[ad_1]

In This Article

Final October, I wrote an article explaining why I had stopped shopping for rental properties to purchase actual property funding trusts (REITs) as a substitute. I argued that REITs have been mispriced, providing a chance for traders to purchase actual property at a reduction to its honest worth.

Since then, REITs have risen by 36% on common, whilst personal actual property has largely stagnated and even barely declined in worth:

I’d additionally add that this is simply the common of the REIT sector, represented by the Vanguard Actual Property ETF (VNQ), which incorporates the great and unhealthy.

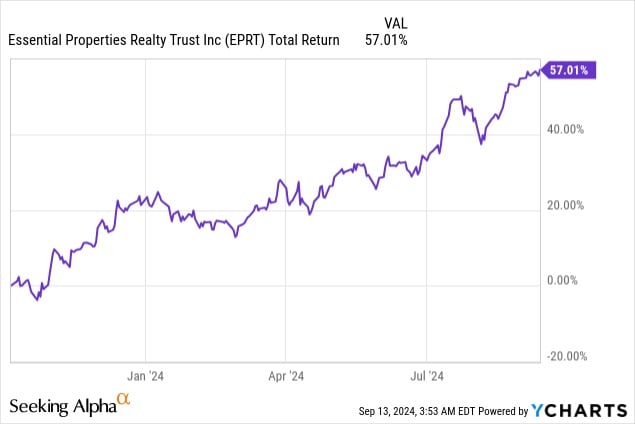

When you have been selective and invested within the proper REITs, you can have executed so much higher. For instance, our largest REIT funding throughout this time interval was Important Properties Realty Belief (EPRT), and it’s up 57% in simply 11 months:

However are REITs nonetheless a compelling funding alternative, or has the window for investing in them already closed?

I consider the former is true.

Even after the current rally, numerous REITs are nonetheless buying and selling at giant reductions relative to the honest worth of their actual property.

Take the instance of BSR REIT (HOM.U:CA), which I mentioned in final 12 months’s article. It’s an residence REIT that focuses on quickly rising Texan markets. It was priced at a whopping 42% low cost again in October 2023 and has recovered considerably since then, however nonetheless trades at a 24% low cost at present.

In different phrases, you possibly can nonetheless purchase an fairness curiosity in the actual property of BSR at 76 cents on the greenback, a greater deal than what you’ll get within the personal market. It trades at ~6% implied cap fee, however its properties are value nearer to a ~5% cap fee within the personal market.

However I believe the times of REITs buying and selling at giant reductions are actually numbered. The one cause REITs are priced as they’re at present is as a result of the market overreacted to the surge in rates of interest.

REITs usually use little leverage, and their fundamentals haven’t been closely impacted. In reality, REIT money flows and dividends saved rising in 2022, 2023, and to date in 2024, even regardless of the surge in rates of interest.

Nevertheless, it nonetheless induced their share costs to crash as a result of numerous revenue traders offered their REITs, no matter their fundamentals, to reinvest in bonds and Treasuries as a substitute. These traders have been by no means really occupied with proudly owning REITs, however they’d invested in them to earn yield in a yieldless world. However as quickly as bonds and Treasuries supplied a good yield, they offered, inflicting REITs to crash.

This may be very clear if you happen to take a look at the robust inverse correlation between REIT share costs and rates of interest on this bear market:

However we’ll now see the alternative occur as rates of interest return to decrease ranges, which is why REITs have begun their restoration.

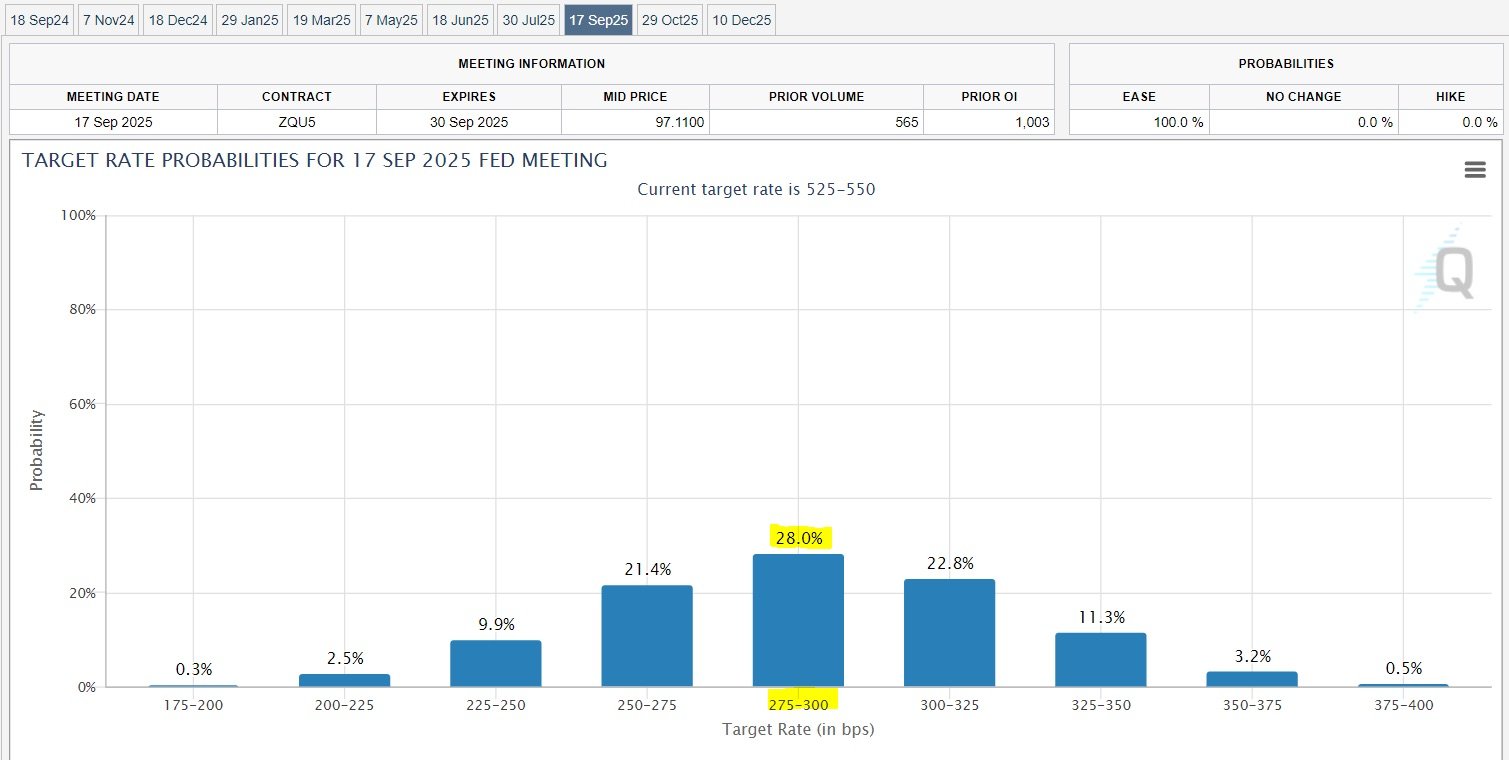

The debt market is predicting that rates of interest will drop by roughly 250 foundation factors inside a 12 months from now:

This anticipation has already pushed some traders to reinvest in REITs, and as charges steadily return to decrease ranges, I count on many extra traders to rethink their fixed-income allocations and return to the REIT sector.

REITs are nonetheless comparatively low-cost, buying and selling at reductions to their internet asset values, and it isn’t unusual to search out good REITs nonetheless providing 5% to 7% dividend yields.

REITs have been much less tempting when you can get a 5% yield on cash market funds and short-term Treasuries, however as that turns into 2.5% to three%, REITs will turn into a sizzling commodity once more.

How A lot Upside Do They Provide?

Traditionally, REITs have usually traded at a slight premium to their internet asset values, and this is smart, given all the benefits they provide relative to personal actual property.

You’re basically getting one of the best of each worlds, shares and actual property, in a single bundle, and that’s value a premium:

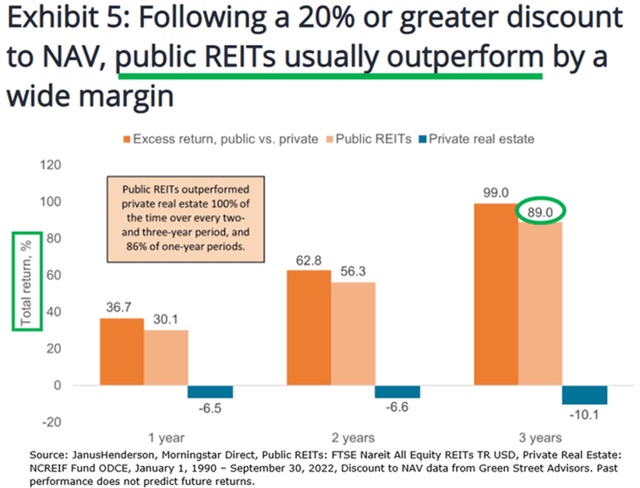

But there are nonetheless numerous REITs that commerce at a 25% to 50% low cost relative to the honest worth of their actual property, internet of debt. This is in the end why I’ve saved shopping for extra REITs as a substitute of rental properties.

I am not in a position to spend money on the fairness of rental properties at a 25% to 50% low cost. This implies that merely returning to their honest worth may unlock 50% to 100% upside in some circumstances, and we now have a transparent catalyst for this upside to be realized.

Because of this, I simply don’t get the purpose of shopping for personal actual property at present. You’re paying extra to purchase an illiquid, concentrated, personal asset that’s administration intensive and taking a larger legal responsibility danger to doubtless earn decrease returns ultimately.

Analysis research clearly present that purchasing REITs at a reduction is a method to earn a lot larger returns:

Observe the Leaders

However don’t take it simply from me. The main personal actual property funding agency, Blackstone (BX), which controls over $1 trillion value of property, is at present selecting to purchase REITs as a substitute of personal actual property.

Earlier this 12 months, it purchased out Tricon Residential (TCN) and paid a 30% premium for it. Then, a number of months later, it acquired House Earnings REIT (AIRC) and paid a 25% premium for it. Now, it is rumored to be trying to purchase out a 3rd REIT, Retail Alternative Investments (ROIC), and this transfer has already induced its share worth to surge by 25%.

Blackstone is spending tens of billions of {dollars} to accumulate REITs as a result of it’s the most cost-effective actual property that it may well purchase at present—so low-cost that Blackstone is prepared to pay ~30% premiums to their newest share costs and nonetheless suppose that it’s getting a superb deal.

I’m following the identical method however on a smaller scale. As REITs get well, I’ll doubtless get again to purchasing personal actual property finally, however proper now, I can’t make sense of it as a result of REITs are a lot extra enticing.

Make investments Smarter with PassivePockets

Entry schooling, personal investor boards, and sponsor & deal directories — so you possibly can confidently discover, vet, and spend money on syndications.

Be aware By BiggerPockets: These are opinions written by the writer and don’t essentially signify the opinions of BiggerPockets.

[ad_2]

Source link