[ad_1]

Summary Aerial Artwork

By Warren Patterson

Oil market in deficit for the rest of 2024

Oil costs had been largely rangebound by way of a lot of Might however have come below strain in current days. There are rising indicators of weak point within the bodily oil market, which prevented oil costs from transferring considerably increased. Weak refinery margins are beginning to see refiners decreasing run charges, whereas the weak point in immediate crude oil timespreads suggests little concern over the supply within the close to time period.

The easing in oil costs will likely be a priority for OPEC+, and it is no shock that the group determined at its 2 June assembly to increase their further voluntary provide cuts of two.2m b/d till the tip of September 2024. Members will then begin to unwind these cuts step by step from October by way of to September 2025. In the meantime, group-wide cuts of round 2m b/d, which had been set to run out on the finish of 2024, have been prolonged to the tip of the next 12 months. 1.66m b/d of voluntary cuts, which have been in place since Might 2023, will equally be prolonged to the tip of 2025.

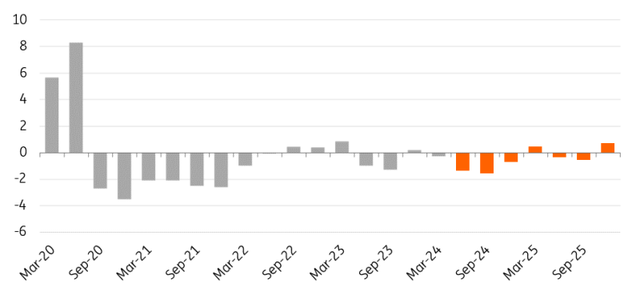

Motion taken by OPEC+ ought to be sure that the market stays in deficit for the rest of the 12 months and that ought to present assist to grease costs throughout the peak demand interval over the summer season months.

Nevertheless, we might count on oil costs to ease by way of 2025 from a peak within the third quarter of this 12 months, with the market set to return to a small surplus as OPEC+ step by step returns provide to the market. There’s potential that OPEC+ resolve in opposition to unwinding cuts if market situations don’t permit for added provide. Nevertheless, long run, the size of cuts from the group might grow to be a problem. Members will probably develop pissed off by holding a major quantity of oil from the market and giving market share to non-OPEC+ producers.

Oil market in deficit for the remainder of 2024 earlier than returning to surplus in 2025 (m b/d)

ING Analysis, IEA, EIA, OPEC

Provide worries enhance European pure fuel

European pure fuel costs have strengthened considerably over the past month. TTF has rallied virtually 18% in Might, taking costs above EUR34/MWh. A number of provide issues have pushed the market increased.

Firstly, ongoing summer season upkeep in Norway has decreased Norwegian flows to Europe. In Might, each day common flows had been 8% decrease month-on-month. Extra not too long ago, an unplanned outage in Norway on account of a crack in a pipeline led to even decrease pipeline flows, solely intensifying provide issues and including to volatility.

Secondly, Asian LNG demand has been stronger thus far this 12 months. LNG imports within the first 5 months of 2024 had been up 11% year-on-year. Stronger demand has been pushed by hotter climate in giant components of Asia, and now we have additionally seen extra price-sensitive patrons within the area returning to the LNG market, with spot costs coming down from the excessive ranges seen in 2022 and 2023.

And there are nonetheless issues over the remaining Russian pipeline flows to the EU, particularly these to Austria. The Austrian oil and fuel firm OMV (OTCPK:OMVJF, OTCPK:OMVKY) introduced there’s a threat to Gazprom (OTCPK:GZPFY) provides to the nation following a court docket case ruling which might block fee to Gazprom for fuel deliveries. If enforced, it could probably result in Gazprom halting these flows. OMV has a long-term contract of round 6bcm per 12 months for Gazprom provides. Nevertheless, Austria and Europe as an entire ought to handle if this provide is misplaced. As well as, from late 2024 onwards, a considerable amount of new LNG provide capability is scheduled to start out, largely from the US.

The probability that Russian pipeline flows to the EU by way of Ukraine come to a cease on the finish of this 12 months can also be excessive; Ukraine has made it clear that it has no intention to increase a transit cope with Gazprom. This may imply the lack of round 15bcm of fuel, which is round 5% of complete EU imports. Whereas Gazprom might be able to divert some marginal flows by way of TurkStream, Europe would want to search for different provides. That potential provide loss has moved from a threat to the market to most likely being largely anticipated.

Regardless of quite a few issues, Europe ought to see storage hitting 100% full forward of the 2024/25 heating season. It is already greater than 71% full, nicely above the five-year common of 59%, and likewise barely forward of final 12 months’s degree of 70%. Because of this, we proceed to count on European fuel costs to weaken over the third quarter of this 12 months.

Copper hits report ranges

Metals stood out in Might, main the advanced increased. Copper costs rallied greater than 10% final month, reaching a brand new report excessive of greater than $11,000/t. Nevertheless, since then, costs have given again quite a lot of these positive factors. The transfer in copper has been pushed by speculators with a bullish narrative on account of issues over an absence of mine provide at a time when demand is about to develop strongly amid the vitality transition. As well as, a number of assist measures introduced over the past month for the Chinese language property sector added to the constructive sentiment.

Nevertheless, whereas the longer-term outlook stays constructive for copper, short-term fundamentals are nonetheless a priority, significantly in China. Copper shares held in Shanghai Futures Trade (SHFE) warehouses are at seasonal report highs. Chinese language import premiums for refined copper are detrimental, and home refined copper output continues to develop year-on-year regardless of remedy prices falling considerably for smelters.

Moreover, LME copper shares have grown greater than 15% since mid-Might, whereas the money 3-month unfold is in deep contango and never far-off from the current report lows – suggesting little concern over refined copper provide within the close to time period.

Content material Disclaimer

This publication has been ready by ING solely for info functions no matter a specific person’s means, monetary state of affairs or funding aims. The data doesn’t represent funding advice, and neither is it funding, authorized or tax recommendation or a suggestion or solicitation to buy or promote any monetary instrument. Learn extra

Authentic Put up

[ad_2]

Source link