[ad_1]

Schedivy Footage Inc.

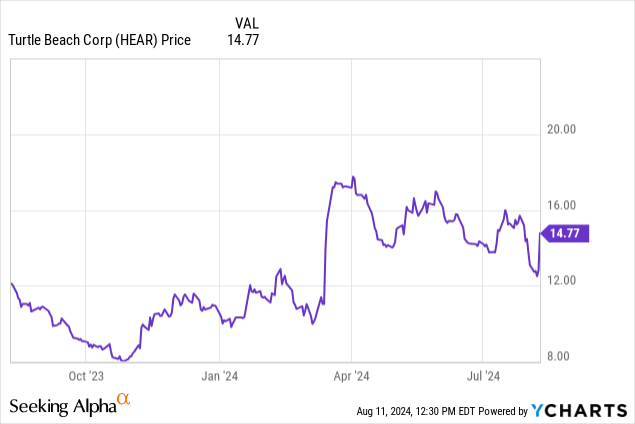

Turtle Seashore Company (NASDAQ:HEAR) rose 15% on Friday after it introduced its Q2 outcomes and raised steerage. Although it did unload for many of the day after it hit $16 in early morning buying and selling. The corporate beat analyst expectations on income by practically $6 million; nevertheless, its internet lack of $0.35 EPS missed expectations by $0.05. Apparently, the corporate raised its adjusted EBITDA steerage by $2 million from $51 to $54 million to $53 to $56 million regardless of leaving income steerage flat. Income progress is spectacular, and I do not dislike the long-term way forward for the corporate. Nonetheless, I feel it’s being buoyed partially by an aggressive inventory buyback program. Whereas it is claiming previous buybacks are from working money move, it is truly utilizing debt to finance them. I do not suppose that is the fitting transfer for an organization with sturdy income progress however precarious earnings energy in the meanwhile whereas debt is costly. Shareholders ought to take into account promoting their stake on any hype of additional inventory buybacks.

Income progress for the quarter was up a formidable 59% from $48 million to $76.5 million. Nonetheless, when excluding the income from Efficiency Designed Merchandise, a latest acquisition, natural income progress was up a extra tepid 15%. Gross margins have drastically improved to $23.1 million in Q2 from $11.9 million in Q2 2023 and $17.8 million in Q1 2024. This improved gross margin has resulted within the working loss shrinking to $4.1 million for Q2 2024. In comparison with $15.8 million in Q2 2023. HEAR seems to be headed in the fitting path, accelerated by the PDP acquisition. However the inventory buyback program has made it more durable to garner constant income.

HEAR spent $15.2 million to repurchase 952,000 shares throughout the second quarter. This comes out to a mean price of just below $16. As seen within the value chart above, these shares have been bought fairly near the 52-week excessive. I feel had the corporate waited for a extra opportune time throughout the quarter, it may have spent much less cash for a similar quantity of shares. The corporate has one other $31.4 million remaining within the repurchase program, which expires on April 9, 2025.

I take difficulty with the next remark within the Q2 press launch:

We’re significantly happy with our capability to generate sturdy money move from operations, which has allowed us to repurchase roughly $15 million of our inventory this quarter-the largest repurchase in our historical past. This motion underscores our confidence in Turtle Seashore’s trajectory and our dedication to enhancing shareholder worth.

Whereas it is true that HEAR generated constructive money move from operations, I’d not take into account it to be sustainable sufficient to help a inventory buyback program. When reviewing the money move assertion, working money move was $14.6 million for the primary half of 2024, down from $24.2 million for the primary half of 2023. The working money move is not constructive on account of operations, however from adjustments in working capital line gadgets. Primarily from a $32.6 million delta in accounts receivable.

The money move from financing actions part of the money move assertion tells us a clearer story. The online borrowings elevated by $74 million. Principally to help the acquisition and rising inventories, however including a $15.2 million money outflow for getting again inventory appears ill-timed. The elevated borrowing resulted in a $2.2 million enhance in curiosity expense. Web loss for the quarter was $7.5 million, with the brand new curiosity expense being the most important supply of the delta between the web loss and working loss.

Working capital has eroded from $68.5 million on the finish of 2023 to $40.4 million on the finish of June 2024, with one other $46 million in long-term debt added to the stability sheet since then. I really feel this isn’t an organization that must be spending its remaining working capital on a inventory repurchase plan. A minimum of not till it could actually present constant income. Ought to HEAR resolve to push ahead with this plan, buyers want to noticeably take into account promoting into the hype. Beneath this situation, HEAR’s monetary flexibility within the face of a latest acquisition and the necessity to develop the enterprise could be considerably impaired.

An aggressive inventory repurchase program that used up the remaining $31.4 million wish to internet round one other 2 million shares. The inventory usually trades lower than 200,000 shares in a day, so a repurchase plan of this dimension taken over a couple of days would have a notable impression on liquidity. Buyers would have a possibility to get out at an excellent value on an organization that has a shortly eroding stability sheet. It looks as if a no brainer determination to me.

I’m presently impartial on HEAR in expectation of the inventory repurchase plan. This isn’t a inventory to brief, however somewhat one which buyers who already personal it ought to take into account taking income as soon as the chance arises.

[ad_2]

Source link