[ad_1]

Merchants,

I’ll be sharing my high concepts, thought course of, and exact entry and exit plans with you for the upcoming week.

Now, simply earlier than we get into that, some essential reminders. Earnings are getting underway, and this week, a number of market giants, like Tesla and Alphabet, reporting earnings. Final week was pushed in lots of points by breaking information and headlines, which created each alternatives and uncertainty. So, an additional reminder to at all times be in tune with what is occurring and versatile sufficient to adapt your plans and danger administration accordingly.

Now, for the week forward, here’s what I’m watching.

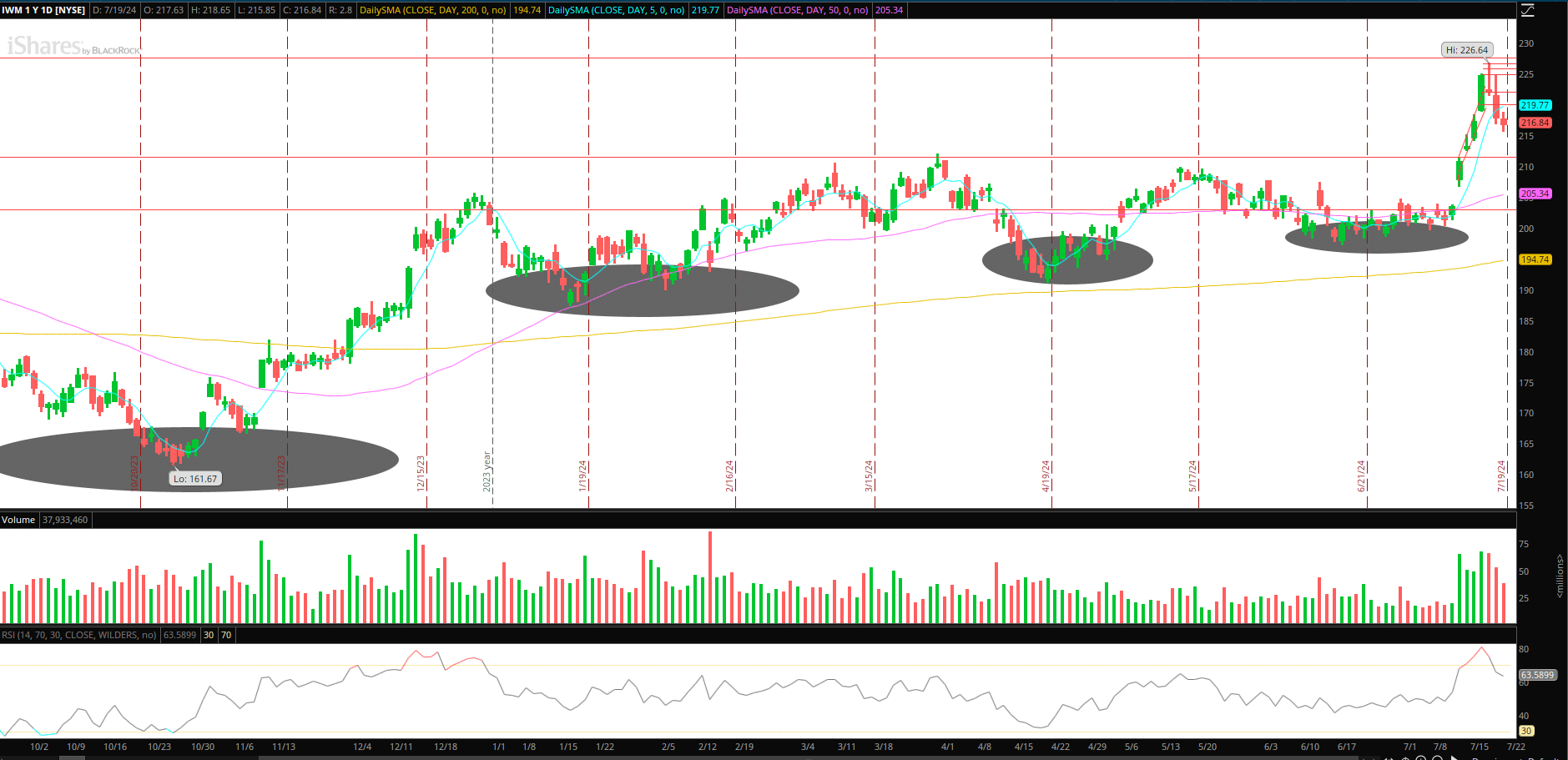

Stalking Small Caps for a Lengthy Entry (IWM/TNA)

Undoubtedly, one of many high alternatives up to now within the month has been the breakout in IWM, adopted by the pullback commerce, and I’m glad to have seen a number of merchants on the desk crush the opps. Within the newest Inside Entry assembly, we reviewed the chance within the IWM intimately.

Now, much like my ideas final week, my high concept coming into the week might be stalking the IWM for a backside and lengthy entry for a bounce and potential second leg.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements resembling liquidity, slippage and commissions.

Right here’s my plan:

It was a implausible higher-timeframe breakout, adopted by a gentle pullback into the top of final week. With the realm of $216 establishing itself on Friday as assist, it is going to now be a key space I watch going ahead.

Ideally, I want to see IWM show some relative energy to the general market, indicating that the theme of short-term outperformance stays intact. For an entry, I want to see a better low versus Friday’s low and/or a wash beneath Friday’s low and rapid reclaim. That may get me to put a starter place lengthy. I want to see the IWM maintain agency above the $218 zone and Friday’s excessive to dimension into the place. Whereas I’ll handle this place on the 15-minute timeframe, scaling out on increased highs and trailing utilizing increased lows, I will even goal ATRs to scale out and key each day ranges over a number of days, resembling $222 and $225.

Listed here are A number of Extra Concepts for the Week

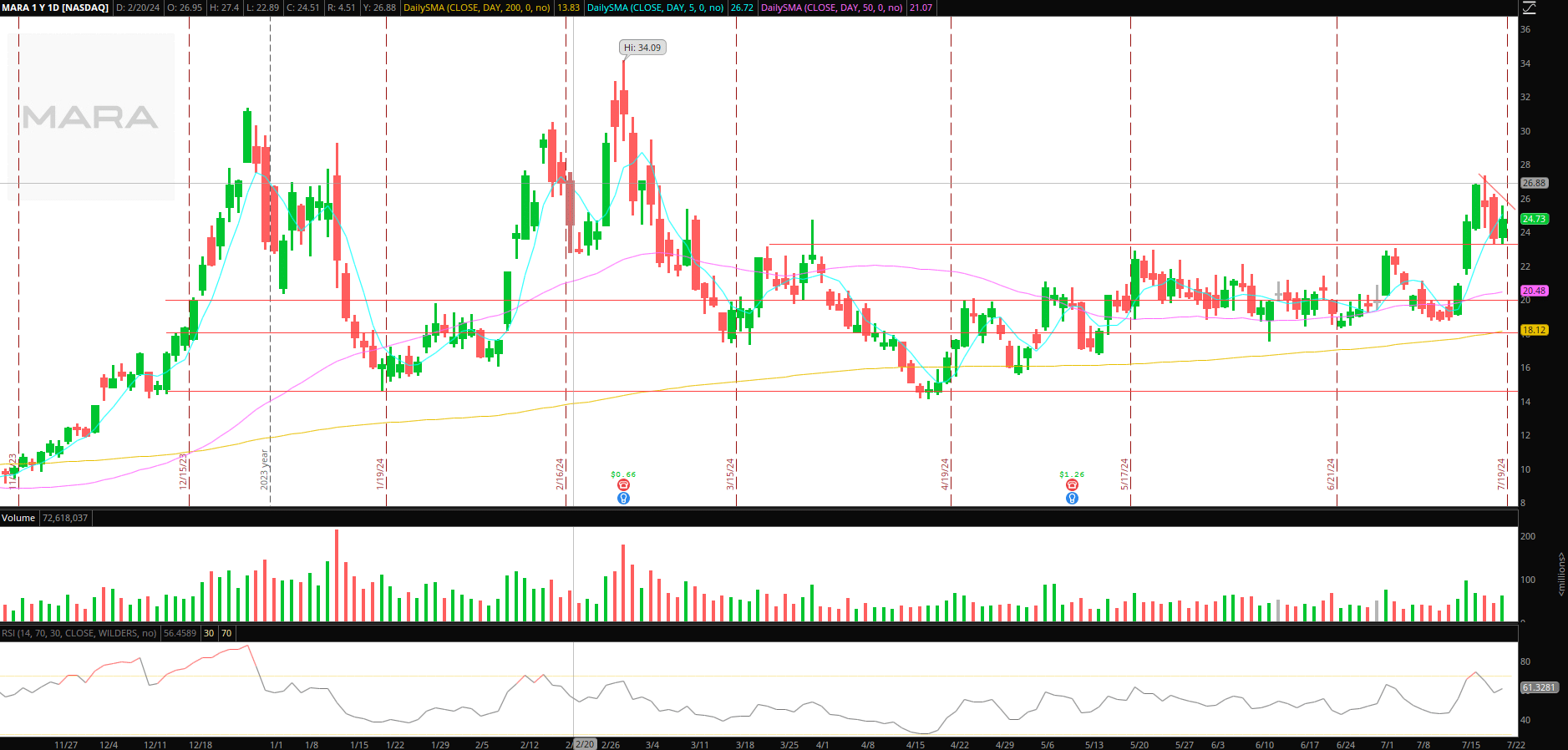

Greater Low in Bitcoin Names: Bitcoin had an incredible restoration final week. Going ahead, I’ll be monitoring crypto-related names, resembling MARA, CLSK, IBIT, and many others. For instance, in MARA, together with conserving a detailed eye on Bitcoin, I might be searching for additional construct and a better low on this consolidation for a possible long-swing entry. Given the extent of Bitcoin’s bounce, I gained’t be too desperate to pay up however slightly monitor the motion going ahead to see the way it shapes up.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements resembling liquidity, slippage and commissions.

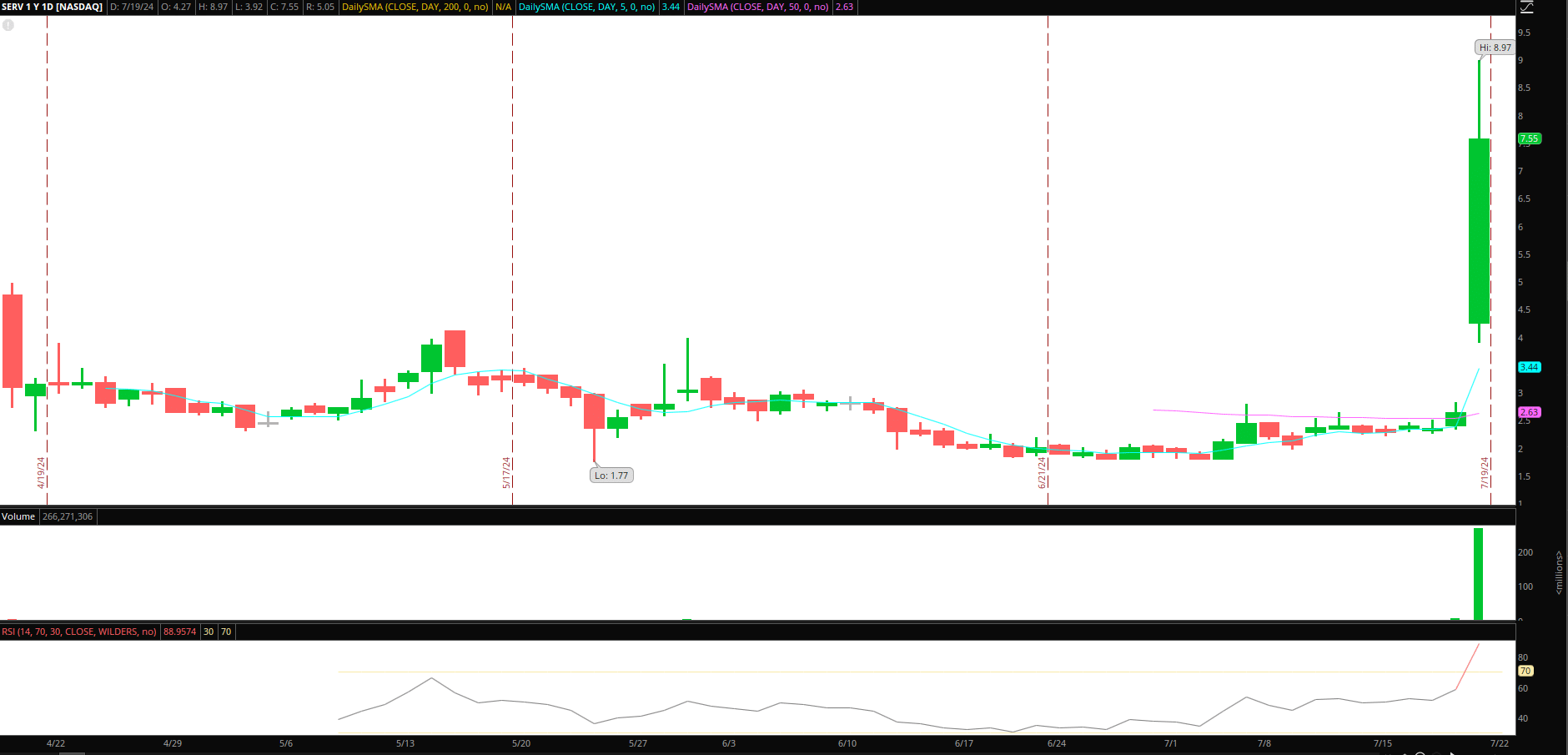

Momentum Trades in SERV: Lovely momentum mover on Friday, providing sensible lengthy and quick trades intraday. Whilst you solely want to take a look at the SOUN chart to see the way it ends, there isn’t a have to be biased within the quick time period. I’ll be actively watching this for momentum trades intraday till a transparent bottom is confirmed; on this case, I’ll change to a swing mindset. What might that seem like to substantiate? Blow-off high, consecutive decrease highs, uptrend break, shift in worth motion, and VWAP crack.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements resembling liquidity, slippage and commissions.

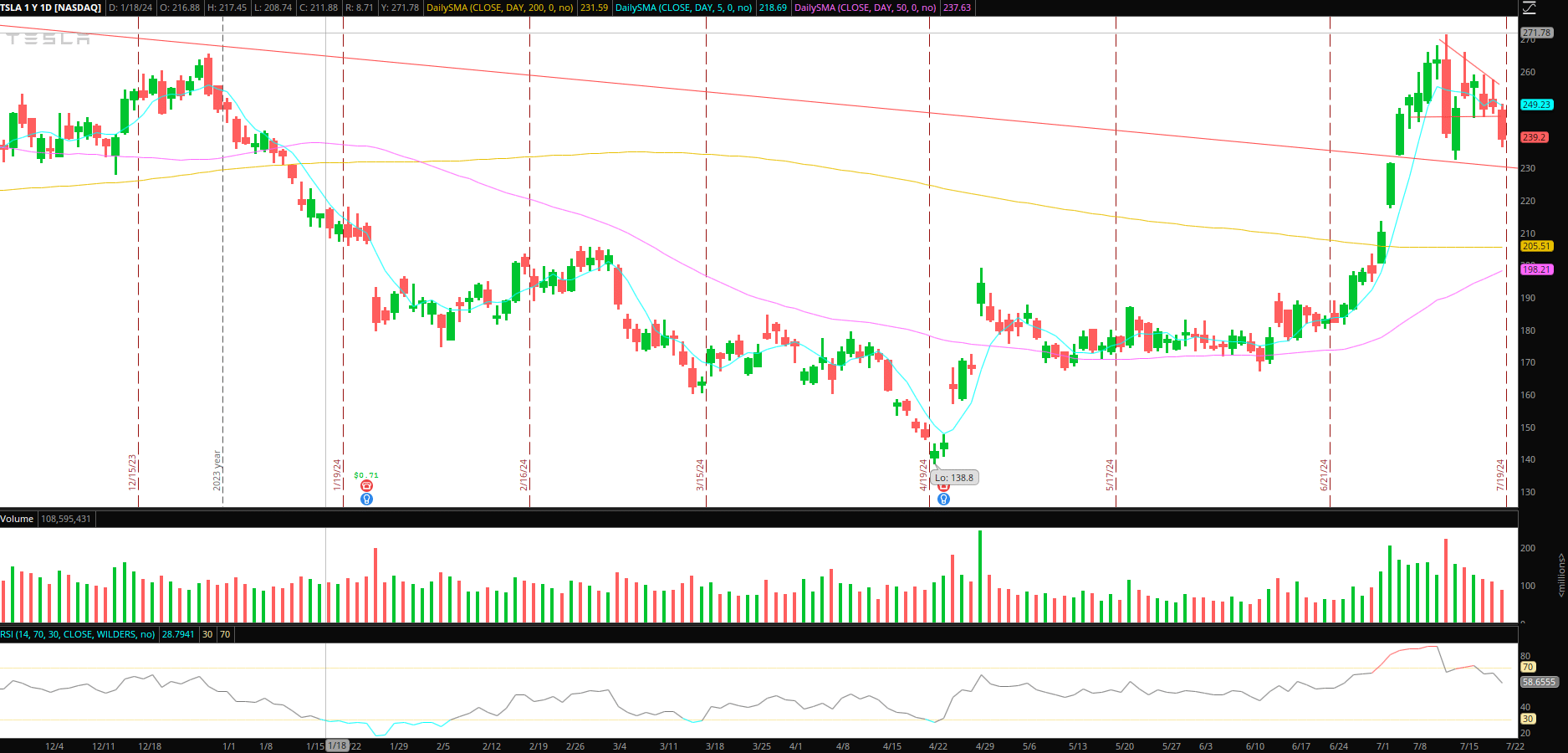

Tesla and Alphabet Earnings: Two mega-caps report early subsequent week. I’ll search for alternatives after earnings. First, earlier than I search for a setup, I’ll familiarize myself with key ranges, total sentiment, and the outcomes. Solely then will I familiarize myself with the worth motion and look to kind a commerce plan if a setup begins to kind. We’ll go over this and overview the motion in additional element within the upcoming Inside Entry assembly.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements resembling liquidity, slippage and commissions.

Vital Disclosures

[ad_2]

Source link