[ad_1]

Subsequent 12 months, Norges Financial institution, Norway’s Central Financial institution, goes to make a serious resolution relating to the potential of creating its personal CBDC, or central financial institution digital foreign money.

In line with Deputy Governor Pal Longva, the central financial institution was transferring towards finalizing the advice, although it didn’t really feel just like the work needed to be fast-tracked instantly.

Certainly, different European nations, like Switzerland, have been transferring forward on digital foreign money tasks. Norway, then again, will all the time take its time and transfer cautiously.

“We’re in keeping with many central banks — we’re learning advanced points and have a lot to contemplate earlier than continuing,” Longva stated throughout an interview in Oslo.

He expressed how Norway hasn’t fallen behind within the recreation whereas Switzerland, as an example, can be on tempo, pushing forward in comparable plans. Norway is weighing the complexities concerned earlier than committing to any type of a CBDC program.

Evaluating Retail Vs. Wholesale CBDC Choices

Norges Financial institution is at present creating two attainable fashions for CBDC, together with retail CBDC, which shall be utilized by shoppers, and wholesale CBDC for transactions between banks.

At the moment, Norges Financial institution focuses extra on the wholesale CBDC strategy, which is presently gaining a powerful foothold in numerous research by central banks all over the world.

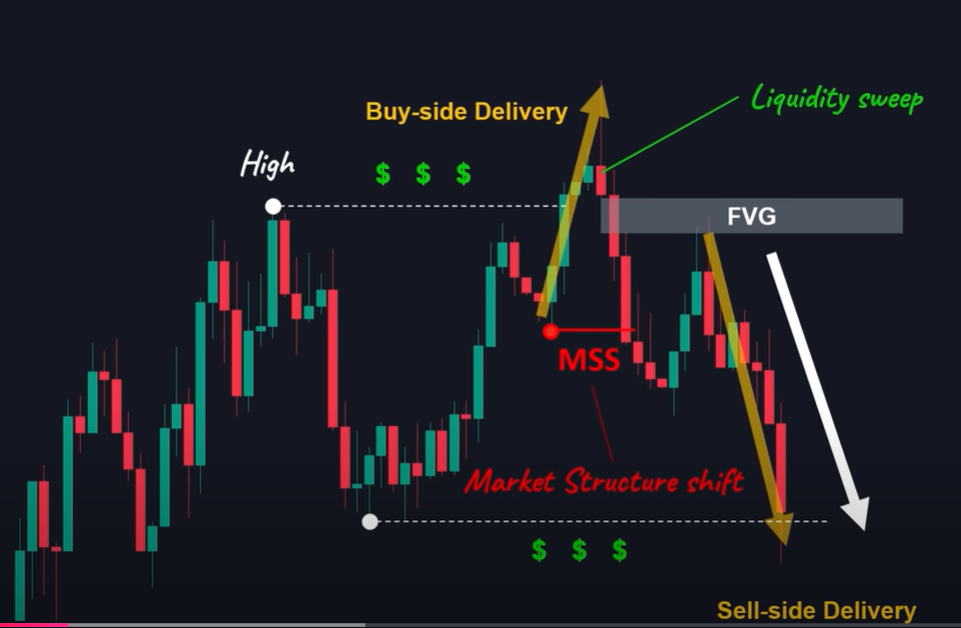

BTCUSD buying and selling at $67,024 on the day by day chart: TradingView.com

Longva stated {that a} wholesale model of CBDC could also be simpler to deploy than a retail model as a result of, for now at the very least, it poses issues that seem a bit extra sophisticated and require additional dialog with non-public banks in addition to different stakeholders.

Different central banks are additionally trending to the wholesale mannequin, in accordance with the Financial institution for Worldwide Settlements survey. The newest insights counsel that it’s extra possible {that a} wholesale CBDC shall be launched into circulation inside a six-year interval than a retail CBDC.

A Steady Cashless Society

Norway is without doubt one of the most cashless societies on the earth as a result of 98% of its inhabitants makes use of debit playing cards and over 95% depends on cell fee platforms, in accordance with the Buying and selling Platforms’ survey carried out in 2023.

Supply: Cash

Supply: Cash

Though the usage of money has declined sharply, current figures present that it has flattened out at low ranges. Solely 2% of respondents reported utilizing money at their final buy in a bodily retailer, in accordance with a Norges Financial institution survey.

With that gentle migration into digital funds, Norges Financial institution is contemplating all of the implications of a CBDC, particularly in its privateness issues, and impacts on the banking sector. It’s the prerogative of the federal government to resolve whether or not or not Norway will use a digital foreign money.

All that the central financial institution is attempting to do is to present its suggestion by 2025 after ending the research and consultations.

Featured picture from Innovation Norway, chart from TradingView

[ad_2]

Source link