[ad_1]

krblokhin/iStock Editorial through Getty Pictures

Traders are very conscious of the AI bubble this 12 months, however there’s one different sector that is getting so much much less consideration however seeing important market good points this 12 months: fast-casual meals chains. Business titan Chipotle (CMG) is up practically 30% this 12 months after an enormous 50-for-1 inventory cut up; whereas new IPO CAVA (CAVA) has barely greater than doubled year-to-date as traders cheered the corporate’s tempo of retailer enlargement with its appreciable IPO funds.

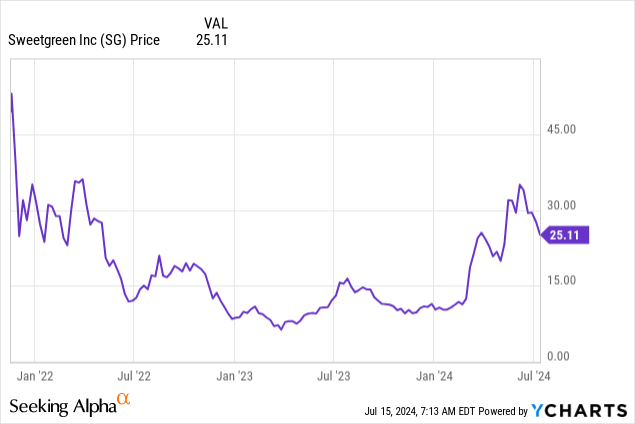

And but one identify is main the pack: Sweetgreen (NYSE:SG), the fast-casual salad idea, which has seen its share worth surge greater than 120% 12 months up to now. Sweetgreen’s success within the inventory market this 12 months is not simply an expression of sturdy enterprise efficiency, however a wager on the corporate’s future because it automates extra of its retailer fleet with robotics.

Regardless of my common aversion to high-flying momentum shares, I am initiating Sweetgreen at a purchase ranking.

To me, there are two fundamental elements that make Sweetgreen stand out versus its fast-casual rivals:

Automation potential. Sweetgreen was comparatively early in creating a plan not only for automated ordering programs, however robotic salad-making as properly. Although these are expensive upfront endeavors, Sweetgreen’s investments can yield super financial savings in restaurant working prices over time. Respectable same-store gross sales progress, and better meals margins versus friends. Whereas rival CAVA is seeing a pointy deceleration in same-store gross sales progress, Sweetgreen is anticipating mid-single digit same-store gross sales progress this 12 months. Maybe greater than another fast-casual restaurant, Sweetgreen advantages from wholesome meals consuming traits. We word as properly that Sweetgreen’s margin on uncooked meals inputs is barely greater than friends.

We word that the inventory is down ~20% from year-to-date highs above $30, technically placing Sweetgreen in bear market territory. Although I would not wager the proverbial farm on this inventory, I consider Sweetgreen may be very deserving of a small place in your portfolio.

Automation push

You’ve got most likely seen your neighborhood McDonald’s (MCD) convert to digital ordering towers, although it is nonetheless very potential to go as much as the counter and provides your order to the cashier in individual. Sweetgreen, nonetheless, is taking automation one step additional than simply the ordering course of: it has designed robots to automate the salad-making course of as properly.

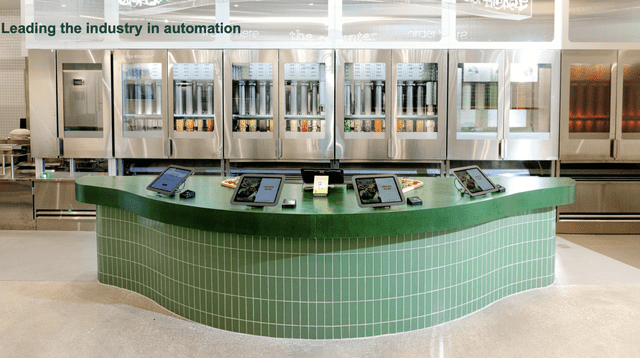

Sweetgreen automation graphic (Sweetgreen June 2023 investor presentation)

The corporate opened its first totally automated location in Could 2023, in Naperville, Illinois. The corporate’s automated system is branded as “Infinite Kitchen,” and has the capability to provide as much as 500 salad bowls per hour. After a buyer locations an order, the Infinite Kitchen instantly begins assembling their chosen dish. A mechanical platform rotates the salad bowl because the system drops particular person elements, toppings, and dressings into the bowl.

For the time being, labor is 29% of Sweetgreen’s income (as of its most up-to-date quarter). Evidently, slicing down on restaurant labor over time is a really engaging margin accretion catalyst, particularly in a enterprise the place restaurant-level working margins are solely within the excessive teenagers. Nevertheless it’s not simply labor financial savings that make automation engaging: if executed efficiently, the shopper expertise improves as properly, specifically by bypassing the wait time for cellular order pickups.

On Sweetgreen’s latest Q1 earnings name, CEO Jonathan Neman famous that its first few Infinite Kitchens are producing 10 factors of working margin profit relative to the opposite eating places within the firm’s portfolio. The corporate is planning to broaden its automation this 12 months:

On the finish of the primary quarter, the 2 Infinite Kitchens positioned in suburban commerce areas are monitoring to a median 12 months, one common unit quantity of $2.6 million, they usually delivered a median first quarter margin of 28%, 10 factors above the fleet common, giving us confidence in our go-forward deployment technique.

Additionally they proceed to reveal further advantages to our working mannequin, reminiscent of quicker throughput, higher order accuracy, portion in consistency and considerably decrease group member turnover. Moreover, we proceed to see greater common checks than the markets they function in.

In 2024, we stay on monitor to open roughly seven new Infinite Kitchen eating places in addition to retrofit three to 4 giant city eating places with the Infinite Kitchen. Our first retrofit can be in New York Metropolis this summer season. In 2025, we plan to deploy an rising variety of new eating places powered by the Infinite Kitchen. As we construct our future actual property pipeline, we see super white area alternatives throughout the USA in each new and current markets.”

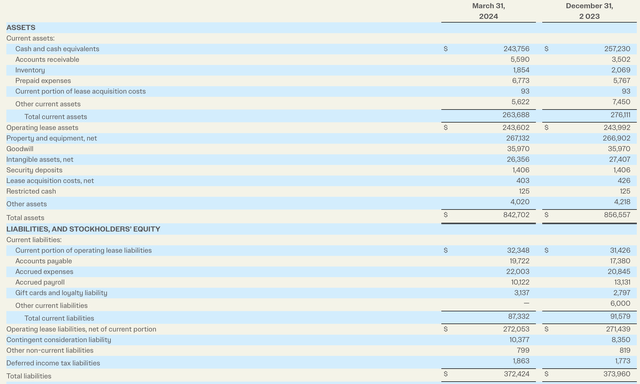

Every retrofit prices between $450,000-$500,000 to execute. It is comforting to know, then, that Sweetgreen has a large money reserve of $243.7 million as of its most up-to-date stability sheet, which is unencumbered of debt.

Sweetgreen stability sheet (Sweetgreen Q1 earnings launch)

Wholesome same-store gross sales progress and margin potential

Put apart the automation potential for a minute, and we nonetheless discover that Sweetgreen’s execution and basic outcomes right now are engaging in comparison versus friends.

The metric that I lean on most by way of model success is same-store gross sales progress, which measures progress per location, stripping out the affect that new restaurant expansions have on income progress.

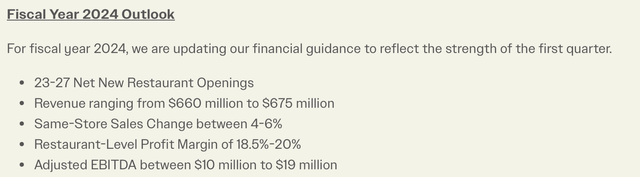

For FY24, Sweetgreen is guiding to same-store gross sales progress of between 4-6% y/y, and its same-store gross sales progress in Q1 additionally clocked in on the midpoint of that vary, 5% y/y. We do word that a part of this enhance owes to pricing, as Sweetgreen rolled out greater menu pricing this 12 months (consistent with many trade friends).

Sweetgreen outlook (Sweetgreen Q1 earnings launch)

The corporate has already famous that Infinite Kitchens assist to spice up common ticket costs, so the corporate’s plans to retrofit a portion of its retailer fleet with automation could assist to spice up similar retailer gross sales additional.

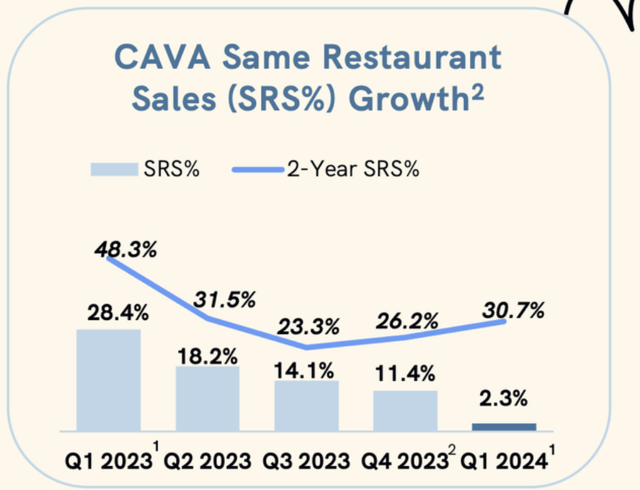

We word that this compares fairly favorably to CAVA, which I’ve a bearish opinion on. Although CAVA can be guiding to ~5% same-store gross sales progress this 12 months, we word that the corporate’s SRS decelerated sharply to 2.3% in its most up-to-date quarter.

Cava SRS deceleration (Cava Q1 earnings launch)

Whereas Sweetgreen’s steering is consistent with its precise Q1 outcomes, CAVA’s precise efficiency in SRS has slipped under what it is guiding to, which can trigger disappointment down the highway.

We do word that Chipotle is trouncing each Sweetgreen and CAVA in SRS, having reported a 7.0% progress price in Q1 and guiding to mid-high single digit progress for the 12 months. That is, nonetheless, pushed largely as properly by greater menu pricing.

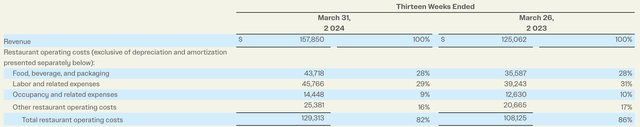

The place Sweetgreen trounces each of those rivals, nonetheless, is in its greater meals margin. In Q1, for instance, the corporate’s meals, beverage, and packaging prices represented 27.7% of its income.

Sweetgreen COGS breakdown (Sweetgreen Q1 earnings launch)

This compares to twenty-eight.6% for CAVA and 28.8% for Chipotle. In a enterprise the place restaurant working margins hover close to ~20%, Sweetgreen’s ~100bps benefit in meals prices (should you suppose lunch salads are overpriced, this is a sign that you simply’re most likely proper) makes an enormous distinction.

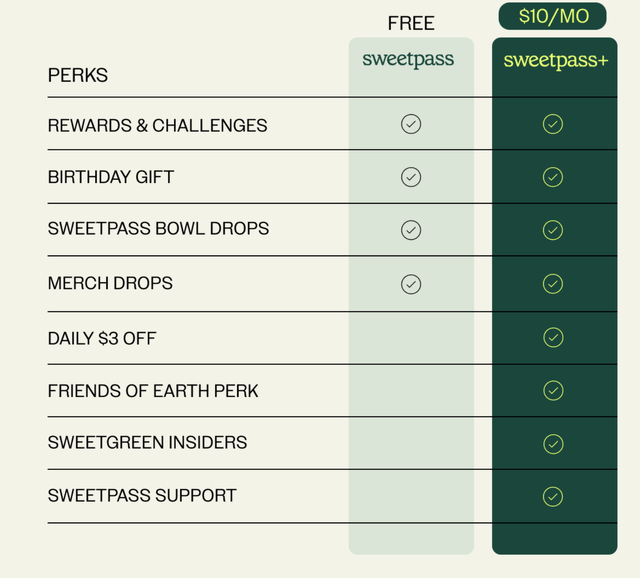

One other space through which Sweetgreen differs from friends: whereas most restaurant chains provide a loyalty and rewards program, Sweetgreen additionally has a paid subscription plan known as Sweetpass+.

Sweetpass+ (Sweetgreen web site)

The important thing profit right here is $3 in day by day salad financial savings in trade for a $10/month membership price. Whereas the corporate has famous that subscription income isn’t a serious income driver but, what it does encourage is habitually inside its most loyal buyer base.

Dangers and key takeaways

Sweetgreen enjoys a wholesome same-store gross sales progress premium above friends like CAVA, and it has the next meals margin in addition to ongoing potential advantages from its early investments into automation – which, over time, will help drive a considerable revenue margin hole to its friends.

There are dangers right here, in fact. The primary fundamental threat is that Sweetgreen is driving wholesome income progress this 12 months via worth will increase. In a really inflationary surroundings, customers could ultimately push again towards worth will increase (particularly as salads may be very low-cost and simple to make at house).

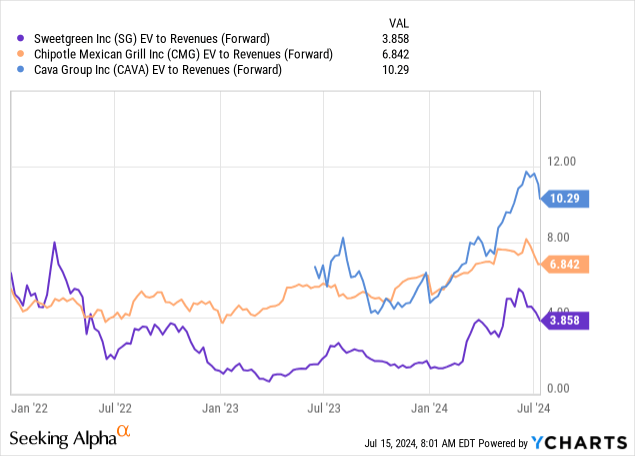

The second threat is valuation: with the restaurant group’s surging share costs this 12 months, we might be due for an even bigger clawback of latest good points. I do, nonetheless, take consolation in the truth that Sweetgreen trades at a a lot decrease ahead income a number of (~4x) than its friends:

All in all, I feel there are each engaging near-term and long-term success drivers for Sweetgreen, particularly as curiosity in well being traits proceed to develop. Take this near-term dip as a shopping for alternative.

[ad_2]

Source link