[ad_1]

Are you trying to navigate the ever-changing world of Foreign exchange with confidence?

The Skilled Quantity Sign might be your information.

We provide a strong buying and selling technique and its related alerts, designed for simplicity in figuring out traits primarily based on market quantity. This oscillator and its alerts assist you set up a scientific strategy for coming into and managing trades, empowering you to take management of your monetary future.

Introduction to the Technique:

The Skilled Quantity Sign Technique is the results of years of buying and selling expertise in Forex and programming, now accessible to you thru the implementation of synthetic intelligence in analyzing and evaluating previous alerts.

This technique makes use of the next strategies:

– Buying and selling quantity

– Fibonacci

– Buying and selling periods

– Oscillator designed by the Commerce Wizards group

Notice: Because of the mixed nature of this technique, we’ve prevented offering ranges of false purchase alerts and different analytical instruments on the chart, presenting just one oscillator that shows the ultimate sign and value pattern modifications primarily based on quantity.

Product Specs:

– Doesn’t alter alerts, SL, TP, or the oscillator in any approach (no repainting).

– Precisely identifies pattern modifications and offers alerts.

– Provides alerts together with TP and SL (with out modifications or manipulation).- Suggests 3 revenue goal areas.

– Gives SL at a secure level with an acceptable risk-to-reward ratio relating to TP2.

– Able to suppressing alerts.

– Gives a sign desk and calculates previous targets (might be examined within the tester).

– Usable on timeframes of5 and above.

– Greatest outcomes for gold scalpers are in1 and5-minute timeframes.

Tips on how to Work with Skilled Quantity Sign:

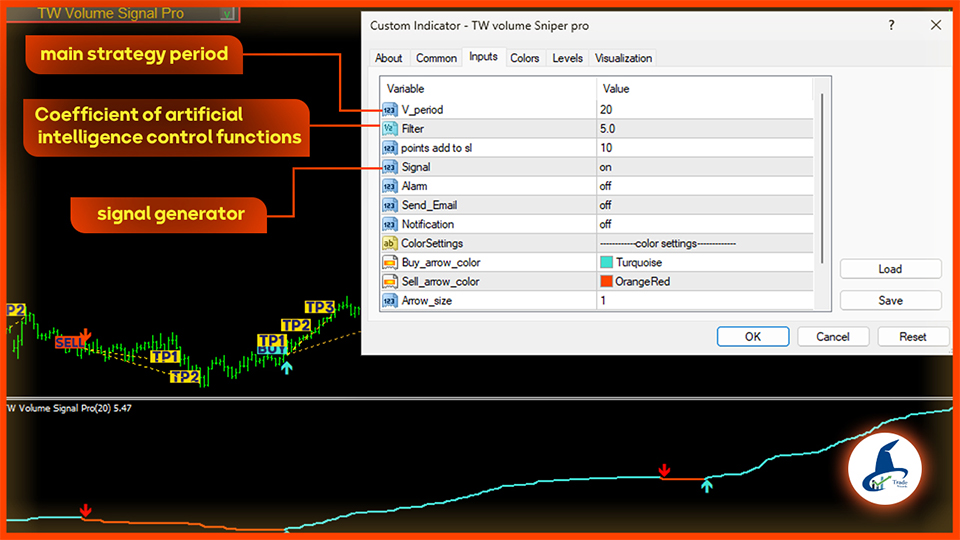

Enter Settings:

within the enter settings, a very powerful components are “v_Periode” and “Filter”

-V_ Periode: This quantity creates a set of variations in the primary oscillator and the sign calculations that alter the outcomes.

– Filter: This quantity instantly impacts the AI modes and time periods, impacting the velocity of research and modifications.

Different Points:

You may flip off the sign and use the oscillator for private analyses and to boost your technique. The sign colours might be modified for consumer comfort.

Notice: The sign launch time offers you an alarm/e mail (with the choice to show it off).

Sidebar Panel subsequent to the Chart:

Perform of the Sidebar Panel:

On this product, a panel has been designed that:

The primary window shows the present sign specs. The second window exhibits the targets achieved because the indicator was launched, together with the revenue and lack of previous positions. The third window presents the general outcomes achieved.

Notice: You may reduce the panel utilizing the arrow on the prime of the panel.

Notice: With this panel, you’ll be able to freely take a look at the technique on the tester over any time-frame and most well-liked settings, and think about the outcomes earlier than buying.

Window One:

This technique exactly identifies the entry level and shows the next info within the panel subsequent to the chart and on the chart itself in the meanwhile the sign is introduced:

– Entry Value

– Place Sort

– TPs (Take Earnings)

– SL (Cease Loss)

– Pip quantities for SL and TPs (for threat administration and decision-making for entry)

Second Window:

On this window, the quantity and complete pips achieved for every TP and SL are displayed individually for Purchase and Promote, indicating the power of the targets and their realization charge.

The Maintain part exhibits the quantity and pip values of alerts which can be lengthy swings and have moved past TP3, which may have been achieved utilizing the trailing cease technique.

Notice: Within the calculations for this part, when a place hits its subsequent goal, it’s faraway from the earlier goal and added to the following goal. Due to this fact, duplicate numbers usually are not included in any goal, and every place is calculated beneath both one of many SLs or TPs to make sure the outcomes are correct and dependable.

Notice: After every SL and TP is achieved, the realized gadgets are coloured, and the unrealized targets are eliminated on the time of the brand new sign (to declutter the chart).

Third Window:

This window is for viewing the general outcomes and abstract, which incorporates 4 sections:

1- Win to Loss: The ratio of successful positions to shedding ones.

2- Win Fee: The proportion of successful positions to the whole.

3- Whole Pips of Profitable Positions.

4- TP – Cease: The distinction between realized pips minus positions that hit the cease.

On this part, an effort has been made to offer customers testing this product within the tester with a normal view of the technique’s power.

Notice: The designed panel subsequent to the chart might be minimized.

Occasions on the Chart:

Oscillator:

The skilled quantity oscillator consists of a number of easy components:

Optimistic slope of the oscillator signifies an uptrend and adverse slope signifies a downtrend.

When the pattern modifications, the colour of the band modifications.

Arrows in blue and purple point out the alerts issued.

Different Components:

1- Crimson and blue arrows: Point out the sign candle.

2- Crimson or blue field on the arrowed candle signifies the entry value.

3- Yellow field signifies the realized TP value.

4- Orange field signifies the realized cease value.

5- Grey field signifies the unrealized TP and cease value.

6- Dotted strains join the cease and TP factors of every place.

Threat Administration:

You may select your entry quantity utilizing the oscillator on the chart and by managing your threat.

Notice: If the cease loss quantity exceeds the chance tolerance stage of your capital, don’t enter the commerce.

Attempt to comply with a constant and systematic cash administration strategy, and on the proper time (when reaching TP1 or TP2), path or safe income to boost the result from backtesting and benefit from the progress of your capital.

Notice: Each time attainable, attempt to use the M5 and M15 time frames.

Notice: Gold scalpers can make the most of this technique with scalping strategies within the M5 and M1 time frames utilizing efficient cash administration.

Instructed Settings:

Under is the settings file primarily based on our expertise, which has yielded profitable outcomes. You’ll want to use it.

20/5//on/off/off/off

The pattern checks above might be seen within the video beneath.

You may customise this product in response to your wants.

Different Strategies:

You may make the most of the alerts from this product for Martingale strategies, hedging, and trailing stops primarily based in your capabilities.

Suggestions:

Use time frames in response to your threat administration and capital ranges. Use ECN and ECN Professional accounts. Select your required forex primarily based in your familiarity, earlier backtesting, the volatility of the forex, and your capital stage. Check on the tester earlier than buying.

When you have any additional questions, be happy to ask within the chat.

In conclusion:

This technique consists of a number of further steps that will present stronger and extra alerts in future updates, that are presently being designed. Please notice that it’ll now not embody reductions sooner or later. In case you are glad with the checks, make your buy now.

The Commerce Wizard workforce needs you success and wealth in full peace of thoughts.

[ad_2]

Source link