[ad_1]

The inverse head and shoulders chart sample is a technical chart formation that indicators a possible development reversal.

This bullish sample consists of three troughs: a decrease “head” between two increased “shoulders.”

The commerce is on as soon as the worth breaks again above the formation line or neckline.

Contents

Merchants typically enter lengthy positions when the worth rises above the neckline and set cease losses under the suitable shoulder.

Combining this sample with extra indicators, such because the Relative Power Index (RSI) and the Transferring Common Convergence Divergence (MACD), additional validate and probably improve profitability.

The other of the bearish head and shoulders chart sample, the inverse head and shoulders is a bullish reversal sample.

Just like the top and shoulders, it incorporates each a proper and left shoulder and a head within the center; that is simply turned the wrong way up.

This generally is a highly effective sample to acknowledge for a dealer trying to play a possible reversal.

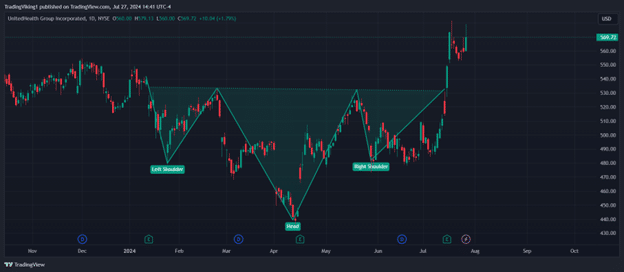

Take the chart above of UNH for example; whereas it isn’t the cleanest instance, that is as a rule what a real-world sample will appear to be.

Worth comes down in early 2024 and pivots again up, failing to make a better excessive; that is the left shoulder.

It then spends the following a number of months slowly declining to type the low that can ultimately turn out to be the top within the sample.

The final step is that the worth shouldn’t take out the excessive of the left shoulder earlier than resuming a downward development.

Search for the worth to reverse someplace across the worth that the left shoulder did, and you’ve got the suitable shoulder forming.

As you possibly can see above, neither shoulder fashioned {a partially} neat sample, however they’re nonetheless legitimate shoulders.

Now that now we have all the fundamentals of the inverse head and shoulders let’s take a look at tips on how to commerce this sample.

The normal commerce is to attend for the worth to shut above the neckline and enter the commerce on the opening of the following candle.

Let’s look once more on the UNH instance above.

The entry on the chart is marked off with the phrase “A.”

Sadly, this sample occurred round earnings, and the entry was considerably increased than the neckline.

You’d place your stoploss beneath the suitable shoulder, marked off by the white “B” on the chart.

On your take revenue, you’d search for the variety of factors from the trough of the top to the neckline.

On this case, it’s roughly 88 factors.

There’s a second strategy to enter primarily based on the inverse head and shoulder sample that’s extra aggressive; nonetheless, it can get you into the commerce considerably sooner than the traditional commerce.

For the aggressive entry, you’d search for the suitable shoulder to type and enter when the worth closes above the midway mark on the suitable shoulder, marked by the orange arrow.

Your cease would nonetheless be beneath the low of the suitable shoulder, and your take revenue would nonetheless be calculated from the neckline.

A method to assist affirm your entries and improve the inverse head and shoulder technique is to make use of extra indicators just like the Relative Power Index (RSI) and the Transferring Common Convergence Divergence (MACD).

Entry The High 5 Instruments For Choice Merchants

Including the relative power index to the inverse head and shoulder sample is straightforward.

You solely need to see two issues to assist affirm your entry.

First, you need to the index worth over the shifting common.

You possibly can see an instance right here on the left.

The second factor you need to see is that RSI persevering with to development up.

It doesn’t matter if the RSI is above the 70 threshold that’s typically used to point out in a single day.

It’s strictly getting used to verify the power of the transfer.

One other frequent indicator that’s added to verify this commerce is the Transferring Common Convergence Divergence (MACD) indicator.

Including the MACD is simply so simple as including the RSI, and equally, you’re searching for solely two issues to verify the potential reversal.

The very first thing you’re searching for is the MACD line cross-over to remain above the shifting common.

That is proven within the picture on the orange arrow.

On the similar time, you’re searching for the MACD histogram to maneuver from purple to inexperienced.

This exhibits a possible development change;

The blue arrow exhibits this.

We now have a stable understanding of the inverse head and shoulders and tips on how to use some frequent indicators to reinforce the setup.

Let’s take a look at how we are able to turbocharge this sample utilizing choices.

Just like the common head and shoulders, shopping for an possibility is the only strategy to commerce it.

You could possibly buy a name possibility at both of the 2 entry factors and nonetheless use the suitable shoulder low as an exit.

A number of the points listed here are the timing of the transfer, which strike to enter, and the truth that earnings and different excessive implied volatility occasions can artificially inflate the choices worth.

A probably higher answer is a commerce that includes a brief contract to assist offset any potential premium decay.

Just like the common head and shoulders, credit score or debit vertical spreads are very helpful.

Each lock in your most loss and most acquire however may help you directionally play a reversal with out worrying in regards to the underlying worth overcoming each the inverse head and shoulders worth sample and the amount of cash spent on the lengthy possibility.

Whether or not you select the credit score or debit model of the unfold is as much as your commerce plan and danger tolerance.

Lastly, extra unique spreads just like the ZEBRA technique additionally work nicely.

The fundamentals of this technique are to realize the choices equal of 100 shares however with considerably much less capital danger.

This technique has distinctive challenges, although you possibly can learn extra in regards to the ZEBRA unfold right here.

The inverse head and shoulders chart sample is a strong software for merchants to establish and capitalize on potential development reversals.

It could present a transparent visible sign of a inventory bottoming and, when mixed with extra indicators and choices, can turn out to be a strong strategy to commerce.

Choices methods such because the vertical unfold or the ZEBRA unfold can dramatically improve profitability whereas chopping some potential dangers if the sample fails.

We hope you loved this text on the inverse Head and Shoulder chart sample.

When you have any questions, please ship an electronic mail or depart a remark under.

Commerce protected!

Disclaimer: The knowledge above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for traders who aren’t accustomed to alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link