[ad_1]

Richard Drury

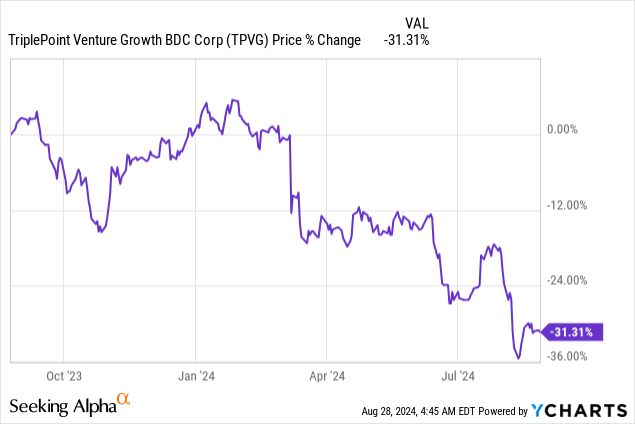

TriplePoint Enterprise Progress (NYSE:TPVG) chopped its dividend by 25% this month because of inadequate web funding revenue and efficiency challenges within the debt portfolio. The dividend reduce was extensively anticipated, because the BDC’s shares traded at a dividend yield of up 19% prior to the announcement. I consider TriplePoint Enterprise Progress reduce its dividend right down to a extra manageable stage and the brand new distribution of $0.30/share is extra sustainable.

An increase within the non-accrual share, persistent funding losses and a steep drop-off in curiosity revenue/complete funding revenue created important promoting strain for TPVG, whose shares are actually buying and selling at a 15% low cost to web asset worth. For my part, the best choice for revenue buyers post-dividend reduce is to remain the course, because the BDC’s distribution protection profile ought to enhance going ahead.

Earlier ranking

In my June work Get Prepared For A Dividend Minimize, I argued {that a} dividend reset was extremely possible and that buyers ought to be ready for an announcement within the subsequent 1-2 quarters. The explanation for this was that TriplePoint Enterprise Progress was affected by a excessive ratio of non-performing loans in its portfolio and excessive funding losses. This in flip led to a weak distribution protection profile and made a dividend reduce that rather more possible. Now that the dividend has been reset, I consider the distribution protection profile is ready to enhance, and I subsequently improve TPVG to carry.

Weak efficiency outcomes result in dividend reduce

The second-quarter was not a fantastic one for TriplePoint Enterprise Progress: the BDC suffered continuous efficiency points in its debt portfolio, which led to a surging non-accrual share in addition to quantity of funding losses. Consequently, TriplePoint Enterprise Progress reported steep declines in web funding revenue and was compelled to reset its dividend at a decrease charge.

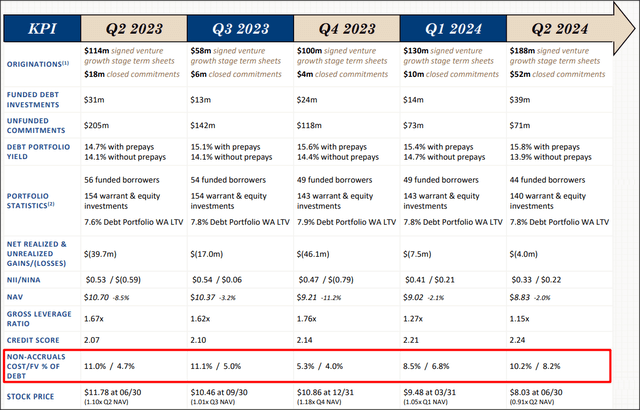

TriplePoint Enterprise Progress’s important concern is its weak steadiness sheet high quality. Previous mortgage originations have turned bitter and the BDC was compelled to place extra loans on non-performing standing. Consequently, TriplePoint Enterprise Progress now sees one of many highest non-accrual percentages within the trade: on the finish of the second-quarter, TriplePoint Enterprise Progress’s non-accruals surged to eight.2% (based mostly off of truthful worth), exhibiting a rise of 1.4 PP quarter-over-quarter. Except for This fall’23, the non-accrual development has gotten progressively worse all through the final 12 months.

TPVG

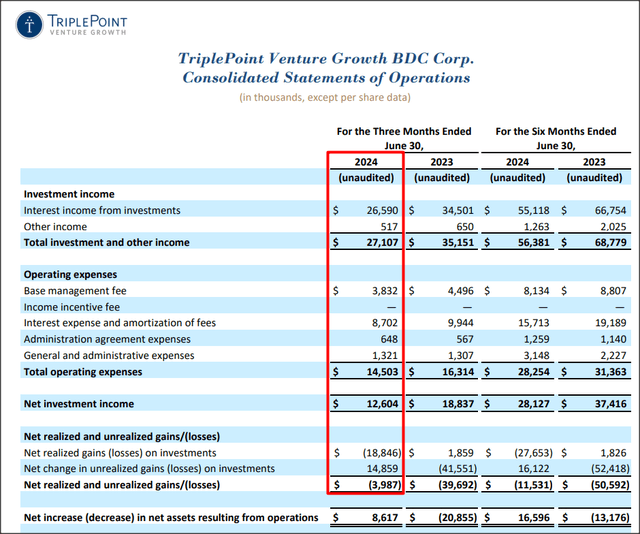

Due to TriplePoint Enterprise Progress’s credit score issues, the BDC suffered a steep drop-off in its revenue within the second-quarter: the BDC reported an enormous 23% year-over-year decline in curiosity revenue in addition to in complete funding revenue. Moreover, TriplePoint Enterprise Progress realized losses on debt investments totaling $18.8M within the second quarter, which resulted in a 2% Q/Q decline in web asset worth.

Consequently, TriplePoint Enterprise Progress’s earnings scorecard revealed a a lot weaker distribution protection profile within the second-quarter. The BDC generated a distribution protection ratio, based mostly off of web funding revenue, of solely 0.825X in Q2’24 in comparison with 1.025X in Q1’24. Given the clear unsustainability of the dividend, TriplePoint Enterprise Progress lowered its future payout from $0.40/share to $0.30/share, exhibiting a 25% decline.

Now that TriplePoint Enterprise Progress reset its dividend at a decrease charge, the BDC’s distribution protection profile is ready to enhance within the subsequent quarter. Nevertheless, there may be nonetheless the danger that different investments shall be moved to non-performing standing. Subsequently, I consider that TriplePoint Enterprise Progress nonetheless has a substantial quantity of web funding revenue and dividend dangers going ahead.

TPVG

TPVG’s valuation

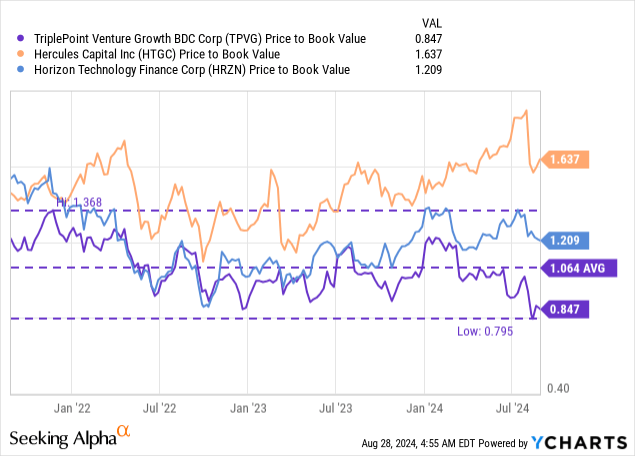

The dividend reduce had an anticipated adverse impression on the BDC’s valuation: shares of TriplePoint Enterprise Progress have bought at a small low cost to web asset worth forward of the dividend reduce, however are actually buying and selling at a a lot bigger low cost of 15% to web asset worth.

Horizon Know-how Finance (HRZN) and Hercules Capital (HTGC) are rival BDCs in TriplePoint Enterprise Progress’s area of interest, as all firms give attention to investments within the venture-backed development sector. Hercules Capital is buying and selling by far on the highest P/NAV ratio of 1.64X, largely as a result of the BDC has been capable of ship regular and constant web funding revenue outcomes for the advantage of shareholders within the final a number of years. Hercules Capital’s robust second-quarter earnings sheet was the explanation why I upgraded shares to purchase simply days in the past.

TriplePoint Enterprise Progress is at present buying and selling properly beneath its longer-term common P/NAV ratio of 1.06X as properly, and this low cost is the direct results of the BDC’s credit score issues and dividend reduce. I consider will probably be all however not possible for TPVG to return to P/NAV ratio of 1.0X within the quick time period because the BDC nonetheless has a excessive non-accrual share which factors to decrease future web funding revenue and which places revenue buyers off. Subsequently, I’d not be snug shopping for into TriplePoint Enterprise Progress at this level, however I’d as an alternative wait till the BDC’s credit score points have been resolved.

For buyers that owned the BDC earlier than the dividend bought chopped, I consider probably the most smart method right here is to attend and see how the credit score state of affairs develops. My longer-term value goal for TriplePoint Enterprise Progress is the corporate’s web asset worth ($8.83/share on the finish of June), however I do not see a short-term catalyst that might drive shares as much as my truthful worth goal within the close to time period. My truthful worth estimate would possible solely get reached if the BDC succeeds in defending its new dividend and avoids incremental asset high quality points.

Dangers with TPVG

The primary threat for TriplePoint Enterprise Progress is a possible deterioration within the distribution protection profile even after the BDC reset its dividend. Have been this to occur, TriplePoint Enterprise Progress would possible create new adverse sentiment overhang for its shares. If TriplePoint Enterprise Progress had been to fail to cowl its dividend with web funding revenue within the subsequent 1-2 quarters, I’d possible change my advice to promote.

Last ideas

Revenue buyers hate nothing greater than a dividend reduce and that is what TriplePoint Enterprise Progress sadly offered to shareholders this month: the brand new $0.30/share quarterly dividend displays a large 25% discount in dividend revenue for buyers which, for my part, will weigh on the BDC’s valuation for an extended time frame.

I downgraded TriplePoint Enterprise Progress to promote in expectation of a dividend reduce, which turned out to be right, however I’m not but able to improve shares to purchase. The reason being the outsized non-accrual share in TriplePoint Enterprise Progress’s funding portfolio. The distribution protection profile is ready to enhance after the dividend bought chopped, nonetheless, however it’s higher, for my part, to play it protected right here. Buyers could need to keep on the sidelines and see how issues develop with regard to TriplePoint Enterprise Progress’s non-accrual and web funding revenue tendencies earlier than shopping for the BDC’s shares.

[ad_2]

Source link