[ad_1]

JHVEPhoto

PayPal inventory (NASDAQ:PYPL) has misplaced greater than 10% of its worth since key competitor Apple (AAPL) deepened its foray into client fee options with the launch of “Faucet to Money” in early June. Regardless of PayPal’s Q2 beat and lift, the inventory’s responding uplift has but to get well from its intra-quarter declines. As we had mentioned in a earlier protection, Apple Pay’s deeper penetration into client fee options has come immediately for PayPal’s Venmo monetization efforts this yr.

Admittedly, PayPal administration has delivered constant constructive progress on its “transition yr”. That is corroborated by the Q2 beat and lift, which consisted of sturdy topline and whole fee quantity (“TPV”) progress to assist margin growth and an elevated capital returns program for 2024. The stellar outcomes additionally proceed to focus on administration’s dedication to driving worthwhile progress via prioritizing branded quantity progress and worth to worth enhancements in unbranded checkout.

But we stay cautious of administration’s growing lack of focus in making certain mass market adoption and long-term stickiness to the enhancing PayPal ecosystem, which they’ve been working arduous to revamp. This accordingly raises issues concerning the long-term sustainability of PayPal’s present FCF progress trajectory, which is essential to its beneficiant capital returns program via share buybacks, in addition to its valuation prospects.

Though the inventory stays discounted at present ranges on each an intrinsic and relative foundation, particularly given beneficial near-term prospects, we stay incrementally cautions on PayPal’s outlook for a sturdy upward valuation re-rate.

Idiosyncratic 2H24 Tailwinds

Regardless of typical seasonality weak spot in client end-markets, PayPal has delivered a “front-end loaded yr” with constant outperformance via 1H24. And we count on this development to proceed via the latter half of the yr, per administration’s choice to boost their steering for PayPal’s full yr 2024 earnings to a variety of $3.88 to $3.98 (beforehand ~$3.65). That is supported by a number of PayPal-specific tailwinds later this yr, which is able to complement the upcoming back-to-school and vacation purchasing season essential to its TPV.

The upcoming common availability of Fastlane in August is anticipated to be a key company-specific power later this yr, complementing seasonality tailwinds from back-to-school and vacation purchasing. Recall that Fastlane is certainly one of PayPal’s core product innovation this yr, deepening its concentrate on making a frictionless buy course of by enabling fast-tracked visitor checkout for customers. Fastlane by PayPal saves client fee and delivery particulars throughout their first checkout expertise at a supported service provider storefront. This basically unlocks one-click visitor checkout on all future purchases at on-line storefronts that assist Fastlane by PayPal for the consumer, making a seamless fee course of for customers whereas additionally driving conversion for retailers.

Particularly, early adopters of Fastlane throughout the pilot section have proven a median conversion fee of 80%, versus as much as 50% with out the characteristic. This has resulted in a low double-digit uplift in visitor checkout conversion for retailers that assist Fastlane, highlighting the product’s worth proposition. Fastlane can also be not restricted to PayPal customers. Customers that decide into Fastlane don’t want a PayPal account or pockets, permitting the corporate to higher penetrate end-market pockets share. With Fastlane rolling out to all customers and retailers forward of the vacation purchasing season, we count on the product to be an additive TPV progress driver. This is able to additionally inadvertently profit transaction margin {dollars} by enhancing economies of scale in lower-margin unbranded volumes.

Along with Fastlane, PayPal’s technique of enhancing SMB penetration with PayPal Full Funds (“PPCP”) continues to make progress. PPCP is actually a funds resolution one-stop-shop curated for SMB retailers, giving them entry to PayPal’s newest and best branded checkout options and different value-added companies. PPCP penetration has possible jumped from 7% in Q1, given the cohort’s TPV progress of greater than 40% via the primary half of the yr. This additionally highlights additional headroom for accelerated SMB service provider adoption via the vacation purchasing season later this yr.

The SMB-focused product has continued to show itself an accretive issue to transaction margin {dollars}. Not solely does it enhance PayPal’s publicity to increased margin branded checkout volumes, however it additionally improves the corporate’s worth to worth functionality by concentrating on the SMB service provider cohort that has much less pricing energy. This compares to PayPal’s bigger enterprise service provider base which have traditionally pressured the corporate’s margins.

Though PayPal can generate higher worth to worth from the SMB service provider base by profiting from their weaker pricing energy, the corporate doesn’t supply any much less worth proposition to the cohort. Particularly, SMBs which have adopted PPCP proceed to display double the income per account in comparison with these on legacy integrations.

PPCP has additionally inspired increased service provider uptake of PayPal’s expansive product portfolio, resembling Venmo, PayPal Branded Checkout, Pay Later, and PayPal Credit score. By enhancing SMBs’ entry to the market’s ever widening array of fee strategies, PPCP successfully helps the service provider base scale back their publicity to deserted purchasing carts at checkout. This, in flip, reinforces scale to PayPal’s branded and unbranded volumes as effectively, driving ensuing enhancements to take charges and transaction margin {dollars}. That is corroborated by the maintained common uptake of 4 merchandise noticed throughout PPCP retailers, highlighting PayPal’s potential to forge deeper buyer relationships with the platform, thus lowering the corporate’s publicity to churn dangers.

And to additional enhance adoption, PayPal has additionally ensured the incorporation of low or no-code integration instruments, which allows additional effectivity beneficial properties essential to cost-sensitive SMBs. We consider PPCP stays a essential instrument for PayPal in capturing higher-margin TPV from the underpenetrated SMB market forward of the vacation purchasing season.

Adoption Curve Uncertainties for “First Look” Improvements

Admittedly, administration’s continued dedication to driving up penetration of higher-margin branded volumes stay essential to their concentrate on making certain sustained worthwhile progress at PayPal. That is evident in PayPal’s’ deepening push into gaining share within the underpenetrated SMB market with PPCP as mentioned above, whereas additionally rolling out instruments like Fastlane to converge branded and unbranded volumes and enhance their respective economics.

Nevertheless, we see restricted sturdiness to PayPal’s current efficiency enhancements. Whereas the First Look improvements are a step in the fitting route, we’re cautious concerning the lack of a sustainable flywheel on this technique. Particularly, PayPal seems to be missing a gateway to make sure speedy client adoption of its new merchandise, which might be essential to reinforcing stickiness to its broader platform. Solely this might actually give PayPal leverage in producing better service provider adoption of its progressive fee options and instruments, like Good Receipts and Venmo Enterprise Profiles, which underpins the technology of advantages proper again to customers to encourage adoption.

Missing Gateway to Sustained Adoption

As an example, there may be an growing gross merchandise worth (“GMV”) combine shift in direction of on-line marketplaces resembling Amazon.com (AMZN). The e-commerce large presently generates an estimated $700+ billion in GMV, which is 7x of second runner-up Walmart’s (WMT) $100 billion reported final yr. And the shortage of PayPal’s presence within the e-commerce large’s checkout web page attracts inquiries to the long-term sustainability of its current monetary enhancements generated primarily from SMB penetration.

Admittedly, SMBs characterize an underpenetrated alternative in e-commerce fee options, with nearly all of their storefronts nonetheless primarily offline or within the technique of coming on-line. However growing adoption of multichannel commerce is enhancing integration of impartial service provider storefronts with bigger on-line marketplaces that boast the best publicity to client pockets share. And this convergence is clear in current e-commerce partnerships, resembling Shopify’s (SHOP) current partnership with Amazon via the mixing of “Purchase with Prime” for its service provider base. The partnership has possible been additive to Shopify Checkout volumes, because it helps Purchase With Prime integration. This has allowed Shopify to piggyback on Amazon’s sturdy Prime membership base, and the purchasing vacation spot’s deep attain into client wallets, which was evident within the platform’s newest gross sales file for Prime Day.

Admittedly, further partnerships with giant enterprises and on-line marketplaces past Walmart and eBay (which lately began supporting Venmo) is perhaps incrementally margin dilutive, given PayPal’s comparatively decrease pricing energy. Nevertheless, the technique could also be proving more and more obligatory to enhance sustained Branded Checkout adoption amongst customers. We consider this technique might create a long-term self-sufficient flywheel to optimize the worth that current improvements can generate for all of PayPal, its retailers and its customers.

Particularly, by probably partnering with Amazon, PayPal Checkout might acquire better recognition and adoption via the expanded client base. This is able to accordingly add worth to lately launched consumer-focused merchandise, resembling Good Receipts and Superior Provides Platform, which is linked on to Branded Checkout utilization. And the ensuing perks to customers would then reinforce their recurring utilization of Branded Checkout, which improves PayPal’s worth proposition to retailers, enabling a self-sufficient flywheel. Though further partnerships with giant enterprises like Amazon dangers margin dilution, it might characterize an efficient go-to-market price that retains giving. And PayPal has the money flows to maneuver ahead with related investments, which might probably result in long-term returns as enhanced PayPal Checkout publicity via marketplaces like Amazon would possible reinforce client recognition and adoption of PayPal ecosystem instruments for each on-line and offline purchases.

Missed Model Consciousness Alternatives

One other potential key to additional optimizing the worth of PayPal’s current improvements is leveraging world occasions to enhance its model publicity. We consider the upcoming Olympics was a missed alternative for PayPal. Admittedly, Visa (V) has lengthy been the Olympics’ key funds companion and sponsor. Nevertheless, PayPal – like many others within the broader tech trade – might have higher leveraged the worldwide occasion in enhancing its model recognition and higher its seize of related cyclical tailwinds.

For PayPal particularly, which has a considerable publicity to modifications in retail spending, the approaching Olympic Video games is estimated to generate a further $100 million in world gross sales from their licensed merchandise alone. In the meantime, the Paris Tourism Workplace estimates an incremental $2.8 billion in Olympics-related tourism income this summer season.

With greater than 40% of customers in France already utilizing PayPal, the Paris Summer time Olympic Video games would have represented a beneficial alternative for the corporate to enhance its model publicity and uptake. This is able to have additionally been complementary to PayPal’s ongoing efforts this yr in enhancing underutilized merchandise, resembling its concentrate on enhancing monetization of Xoom. And on the service provider entrance, with lots of PayPal’s merchandise aimed toward dealing with overseas change transactions and making a seamless course of for accepting worldwide funds, the corporate might have taken benefit of the worldwide occasion as a chance to display its worth proposition.

Elementary Issues

Regardless of being incrementally cautious concerning the missing sturdiness to PayPal’s long-term progress outlook, we consider administration’s raised steering for full yr 2024 proves conservative nonetheless given the corporate’s constant outperformance within the first half. That is supported by ongoing worth self-discipline noticed at Braintree, as evident in PayPal’s sequential transaction margin growth, which stays accretive to the corporate’s profitability and money flows. In the meantime, PPCP adoption amongst SMBs stay robust, driving additional accretion to transaction margin {dollars}. The corporate additionally faces additive progress tailwinds to TPV with the upcoming common availability of Fastlane, which is anticipated to enhance the back-to-school and vacation purchasing season which have traditionally been a boon to PayPal’s efficiency.

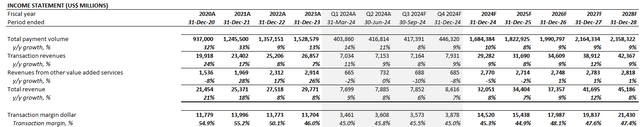

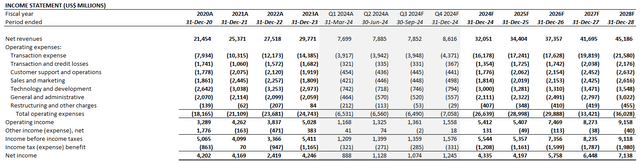

Taken collectively, we count on PayPal to develop 2024 revenues by 8% y/y to $32.1 billion. This is able to be pushed by TPV progress of 10% y/y to $1.7 trillion, with a transaction take-rate of 1.74% in keeping with administration’s expectation of moderating headwinds from PayPal’s unbranded-weighted income combine. Contemplating incremental accretion from ongoing worth self-discipline actions at Braintree, scale from robust PPCP uptake, and additive progress to TPV anticipated from Fastlane’s common availability, we estimate $14.5 billion in transaction margin {dollars} for full yr 2024, which might characterize 6% y/y progress.

Creator

This mixture possible means that the upper vary of administration’s steering for mid-to-high single digit non-GAAP earnings growth this yr as the bottom case. We consider this might additionally reinforce confidence in expectations for $5+ billion in FCF this yr to bolster PayPal’s capital allocation priorities, which embrace a raised share buyback finances from the earlier $5 billion to now $6 billion, in addition to continued progress investments.

Creator

Valuation Issues

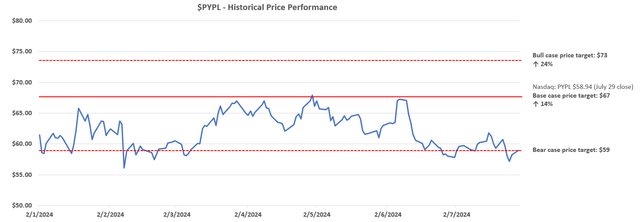

Though PayPal has been constantly outperforming in current quarters, growing uncertainties to its long-term market place in fee processing options characterize a rising overhang on the inventory’s valuation prospects. Consequently, we’re updating our base case worth goal for the inventory to $67 (beforehand $70).

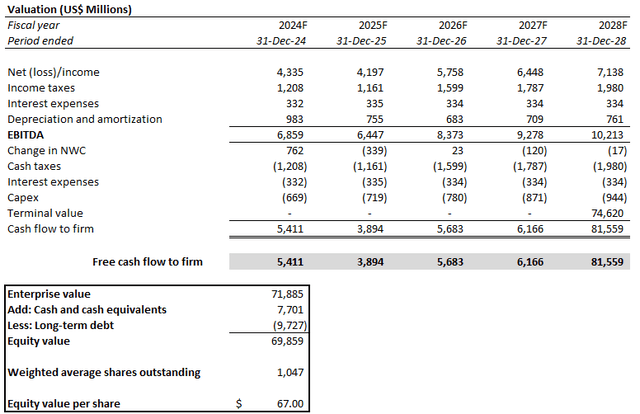

Creator

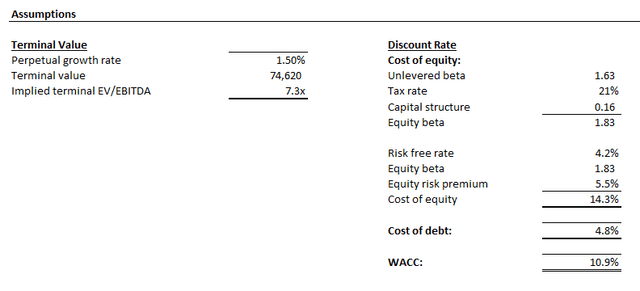

The value goal is derived underneath the discounted money circulate (“DCF”) method. The evaluation considers money circulate projections taken along side the basic forecast mentioned within the earlier part. A ten.9% WACC is utilized, which is per PayPal’s capital construction and danger profile. The evaluation additionally considers an implied perpetual progress fee of 1.5% on estimated terminal money flows. That is per the anticipated tempo of long-term financial growth throughout PayPal’s core working areas. The valuation assumption can also be reflective of our elevated issues over the sturdiness of PayPal’s current basic outperformance, given the shortage of a sustained consumer acquisition and retention gateway over the longer-term.

Creator Creator

Conclusion

The most recent Q2 outperformance is proof that new administration continues to execute and ship on PayPal’s “transition yr”. And the corporate’s basic power noticed in 1H24 is more likely to muscle via the rest of the yr contemplating idiosyncratic tailwinds, making administration’s steering probably conservative.

Nevertheless, we see rising uncertainties to PayPal’s longer-term outlook, given the shortage of progress up to now in securing a sustained adoption gateway. Whereas the brand new initiatives launched at “First Look” are steps in the fitting route, PayPal appears to be lacking an inroad to making sure mass client and service provider market publicity, which might be essential to reinforcing long-term utilization and enabling a self-sufficient flywheel.

Whereas we consider the inventory stays undervalued at present ranges, a considerable upward valuation re-rate would require PayPal’s restoration of its trade management. And in our opinion, this stays out of attain underneath its present enterprise roadmap.

[ad_2]

Source link