[ad_1]

PM Photographs

Co-authored by Treading Softly

My household used to like enjoying the board recreation “Threat.” On this recreation, you management armies and intention to take over the world through dice-rolled fight. Once you play a technique recreation with others, you may shortly decide who’s a threat taker and who likes to “play it secure” with their forces. This will straight apply to on a regular basis life and the inventory market. Solely the stakes in actual life are increased than in a board recreation.

With the expectation of a recession across the nook and price cuts on the docket for the longer term, one of many many market subsectors that traders count on to battle is BDCs (enterprise improvement corporations). These corporations specialise in offering liquidity and administration experience to middle-market, sometimes privately held corporations. The first technique of income for BDCs are charges for aiding administration and curiosity from lending actions. Much like a REIT or CEF (closed-end fund), a BDC has restricted technique of progress. Being required to pay out 90% of taxable earnings and capital beneficial properties to shareholders, a BDC can develop through share issuance, debt, or shopping for out different companies.

With a recession on the horizon, many BDCs are enjoying it secure, permitting loans to mature and never racing to originate new substitute loans. This will trigger a drop in earnings as much less income pours in, however it may possibly additionally set them up for potential success when charges fall and lending exercise picks up once more.

In the present day, I need to cowl a preferred BDC that’s being strategic in its progress however, not like its friends, remains to be actively engaged on rising successfully. They are not sitting again and searching for a brighter tomorrow; they’re being proactive at present.

Let’s dive in!

One BDC is healthier than Two

Blue Owl Capital Company (NYSE:OBDC), yielding 10.2%, is a BDC that focuses on lending to middle-market companies inside the US financial system. It is overseen by Blue Owl Capital (OWL). OBDC is likely one of the largest publicly traded BDCs. OBDC reported a strong quarter. Internet funding earnings ticked as much as $0.48, roughly consistent with what we’ve seen in the course of the previous 12 months. NAV (internet asset worth) got here in at $15.36. Supply

OBDC Q2 2024 Complement

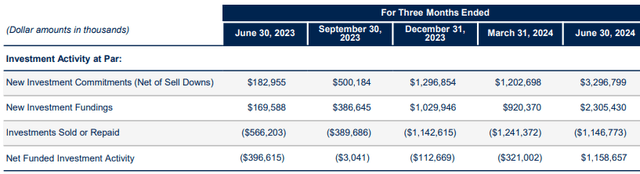

We proceed to imagine that OBDC is an organization that ought to commerce at a premium to guide worth. OBDC grew its portfolio in Q2 with $1.1 billion in internet funded investments. That is bullish for subsequent quarter’s NII.

OBDC Q2 2024 Presentation

Additionally, OBDCs pipeline is robust with new funding commitments just below $3.3 billion, which means OBDC made greater than $1 billion in offers that can be funded in future quarters.

We all know that declining rates of interest can be a headwind to the spreads that OBDC enjoys. They lend at floating charges and borrow at mounted charges. So if rates of interest come down, these borrowing from OBDC pay much less curiosity, whereas the curiosity OBDC owes stays unchanged. One method to make up for that is by way of quantity. A bigger portfolio incomes a decrease unfold can nonetheless have comparable or increased whole earnings than a smaller portfolio incomes a better unfold.

Along with the unfunded lending commitments OBDC has made, it is also rising by merging with Blue Owl Capital Company III (OBDE), a sister firm that is managed by the identical supervisor. OBDE was a non-traded BDC that went public this 12 months. It has numerous overlap with OBDC, and is concerned in most of the identical offers however tends to be barely extra conservative. Roughly 90% of OBDE’s investments are additionally in OBDC.

This can be an all-stock merger and can be completed primarily based on OBDC’s value/NAV. If OBDC is buying and selling beneath NAV, then the merger can be impartial to NAV/share. If OBDC is buying and selling at a premium to NAV, then OBDC’s NAV will improve.

Because the corporations have a lot overlap, that is pure progress. It is OBDC doing the identical factor it does now, simply with an additional $4.3 billion in property. Supply

OBDC/OBDE Merger Presentation

After this merger, OBDC would be the second-largest publicly traded BDC, behind solely Ares Capital (ARCC). As mentioned above, with rates of interest more likely to come down, one method to maintain earnings at present ranges or increased is thru quantity. Merging with OBDE provides numerous quantity, and it is quantity with a considerably comparable portfolio.

General, we view the merger as very constructive for shareholders, and we preserve our perception that OBDC must be buying and selling at a premium to NAV. We’re pleased to purchase whereas the market is giving a reduction.

Conclusion

OBDC, and by extension, its soon-to-be-absorbed peer OBDE, are each excellently run BDCs. Since their arrival on the general public markets, the administration group working them has been constant in its messaging and targets, typically attaining its said targets as deliberate. I think the advantages of the merger can be realized shortly and successfully for shareholders.

In terms of retirement, having robust and steady earnings producers in your assortment of investments lets you have a better diploma of economic safety. The much less time you have to spend fiddling and worrying about your portfolio, the extra time you may benefit from the finer components of life. There’s little extra that I take pleasure in than spending time reminiscing with my family members and having fun with the sound of a roaring hearth within the hearth. I would fairly have a retirement that jogs my memory of a heat cup of tea than one marked by stress and fear. Having earnings pouring in from the market into your private coffers is usually a great balm for the thoughts, permitting you to see extra enjoyment from retirement.

That is the fantastic thing about my Earnings Technique. That is the fantastic thing about earnings investing.

[ad_2]

Source link