[ad_1]

Definition of Order Guide

The Order Guide is a basic element in monetary buying and selling that lists purchase and promote orders for a selected asset. It organizes these orders by worth degree, showcasing the market’s provide and demand dynamics. Within the context of Foreign currency trading, the Order Guide contains pending or restrict orders, equivalent to purchase stops, purchase limits, promote stops, and promote limits, alongside merchants’ place cease losses and take earnings. This structured overview supplies merchants with insights into the place market individuals intend to execute their trades.

Definition of Place Guide

The Place Guide, distinct from the Order Guide, information opened positions held by merchants. It contains each purchase and promote positions, reflecting the present buying and selling exercise inside the market. By visualizing open trades, the Place Guide permits merchants to determine prevailing tendencies and situational sentiment primarily based on the distribution of those energetic positions throughout numerous worth ranges

Why its necessary to trades?

The Order Guide is important for merchants because it supplies real-time insights into market sentiment and behaviors. By analyzing the Order Guide, merchants can detect each help and resistance ranges, which might considerably affect their buying and selling methods. Furthermoe, the Order Guide acts as a number one indicator, providing early indicators of potential worth actions that allow merchants to make knowledgeable entry and exit selections.

And the Place Guide is equally essential, because it supplies a complete view of merchants’ present positions out there. By finding out these open trades, merchants can gauge general market sentiment and predict future worth actions primarily based on energetic positions. This info helps merchants handle their danger successfully whereas aligning their methods with present market dynamics.

Benefits of OrderBook and PositionBook

Some great benefits of the Order Guide embody enhanced market transparency, because it shows the amount and worth of positioned orders. This transparency permits merchants to determine prevailing demand and provide dynamics that assist inform their buying and selling selections. Moreover, the Order Guide permits merchants to rapidly reply to altering market circumstances, optimizing their buying and selling actions to handle their optimum place cease loss and take earnings.

And concerning the the Place Guide, It affords important benefits by displaying energetic buying and selling positions that mirror the real-time attitudes of market individuals. This perception permits merchants to determine buying and selling tendencies and make knowledgeable selections relating to their methods. Furthermore, the Place Guide aids in danger administration by offering a transparent depiction of at present held positions, which helps merchants gauge potential market actions and analyse the long run strikes by checking the quantity of place in revenue or loss. Wonderful.

Merchants can forecast upward or downward strain by analyzing the accumulations inside each the Order Guide and Place Guide. For example, important clusters of Cease Loss orders typically point out potential worth targets, whereas concentrations of restrict orders close to the present market worth recommend help or resistance ranges. Moreover, the Place Guide can reveal clusters of open purchase or promote positions that would affect future worth actions, providing a glimpse into potential directional strain.

In abstract, you get these:

Market Sentiment, The market is within the palms of consumers or sellers? discover the likelihood help resistance ranges (Provide and Demand) Discover the merchants Cease loss and take revenue ranges, So you understand the place and the way they are often cease looking! Decided the variety of merchants and positions which are in revenue or in loss to foretell the subsequent market actions

Let’s dive into the small print.

How you can Learn the market with OrderBook

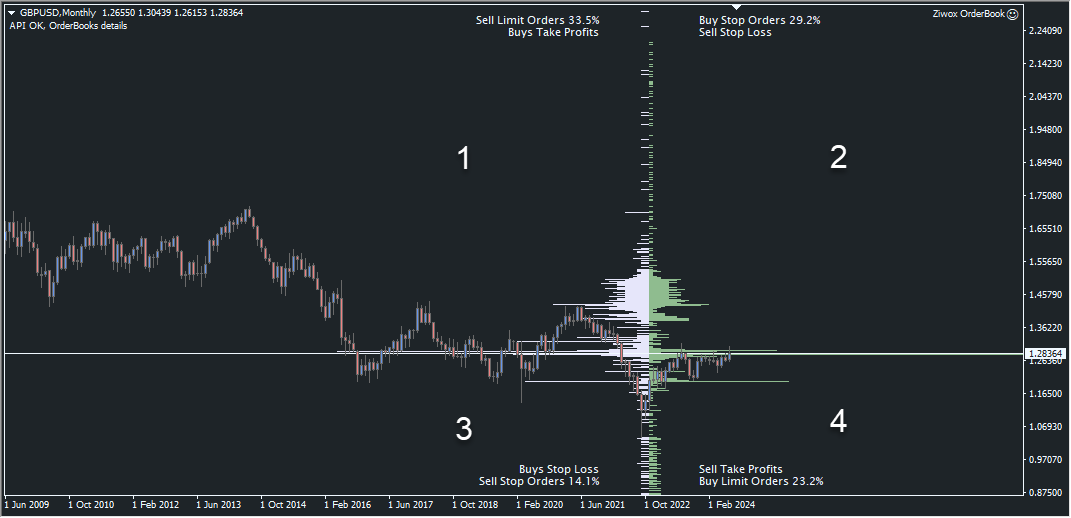

Picture 1, GBPUSD OrderBook

Have a look at the picture 1

Order Guide, devide the market restrict orders in 2 facet, left facet histogram (White bars) displays promote orders. proper facet (Inexperienced) are purchase restrict orders. merchants can profit from its twin histogram illustration. Merchants can see during which areas there’s important compression of orders to indicating potential help or resistance ranges. The connection between these two histograms supplies a complete image of market dynamic and normal market development.

So, we seperate this 2 facet histogram with deeper particulars.

Space 1, Promote cease orders together with the Purchase positions Take earnings. Space 2, Purchase cease orders together with the Promote positions cease losses Space 3, Promote cease orders together with the Purchase place cease losses. Space 4, Purchase restrict orders, together with Promote place take earnings.

By trying deeper yow will discover necessary ranges for merchants. Peaks include extra volumes and putting orders and valleys include fewer orders set by merchants. ranges with longer lengths have extra positioned orders.

Explicit, all peaks correspond to cost peaks on the chart. You shoul search, like a detective to search out clues!

Have a look at the picture 1, and focuse to the 1.16555 worth space. An enormous variety of order have been placeds on this ranges. Is it fascinating that this quantity is strictly within the ranges that’s noticed on February 1st with a really sturdy shadow??

Is that this fascinating that this big quantity of purchase restrict orders is strictly on the identical degree of February 1st? trying on the massive shadow tha pulled up with a robust demand?

These big variety of orders, might be our Assist and ressistance ranges. They’re liquidity and acte like a magnet for worth.

The enticing benefit of this half is that you understand the place are a number of different folks’s stoplosses. And this level will enable you to know when and at what worth you could be cease looking 🙂 Attempt to not

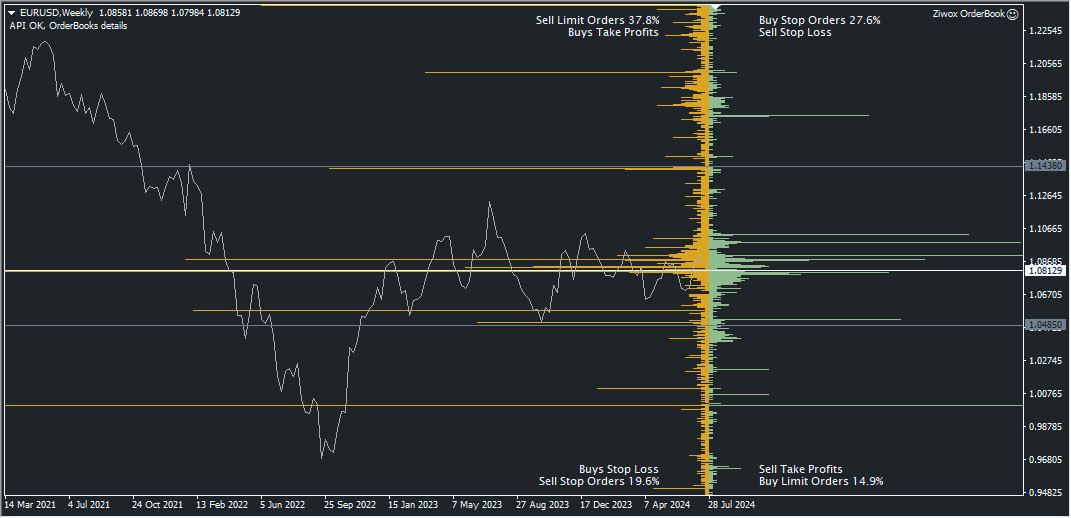

Picture 2, EUYRUSD OrderBook

Lets describe it, by extra instance. have a look at the picture 2. Accumulation of shopping for orders from 1.08129 to the 1.0485 ranges together with it putting these purchase orders cease loss on the 1.0485 space. There’s a lovely match with the value ceiling and flooring within the chart. or discover the 1.14380 worth ranges. In case you are accustomed to the ICT buying and selling methodology, you will discover the Drop,base,Dropp development on that ranges. It’s precisely equal to very large promote restrict orders there.

Now Lets dive deep into thee PositionBook.

How you can Learn the market with PositionBook

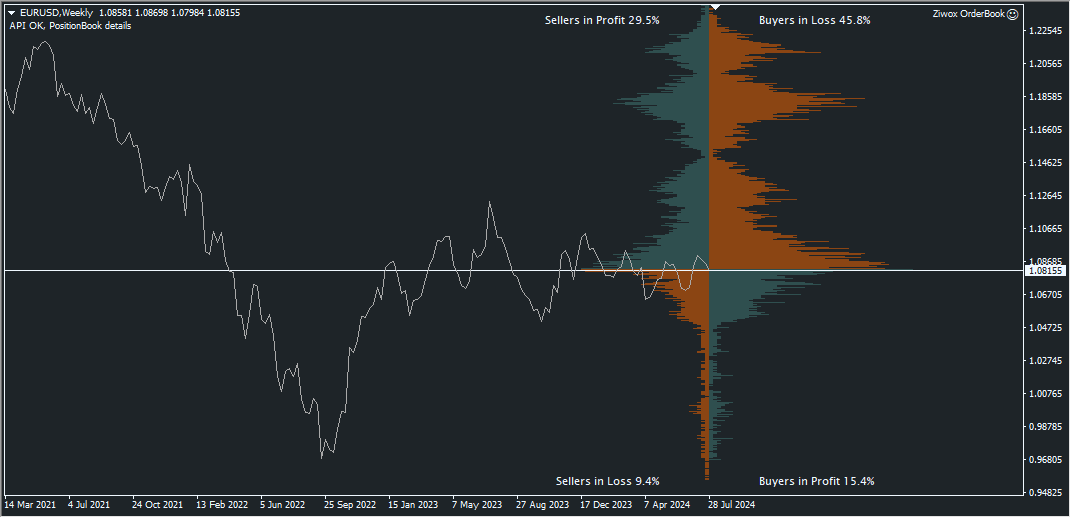

Picture 3, EURUSD PositionBook

Within the PositionBook, you do not simply see the variety of positions. What does it imply when there are various consumers, bellow the present market worth? it displaying you, what number of consumers are worthwhile and all purchase positions above the market worth are in loss. How does this assist us? Suppose that every one these losses are going to be closed quickly, or quite the opposite, If there are various promoting positions in revenue. Promote positions are closed in revenue and enhance the value becasue shut a promote place equal to a brand new purchase place. You get the purpose? Proper?

How you can USE:

Market Sentiment:

To derive market sentiment from the Order Guide, merchants can analyze the amount of purchase and promote orders. An elevated quantity of purchase orders sometimes signifies bullish sentiment, whereas better volumes of promote orders recommend bearish sentiment. Moreover, by inspecting key clusters of pending restrict orders, merchants can decide important help and resistance ranges, indicating the place costs might stabilize or reverse out there

Assist and Resistance Ranges

Assist and resistance ranges may be recognized utilizing the amount of orders inside the Order Guide. For example, substantial clusters of purchase orders at particular worth factors might point out sturdy help, suggesting that the value is much less prone to fall under that degree. Conversely, clusters of promote orders point out resistance, the place costs might wrestle to rise above that time. These ranges assist merchants set up the place they may enter or exit trades primarily based on anticipated worth conduct1

Discovering Optimum Ranges for Cease Loss and Take Revenue

In the case of setting cease loss and take revenue ranges, merchants ought to make the most of insights from the Order Guide. It’s advisable to put cease losses past important help or resistance ranges to keep away from being prematurely triggered throughout potential cease looking. Furthermore, analyzing the order circulate can reveal areas the place quite a few cease losses are clustered, and setting ranges an inexpensive distance past these targets can defend merchants from being hunted. By using sound methods primarily based on historic Order Guide knowledge, merchants can enhance the effectiveness of their cease loss and take revenue ranges, thus managing their dangers higher.

Dropping Trades: Analyzing clusters of dropping trades in the best order e-book can recommend areas the place worth might bounce again upward as soon as these positions are closed.Profitable Trades: Conversely, a considerable presence of profitable trades might point out a possible market reversal, as speedy closures might push costs in the wrong way

[ad_2]

Source link