[ad_1]

niphon

The ECB anticipated to chop

The European Central Financial institution is extensively anticipated to chop rates of interest on Thursday, in what looks like a coverage price normalization.

Primarily, it seems that the ECB has achieved a soft-landing – the EU GDP is reasonably constructive, inflation is simply above the two% goal, the unemployment price is steady, and the European inventory market indices are within the bull market.

On the opposite facet of the Atlantic, the Fed will not be anticipated to start out chopping rates of interest this summer time, with attainable cuts coming in November or December, though some consider that the Fed won’t capable of reduce in 2024 in any respect. Particularly, inflation within the US appears to be sticky slightly below the 4% stage, and that is too excessive for the Fed to start out normalizing rates of interest. On the similar time, the unemployment price within the US is rising, whereas the GDP development is slowing. The US is dealing with a stagflationary setting.

Regardless of the stagflationary setting within the US, the US inventory market can also be within the bull market, with the S&P 500 close to the all-time highs. The important thing issue behind the US inventory bull market has been the expectations of soft-landing and the Fed’s coverage price normalization – precisely what’s about to unfold within the EU.

The query is whether or not the European soft-landing is previous the US soft-landing, and the ECB cuts are signaling that the Fed cuts are coming. If sure, this might justify the bull market within the US inventory market, and the European inventory market.

In different phrases, the ECB reduce might be signaling that the worldwide central banks are soft-landing the post-pandemic economic system, and that may be a constructive for world shares.

The argument on this article is that the worldwide soft-landing is unlikely. Particularly, the US is prone to enter a recession, and that is a hard-landing situation. Thus, the European soft-landing is probably going solely a brief state earlier than the hard-landing as nicely.

The European soft-landing

Listed below are some key data-points with respect to the EU soft-landing.

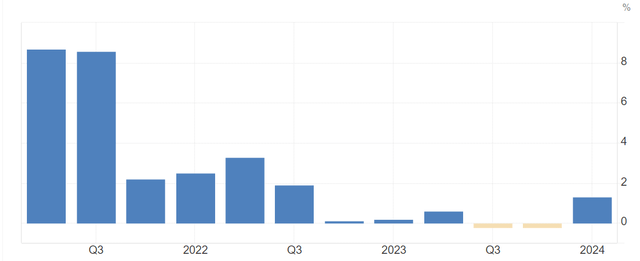

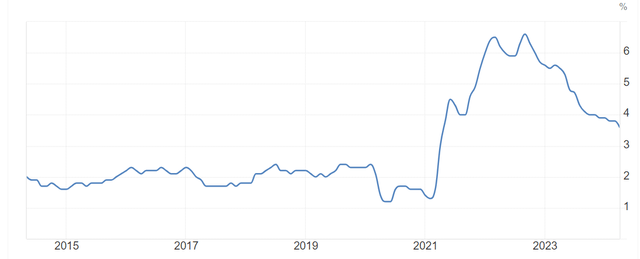

The EU economic system is exiting a light technical recession – the EU GDP had adverse development in Q3 and This fall of 2023 at -0.2%. Nonetheless, the EU economic system rebounded in Q1 2024, rising at 1.3%, and that is constructive.

EU GDP (Buying and selling Economics)

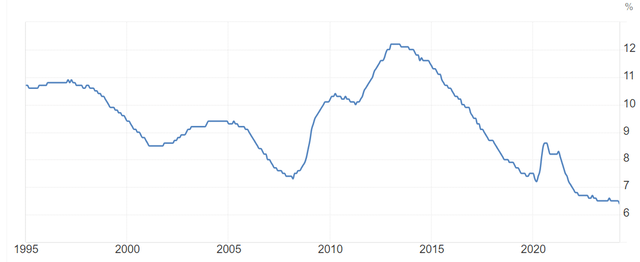

The late 2023 EU recession was solely a technical recession as a result of the EU unemployment price remained at 6.4% – there was no spike within the unemployment price, which is what occurs in “actual” recessions. That is additionally constructive – it verifies the soft-landing.

EU unemployment price (Buying and selling Economics)

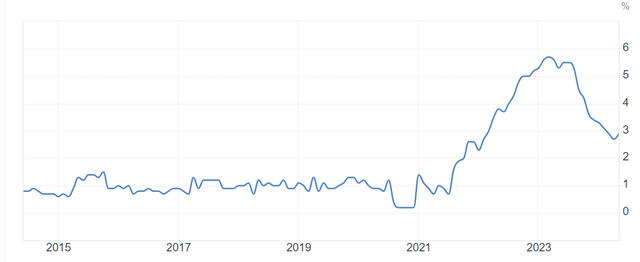

The EU headline inflation fell again from the pandemic highs of above 10% to only above the two% stage and remained pretty steady. That is constructive, because the EU has suffered from low inflation and deflation pre-pandemic.

EU inflation (Buying and selling Economics)

Nonetheless, the EU core CPI inflation continues to be elevated, at slightly below the three% stage, and that is doubtlessly too excessive to start out normalizing rates of interest. The EU inflation is extra delicate to vitality and meals costs, so the autumn within the headline inflation is a mirrored image of falling oil costs. Nonetheless, the core CPI stays elevated.

EU core CPI (Buying and selling Economics)

The unfolding US stagflation

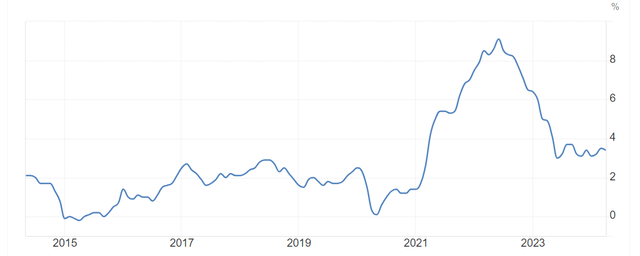

Meantime, within the US, the headline CPI inflation has been sticky at slightly below the 4% stage for a lot of months now. That is virtually double the Fed’s 2% goal and exhibits that the disinflationary course of within the US has stalled close to the 4% stage – a lot greater than within the EU’s inflation stage.

US CPI (Buying and selling Economics)

The US core CPI has additionally stalled slightly below the 4% stage, and the current disinflationary course of has been very sluggish. The US nonetheless has an inflation downside – inflation continues to be too excessive for the Fed to start out coverage normalization.

US core CPI (Buying and selling Economics)

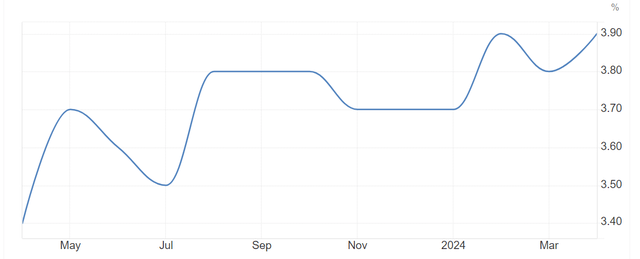

On the similar time, the unemployment price within the US has been rising during the last 12 months from 3.4% to three.9%, in contrast to the unemployment price within the EU, which is greater at 6.4%, however remained regular. Thus, the US is extra prone to enter a “actual” recession if the pattern of rising unemployment price continues and breaches the 4% stage.

US unemployment price (Buying and selling Economics)

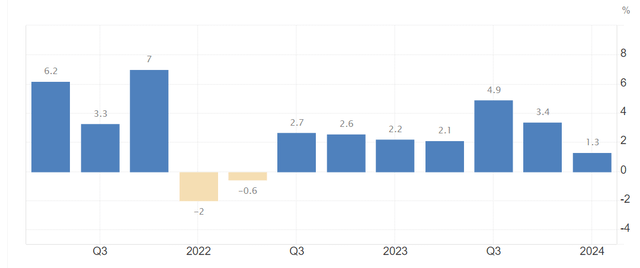

The US economic system has considerably slowed in Q1 2024 to 1.3% annual development price. Whereas the EU economic system was in a recession, the US economic system was booming in Q3 and This fall 2023. Now, the US economic system is slowing. Primarily based on the current client spending report, the US actual consumption decreased by 0.1% in April 2024. Thus, the US GDP is prone to proceed to sluggish in Q2 2024, presumably slipping into adverse territory by Q3 2024.

US GDP (Buying and selling Economics)

Is the ECB reduce untimely?

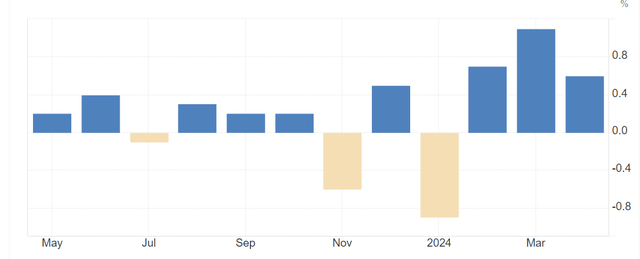

On the floor, the EU is in a soft-landing. Nonetheless, the current knowledge exhibits in any other case. The month-to-month core CPI reveals that inflation can also be accelerating within the EU. Particularly, the disinflationary course of within the EU continued as a result of base results, as month-to-month inflation fell sharply in 2024, with a number of months of deflation, most notably in November 2023 when month-to-month inflation fell by 0.9%.

Nonetheless, the EU month-to-month core inflation has been very excessive in Q1 2024, and the inflationary bump from the US can also be evident within the EU. Thus, the ECB is doubtlessly prematurely enthusiastic about chopping rates of interest. Consequently, the ECB won’t even reduce rates of interest subsequent week, because the market expects.

Moreover, might the ECB actually be enthusiastic about chopping rates of interest with the escalating geopolitical scenario within the Center East and Ukraine, and crude oil (USO) weak to a pointy spike?

The worldwide economic system is dealing with a stagflationary setting as a result of unfolding technique of deglobalization, with protectionism, actual wars, and chilly wars. Thus, world inflation will likely be liable to shocks, as commodity costs spike and provide chains get disrupted. That is actually what the current spike in value of gold (GLD) alerts.

EU MoM core CPI (Buying and selling Economics)

Implications

The S&P 500 (SP500) and the Stoxx 600 (STOXX) are each buying and selling based mostly on sentiment, hoping that the ECB and the Fed will be capable to engineer a soft-landing.

The ECB reduce subsequent week, if it occurs, might be a short-term enhance to world shares because the market will get excited with hopes of a world comfortable touchdown – earlier than these hopes get dashed by the hard-landing knowledge on either side of the Atlantic.

The S&P 500 and the Stoxx 600 are dealing with a recessionary bear market. The S&P 500 is particularly weak to a deep correction attributable to its extreme PE a number of valuation at 22, and concentrated publicity to the “AI-hyped” megacaps.

[ad_2]

Source link