[ad_1]

Merchants,

I’ve received a recent batch of concepts that would set us up for an thrilling week forward. On this replace, I’ll stroll you thru my thought course of and element my entry and exit methods for my high picks, that are poised for vital directional strikes.

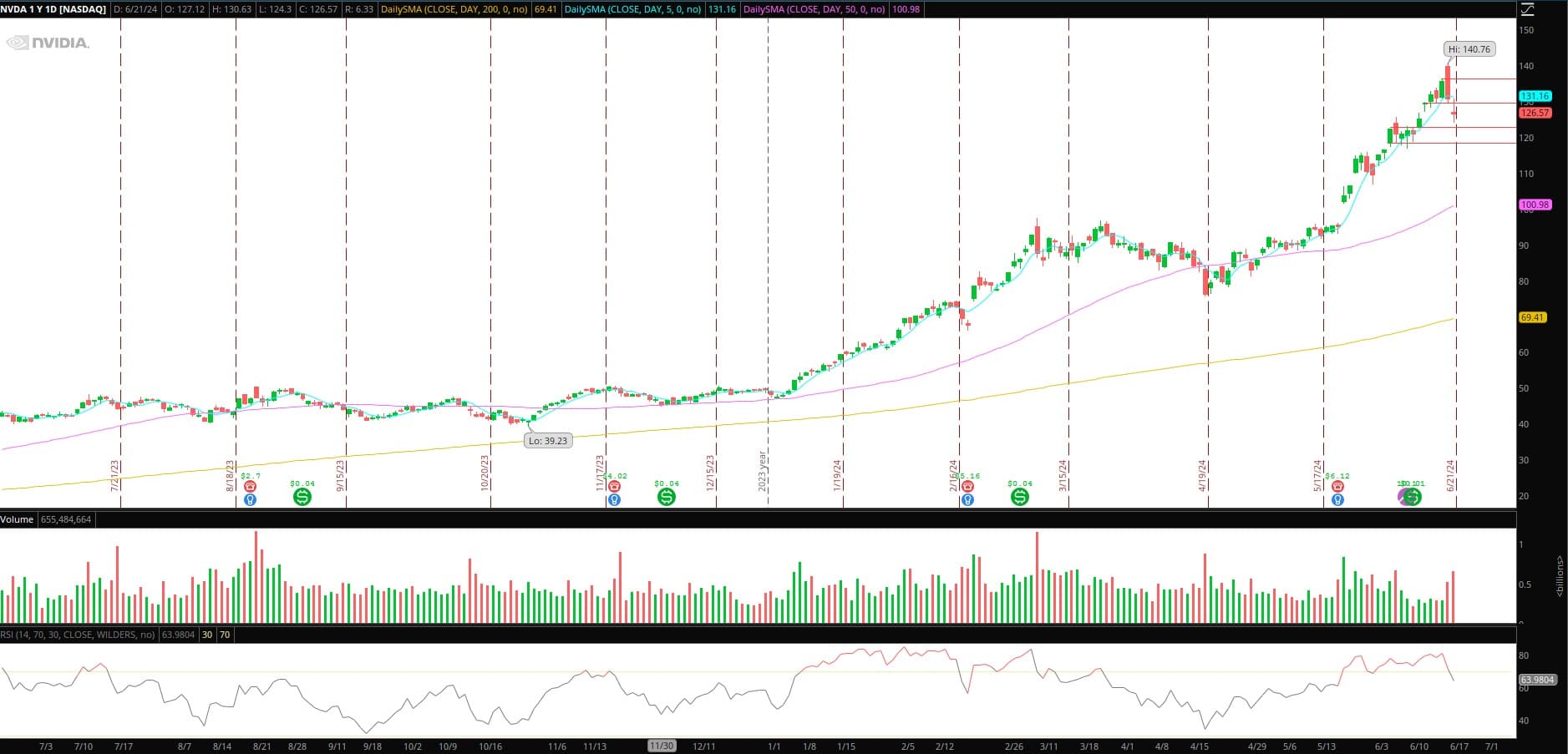

The expectation adjustment, rotation, and profit-taking anticipated within the semi-sector and NVDA, which I outlined final week, have been spot on. The reversion commerce in NVDA and semis was by far the best opp of the earlier week, and one which I spoke about and reviewed intimately in my newest assembly on Thursday after the market closed.

Click on right here to listen to extra from me and several other different merchants on the desk.

Now, listed here are my high concepts for the week.

Washout Lengthy / Bounce in NVDA

This concept applies to a number of names, so it’s necessary to give attention to what most closely fits your model. For me, I’ll focus my consideration on NVDA and presumably SOXL as effectively to specific the thought and commerce if it materializes.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market components similar to liquidity, slippage and commissions.

Here’s what I’m in search of:

Firstly, much like the motion in March on the eighth and eleventh, historical past may repeat itself, and the inventory may hole up into potential resistance. If that have been to occur, and NVDA gaps into / trades into the low $130s, I might not be targeted on the lengthy. As a substitute, I might be open to a brief scalp, which might be on a decrease timeframe and intraday.

The thought I’m enthusiastic about is that if historical past doesn’t repeat itself. Now that the rebalance is out the best way and the inventory has pulled again considerably from the excessive, I might love a washout close to potential assist within the low $120s. An additional decline would excite me concerning the R: R for the lengthy.

I might search for a washout and snapback or regular decline, then a development break and better low. As soon as there’s a larger low and affirmation of a reversal, I’ll get lengthy versus the earlier low for a swing lengthy. I plan on scaling out of the place on a 1 ATR up transfer, close to potential resistance round $127, and trailing the cease utilizing larger lows on the 15-minute timeframe, in the end focusing on a transfer above $130, doubtlessly towards the low to mid $130s over a number of days. The important thing right here shall be to take earnings into goal 1, path my cease, and proceed to scale out of the place because the inventory makes vital larger highs, thereby managing threat and turning it right into a risk-free commerce.

So, coming into the week, I’ll give attention to NVDA and the semis. That’s the place the vary and liquidity are, and due to this fact, that’s the place my consideration shall be.

Nonetheless, a number of different names are on my radar as effectively:

Continuation in AMZN: Good breakout and rotation into AMZN on Friday, as I mentioned on Thursday in Inside Entry. Going ahead, if AMZN can proceed to base above $188, I’ll look to get lengthy on an intraday breakout with a low of day / $188 cease for a multi-day momentum lengthy swing, focusing on a transfer to new highs.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market components similar to liquidity, slippage and commissions.

Monitoring META for a Breakout: META has been consolidating steadily throughout a number of timeframes with clear resistance. I’ll monitor it going ahead for additional consolidation and a possible breakout over resistance. If that develops, I’ll enter lengthy as soon as it has primarily based above resistance, with a low-of-day cease, focusing on a transfer initially towards the latest pivot excessive.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market components similar to liquidity, slippage and commissions.

Pop to Quick in MINM: Regular fail and weak shut in MINM on Friday. Ideally, this has a push again into potential resistance and provide close to $3.8 – $4. As soon as that confirms and fails, I might search for a brief versus the excessive, focusing on a transfer again to low $3.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market components similar to liquidity, slippage and commissions.

Pop to Quick in AREB: Much like MINM. Focusing on a push again towards the 2-day VWAP and fail for a gentle stroll decrease and unwind. If it reclaims its multi-day VWAP, I can’t be short-biased.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market components similar to liquidity, slippage and commissions.

Essential Disclosures

[ad_2]

Source link