[ad_1]

Revealed on November twenty sixth, 2024 by Bob CiuraSpreadsheet information up to date day by day

The Dividend Kings are the best-of-the-best in dividend longevity.

What’s a Dividend King? A inventory with 50 or extra consecutive years of dividend will increase.

We’ve compiled a listing that features each Dividend King. You may see the complete downloadable spreadsheet of all 54 Dividend Kings (together with essential monetary metrics corresponding to dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the hyperlink under:

The Dividend Kings checklist consists of a number of mega-cap shares which have huge companies, corresponding to Walmart Inc. (WMT) and Coca-Cola (KO).

However there are additionally smaller corporations which have generated sturdy shareholder returns, and have elevated their dividends for over 50 years.

The next 10 shares symbolize the Dividend Kings with the smallest market caps.

Desk of Contents

Dividend Kings Overview

The necessities to be a Dividend King are comparatively easy: 50 consecutive years of dividend will increase. Not like the Dividend Aristocrats, there are not any different necessities.

There are at present 54 Dividend Kings. The Dividend Kings are obese within the Industrials, Shopper Staples, and Utilities sectors. On the similar time, the Dividend Kings checklist is underweight the know-how sector.

The next part lists the ten Dividend Kings with the smallest market caps.

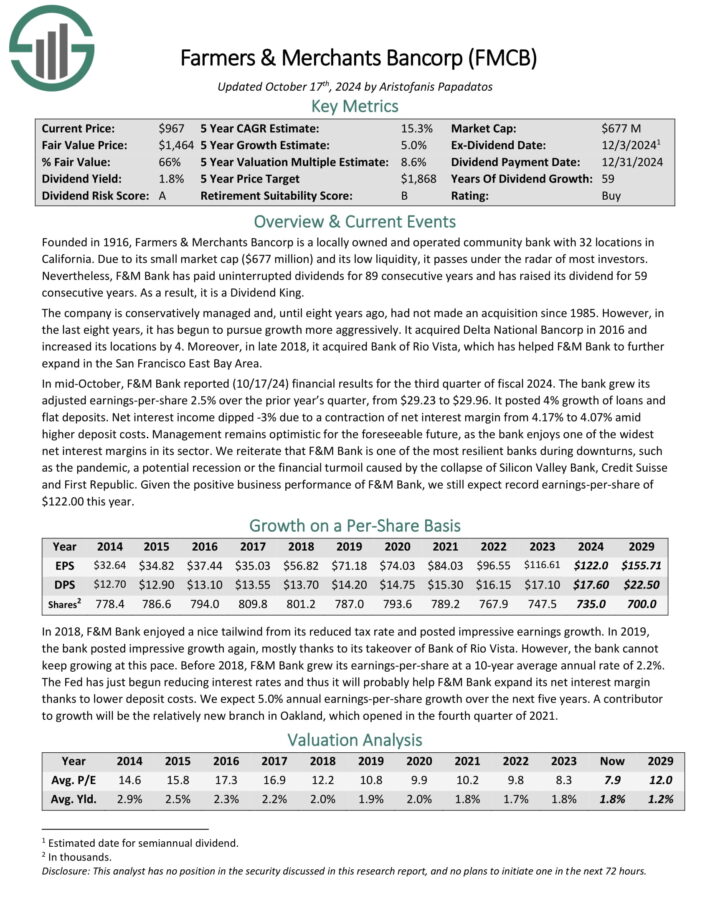

Dividend King You’ve By no means Heard Of: Farmers & Retailers Bancorp (FMCB)

Farmers & Retailers Bancorp is a regionally owned and operated neighborhood financial institution with 32 places in California. As a consequence of its small market cap and its low liquidity, it passes beneath the radar of most traders.

F&M Financial institution has paid uninterrupted dividends for 88 consecutive years and has raised its dividend for 59 consecutive years.

In mid-October, F&M Financial institution reported (10/17/24) monetary outcomes for the third quarter of fiscal 2024. The financial institution grew its adjusted earnings-per-share 2.5% over the prior 12 months’s quarter, from $29.23 to $29.96.

It posted 4% development of loans and flat deposits. Web curiosity earnings dipped -3% resulting from a contraction of web curiosity margin from 4.17% to 4.07% amid increased deposit prices.

F&M Financial institution is a prudently managed financial institution, which has at all times focused a conservative capital ratio. The financial institution at present has a complete capital ratio of 14.95%, which leads to the very best regulatory classification of “effectively capitalized.”

Furthermore, its credit score high quality stays exceptionally sturdy, as there are extraordinarily few non-performing loans and leases in its portfolio.

Click on right here to obtain our most up-to-date Positive Evaluation report on FMCB (preview of web page 1 of three proven under):

Dividend King You’ve By no means Heard Of: Gorman-Rupp Co. (GRC)

Gorman-Rupp started manufacturing pumps and pumping programs again in 1933. Since that point, it has grown into an business chief with annual gross sales of practically $700 million and a market capitalization of $1 billion.

Right this moment, Gorman-Rupp is a targeted, area of interest producer of vital programs that many industrial shoppers depend upon for their very own success.

Gorman Rupp generates about one-third of its complete income from outdoors of the U.S.

Supply: Investor Presentation

Gorman-Rupp posted third quarter earnings on October twenty fifth, 2024. Outcomes had been weaker than the analysts’ estimates however nonetheless they mirrored sturdy development over the prior 12 months.

Income grew marginally (0.4%), from $167.5 million to $168.2 million, as value hikes offset a lower in volumes.

Adjusted earnings-per-share of $0.49 missed the analysts’ consensus by $0.06, however they had been 44% increased than these within the prior 12 months’s interval. The sturdy efficiency resulted primarily from value hikes and decrease enter prices.

Click on right here to obtain our most up-to-date Positive Evaluation report on GRC (preview of web page 1 of three proven under):

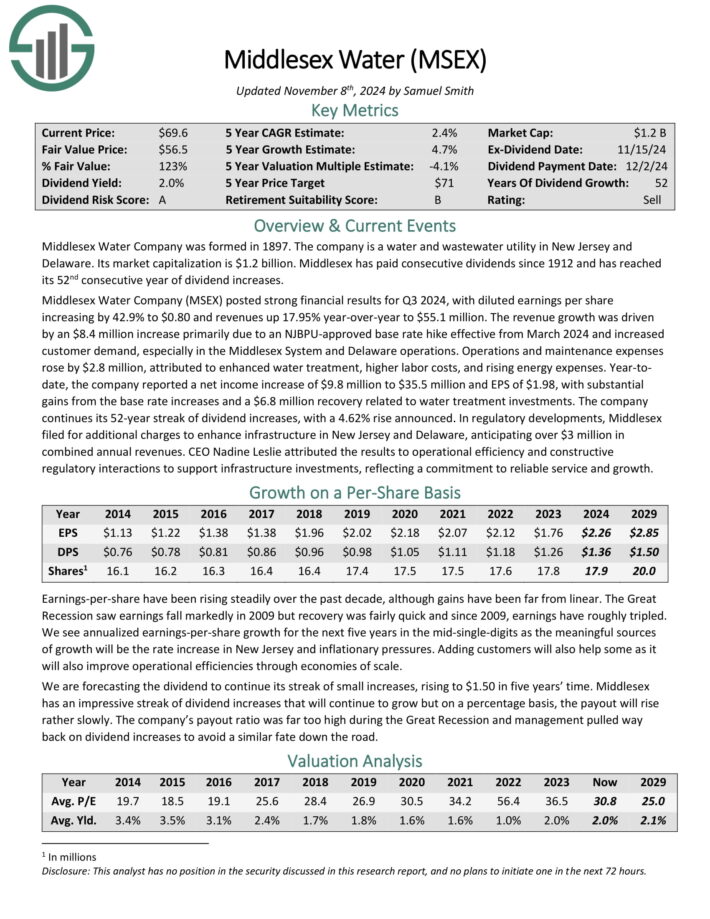

Dividend King You’ve By no means Heard Of: Middlesex Water Co. (MSEX)

Middlesex Water Firm was shaped in 1897, making the corporate one of many oldest water and wastewater utility names within the U.S. The corporate has operations primarily in New Jersey, and annual income of roughly $180 million.

Like a lot of its friends, Middlesex is primarily targeted on the regulated portion of its enterprise.

Supply: Investor Presentation

Middlesex supplies primary water-related companies to clients, corresponding to promoting, distributing, amassing, and treating water. The non-regulated enterprise consists of service contracts that embrace the operation and upkeep of municipal non-public water and wastewater programs in New Jersey and Delaware.

The overwhelming majority of income comes from the regulated aspect. Certainly one of its largest service areas consists of Middlesex County, the place the corporate supplies water companies to over 61,000 retail clients. This enterprise contributed ~60% of income final 12 months.

Middlesex reported third-quarter earnings in late October. Income grew 18% over the prior 12 months’s quarter and earnings per share grew 43%, from $0.56 to $0.80, exceeding the analysts’ estimates by $0.12.

Click on right here to obtain our most up-to-date Positive Evaluation report on MSEX (preview of web page 1 of three proven under):

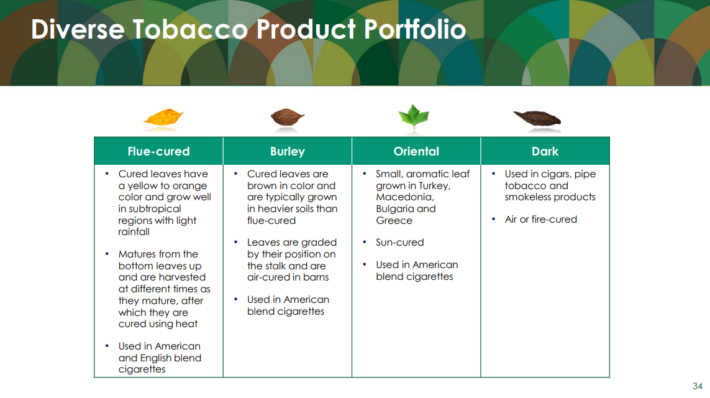

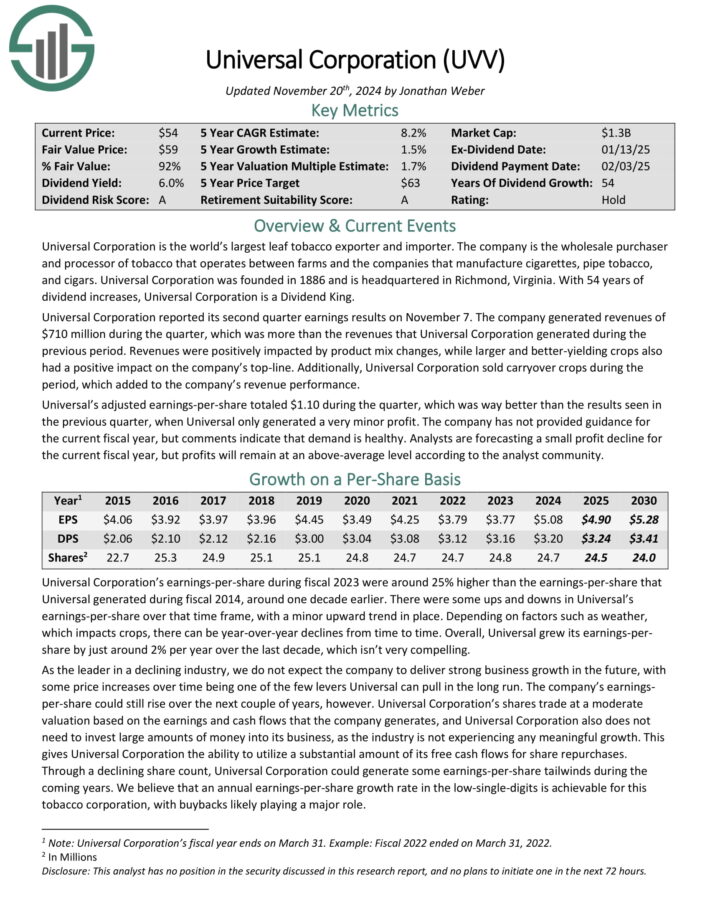

Dividend King You’ve By no means Heard Of: Common Corp. (UVV)

Common Company is a market chief in supplying leaf tobacco and different plant-based inputs to client product producers.

The Tobacco Operations section buys and sells tobacco used to make cigarettes, cigars, pipe tobacco, and smokeless merchandise.

Common buys tobacco from its suppliers, processes it, and sells it to giant tobacco corporations within the US and internationally.

Supply: Investor Presentation

The Ingredient Operations deal primarily with greens and fruits however is considerably smaller than the tobacco operations. Common has been rising this enterprise by means of acquisitions beginning in 2020.

Common Company reported its second quarter earnings outcomes on November 7. The corporate generated revenues of $710 million throughout the quarter.

Moreover, Common Company offered carryover crops throughout the interval, which added to the corporate’s income efficiency.

Click on right here to obtain our most up-to-date Positive Evaluation report on Common (preview of web page 1 of three proven under):

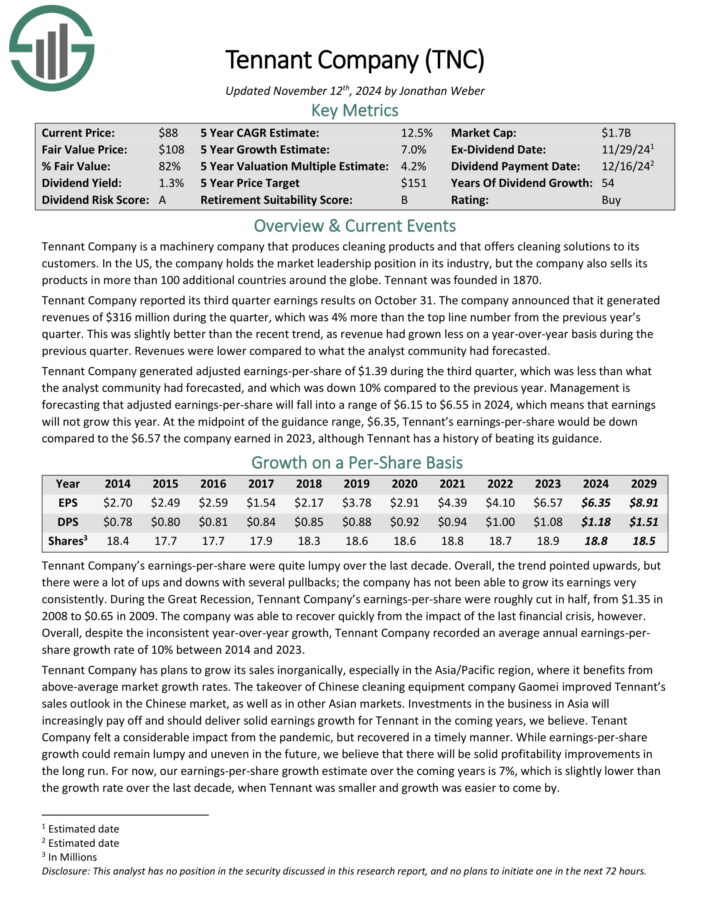

Dividend King You’ve By no means Heard Of: Tennant Co. (TNC)

Tennant Firm is a equipment firm that produces cleansing merchandise and that gives cleansing options to its clients.

Within the US, the corporate holds the market management place in its business, however the firm additionally sells its merchandise in additional than 100 extra nations across the globe.

Supply: Investor Presentation

Tennant Firm reported its third quarter earnings outcomes on October thirty first. The corporate introduced that it generated revenues of $316 million throughout the quarter, which was 4% greater than the highest line quantity from the earlier 12 months’s quarter.

This was barely higher than the latest development, as income had grown much less on a year-over-year foundation throughout the earlier quarter. Revenues had been decrease in comparison with what the analyst neighborhood had forecasted.

Tennant Firm generated adjusted earnings-per-share of $1.39 throughout the third quarter, which was lower than what the analyst neighborhood had forecasted, and which was down 10% in comparison with the earlier 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on TNC (preview of web page 1 of three proven under):

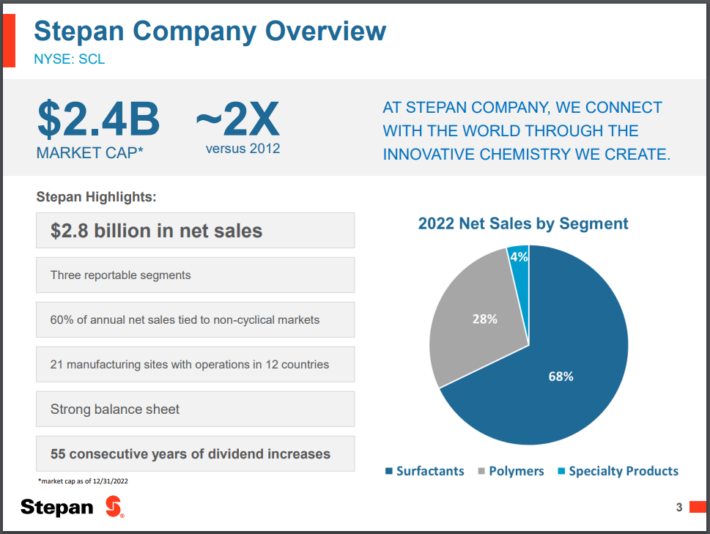

Dividend King You’ve By no means Heard Of: Stepan Co. (SCL)

Stepan manufactures primary and intermediate chemical compounds, together with surfactants, specialty merchandise, germicidal and material softening quaternaries, phthalic anhydride, polyurethane polyols and particular elements for the meals, complement, and pharmaceutical markets.

It’s organized into three distinct enterprise traces: surfactants, polymers, and specialty merchandise. These companies serve all kinds of finish markets, that means that Stepan will not be beholden to a handful of industries; an essential trait throughout an financial downturn.

Supply: Investor presentation

The surfactants enterprise is Stepan’s largest by income, accounting for ~68% of complete gross sales in the newest quarter. A surfactant is an natural compound that comprises each water-soluble and water-insoluble elements.

Stepan posted third quarter earnings on October thirtieth, 2024, and outcomes had been combined. Adjusted earnings-per-share got here in effectively forward of expectations at $1.03, which was 38 cents higher than anticipated. Income, nevertheless, was off virtually 3% year-over-year to $547 million, and missed estimates by over $30 million.

International gross sales quantity fell 1% year-over-year, as double-digit development in a number of of the corporate’s Surfactant finish markets had been absolutely offset by demand weak point in Polymers.

Click on right here to obtain our most up-to-date Positive Evaluation report on SCL (preview of web page 1 of three proven under):

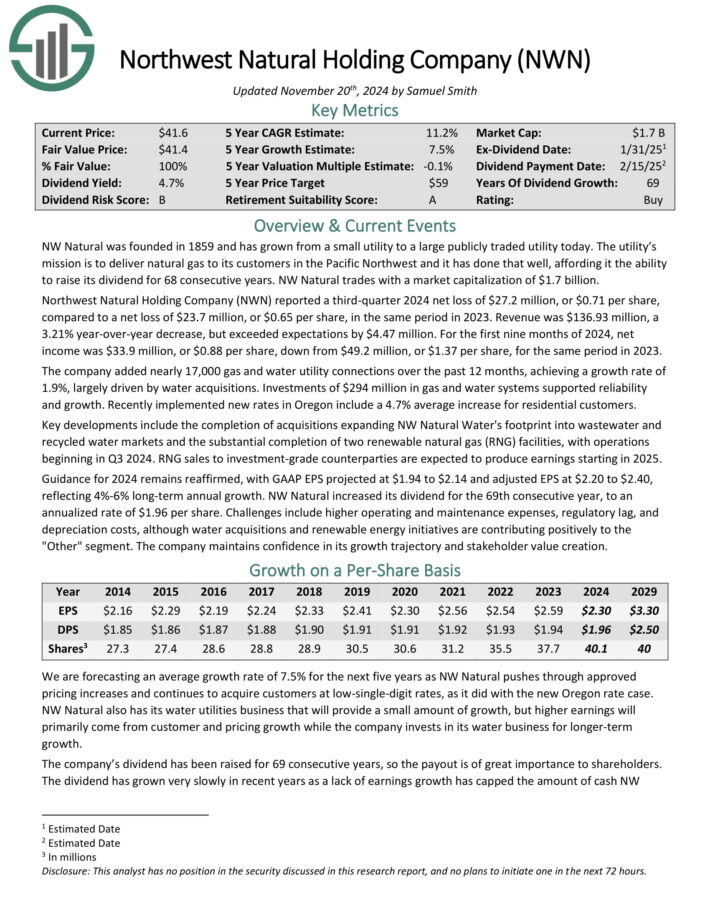

Dividend King You’ve By no means Heard Of: Northwest Pure Holding (NWN)

Northwest was based over 160 years in the past as a pure fuel utility in Portland, Oregon.

It has grown from a really small, native utility that offered fuel service to a handful of shoppers to a really profitable regional utility with pursuits that now embrace water and wastewater, which had been bought in latest acquisitions.

The corporate’s places served are proven within the picture under.

Supply: Investor Presentation

Northwest supplies fuel service to 2.5 million clients in ~140 communities in Oregon and Washington, serving greater than 795,000 connections. It additionally owns and operates ~35 billion cubic ft of underground fuel storage capability.

Northwest Pure Holding Firm reported a third-quarter 2024 web lack of $27.2 million, or $0.71 per share, in comparison with a web lack of $23.7 million, or $0.65 per share, in the identical interval in 2023. Income was $136.93 million, a 3.21% year-over-year lower, however exceeded expectations by $4.47 million.

For the primary 9 months of 2024, web earnings was $33.9 million, or $0.88 per share, down from $49.2 million, or $1.37 per share, for a similar interval in 2023.

Click on right here to obtain our most up-to-date Positive Evaluation report on NWN (preview of web page 1 of three proven under):

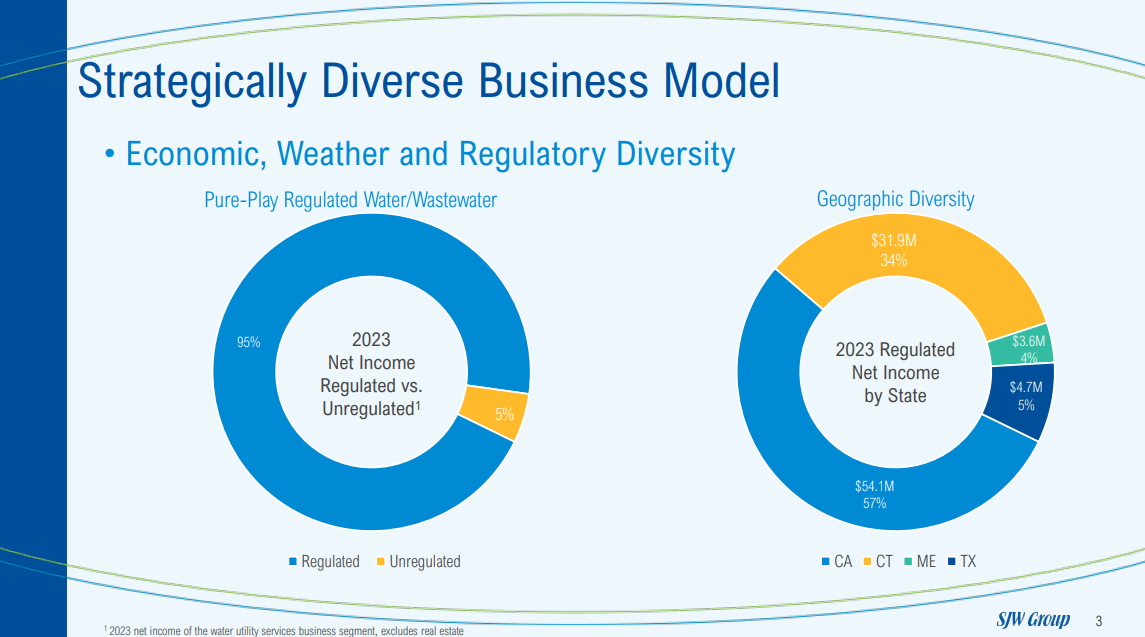

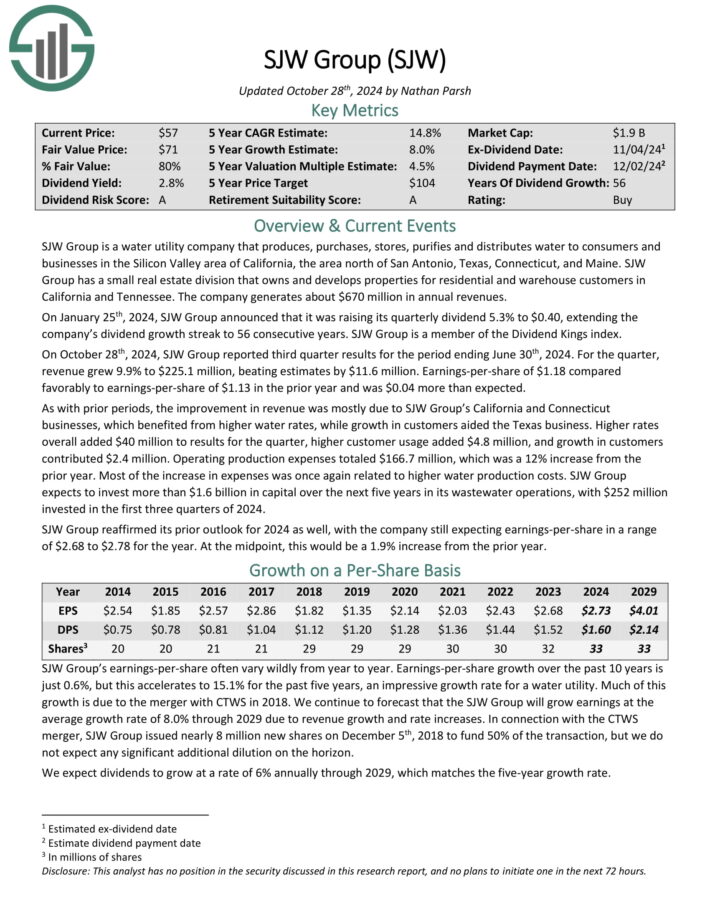

Dividend King You’ve By no means Heard Of: SJW Group (SJW)

SJW Group is a water utility firm that produces, purchases, shops, purifies and distributes water to customers and companies within the Silicon Valley space of California, the realm north of San Antonio, Texas, Connecticut, and Maine.

SJW Group has a small actual property division that owns and develops properties for residential and warehouse clients in California and Tennessee. The corporate generates about $670 million in annual revenues.

Supply: Investor Presentation

On October twenty eighth, 2024, SJW Group reported third quarter outcomes for the interval ending June thirtieth, 2024. For the quarter, income grew 9.9% to $225.1 million, beating estimates by $11.6 million. Earnings-per-share of $1.18 in contrast favorably to earnings-per-share of $1.13 within the prior 12 months and was $0.04 greater than anticipated.

As with prior intervals, the development in income was largely resulting from SJW Group’s California and Connecticut companies, which benefited from increased water charges, whereas development in clients aided the Texas enterprise.

Larger charges general added $40 million to outcomes for the quarter, increased buyer utilization added $4.8 million, and development in clients contributed $2.4 million. Working manufacturing bills totaled $166.7 million, which was a 12% enhance from the prior 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on SJW (preview of web page 1 of three proven under):

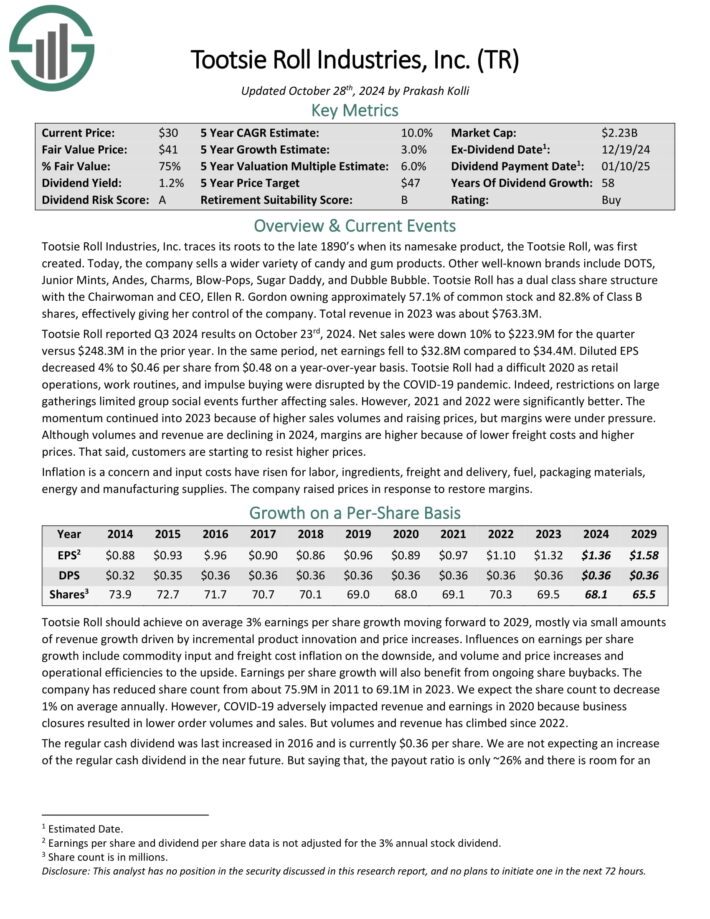

Dividend King You’ve By no means Heard Of: Tootsie Roll Industries (TR)

Tootsie Roll Industries, Inc. traces its roots to the late 1890’s when its namesake product, the Tootsie Roll, was first created. Right this moment, the corporate sells a greater variety of sweet and gum merchandise. Different well-known manufacturers embrace DOTS, Junior Mints, Andes, Charms, Blow-Pops, Sugar Daddy, and Dubble Bubble.

Tootsie Roll has a twin class share construction with the Chairwoman and CEO, Ellen R. Gordon proudly owning roughly 57.1% of widespread inventory and 82.8% of Class B shares, successfully giving her management of the corporate. Complete income in 2023 was about $763 million.

Tootsie Roll reported Q3 2024 outcomes on October twenty third, 2024. Web gross sales had been down 10% to $223.9M for the quarter versus $248.3M within the prior 12 months. In the identical interval, web earnings fell to $32.8M in comparison with $34.4M. Diluted EPS decreased 4% to $0.46 per share from $0.48 on a year-over-year foundation.

The corporate’s aggressive benefit is the model power of its core product, the Tootsie Roll, and its lack of direct competitors given the distinctiveness of the product. A few of the firm’s different manufacturers are additionally well-known.

Click on right here to obtain our most up-to-date Positive Evaluation report on TR (preview of web page 1 of three proven under):

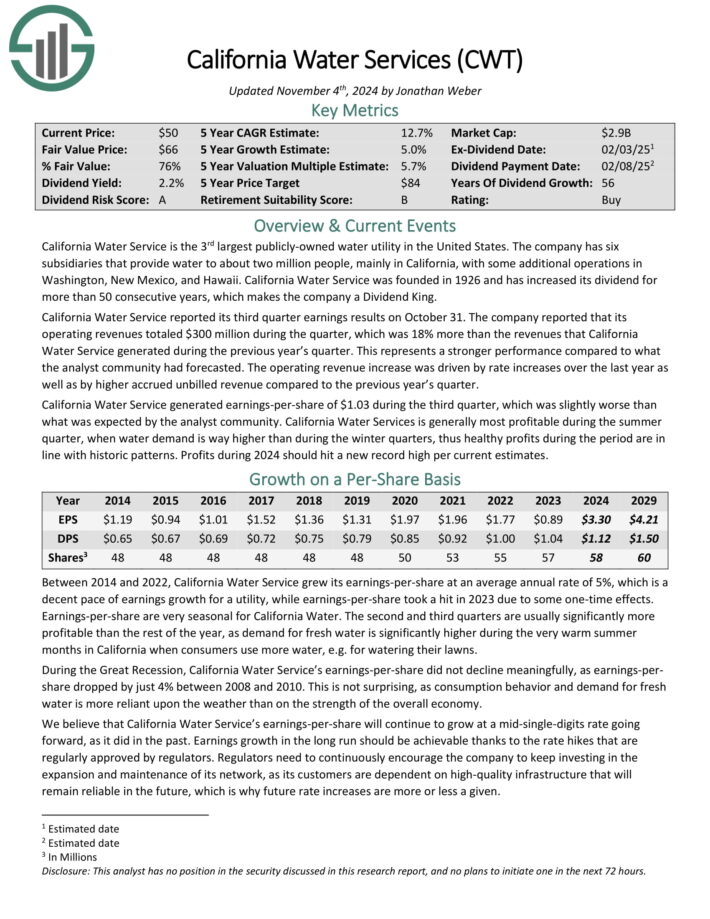

Dividend King You’ve By no means Heard Of: California Water Service Group (CWT)

California Water Service is a water inventory and is the third-largest publicly-owned water utility in america.

It was based in 1926 and has six subsidiaries that present water to roughly 2 million individuals in 100 communities, primarily in California but in addition in Washington, New Mexico and Hawaii.

Supply: Investor Presentation

California Water Service reported its third quarter earnings outcomes on October thirty first. Working revenues totaled $300 million throughout the quarter, which was 18% increased than the identical quarter final 12 months. This represents a stronger efficiency in comparison with what the analyst neighborhood had forecasted.

The working income enhance was pushed by charge will increase over the past 12 months in addition to by increased accrued unbilled income in comparison with the earlier 12 months’s quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on CWT (preview of web page 1 of three proven under):

Further Studying

The Dividend Aristocrats are among the many greatest dividend development shares to purchase and maintain for the long term. However the Dividend Aristocrats checklist will not be the one solution to rapidly display for shares that usually pay rising dividends.

Now we have compiled a studying checklist for extra dividend development inventory investing concepts:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.

[ad_2]

Source link