[ad_1]

Kevin Dietsch

The Smith & Wesson Funding Thesis

In search of Alpha

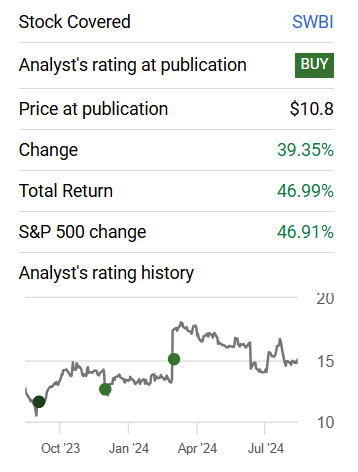

I wrote my first article on Smith & Wesson (NASDAQ:SWBI) in March 2023, and since then, the inventory has returned nearly precisely the identical because the S&P 500 (SPY). Each are up 46% throughout a interval when Smith & Wesson has struggled with excessive prices as a result of its headquarters relocation.

And I proceed to imagine that it’s only now, after the relocation, that shareholders could also be rewarded for his or her persistence. The upside potential over the subsequent 5 years is roughly 100% in response to my EPS estimate.

Smith & Wesson’s FY24 Outcomes

In my final article on Smith & Wesson, I predicted that Smith & Wesson would report FY24 revenues between $520 million and $535 million. Fortuitously, they hit the excessive finish of my vary, coming in at $535.8 million.

This represents a rise in internet gross sales of 11.8%, or $56.6 million, in a tough yr, which is a powerful accomplishment by the administration crew. The gross margin was barely decrease than in FY23, 29.5% versus 32%, however EPS and internet earnings had been larger, so the outcomes are nonetheless passable. Nevertheless, there are alternatives to enhance margins within the coming years via operational enhancements as soon as the stress of the transfer has subsided.

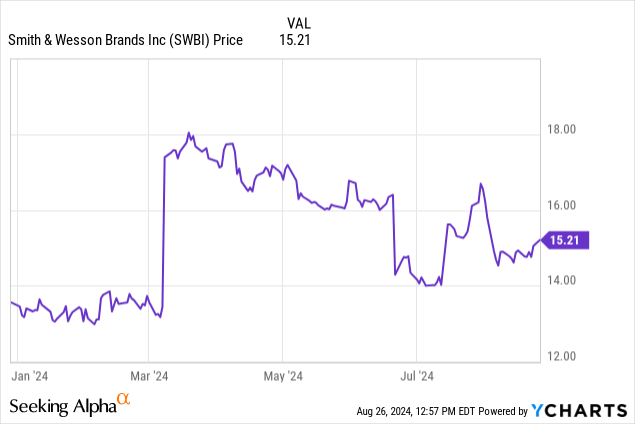

Sadly, the market didn’t take effectively to the information that demand can be weaker than anticipated within the close to time period, resulting in a modest sell-off. Nevertheless, the upside potential for FY25 as an entire, together with the elections and their potential impression, must be comparatively excessive, offsetting the weaker-than-expected Q1.

Smith & Wesson is subsequently more likely to stockpile for this eventuality and be ready for a excessive degree of demand.

SWBI’s Capital Allocation

SWBI 10-Okay FY24

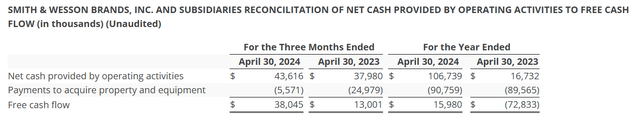

My unique thesis was that Smith & Wesson, normalized after the relocation, would have about $80 to $100 million of FCF out there to distribute to shareholders. This relocation plan, introduced in September 2021, has thus far price greater than $150 million in FY23 and FY24. However the huge prices appear to be over, and if there are any in FY25, they are going to be smaller quantities.

However as you’ll be able to see in This autumn/24, the place SWBI nearly tripled FCF in comparison with This autumn/23, $38 million versus $13 million, using capital already appears to be more practical. Whereas This autumn is usually the quarter with the perfect FCF, I believe an estimate of $20 to $30 million of CapEx for the complete yr and $100 to $110 million of working money stream for FY25 might be real looking. That may be roughly within the $80 million to $100 million FCF vary.

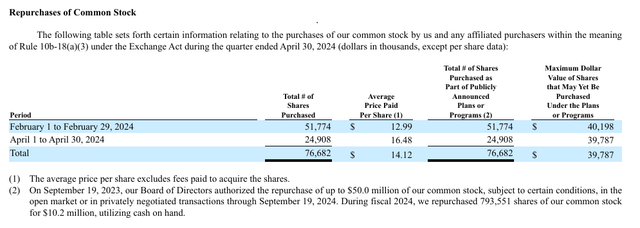

In FY24, $22 million was paid in dividends and $10.2 million in share repurchases. In complete, greater than $30 million was returned to shareholders. And in FY25, I hope to see one thing between $40 million and $45 million, nearly all of which I wish to see used for share repurchases.

SWBI 10-Okay FY24

For the $10.2 million share repurchases made in FY24, 793,551 shares had been repurchased and a further $39 million is obtainable beneath the repurchase program. Relying on the costs at which these shares are purchased again, I assume that it will likely be about 2,500,000 to three,000,000 shares.

SWBI 10-Okay FY24

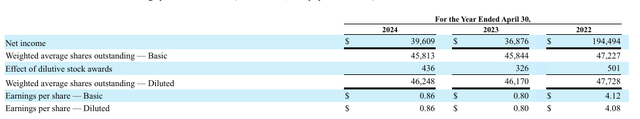

Sadly, the $10.2 million didn’t end in a big discount in shares excellent, because it solely offset the dilution from SBC. As in FY23, the weighted variety of shares excellent stays at roughly 46 million.

However I count on the share buybacks to be bigger than the SBC in FY25, which is able to scale back the share depend. Ideally, a discount of a bit greater than 1 million shares per yr over the subsequent 5 years to get the shares excellent all the way down to 40 million could be very supportive of complete returns for my part.

I imagine that by standardizing processes, SWBI can enhance its margins and obtain strong development with out having to make extraordinarily giant investments.

SWBI’s Stability Sheet

SWBI 10-Okay FY24

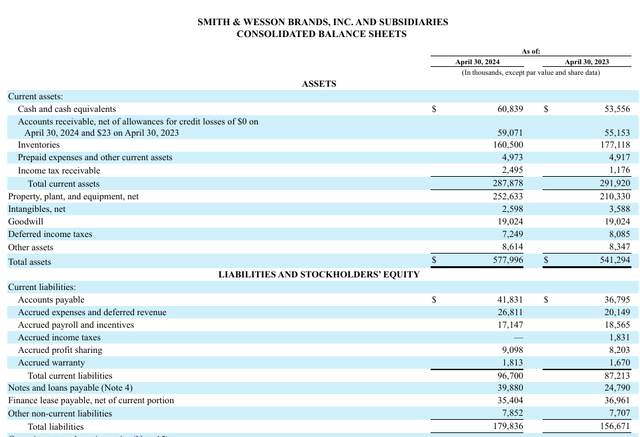

Smith & Wesson has a strong stability sheet with no long-term debt on the stability sheet, however they do have $40 million of borrowings excellent on the revolving line at an rate of interest of about 7.18%. However in addition they have $60 million in money, so repaying the borrowings shouldn’t be an enormous downside.

Accounts receivable and accounts payable are up, so we must always take a look at days gross sales excellent and days payable excellent to get a greater image of capital effectivity. And right here we’ve an encouraging improvement as a result of DSO went from 50 in FY20 to 39 in FY24, which suggests Smith & Wesson is getting paid sooner. And DPO went from 47 in FY20 to 40 in FY24, which suggests distributors are additionally getting paid a bit bit sooner. However all in all, Smith & Wesson’s clients are paying sooner than Smith & Wesson has to pay its suppliers. A constructive signal.

As well as, suppliers haven’t any actual pricing energy as a result of Smith & Wesson has main and secondary sources for each crucial half it doesn’t manufacture.

Smith & Wesson’s Valuation

Smith & Wesson is at present ready the place it has the potential to develop its margins, change into a share cannibal, and develop internet gross sales barely every year. Due to this fact, in my 5-year plan, I might assume the next numbers. Web earnings margin enlargement to 10%, share depend decline to 40 million, and gross sales development of 4% at an exit P/E a number of of 18x.

Beginning income: $535m Worth: $15

Income in 5 Years $651m Web Earnings $65,1m Shares Excellent 40m EPS $1.63 A number of 18x Share Worth 5Y $29,34 Upside ~96% Click on to enlarge

A 96% upside, with dividends on prime of that, on solely 4% income development is a powerful outlook for my part. And I count on dividends to proceed to rise over the subsequent few years, which might considerably improve the overall return.

My hurdle price is all the time a 100% upside over 5 years, and I believe that on this case it’s given with comparatively conservative assumptions.

Conclusion

I believe Smith & Wesson continues to be attractively valued and has loads of upside. Nevertheless, it will likely be necessary to control SBC prices and see how administration deploys FCF this yr. I believe FY25 might be crucial right here to see the place the journey goes within the coming years.

[ad_2]

Source link