[ad_1]

Our aim with The Every day Transient is to simplify the largest tales within the Indian markets and show you how to perceive what they imply. We gained’t simply inform you what occurred, however why and the way too. We do that present in each codecs: video and audio. This piece curates the tales that we discuss.

You may take heed to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and video on YouTube.

You may also take heed to The Every day Transient in Hindi.

At present on The Every day Transient:

Funding bankers and SME IPOs

Slowdown in private loans

What’s occurring with the house textiles trade?

Cash is imaginary

In our first story, let’s dive into some shady dealings occurring in funding banking, particularly with SMEs (Small and Medium Enterprises). These days, some funding bankers have been caught making under-the-table offers with SMEs, and right here’s the way it works:

These funding bankers promise to assist SMEs elevate extra money by inflating their firm valuations. In return, they take a lower of the additional money raised. Usually, bankers cost a payment of round 1-3%, however with these secret offers, they’re pocketing as a lot as 50% of the additional funds.

If that sounds a bit complicated, let’s break it down with an instance.

Think about there’s an organization price ₹500 crore. The funding banker is available in and says, “We are able to make it seem like you’re price ₹1,000 and even ₹2,000 crore.” They pump up the valuation, elevate extra cash from traders, break up the surplus, after which vanish. The corporate walks away with extra money than it’s really price, the funding banker will get a hefty payout, and traders are left holding overpriced shares which can be more likely to drop in worth.

And this isn’t only a one-time factor—it’s spreading quick. It began in Gujarat and Maharashtra, however now it’s making its means throughout India. SEBI, the market regulator, has been sounding the alarm and warning traders, however typically, by the point anybody catches on, the injury is already achieved.

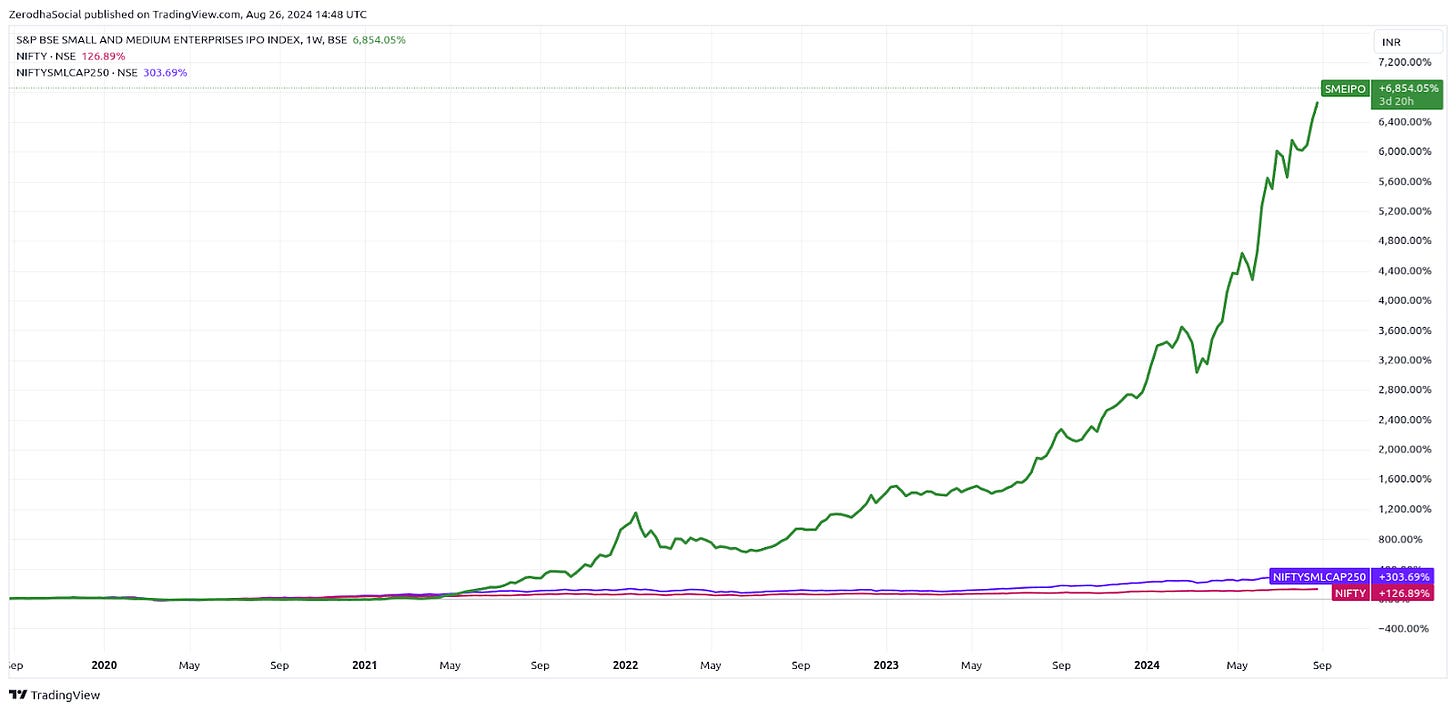

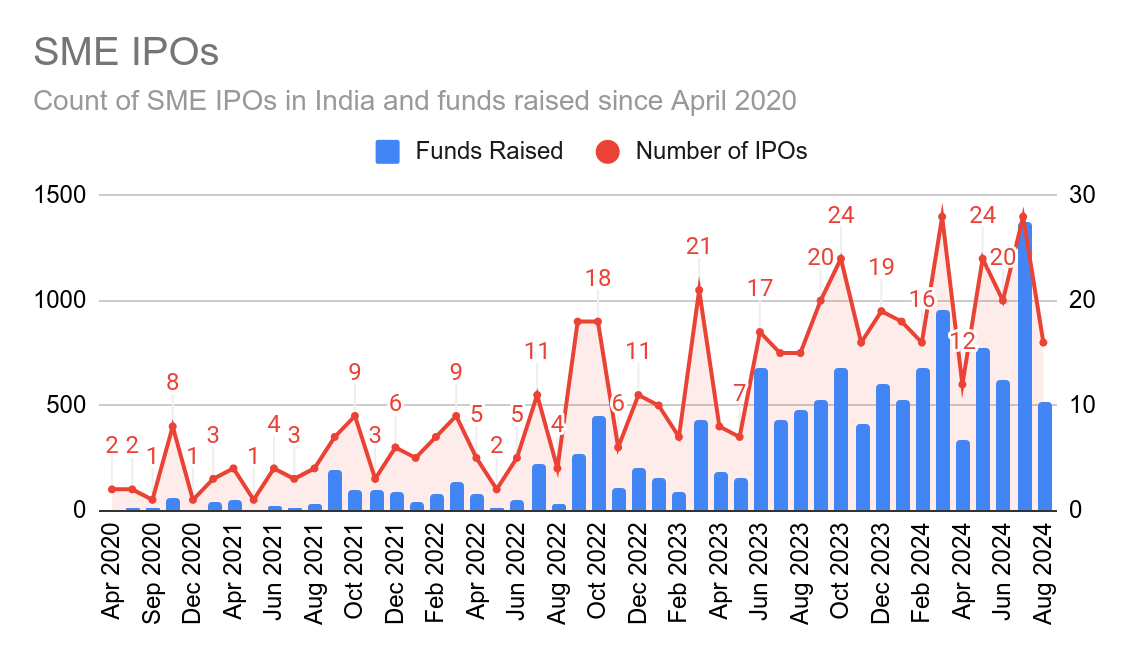

Simply final 12 months, SMEs raised over ₹6,000 crore by IPOs (Preliminary Public Choices). Practically half of the cash raised on SME platforms within the final decade got here up to now 12 months. This market is booming, nevertheless it’s additionally elevating some critical purple flags.

So, how did we find yourself right here?

The SME IPO market began with good intentions. The concept was to make it simpler for smaller firms to boost cash with out the prices and purple tape of an everyday IPO. Banks often aren’t desirous to lend to smaller companies, and after they do, the rates of interest are sometimes sky-high. That’s why, in 2012, NSE and BSE created particular platforms only for SMEs to go public.

Nevertheless it hasn’t been easy crusing. Some firms have discovered sneaky methods to take advantage of the system. Take Varanium Cloud, a small tech firm. In 2022, they raised ₹33 crore by an SME IPO, claiming the cash was for enterprise development. However when SEBI dug deeper, they discovered the funds have been being misused. Varanium inflated bills, shuffled cash round, and misled traders—traditional smoke and mirrors.

Is SEBI doing something about it? And if they’re, what precisely are they doing?

SEBI is aware of it is a huge downside, they usually’ve began to crack down. NSE lately launched a rule requiring SME IPOs to point out constructive money move in a minimum of two of the final three years earlier than they’ll go public. The aim is to filter out firms with weak funds to allow them to’t rip-off traders.

Nevertheless it’s not simply the SMEs below the microscope—SEBI can be tightening the principles for the funding bankers who deal with these IPOs. The rules for service provider bankers haven’t been up to date since 1992, which is historical historical past in monetary phrases. SEBI now needs to make sure that solely critical, well-funded bankers are managing public points.

Presently, service provider bankers want a web price of ₹5 crore, however SEBI is pushing to boost that to ₹50 crore for these coping with bigger IPOs. It’s a transfer to make sure that solely skilled, steady bankers are in cost. SEBI additionally needs to restrict what these bankers can do as a result of many are concerned in different companies, like mortgage syndication and challenge advisory, which create conflicts of curiosity. The goal is to maintain them centered on the securities market.

However right here’s the tough half: SEBI is making an attempt to strike the correct stability. They wish to shield traders with out making it unattainable for SMEs to boost cash. If the principles are too strict, small firms would possibly battle to get the funds they should develop. But when they’re too free, we’ll see extra fraudulent and inflated IPOs.

What does this imply for you?

SEBI’s new guidelines for SMEs and service provider bankers are steps in the direction of cleansing up the market. Nevertheless it’s nonetheless a piece in progress, and solely time will inform if they’ll get it proper—the place firms can elevate cash pretty, and traders don’t find yourself getting burned.

Within the meantime, when you’re interested by investing in SME IPOs, right here’s a chunk of recommendation: be further cautious. The market is rising shortly, however with development comes danger, and proper now, there are many purple flags to be careful for.

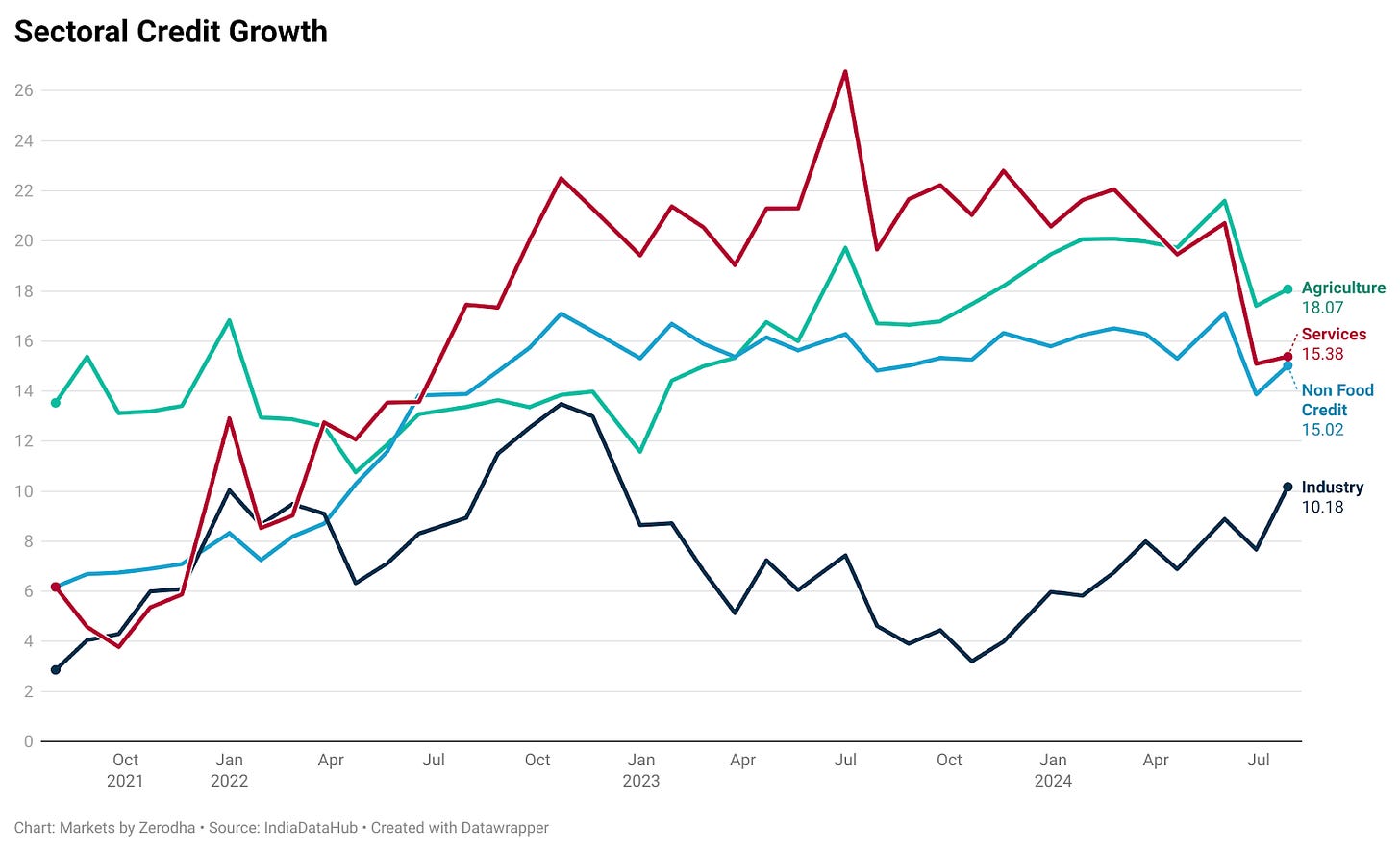

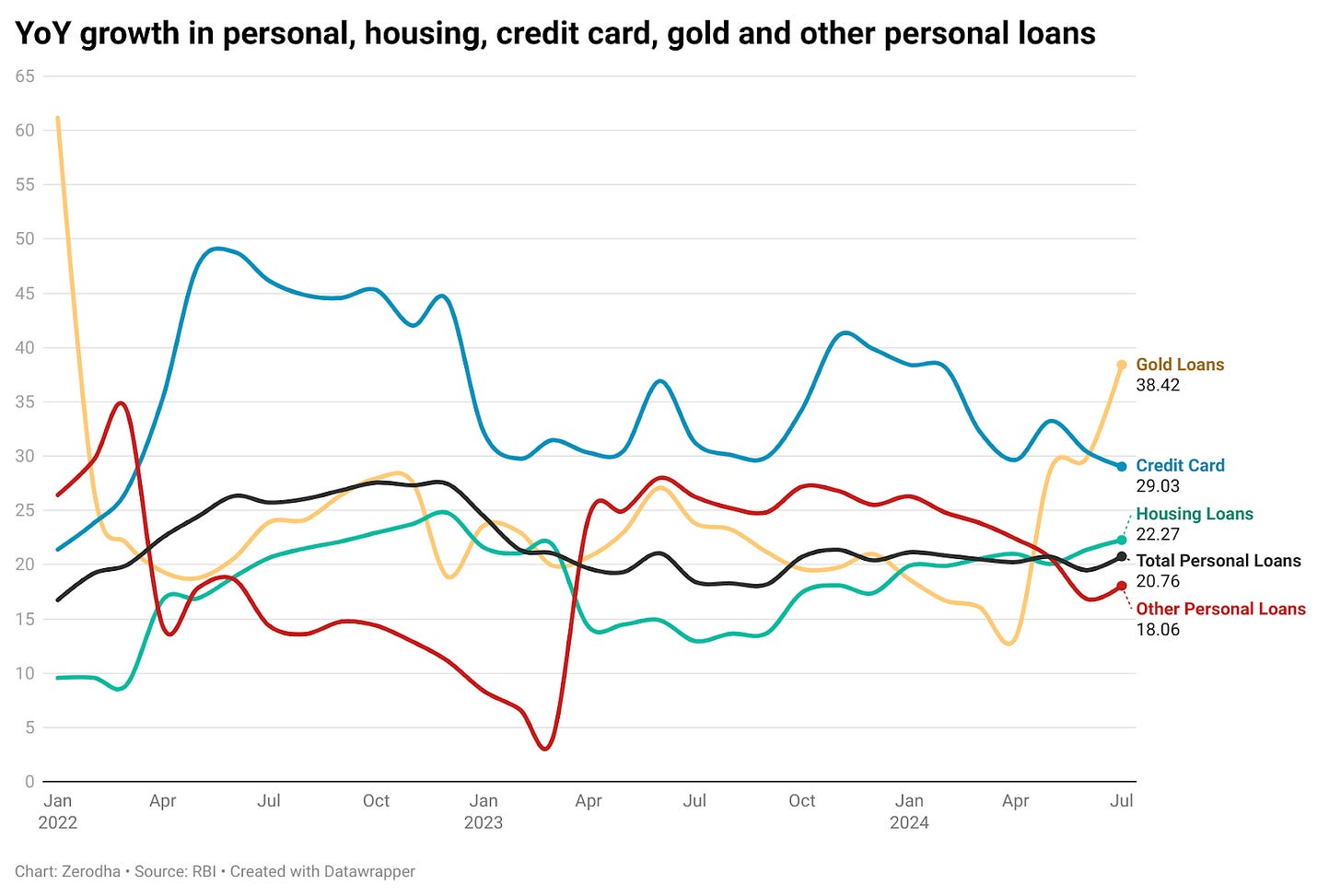

There’s one thing attention-grabbing occurring within the private loans and unsecured lending house proper now. The Reserve Financial institution of India (RBI) lately launched its September bulletin, and it looks as if the NBFC (Non-Banking Monetary Firm) sector in India is going through a major slowdown, particularly in private and unsecured loans. Let’s break down what’s happening:

First, it’s vital to know that unsecured loans make up an enormous chunk—round 26%—of all loans given out by NBFCs. So, when this phase slows down, it drags the entire NBFC sector down with it. And this slowdown isn’t small or gradual; for NBFCs within the center tier, development in unsecured loans has dropped from over 50% year-on-year to simply about 10%.

To present you some context, a middle-tier NBFC is one with property of ₹1,000 crore or extra. They face stricter guidelines than smaller NBFCs however are usually not as closely regulated as banks.

Nevertheless it’s not simply NBFCs feeling the pinch; banks and fintechs are additionally experiencing a slowdown. Private loans, which have been rising at over 25% earlier than, are actually solely rising at round 18%. In line with a current report by TransUnion CIBIL, new loans grew by simply 3% within the quarter ending June 2024, in comparison with a whopping 36% development a 12 months in the past!

What’s inflicting this slowdown?

It began when the RBI elevated danger weights on sure retail loans in November 2023. They did this to chill down the fast development in unsecured shopper credit score. This transfer hit not simply private loans however different sorts of loans as effectively. The identical TransUnion report reveals that bank card originations dropped by an enormous 30% year-on-year within the June 2024 quarter.

One huge motive behind that is the rising default charges. Bank card firms are coping with larger prices and have began tightening their insurance policies by issuing fewer playing cards, lowering advantages, and decreasing credit score limits.

Nevertheless it’s not all unhealthy information—there are some brilliant spots too.

Whereas private loans and bank cards are struggling, different areas are selecting up. In line with RBI information, loans to the agriculture sector are doing effectively. This shift towards agriculture is an efficient signal, exhibiting that not all credit score development is stalling.

Gold loans are additionally booming, particularly in rural areas the place they’re seen as a fast and dependable method to get credit score. These loans are rising at almost 40% year-on-year, in comparison with slightly below 15% in April. George Muthoot, MD of Muthoot Finance, talked about that with private and SME loans changing into more durable to get, persons are turning to gold loans.

Nevertheless, in the case of unsecured loans, there are early warning indicators of bother. Delinquency charges—loans which can be overdue by 30 to 90 days—are rising for each secured and unsecured loans. Whereas private mortgage delinquencies have stayed steady, points are creeping up with bank cards and small loans.

The TransUnion CIBIL Credit score Market Indicator additionally factors out that whereas credit score efficiency is enhancing for many merchandise, bank cards are an exception, with delinquencies on the rise.

It’s additionally price noting that public sector banks are seeing a sharper improve in early-stage delinquencies in comparison with non-public banks. Even house loans, often seen as protected, have seen delinquency charges rise from 1.9% in 2023 to 2.3% in 2024.

Why is that this occurring?

Components like inflation, larger rates of interest, and tighter liquidity are making it more durable for folks to maintain up with their mortgage repayments, particularly on unsecured loans, that are already dangerous.

One other development is in auto loans, the place high-value loans (₹20 lakh and above) are rising quickly. Since 2020, their worth has elevated by 2.8 instances, and their quantity has risen by 3.2 instances, suggesting that customers are more and more leaning towards shopping for extra premium autos.

All these challenges imply that lenders have gotten extra selective, particularly with debtors who don’t have a powerful credit score historical past. The TransUnion report reveals that the share of first-time debtors in new loans dropped to a report low of 12% within the June 2024 quarter from 16% a 12 months in the past. Lenders are merely not prepared to take dangers on new debtors within the present surroundings.

Let’s discuss a sector that doesn’t get sufficient consideration however is quietly rising—house textiles. And belief us, there’s extra to this market than simply bedsheets and curtains. It’s a a lot larger house than most individuals notice, and it’s rising sooner than you would possibly assume.

Let’s begin with some numbers. The worldwide house textile market was valued at $122 billion in 2022 and is anticipated to succeed in $134 billion by the tip of subsequent 12 months. Wanting even additional forward, it’s set to grow to be an enormous $185 billion market by 2030! So, that is undoubtedly an area traders shouldn’t overlook. However what’s actually driving this development?

The easy reply is that persons are spending extra on making their houses look good. Ever because the pandemic, we’ve all been spending extra time at house, and that’s made us wish to spend money on issues like new towels, mattress linens, and different necessities to make our areas cozier.

Now, right here’s a query for you: Are you able to guess which nation is the chief in house textiles? No surprises—it’s China, with about $23 billion in exports! However right here’s the excellent news: India, with $5.7 billion in exports, is catching up quick, rising at about 8-10% a 12 months.

In India, simply six main firms management round 65% of the market, they usually’ve managed to remain robust regardless of world financial challenges. So, why is India doing effectively on this house? An enormous a part of it’s the “China+1” technique.

Let me clarify. After the COVID-19 pandemic, many nations wished to diversify their provide chains to scale back their dependence on China. That’s the place India stepped in, taking over a few of that demand.

However India’s success isn’t nearly being the choice to China. There’s additionally a rising concentrate on sustainability. Eco-friendly and natural house textile merchandise are gaining reputation, and Indian producers are stepping up with greener, extra sustainable choices.

Nevertheless, it’s not all easy crusing.

The spine of the house textile trade is cotton, and cotton costs have been everywhere. In 2022, poor crop yields despatched costs sky-high, solely to crash down later that 12 months. Proper now, issues are extra steady, however that worth volatility has been a headache for producers making an attempt to keep up regular operations.

When cotton costs spike, it eats into revenue margins, particularly for Indian firms that rely closely on cotton-based merchandise like mattress linens. The hope is that with extra steady costs this 12 months, issues will cool down a bit.

After which there’s the problem of freight prices, which we’ve talked about earlier than in earlier episodes. Transport has grow to be ridiculously costly attributable to world points just like the Russia-Ukraine battle and tensions on the Suez Canal, which is a key shortcut from Asia to Europe. These issues have pushed up oil costs and made transport routes longer and dearer.

For Indian house textile exporters, logistics prices have jumped up almost 5 instances in some instances. So, whereas demand for house textiles is robust and the expansion potential is large, these provide chain challenges are making it powerful to show a superb revenue.

Just lately, Arundhati Bhattacharya, the previous head of the State Financial institution of India, shared some attention-grabbing insights in an interview with CNBC. When she talks about banks, folks listen. She identified that Indians aren’t counting on financial institution deposits as a lot anymore to avoid wasting and develop their cash. As a substitute, the youthful era is getting extra into investing within the capital markets. She even recommended that this might mark the tip of the “deposit-led banking period.”

This isn’t simply her opinion. RBI Governor Shaktikanta Das has additionally been speaking about how folks, particularly retail clients, are discovering different funding choices extra engaging, and because of this, they’re maintaining much less cash in banks.

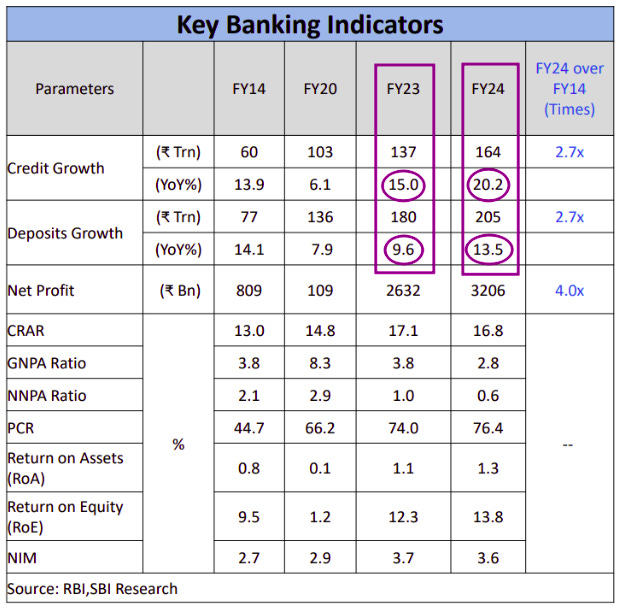

These feedback come at a time when banks are going through one thing uncommon—deposit development isn’t maintaining tempo with mortgage development. Prior to now two years, financial institution credit score grew by 15% and 20% (in FY23 and FY24), however deposits solely grew by 9.6% and 13.5%.

So, what’s happening? Are folks pulling cash out of banks and placing it into the inventory market? And if that’s the case, what does that imply for the loans banks can provide?

On the floor, it appears logical—when you’re investing in shares or mutual funds, you’ve got much less cash in your financial savings account. Nevertheless it’s a bit extra sophisticated than that. What is sensible for one particular person doesn’t at all times add up if you take a look at the larger image.

Right here’s an instance. In case you determine to spend money on a mutual fund as an alternative of leaving your cash within the financial institution, the place does that cash go? It strikes out of your account to the mutual fund’s account. If the mutual fund buys shares, the cash strikes once more—this time to the vendor’s account. So, the cash by no means actually leaves the banking system. It’s at all times sitting in somebody’s account, even when it’s not yours.

So, although folks’s investments don’t technically pull cash out of the banking system, deposits are nonetheless rising slower than loans. How does that make sense? Aren’t banks supposed to make use of deposits to lend out cash?

Not precisely. The best way banks deal with cash is a bit completely different—they don’t want deposits to make loans. In reality, loans really create deposits. Let me clarify.

When a financial institution offers somebody a mortgage, they don’t hand over a bag of money. They only credit score the borrower’s account with the mortgage quantity, and voilà, that reveals up as a deposit. So, within the banking world, each mortgage is a brand new deposit. Banks aren’t taking cash from one particular person’s financial savings to lend to a different; they’re basically creating new cash each time they situation a mortgage.

But when banks can create cash out of skinny air, what’s stopping them from giving out limitless loans?

That’s the place the RBI is available in. The RBI units guidelines to make sure banks don’t go overboard. Banks can solely lend a sure proportion of their whole property, and for each mortgage they make, they need to put aside some money, both with the RBI or in different safe property, to ensure they’ll cowl any money owed if wanted. This retains issues in verify and stops banks from endlessly creating cash.

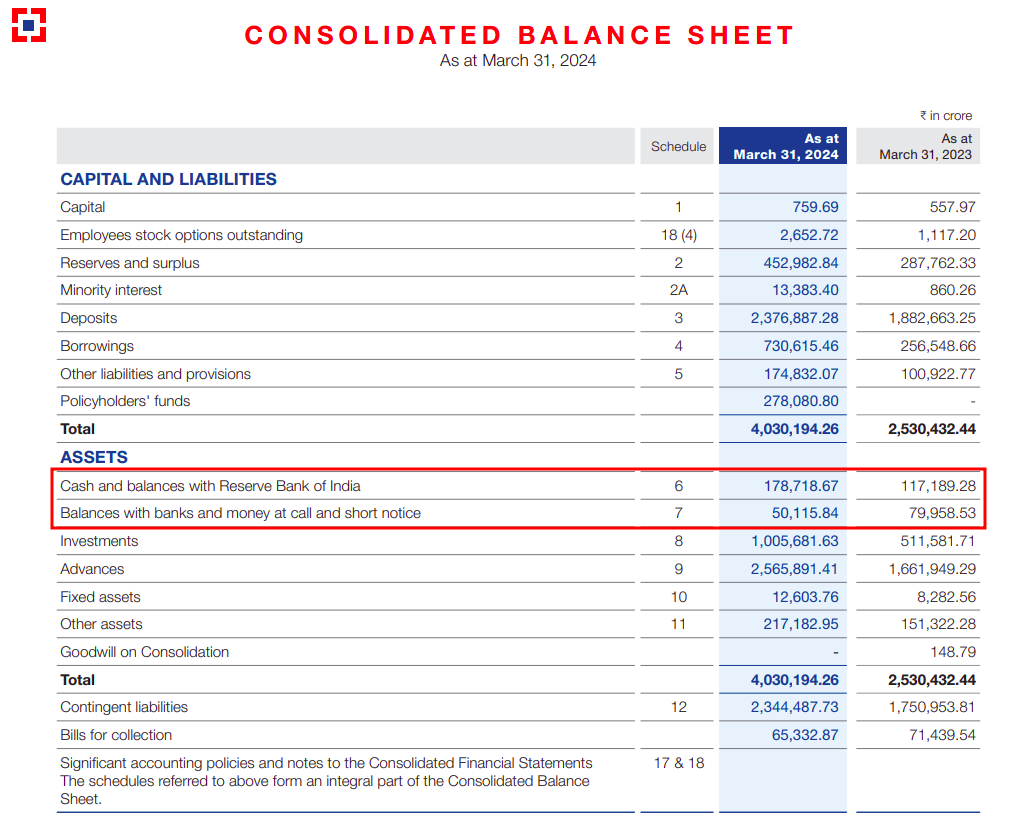

Check out HDFC Financial institution’s stability sheet, for instance. You’ll see their loans on one aspect, however you’ll additionally see a portion of their property in money, balances with the RBI, and different banks. That is what permits them to maintain lending whereas assembly the RBI’s necessities.

However the place do banks get the additional cash they should again up these loans?

They’ve a number of choices. The most affordable is your financial savings account. Then there are fastened deposits, which price them a bit extra. In the event that they want much more, they’ll situation bonds, borrow from the cash markets, or elevate fairness—although these choices are dearer.

And that is the crux of the issue. The cash isn’t disappearing from the banking system, and banks aren’t working out of funds to lend. However with extra loans being given out, banks are more and more tapping into dearer and fewer steady funding sources to satisfy RBI’s guidelines.

As extra folks make investments, banks are struggling to draw a budget, steady funds they used to depend on, like financial savings and glued deposits, making their enterprise riskier and more durable to handle.

So, whereas Indians have gotten smarter traders, banks are discovering themselves preventing more durable for his or her share of the pie.

Tidbits:

Swiggy has acquired SEBI’s approval for a ₹10,375 crore IPO, elevating ₹3,750 crore by contemporary capital and ₹6,664 crore through an Provide for Sale. This transfer will intensify competitors with Zomato in India’s meals supply market.

IIFL Finance plans to boost ₹10,000 crore by issuing bonds after the RBI lifted its ban on gold loans. The corporate is diversifying into SME loans and different enterprise segments.

BookMyShow and Zomato Stay are taking authorized motion in opposition to ticket resellers like Viagogo following chaos throughout Coldplay live performance ticket bookings, aiming to fight scalping and shield customers.

Airtel has launched India’s first AI-powered, network-based spam detection system, providing real-time alerts for suspected spam with out requiring any motion from customers.

Commerce Minister Piyush Goyal highlighted India’s rising position in high-tech manufacturing and the significance of fast commerce platforms partnering with Kirana shops for sustainable last-mile deliveries, supported by the ONDC initiative.

Thanks for studying. Do share this with your pals and make them as good as you might be ![]()

In case you have any suggestions, do tell us within the feedback

[ad_2]

Source link