[ad_1]

UBS strategists say six out of eight indicators of a inventory market bubble are already flashing.

Generative AI hype has pushed inventory costs to document highs, elevating bubble fears.

Present situations mirror 1997, not 1999, suggesting a bubble may quickly kind.

There’s been a whole lot of discuss concerning the inventory market being in a bubble over the previous 12 months as hype for generative synthetic intelligence drives inventory costs to document highs.

In a latest observe from UBS, strategist Andrew Garthwaite outlined the eight warning indicators of a inventory market bubble — and based on Garthwaite, six of them are already flashing.

Which means the inventory market is not in a bubble but, however might be quickly.

“The upside danger is that we find yourself in a bubble. If we’re in such a scenario, then we consider it’s just like 1997 not 1999,” Garthwaite stated.

That is necessary as a result of inventory market bubbles typically result in a painful 80% decline as soon as it pops, however Garthwaite says we’re not there simply but.

“We solely make investments for the bubble thesis if we’re in 1997 not 1999 (which we expect we’re),” Garthwaite stated.

These are the eight inventory market bubble warning indicators, based on Garthwaite.

1. The tip of a structural bull market – Flashed

“Bubbles are likely to happen when historic fairness returns have been very excessive relative to bond returns and thus traders extrapolate historic returns to be predictors of future returns – when actually future returns, as proven by the ERP, are considerably beneath their norms,” Garthwaite stated.

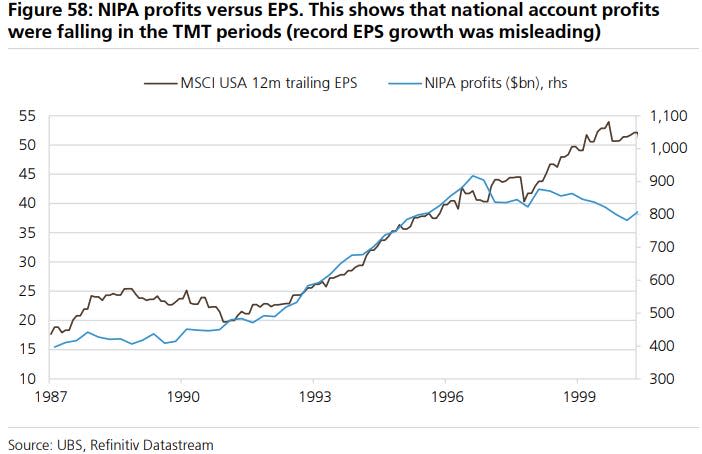

2. When income are underneath strain – Flashed

Whereas S&P 500 income have been booming over the previous 12 months, there’s one other measure of company income that ought to be monitored by traders.

NIPA income measure the profitability of all companies, together with personal corporations, and when these diverge with the income of publicly traded corporations, traders ought to take discover.

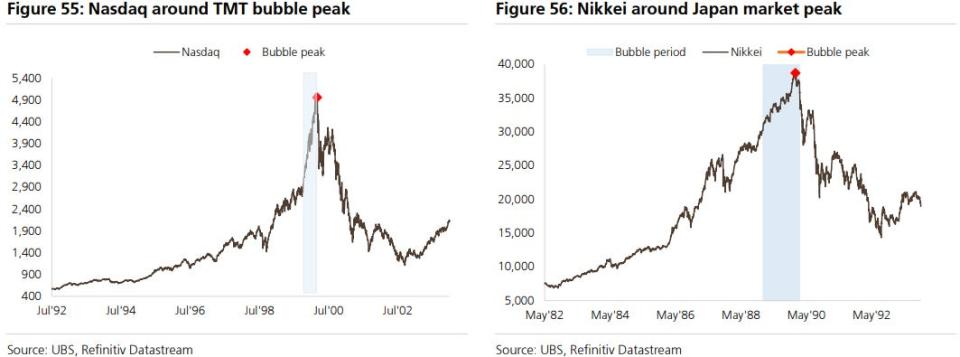

“We are able to see this if we take a look at the TMT interval when the NIPA income fell whereas inventory market income rose. The identical was true in Japan within the late Eighties,” Garthwaite stated.

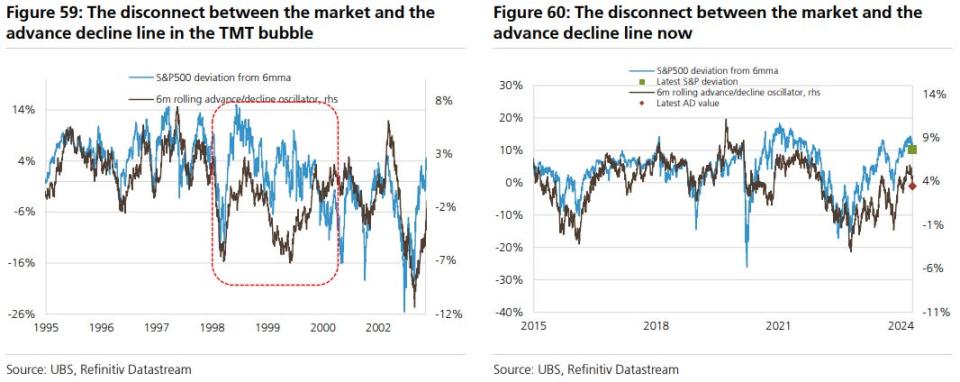

3. Giant lack of breadth – Flashed

When the inventory market is extraordinarily concentrated in a handful of corporations which are driving the majority of the good points, that is an indication that breadth is weak.

With document focus within the mega-cap tech shares, that’s precisely what has been occurring because the median inventory fails to ship sturdy returns.

“We are able to see this specifically if we take a look at the advance to say no line versus the S&P 500 throughout the TMT interval,” Garthwaite stated.

Story continues

4. Wants a 25-year hole from the prior bubble – Flashed

“This permits a complete set of traders to consider ‘it’s totally different this time round’ and develop theories that equities ought to be on a structurally decrease ERP,” Garthwaite stated.

5. Has a 25-year hole from prior bubble – Flashed

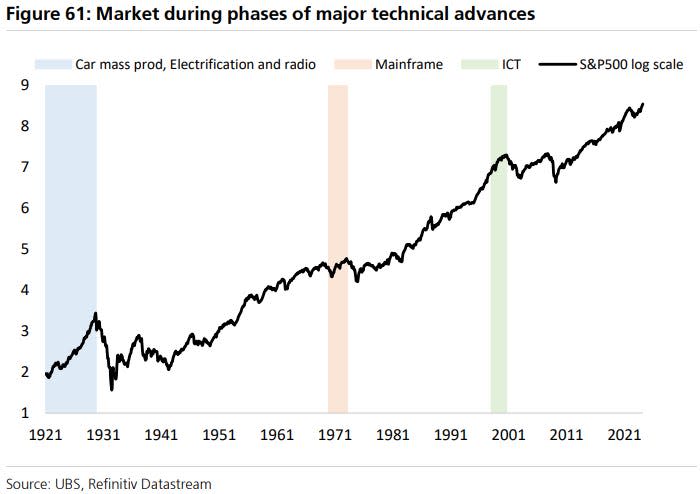

“This narrative both revolves round dominance or extra sometimes know-how. Within the nineteenth century there was a bubble related to railways and within the twentieth century there was a bubble within the run-up to 1929 which was related to the mass manufacturing of vehicles, electrification of cities and the radio,” Garthwaite stated.

6. Retail begins to take part aggressively – Flashed

When retail traders aggressively purchase into the inventory market, it permits the fairness danger premium to fall to very low ranges, resulting in sky-high valuations.

“There may be some proof of this such because the bull/bear ratio of particular person traders being very excessive relative to its norm,” Garthwaite stated.

7. Financial coverage being too free – Hasn’t flashed

Earlier bubbles occurred when actual rates of interest have been allowed to fall in an enormous manner. That hasn’t occurred but, because the Federal Reserve has but to chop rates of interest.

“Present financial situations look abnormally tight versus the output hole,” Garthwaite stated.

8. Prolonged interval of restricted declines – Hasn’t flashed

Earlier inventory market bubbles noticed a multi-year interval of restricted sell-offs of lower than 20%.

With the S&P 500 experiencing a painful bear market in 2022 and promoting off greater than 25% at its low, there might be a protracted strategy to go earlier than this situation is met.

Learn the unique article on Enterprise Insider

[ad_2]

Source link