[ad_1]

The Buffett indicator, also referred to as the Buffet Index or Buffet Ratio, is known as after Warren Buffet, the well-known worth investor and CEO of Berkshire Hathaway.

Contents

The Buffett indicator measures the valuation of the U.S. inventory market in relation to the US gross home product.

In a way, it tells us whether or not the inventory market is overvalued or undervalued.

In line with Wikipedia, this measure was proposed by Warren Buffett in 2001, and he was quoted as saying that it’s “most likely one of the best single measure of the place valuations stand at any given second.”

Buffett might need believed it on the time he stated it.

However whether or not he nonetheless considers this true right now is tough to know.

So, individuals began calling the indicator after his title.

It’s anybody’s guess (apart from Buffett himself) to know whether or not he needs this indicator to bear his title or not. In any case, the title caught.

This indicator suits his funding fashion, by which he continually evaluates whether or not his investments are overvalued or undervalued.

The Buffett indicator is the full U.S. inventory market worth divided by the annualized gross home product (GDP).

The Wilshire 5000 is often used to point the mixture worth of the U.S. inventory market.

The GDP is outlined because the precise annual manufacturing of the U.S. economic system.

Should you think about the inventory market to be the anticipated future financial development, then the ratio might be thought-about a ratio of expectation over precise.

Some think about it analogous to a inventory’s Worth-to-Earnings (P/E) ratio.

The value is individuals’s expectations, and E is the corporate’s earnings.

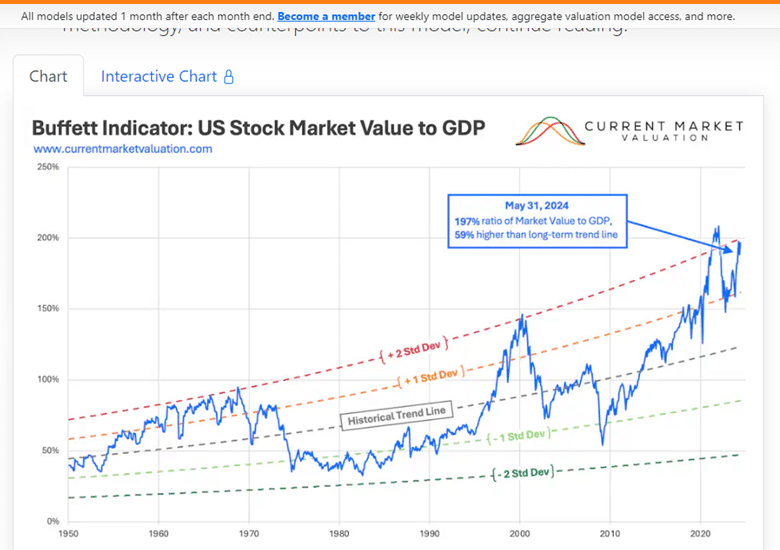

One such place is the Present Market Valuation, which tracks numerous financial fashions that decide the present state of the U.S. inventory market and the broader economic system.

In line with that useful resource, the full U.S. inventory market worth is 55.81 trillion {dollars}, and the GDP is $28.38 trillion as of Might 31, 2024.

Should you divide the 2, you get 1.97. Expressed as a share, it’s 197% as of Might 31, 2024.

The inventory market is about twice as large as the US GDP proper now.

It has good graphs which present the present valuation over time:

Obtain the Choices Buying and selling 101 eBook

The phrase “present” must be taken loosely.

The free model exhibits delayed information up to date one month after every month’s finish.

Contemplating that this chart goes again to 1950, one month is only a tiny blip on this chart.

For extra incessantly up to date information, you have to pay for membership.

The membership contains entry to an interactive model of the chart.

As you possibly can see, this ratio is close to the all-time excessive and is 2 commonplace deviations above the historic pattern line.

It’s protected to say that in accordance with the Buffett indicator, the inventory market is at present overvalued.

On the peak of the Web Bubble in 2000, the ratio reached two commonplace deviations above the norm.

Then, the bubble burst, with the market bottoming at -1.5 commonplace deviations within the years 2008 and 2009 of the Monetary Disaster.

Trying on the graph, each time the valuation hits two commonplace deviations above the norm, it will definitely returns to the historic pattern line.

It might not occur immediately, and it could take ten years, however finally it does.

The Buffett Indicator is a extra appropriate metric for a longer-term view.

Shorter-term merchants will not be too involved with its worth for day-to-day buying and selling.

However, it’s attention-grabbing to know the way large the inventory market is getting in relation to GDP.

We hope you loved this text on the Buffett indicator.

When you have any questions, please ship an e mail or go away a remark under.

Commerce protected!

Disclaimer: The data above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for traders who should not aware of alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link