicity. Our greatest concern, for getting at this level, is worth, which has fallen some extent from its excessive, sufficient in our view to entice buyers to observe for an entrance. On the idea of yield, inventory costs above $17 would change our ranking to a promote. It’s about yield not concerning the worth or well being of the corporate. We proceed a purchase within the $15s. The ATM has some huge cash to dispense. Put your card in and revel in.

[ad_2]

Source link