[ad_1]

Marcos Schnaider/iStock through Getty Photos

Introduction

It is time to discuss one of the crucial well-known dividend (progress) shares on the very finish of the agriculture provide chain: meat processor Tyson Meals (NYSE:TSN).

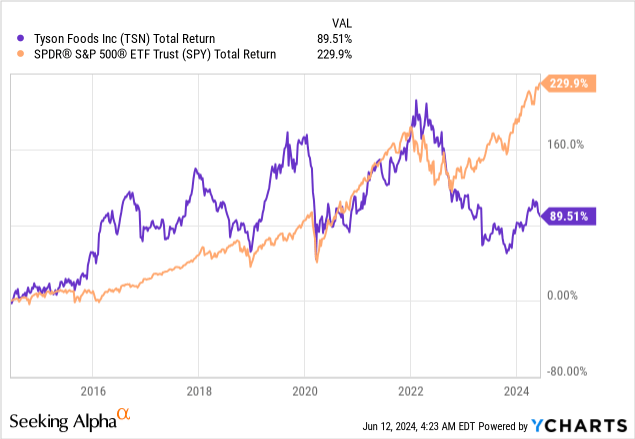

On high of being one of many largest meals corporations in North America, the corporate has been a rollercoaster for traders. Over the previous ten years, TSN shares have returned 90%, together with dividends. This lags the S&P 500’s 230% return by a large margin.

Furthermore, as we will see above, this poor efficiency is because of numerous steep sell-offs.

Whereas meals demand is generally anti-cyclical, the corporate and plenty of of its friends undergo from the easy undeniable fact that the meat processing business is extremely capital and labor-intensive, inclined to produce disruptions, low-margin operations, and different headwinds.

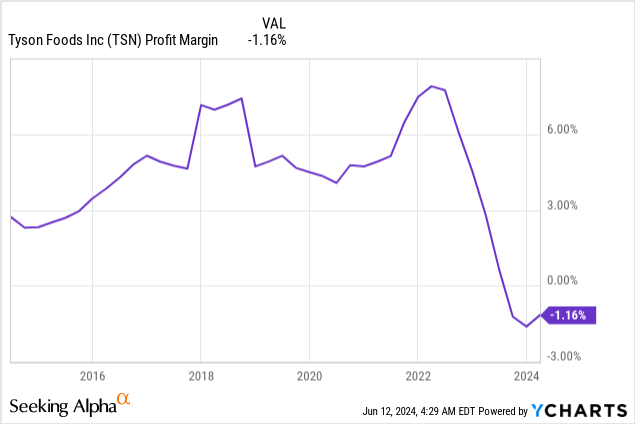

Utilizing the chart beneath, we see revenue margins within the mid-single-digit vary are thought-about “good,” which is a mile beneath the S&P 500’s revenue margin, which has persistently hovered within the low-double-digit vary (excluding the pandemic).

In the course of the pandemic, the corporate was hit by points like restaurant closures, and the truth that hundreds of workers working carefully collectively was a significant well being subject.

To make issues worse, as soon as inflation hit, it began to wrestle with profitability (see the chart above), which resulted in plant closures, as reported by Reuters earlier this 12 months:

Tyson Meals introduced on March 11 that it’ll completely shut a pork plant in Perry, Iowa, in June, which can get rid of jobs for round 1,200 staff.

The corporate, which has seen slowing demand for some merchandise after the tip of the COVID-19 pandemic, has additionally introduced the closures of six hen crops over the previous 12 months and has laid off company workers.

Bloomberg reported on March 11 that Tyson Meals employs about 42,000 immigrants amongst its 120,000 workers within the U.S. – Reuters

Nonetheless, there’s worth in Tyson. If historical past gives any indication, it is that we will use the corporate’s volatility to our benefit.

My most up-to-date article, for instance, was written on December 4, once I went with the title “Tyson Meals: 4% Yield And A Path To >14% Annual Returns.” Since then, shares are up 14% together with dividends.

Whereas that is beneath the 18% return of the S&P 500, Tyson is on a path of enchancment, which might bode effectively for the years forward.

On this article, I am going to elaborate on all of this as I replace my thesis.

So, let’s get to it!

Hen & Working Efficiencies Got here To The Rescue

Tyson Meals has a $20 billion market cap. Whereas that is a big quantity for a meals firm, it doesn’t counsel that the corporate is crucial for our each day wants.

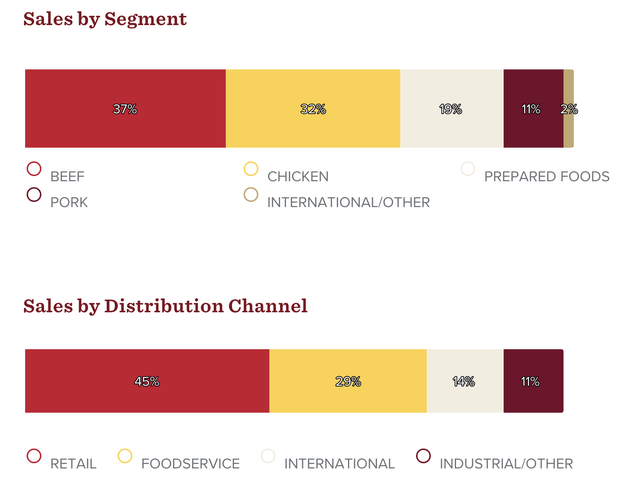

Nevertheless, that evaluation could be incorrect, as the corporate produces roughly a fifth of beef, pork, and hen in the USA! This excludes its portfolio model names like Tyson, Jimmy Dean, Hillshire Farm, BallPark, and others.

Tyson Meals

As common, when coping with low-margin companies, traders typically apply low valuation multiples, which ends up in “subdued” market caps.

To provide you one other instance, Archer-Daniels-Midland (ADM), which has a world community of hundreds of commerce factors and crops connecting farmers to patrons, has a market cap of simply $30 billion.

The mixed market cap of ADM and TSN is simply $50 billion. Nevertheless, if each corporations had been to fade in a single day, meals safety could be in serious trouble – and I am not exaggerating right here.

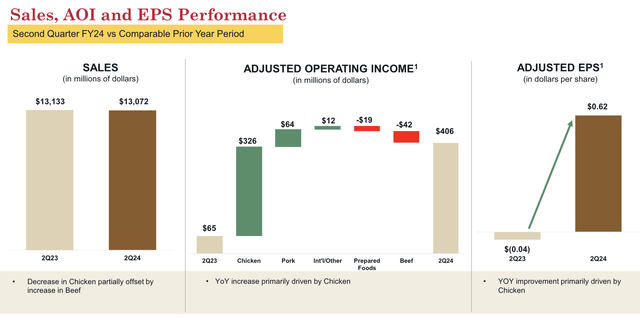

With all of this in thoughts, the corporate is on a path to restoration, reporting a 60% improve in each adjusted EPS and working earnings within the first half of this fiscal 12 months.

In 2Q24:

Gross sales had been secure at $13.1 billion. Adjusted working earnings rose from $65 million to $406 million. This allowed adjusted EPS to show optimistic.

Tyson Meals

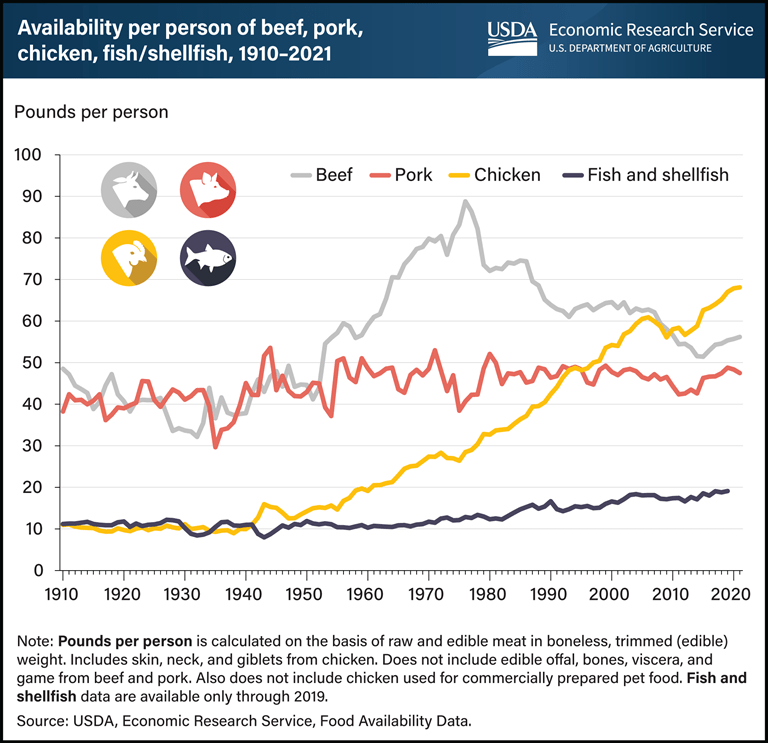

The most important driver was hen, America’s favourite protein. Utilizing the three-year-old chart from the USDA beneath, we see that hen turned the primary protein after the Nice Recession, because it began a Nasdaq-like uptrend within the Fifties.

USDA

Going again to Tyson, I imagine the quote beneath completely sums up why hen turned the star this 12 months. Please notice that AOI stands for adjusted working earnings.

In Hen, the momentum established within the second half of fiscal ’23 continued in Q2. The truth is, versus the second quarter of final 12 months, AOI elevated greater than $325 million. Whereas we’re benefiting from higher market situations, together with decrease grain prices, our daring actions and deal with the basics are additionally evident in our outcomes. Now we have made progress throughout the worth chain. Our dwell operations are considerably higher. We have improved yield, labor efficiencies and utilization in our crops. Our demand planning and customer support have additionally taken important steps ahead. – TSN 2Q24 Earnings Name (emphasis added)

Past that, the corporate believes its energy is its diversified portfolio. This multi-protein technique helps the corporate mitigate dangers that include volatility in numerous commodity markets.

For instance, whereas hen hit it out of the park, beef struggled as a consequence of restricted cattle provide.

That is what the USDA wrote in February, which confirms what Tyson sees:

Regardless of expectations of expanded manufacturing of pork and broiler meat in 2024, progress in provides of crimson meat and poultry are anticipated to be restricted by the impacts of the multiyear drought on provides of cattle and continued changes of the turkey sector to an prolonged interval of weak costs and the influence of Extremely Pathogenic Avian Influenza (HPAI) on turkey flocks in late 2023 and early 2024. (Emphasis added)

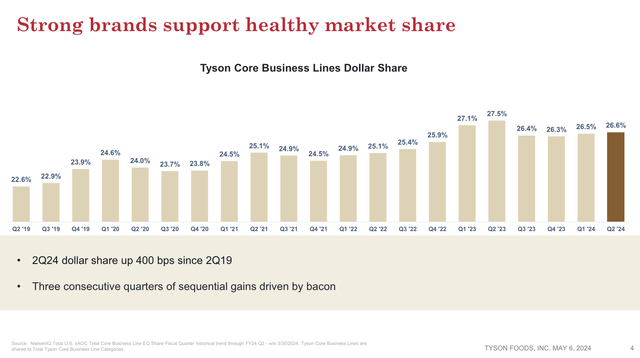

Regardless of some points, the corporate has grown its market share for the third consecutive quarter. Its market share is now 400 foundation factors increased in comparison with 5 years in the past.

Tyson Meals

Including to that, a brand new bacon facility in Kentucky that opened in January is anticipated to additional improve market share.

To additional enhance its progress profile, the corporate continues to innovate with protein merchandise, which incorporates increasing into seasoned and marinated meats to fulfill shopper demand for comfort and selection.

Furthermore, as I already briefly highlighted, the corporate has centered extra on margins, which incorporates closing much less environment friendly amenities and reallocating assets to extra productive crops.

In accordance with Tyson, this strategy to capital deployment has not solely improved money move but additionally positioned the corporate effectively to take care of future challenges and capitalize on progress alternatives.

Good Information For Shareholders

Throughout its 2Q24 earnings name, the corporate reiterated its dedication to constructing shareholder worth via numerous strategic pillars.

Fortifying core proteins. Constructing sturdy manufacturers. Rising globally.

Primarily, the corporate is enhancing its digital capabilities, leveraging information, automation, and AI applied sciences to enhance decision-making and operations.

Tyson Meals

So as to add some colour, through the Annual World Farm to Market Convention final month, the corporate elaborated on its progress plans, explaining that worldwide gross sales reached $2.5 billion on the finish of 2023.

In accordance with the corporate, investments in seven worldwide property over the previous two to a few years at the moment are bearing fruit, as they’re being utilized extra effectively.

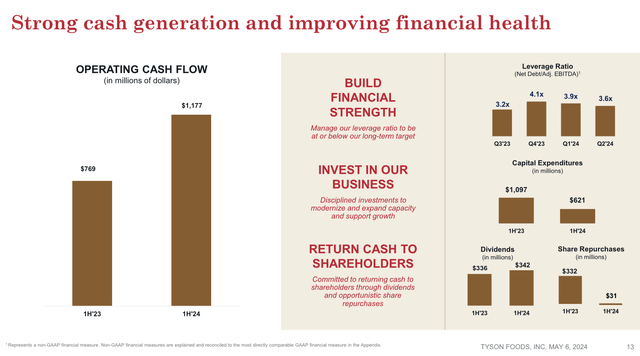

As we will see beneath, previous investments at the moment are paying off, main to higher progress alternatives and decrease capital spending.

Between 1H23 and 1H24, the corporate lowered CapEx from $1.1 billion to roughly $620 million. This allowed the corporate to scale back its internet leverage ratio to three.6x in 2Q24. It additionally helped that it kind of stop shopping for again inventory this 12 months.

Tyson Meals

Going ahead, we will assume that CapEx necessities stay within the low to mid-$1 billion vary, together with upkeep bills and inflation changes.

As such, analysts count on the corporate to decrease the web leverage ratio to 2.3x in 2026, supported by a free money move surge to $1.6 billion (8% of its present market cap).

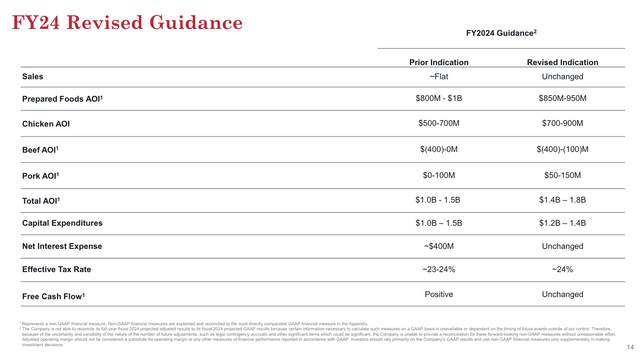

On high of that, the corporate revised its full-year steerage, together with a $400 million increased decrease certain of its whole AOI vary.

Tyson Meals

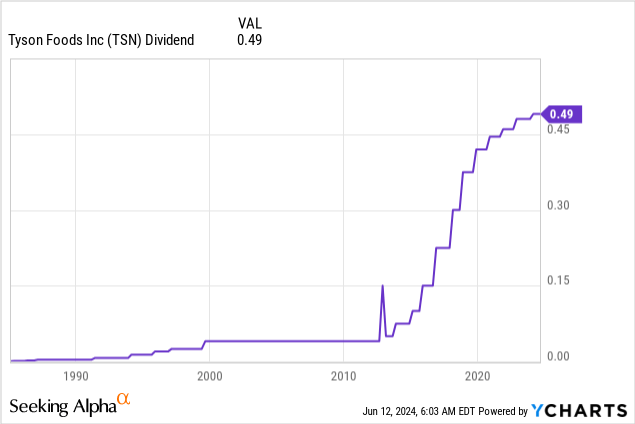

With regard to its dividend, after climbing its dividend by 2.1% final 12 months, it presently pays $0.49 per share per quarter. This interprets to a yield of three.5%.

This dividend is protected by $2.58 in anticipated EPS this 12 months (see the chart within the valuation a part of this text), which suggests a 76% payout ratio. This payout ratio is anticipated to shortly fall as a consequence of sturdy EPS progress projections, as we’ll focus on in a bit.

As such, I count on annual dividend progress within the years forward to rise to at the very least 6.5%, which is its present five-year CAGR.

This brings me to its valuation.

Valuation

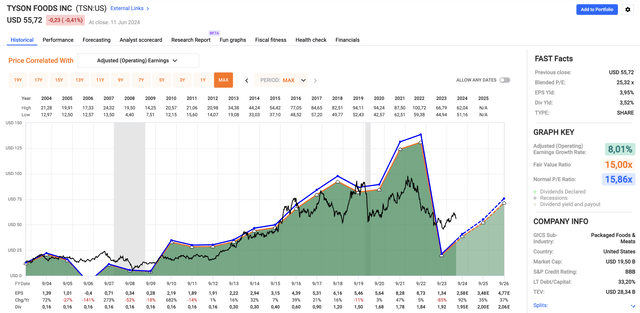

Tyson Meals presently trades at a blended P/E ratio of 25.3x, which is roughly ten factors above its long-term common. Nevertheless, we will ignore this, as this is because of an outlier 12 months. Final 12 months, EPS imploded by 85%.

Now, utilizing the FactSet information within the chart beneath, analysts see a path to restoration, with 92% EPS progress in 2024 and 36% common annual EPS progress in 2025 and 2026.

FAST Graphs

This suggests roughly $4.80 in 2026E EPS. If we apply its normalized 15.9x a number of, we get a good worth goal of $75, roughly 20% above the present worth.

If we assume that the corporate maintains optimistic progress, we’re greater than probably taking a look at a protracted interval of double-digit annual returns, together with its 3.5% dividend.

Therefore, I stay bullish on the corporate and imagine it is one of many most cost-effective shopper defensive shares in the marketplace.

Nevertheless, due to its low-margin enterprise and agriculture provide chain dangers, I can’t make the case that it’s a no-brainer purchase that everybody must personal.

Whereas it’s a respectable undervalued dividend play, I choose friends with way more regular progress, even when they aren’t as undervalued as TSN.

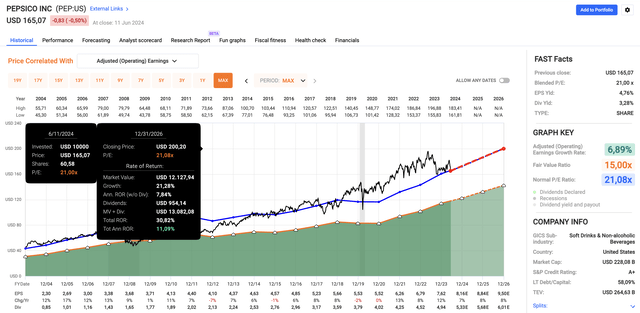

Simply to offer you an instance, PepsiCo (PEP) can also be a defensive participant. Its dividend yield is simply 20 foundation factors decrease and it has a way more constant efficiency than TSN.

After its current inventory worth decline, it additionally comes with a double-digit annual return outlook (see the chart beneath).

FAST Graphs

That stated, I imagine TSN is enticing, and I’ll proceed to cowl its restoration within the quarters forward.

Takeaway

Tyson is a significant participant within the meat processing business, however its efficiency has lagged behind the S&P 500 as a consequence of important business challenges.

Regardless of this, current enhancements in working efficiencies and a powerful deal with hen have accelerated its restoration.

Primarily, Tyson’s diversified protein portfolio and strategic plant closures have improved margins, positioning the corporate for higher progress.

Furthermore, with a 3.5% dividend yield and expectations of sturdy EPS progress, Tyson stays a beautiful funding within the shopper defensive sector.

Though not with out dangers, its undervaluation and potential for double-digit returns make it a inventory value contemplating for dividend-focused traders.

Professionals & Cons

Professionals:

Robust Dividend Yield: Tyson gives a stable 3.5% dividend yield, making it a compelling alternative for income-focused traders. Operational Enhancements: Current effectivity features and strategic plant closures have considerably boosted its profitability. Diversification: Tyson’s big selection of merchandise helps it to offset weak point in sure areas. Progress Potential: With expectations of sturdy EPS progress, there’s potential for double-digit annual returns. Undervalued: Tyson is among the most cost-effective shopper defensive shares.

Cons:

Business Challenges: The meat processing business is extremely capital and labor-intensive. Previous Efficiency: Over the previous decade, TSN’s returns have considerably lagged the S&P 500. Inflation Influence: Inflationary pressures have impacted profitability, resulting in plant closures and layoffs. Elevated inflation might proceed to strain the corporate. Low-Margin Enterprise: In comparison with (non-meat) friends, Tyson operates on thinner margins. Volatility: The inventory is way more unstable than most defensive shopper shares. Agriculture Dangers: Points just like the chook flu, droughts, and different occasions can damage margins and total provide.

[ad_2]

Source link