[ad_1]

Walter Bibikow

Initially created in 1960, the REIT construction’s function was to democratize actual property for the lots. Along with managing properties, reporting and complying with SEC necessities, and paying dividends from money stream, additionally they make use of finance, funding, improvement, and strategic personnel to make choices that may develop worth past a gentle state portfolio. In reality, years in the past they dropped the ‘belief’ classification and at the moment are companies (similar to Apple and Exxon) that qualify for a well-liked tax standing.

Collectively, together with steerage from executives and the board of administrators, the corporate makes choices to amass, dispose, develop, or redevelop properties, promote or purchase again inventory, and problem or retire debt. Known as ‘capital allocation’, this is likely one of the most necessary – if not THE most necessary – qualities for a REIT, or any business actual property proprietor for that matter.

Like several firm, a REIT ought to obey its weighted common value of capital (or WACC) to make these choices. For instance, a widget firm will resolve between constructing a brand new manufacturing facility or shopping for one other firm by evaluating the anticipated returns on deploying this capital versus the returns it might make persevering with on its establishment. Equally, public REITs can evaluate their present inventory worth to the worth of its properties (known as Internet Asset Worth, or NAV) to find out whether or not exterior development can be additive or damaging to NAV per share.

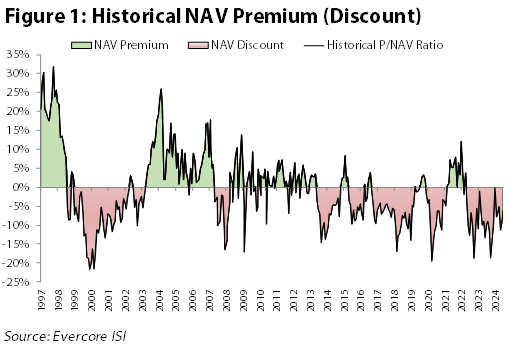

Traditionally, public REITs have loved multi-year intervals of buying and selling at NAV premiums, giving them satisfactory time to boost capital and make accretive investments (acquisitions, mergers, improvement, redevelopment), which have benefited REIT buyers. Theoretically, the businesses elevating accretive capital to spend money on initiatives garner a bigger NAV premium, making a constructive suggestions loop. Nevertheless, since 2010, REITs have traded at an NAV premium for less than 8 months on the longest, and a median length of NAV premium of solely 3.5 months. As such, they’ve needed to eschew a whole leg of the REIT worth creation ‘stool’. Whereas we will’t predict with certainty that this can change sooner or later, we do imagine that buyers ought to concentrate on the potential for a ‘sea change’ that would revive this misplaced artwork.

We imagine that public REITs have confirmed to watch out stewards of investor capital and ought to be trusted to make investments primarily based on their value of capital when it’s advantageous for development in dividends and internet asset worth. We see the subsequent cycle being characterised by much less hypothesis (i.e., decrease provide given larger total capital prices), a significant ramp in rents to replicate rising substitute prices, and fewer competitors from non-public fairness relative to the latest previous. We’re assured that public REITs will be capable of present a risk-adjusted return that ought to be engaging to buyers of every kind and time horizons.

The Previous Guard (1990’s, 2002-2006)

Again when REITs have been considered boring firms that supplied little development however a gentle stream of dividends, acquisitions have been the first technique for rising NAV per share. Within the daybreak of the Fashionable REIT Period, many REITs that got here public have been small, and appeared to the general public market as a technique to increase capital periodically to fund acquisitions. As proven in Determine 1, they traded at a major premium to NAV within the mid-1990’s, which is a interval when the fairness market cap of fairness REITs grew from $6 billion on the finish of 1991 to $128 billion by the top of 1997.

By definition, a interval of NAV premiums creates alternatives to amass at cap charges above a REIT’s personal value of capital. ‘Unfold investing’ was the secret throughout this time, the place REITs might lock in an expansion between the acquisition cap charges and their very own value of capital. This was admittedly helped by the capital scarcity from conventional buyers following main adjustments to tax guidelines for personal homeowners in 1986 and the next meltdown of many monetary establishments together with financial savings and mortgage associations. For example, public REIT Common Development Properties (now owned by Brookfield) was in a position to buy Ala Moana Middle in Honolulu in 1999, now essentially the most invaluable mall on the planet.

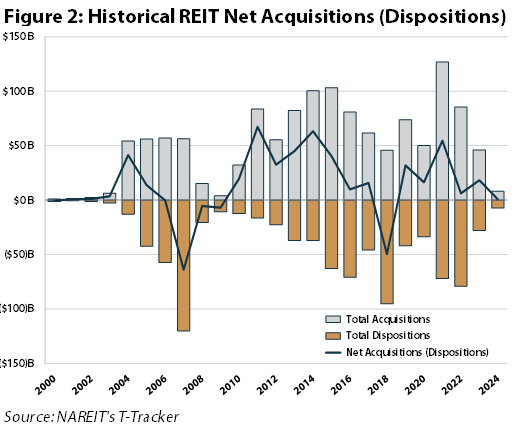

Following an almost four-year interval of NAV reductions because of the rise of tech shares within the dot-com increase (sound acquainted?), REITs then traded at an NAV premium for nearly 5 years straight because of the above common development in reported earnings and a major rise in investor curiosity in business actual property that lifted valuations to then document ranges! Once more, the fairness market cap of REITs soared from $151 billion on the finish of 2002 to over $400 billion in 2006. Throughout this time, we calculate that REITs executed internet acquisitions of $59 billion, elevating over $53 billion in new fairness.

Public REITs have been once more rivals for many giant high-quality properties coming to market given their administration experience and favorable value of capital versus non-public friends. Although there have been fewer IPOs than within the 1990’s, fairness REITs raised vital fairness capital on the secondary market leading to portfolio development, and buyers rewarded them with premiums, leading to +23% annualized complete returns from 2002-2006. The most important examples embrace Simon Property Group’s (SPG) purchases of iconic properties such because the Houston Galleria and Pennsylvania’s King of Prussia Mall, along with firm acquisitions of Chelsea, Prime, and Mills. Maybe essentially the most profitable commerce was executed by Sam Zell at Fairness Workplace Properties. The corporate went on a string of acquisitions from 1998 to 2006, increasing its stability sheet by virtually $13 billion, and bought to Blackstone on the peak in 2007 for $39 billion.

Following the International Monetary Disaster, public REITs had just a few small home windows of NAV premiums the place they have been in a position to safe a number of high-profile offers, together with BXP’s acquisition of the GM Constructing (now essentially the most invaluable workplace constructing on the planet) and AVB/EQR’s acquisition of the Archstone condo portfolio for $5 billion.

2010-2024, the Acquisition Ice Age

Nevertheless, as beforehand talked about, the market has been much less prepared to assign a premium to public REITs up to now 14 years. In reality, the worth/NAV for public REITs averaged 96.3% from December 2010 to July 2024, equal to a 3.7% low cost. Throughout this era (Determine 2), REITs made internet acquisitions of $371 billion, concentrated in a number of sectors that had prolonged intervals of NAV premiums, comparable to industrial, cell towers, information facilities, chilly storage, self-storage, triple internet, and single-family leases. Regardless of the dearth of a broad value of capital benefit over non-public gamers, public REITs delivered an annualized complete return of +8.1% from December 31, 2010 to July 31, 2024.

Many of the high-profile offers have been as a substitute purchased by non-public fairness because of larger debt ratios that produced a WACC that was a lot decrease than public REITs. For instance, since 2010 Blackstone (BX) has grown its actual property platform from $33 billion to $337 billion as of December 31, 2023. In reality, the price of capital had change into so totally different between private and non-private that 21 public REITs went non-public for a complete of $141 billion from 2017 to current day. Notably, BX was the client of 8 of those public REITs for a complete of $58 billion. The alerts modified such that public REITs have been often punished by acquisition and fairness increase bulletins. In consequence, public REITs used the capital markets to pay down debt to document low ranges and, to a lesser extent, purchase again inventory, eschewing exterior development save for just a few sectors and corporations.

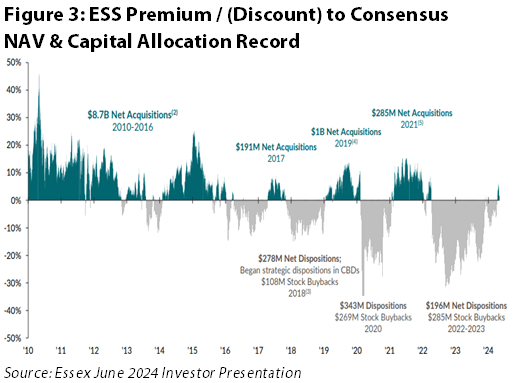

For instance, Essex Property Belief (ESS), a West Coast centered multifamily REIT, was aggressive in acquisitions from 2010-2016 when it was buying and selling at a premium to NAV, making $8.7 billion in internet acquisitions. As proven in Determine 3, the corporate had internet inclinations of $87 million in 2017-2018, and repurchased $108 million of inventory. After a quick interval at an NAV premium in 2019 the place it made $1 billion in internet acquisitions, it has had $254 million in internet inclinations since 2020, making $554 million of inventory buybacks alongside the best way. Whereas the corporate might have made the numbers work by utilizing low-cost debt from 2017-2024, it as a substitute prioritized a fortress stability sheet, garnering a BBB+ ranking from S&P, and a debt ratio of solely 28% as of June 30, 2024.

The ‘X’ Issue for the Subsequent Decade

We imagine ESS and the remainder of the REITs have put themselves in place to be the winners of the subsequent cycle. On account of disciplined capital allocation throughout all property varieties, public REITs boast a mean debt / gross property ratio of 32%, internet debt to EBITDA ratio of 4.5x, and retained money stream of 26% of AFFO as of June 30, 2024. If and when their inventory costs commerce at an NAV premium for an prolonged interval, they are going to be able to pounce.

That is already beginning to happen in a number of property varieties, as public REITs have been patrons of a number of the largest offers in 2023-2024. For instance, triple internet REIT VICI Properties (VICI) purchased BX’s stake in MGM Grand/Mandalay Bay for $1.2 billion in 2023, and has continued its shopping for spree by investments within the Venetian, Bowlero, and Chelsea Piers. Public Storage (PSA) purchased Merely Storage for $2.2 billion from BX in 2023 with out having to boost any new fairness because of its extraordinarily low leverage and favorable borrowing charges. Senior Housing REIT Welltower (WELL) has bought $9.4 billion of senior housing property since 2021, and has produced an annualized complete return of 13.8% over the identical interval (in comparison with the RMZ’s annualized complete return of -3.5% over the identical time interval) as buyers cheered these accretive acquisitions.

Different sectors are nonetheless ready. This 12 months, the profitable bidder on the property within the Quarterra condo portfolio from Lennar was KKR and different non-public fairness homeowners, totaling roughly $4 billion. Brookfield Properties purchased an industrial portfolio from DRA Advisors for $1.3 billion in June 2024. In a special market, these properties could be logical targets for condo and industrial REITs, respectively.

As of July 31, 2024, estimates name for anticipated AFFO development of +5%, and +6% in 2025 and 2026, respectively. Nevertheless, if REITs have been in a position to make acquisitions at a 150 bps unfold that equated to five% of their complete market cap yearly, it might add 150 bps to annual AFFO development, leading to enhanced annual development round +7%.

As lively managers, we’ve the flexibility to pick REITs with much more upside. For instance, Camden Property Belief (CPT) is a prime three obese place within the Chilton REIT Composite as of July 31, 2024. CPT traded at a mean NAV premium of 6.7% from 2003-2006. As of July 31, 2024, the corporate trades at a 17% low cost to NAV. Merely assuming CPT trades in step with its NAV would reward buyers with a 20% worth return. If it have been to commerce at its common premium from the early 2000’s, there may be 28% upside to the inventory. Moreover, we imagine CPT has the flexibility to develop same-store NOI by robust natural development that would strategy +6.1% (2026: +4.3%, 2027: +8.0%) annualized from 2026-2027, plus make vital acquisitions or ramp its improvement pipeline given its low leverage stability sheet at solely 21% debt / gross property.

Conclusion

Recency bias has confirmed to be pricey for many who didn’t anticipate rates of interest would rise at a document tempo in 2022 and 2023. Whereas we will’t predict what the subsequent cycle will appear like and who the beneficiaries can be with any certainty, it ought to be totally different than the prior cycle. In an unsure financial setting, we imagine that the astute stability sheet administration up to now has completely positioned most of the fairness REITs for the present setting the place robust administration and entry to a number of sources of low-cost capital relative to personal gamers ought to enable many to play a a lot bigger function in business actual property throughout all sectors.

[ad_2]

Source link