[ad_1]

Key Takeaways

Starknet’s governance vote passes STRK token staking for late 2024.

Staking options embrace a 21-day withdrawal time-lock and a steadiness between rewards and inflation.

Share this text

Starknet token holders have ratified a proposal to implement staking on the Layer 2 community, marking a major milestone within the platform’s improvement and governance.

The proposal, dubbed “SNIP 18” and submitted by core developer StarkWare, acquired overwhelming assist in a latest vote carried out on Snapshot’s new decentralized Snapshot X platform. Of the collaborating voters, 98.94% voted in favor of implementing staking, whereas 0.45% abstained, and 0.61% voted in opposition to it.

Staking mechanism for STRK

The accepted staking mechanism will permit STRK token holders with a minimal of 20,000 tokens to develop into stakers, whereas others can delegate their tokens. StarkWare CEO Eli Ben-Sasson emphasised the importance of this improvement, stating that his was a “historic milestone” for the chain’s improvement in the direction of full decentralization.

“As one of many first Layer 2s to supply this chance to its token holders, we’re shifting nearer to having a community that’s totally operated and run by the neighborhood for the neighborhood,” Ben-Sasson shares.

The staking implementation is slated to go reside on testnet quickly, with a mainnet launch anticipated within the fourth quarter of this 12 months. This timeline presents an pressing alternative for STRK holders to arrange for participation within the community’s staking ecosystem.

Distinctive minting mechanism

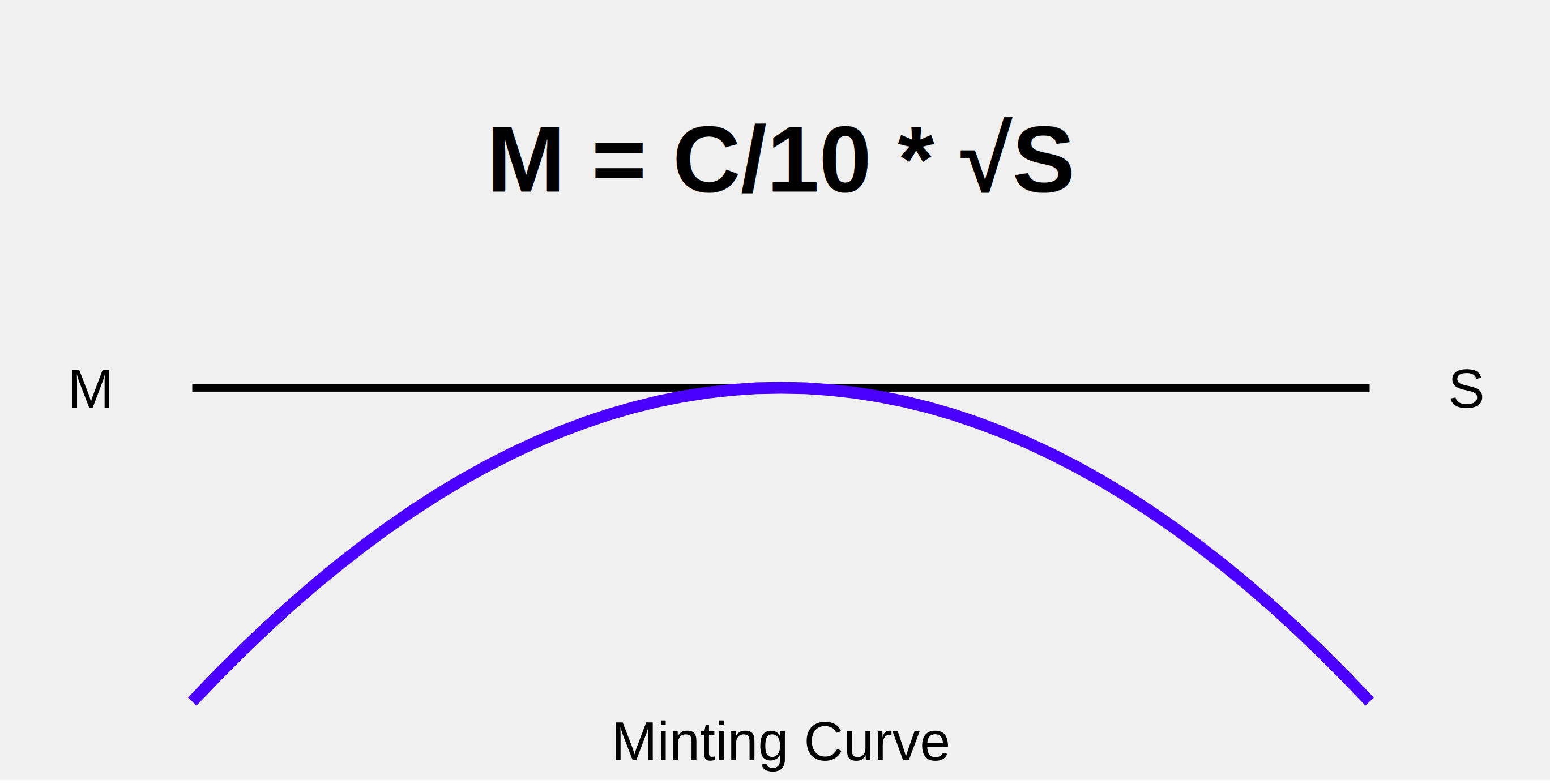

A key element of the accepted proposal is the minting mechanism, which goals to steadiness staker rewards with inflation expectations. The mechanism makes use of a minting curve based mostly on Professor Noam Nisan’s proposal, outlined by the components M = C/10 * √S, the place S represents the staking fee as a proportion of complete token provide, M is the annual minting fee, and C is the utmost theoretical inflation fee.

Initially, the worth of C can be set at 1.6, however the proposal contains provisions for future changes. Both a financial committee created by the Starknet Basis or the Basis itself may have the authority to regulate C inside a spread of 1.0 to 4.0, based mostly on staking participation charges.

To make sure transparency, any adjustments to the minting curve fixed should be introduced publicly on the neighborhood discussion board not less than two weeks prematurely, accompanied by an in depth justification.

Why stake STRK?

The introduction of staking carries vital implications for STRK token holders. It offers a chance for elevated participation in community governance and the potential for incomes rewards. Nevertheless, the comparatively low voter turnout of 0.08% of eligible voters underscores the necessity for larger neighborhood engagement in future governance selections.

Trying forward, Starknet plans to introduce extra governance options and duties for stakers in phases. These could embrace potential roles in decentralizing the community’s sequencer and prover, additional enhancing the platform’s dedication to decentralization. In latest information, the Starknet Basis noticed its former CEO Diego Oliva resign from the group earlier in August.

Working as a Layer 2 scaling resolution for Ethereum, Starknet makes use of zero-knowledge STARK proofs to validate off-chain transactions, considerably rising transaction throughput. The community boasts the aptitude to deal with as much as 100,000 transactions per second throughout peak occasions, probably lowering transaction prices by an element of 100 to 200.

Share this text

[ad_2]

Source link