[ad_1]

The world takes discover at any time when tech large and iPhone maker Apple does something. CEO Tim Cook dinner famously stated that Apple would not emphasize being the primary to do one thing as a result of being the most effective is much extra vital.

Figuring out this, the corporate’s introduced partnership with Purchase Now, Pay Later firm Affirm (NASDAQ: AFRM) to supply loans by way of Apple Pay caught my consideration. Paradoxically, buyers have met Affirm’s inventory with: Meh. Shares are decrease now than they had been earlier than the announcement!

So, has the market fallen asleep right here, or is one thing amiss?

What would possibly Apple’s determination to associate with Affirm imply?

The inventory market hates uncertainty, which is why many new, less-proven firms can spend years preventing market skepticism. Affirm is preventing this battle now; shares are down 80% from their former excessive regardless of the corporate making a ton of enterprise progress (extra on this later). Why? Its core enterprise, Purchase Now, Pay Later loans, may very well be seen as a commodity. Apple thought so when it launched its in-house Purchase Now, Pay Later product Apple Pay Later in March 2023.

Apple’s determination to shutter the enterprise simply over a 12 months later and outsource it to Affirm speaks volumes. One might argue two main statements. First, it says that Apple was not pleased with the patron expertise its service had supplied. Delivering the most effective person expertise is Apple’s bread and butter, the supply of its aggressive edge, which is why Apple’s ecosystem is so darn interesting.

In that very same breath, one would possibly argue that Apple’s determination to associate with Affirm is, in the identical mild, a praise to Affirm’s product, which options myriad mortgage sorts with various phrases and durations. In spite of everything, Apple selected Affirm over everybody else.

Second, it challenges the notion that Purchase-Now, Pay-Later lending is a commodity anybody can copy. If it had been really easy, why did Apple shortly soar ship? Certain, anybody can lend cash, however not everybody can do it nicely. It is one other nod to Affirm’s edge on the sphere.

Apple brings a ton of long-term progress potential to the desk

The extra apparent side of the partnership is the immense progress potential Apple’s person base provides to Affirm’s progress story. Affirm is integrating its lending proper into the Apple Pay interface, enabling customers to seamlessly grow to be Affirm clients with out leaving their digital wallets.

And Apple’s person base is huge. In response to Capital One, there are roughly 60 million Apple Pay customers in america, which might develop to over 75 million by 2030. Affirm isn’t any slouch; the corporate has 17.8 million whole lively customers. Even assuming some overlap, that is instantaneous publicity to a buyer base virtually 4 occasions Affirm’s present measurement, a outstanding alternative that ought to see Affirm decide up customers as soon as issues roll out.

Story continues

After all, not everybody will use Purchase Now, Pay Later loans, however it’s arguably the most effective buyer funnel an organization like Affirm might dream of. Make no mistake — this can be a massive win for Affirm in the long term.

Why Affirm was a purchase even earlier than this

This isn’t to decrease the Apple partnership, however it’s value stating that Affirm has already woven itself deep into the retail house. It really works with over 292,000 lively retailers and has partnerships with different heavyweights, together with Amazon, Shopify, Walmart, and Goal.

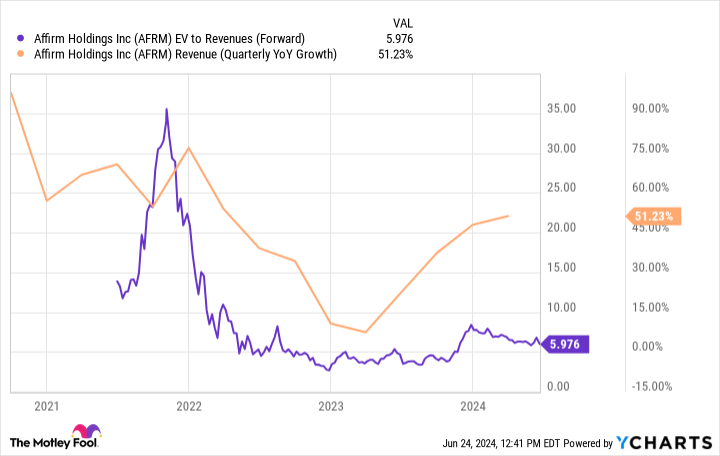

Affirm went public throughout a frenzied market a couple of years again, so it is truthful to say that the inventory’s valuation wanted to chill down. Affirm additionally grappled with surging rates of interest that slowed progress for a number of quarters. Nonetheless, notice the corporate’s turnaround with 51% year-over-year income progress in its most up-to-date quarter. In the meantime, the valuation (enterprise worth to gross sales) stays comparatively suppressed.

Affirm is rising quickly once more, and the Apple partnership hasn’t even begun but. Administration would not assume it can have a cloth impact in its subsequent fiscal 12 months (the rollout will take time), so buyers are seeing a path to sturdy progress that would start within the subsequent 18 months and final for a while.

Buyers might begin feeling good concerning the inventory once more as time goes on. For now, it is exhausting to discover a fintech inventory with extra upside over the following few years than Affirm.

Do you have to make investments $1,000 in Affirm proper now?

Before you purchase inventory in Affirm, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Affirm wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $774,526!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 24, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Justin Pope has positions in Affirm. The Motley Idiot has positions in and recommends Amazon, Apple, Shopify, Goal, and Walmart. The Motley Idiot has a disclosure coverage.

This Hyper-Development Fintech Inventory Is a Desk-Pounding Purchase After Asserting Its New Blockbuster Partnership was initially revealed by The Motley Idiot

[ad_2]

Source link