[ad_1]

Our objective with The Every day Transient is to simplify the largest tales within the Indian markets and show you how to perceive what they imply. We gained’t simply let you know what occurred, however why and the way too. We do that present in each codecs: video and audio. This piece curates the tales that we discuss.

You may hearken to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and video on YouTube.

You can too hearken to The Every day Transient in Hindi.

At present on The Every day Transient:

Will Swiggy hit a sixer like Zomato?

Are India’s semiconductor goals turning into a actuality?

Will our groceries turn out to be costly?

Swiggy, the favored meals supply big, is gearing up for one of the vital talked-about IPOs in India’s startup scene. In case you’ve been maintaining a tally of the market, you realize this can be a massive deal—particularly after the IPOs of Zomato and Paytm.

Swiggy is seeking to elevate ₹3,750 crore by issuing new shares, with further shares being bought by buyers like Prosus and Accel, bringing the entire IPO measurement to over ₹10,000 crore.

However the massive query is: how does Swiggy stack up towards its primary rival, Zomato? What makes Swiggy completely different?

Let’s break it down.

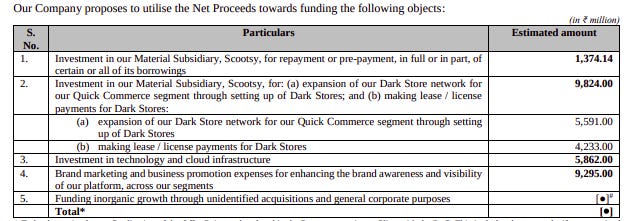

Swiggy plans to make use of the funds from its IPO for a couple of key tasks. First, they’re setting apart ₹982 crore to increase Instamart, their quick-commerce service that guarantees grocery deliveries in beneath half-hour. This implies a significant push into opening extra darkish shops, that are small warehouses designed for fast deliveries.

On high of that, one other ₹930 crore will go in direction of advertising and model promotion. The message is evident: Swiggy is doubling down on grabbing extra market share, particularly within the aggressive quick-commerce house.

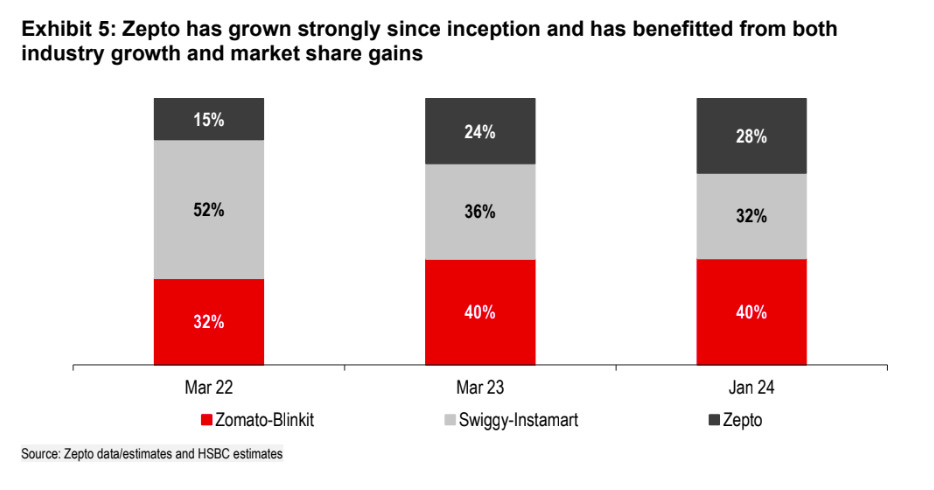

Curiously, Swiggy was the primary main participant to leap into fast commerce in India with Instamart. That early begin ought to’ve given them an edge, proper? However then Zomato shook issues up by shopping for Blinkit, which now holds about 40% of the market, in comparison with Instamart’s 32%. Zepto additionally joined the race, including much more competitors.

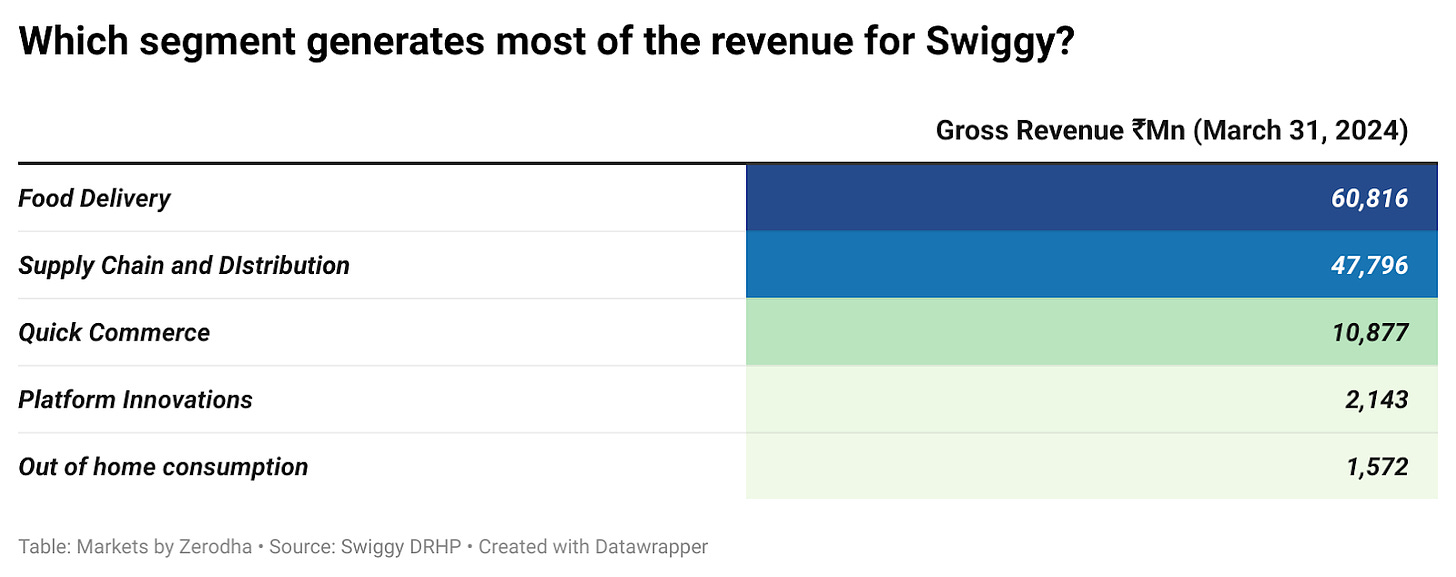

Whereas Instamart has boosted Swiggy’s presence, it’s solely their third-largest income. Then again, for Zomato, fast commerce has turn out to be their second-biggest money-maker, largely due to Blinkit’s fast progress.

Wanting on the greater image, Swiggy and Zomato have various enterprise fashions, however their income sources differ a bit.

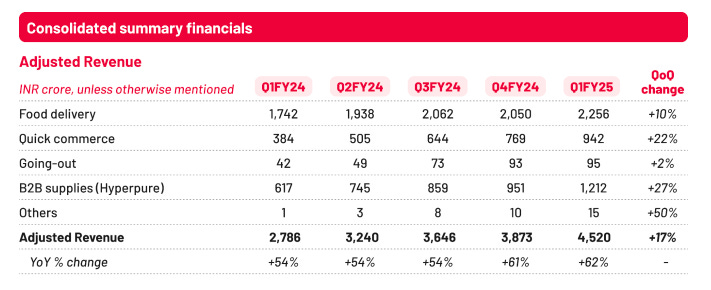

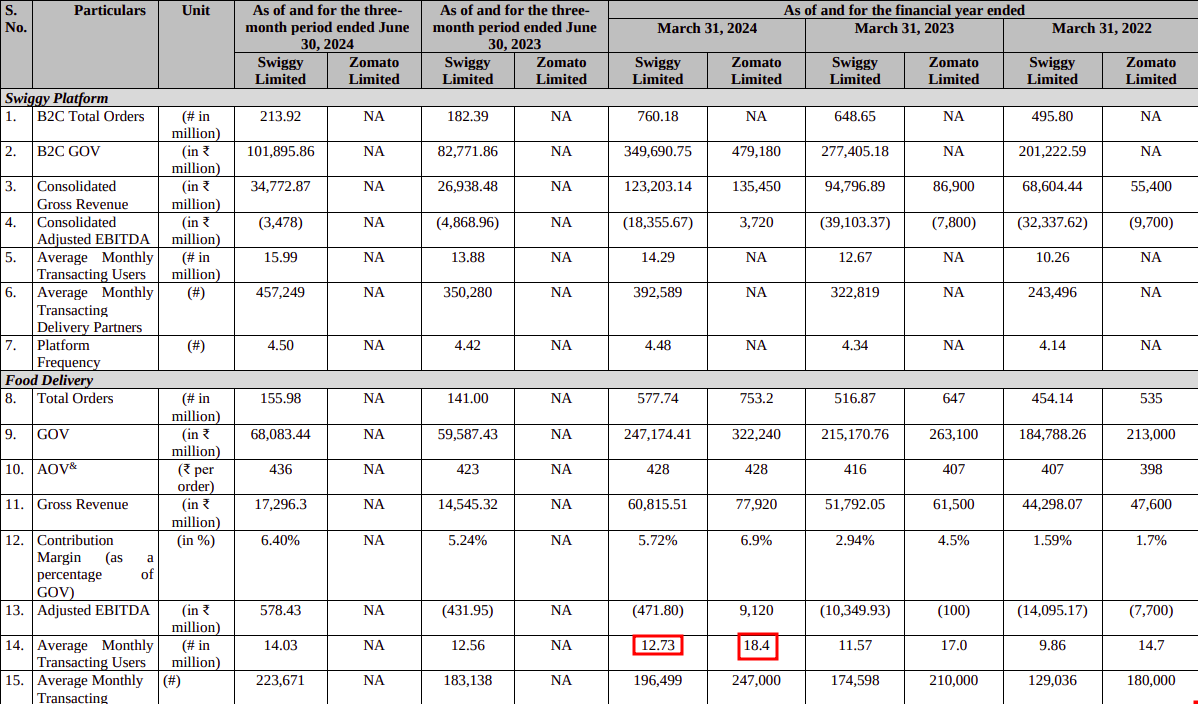

Meals Supply : That is nonetheless the primary focus for each. In Q1 FY25, Swiggy’s meals supply gross order worth (GOV) hit ₹10,189 crore, rising 23%. However Zomato outpaced them, rising 53% to ₹15,455 crore. Zomato is main right here, with 18 million month-to-month energetic customers in comparison with Swiggy’s 12 million.

Fast Commerce : That is the place issues warmth up. Instamart noticed revenues of ₹403 crore, a robust 90% enhance. However Blinkit greater than doubled that, with ₹942 crore in income, rising 145%. The take charges—mainly, how a lot they earn from every order—additionally inform an analogous story: Blinkit’s take price is nineteen.1%, whereas Instamart’s is 14.8%. Regardless of Swiggy’s early begin, Zomato has jumped forward on this house.

B2B Provide Chain : Swiggy’s B2B providers, together with warehousing and logistics, introduced in ₹1,268 crore in Q1 FY25, making it their second-largest income stream. Zomato’s equal, Hyperpure, is rising however nonetheless smaller as compared.

Certainly one of Zomato’s largest strengths is profitability. In Q1 FY25, Zomato posted a internet revenue of ₹253 crore, whereas Swiggy reported losses of ₹611 crore. Even Blinkit’s losses are smaller in comparison with Instamart’s, giving Zomato a slight edge by way of effectivity.

Each Swiggy and Zomato dominate India’s meals supply market, however Zomato is at the moment main in each meals supply and fast commerce. Blinkit’s aggressive progress and higher effectivity have helped it pull forward of Instamart. Though Swiggy has 557 darkish shops for Instamart, the struggle for market share continues to be on, particularly in Tier 2 and Tier 3 cities, the place the following massive progress is anticipated.

Swiggy’s quick-commerce journey goes again even additional. Bear in mind Scootsy? Swiggy purchased the premium meals supply service in 2018 to concentrate on high-end eating places. Whereas Scootsy didn’t change the sport, it did assist Swiggy increase its choices, particularly in Mumbai, earlier than it was ultimately merged into Swiggy’s primary platform.

So, what’s subsequent for Swiggy?

As Swiggy gears up for its IPO, it’s obtained a robust progress story to share. With a mixture of income streams, an early begin in fast commerce, and a stable person base, Swiggy has so much going for it. Nonetheless, Zomato’s lead in each meals supply and fast commerce means Swiggy nonetheless has some catching as much as do.

The following few years can be essential. Each firms will proceed to battle, particularly in fast commerce, the place progress in India’s smaller cities may make an enormous distinction. How Swiggy handles these challenges can be key as to if its IPO meets the hype.

Now let’s dive into Tata’s massive guess on semiconductors and why it might be a game-changer for India’s tech future.

Proper now, India’s chip-making business continues to be fairly underdeveloped. We’ve made some strides in assembling, testing, and packaging chips, however the precise manufacturing half? We’re not fairly there but. However Tata is seeking to change that and is making some daring strikes.

However earlier than we dive into that, in case you’re questioning what the heck a semiconductor chip is and why it’s such a sizzling matter, right here’s a fast 10-second explainer:

Consider semiconductor chips because the “brains” behind all of your digital units. They course of info, retailer knowledge, and management how our units work. Out of your smartphone, pc, and automobile, to even your washer—semiconductor chips are what make these units “sensible” and capable of deal with advanced duties.

Now, again to Tata. They’ve lately teamed up with Powerchip Semiconductor Manufacturing Company (PSMC), one of many world’s high chip makers, to construct India’s first semiconductor fabrication plant, or fab, in Dholera, Gujarat.

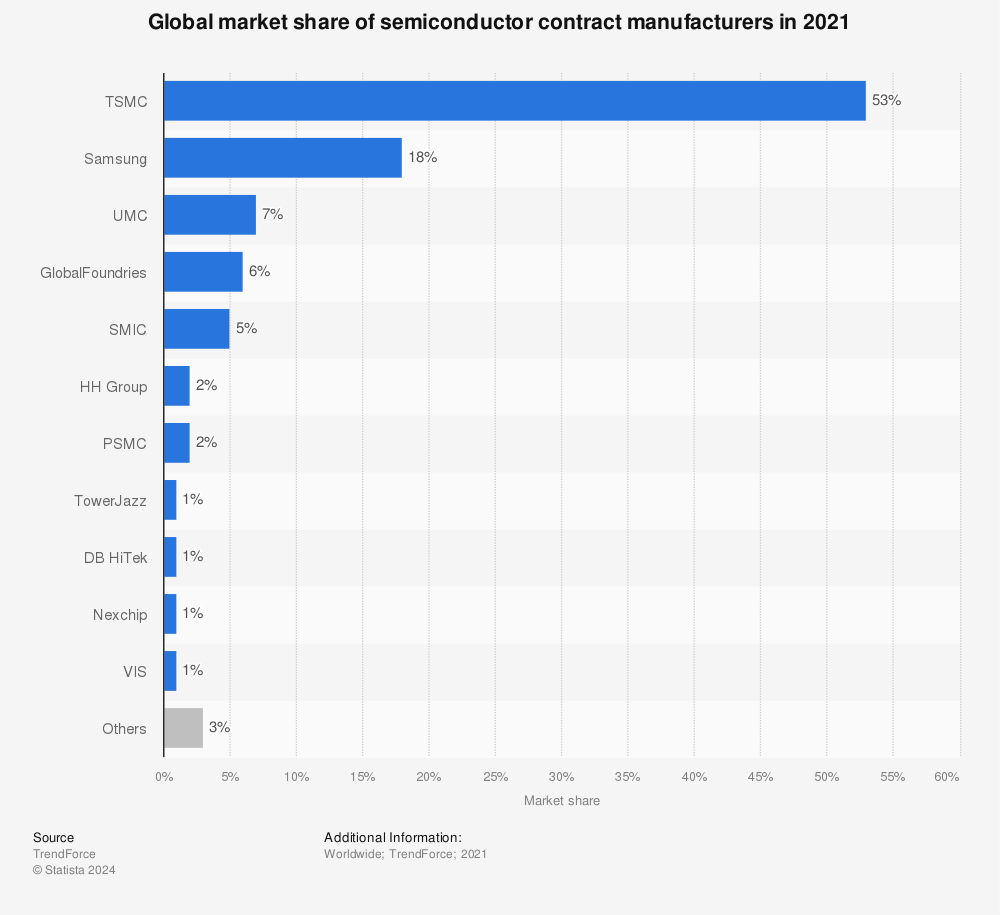

By the best way, don’t combine up PSMC with TSMC—they’re each Taiwanese chip firms, however TSMC is the biggest on the planet, whereas PSMC ranks seventh. Tata’s partnership is with PSMC.

So, why is that this partnership such an enormous deal? PSMC will assist Tata with every thing from design to transferring key applied sciences to India. This fab will produce as much as 50,000 wafers monthly—these are skinny slices of semiconductor materials that ultimately turn out to be the chips powering our units.

Tata is pouring an enormous ₹91,000 crores into this venture. But it surely’s not nearly constructing one manufacturing facility; they’re organising a whole ecosystem for semiconductor manufacturing in India, probably creating 20,000 expert jobs initially, with plans to scale up much more.

However why ought to we care?

Semiconductors energy virtually every bit of tech we use, and proper now, India depends closely on imports. Tata’s fab will make logic chips, that are tremendous necessary for tech like AI and high-performance computing. With the worldwide chip scarcity, Tata’s transfer may place India as a key participant within the international semiconductor market in the long term.

But it surely’s not going to be a stroll within the park. Corporations like TSMC and Samsung have spent many years perfecting their manufacturing, and even they nonetheless face challenges. That’s why Tata’s partnership with PSMC is so essential—it’s the enhance they should get this off the bottom in India.

Wanting forward, Tata plans to construct a number of fabs in Dholera, which may create over 100,000 jobs. Nonetheless, there’s a catch—India has all the time confronted a scarcity of expert staff, particularly in high-tech fields. The excellent news? Tata is tackling this head-on by investing in workforce growth as a part of the venture! They’re planning hands-on coaching for Indian engineers at PSMC’s amenities in Taiwan to make sure they’ve the talents to function these advanced fabs.

In brief, Tata’s massive semiconductor push might be a significant leap in direction of India turning into a key participant within the international chip provide chain. Because the demand for chips retains rising, this might set India up as a necessary various provider sooner or later.

Motilal Oswal lately launched a report on commodity costs, stating some developments that buyers ought to control. Right here’s a fast rundown of what’s occurring.

First up, agricultural commodities are getting pricier. Wheat costs are up 11% in comparison with final yr, and barley has jumped by 15%. This isn’t nice information for firms like United Breweries and Nestlé, which rely closely on these substances. Espresso costs are additionally rising, up 14%, which may imply greater prices for manufacturers like Nestlé and Hindustan Unilever.

So, what does this imply for us? It’s possible these rising prices will ultimately be handed on to us as shoppers, which means our grocery payments may go up quickly.

Subsequent, let’s discuss concerning the edible oil market. Import duties on oils like palm, soybean, and sunflower have risen from 0% to twenty%, and refined oil duties are actually at 32.5%. Whereas this transfer is designed to help native producers, it’s placing strain on FMCG firms like Britannia, Dabur, and Marico, which use these oils. Because of this, we would begin seeing value hikes on objects like biscuits and cooking oils.

But it surely’s not all unhealthy information. Costs of non-agricultural commodities, particularly crude oil, are cooling off—they’re down 7% from final yr, primarily because of China’s financial slowdown. That is good for firms like Asian Paints and Pidilite, which may see higher margins due to decrease uncooked materials prices.

Nonetheless, inflation continues to be a problem for FMCG firms. Key inputs like wheat, sugar, and milk are up about 4% from final yr, placing strain on giants like Hindustan Unilever and Britannia. To guard their margins, we would see extra value will increase on on a regular basis merchandise within the coming months.

So, whereas some sectors may catch a break, inflation continues to be hitting the meals and FMCG house exhausting. We should always brace ourselves for extra value hikes on family items quickly.

ChrysCapital is about to purchase Theobroma Meals and Belgian Waffle Co for a mixed ₹3,200-3,500 crore. They’re seeking to construct a shopper model funding platform, tapping into India’s rising meals market, which is projected to succeed in ₹7.76 lakh crore by FY28.

Appario Retail, as soon as Amazon India’s high vendor, has gone to court docket to problem the CCI’s antitrust investigation, which accuses Amazon and Flipkart of favoring choose sellers. This might set a development for different firms preventing regulatory actions.

OpenAI is restructuring right into a profit company to draw buyers and probably hit a $100 billion valuation. This comes after some management modifications and goals to steadiness AI progress with moral issues.

India introduced a small wage hike for casual sector staff beginning October 1, to maintain up with rising residing prices, with changes linked to inflation developments.

Accenture reported This fall 2024 income of $16.41 billion, pushed by demand for generative AI options, and introduced a $4 billion share buyback, displaying sturdy confidence from buyers.

Thanks for studying. Do share this with your folks and make them as sensible as you might be ![]()

When you have any suggestions, do tell us within the feedback

[ad_2]

Source link