[ad_1]

kefkenadasi/iStock through Getty Photographs

Signet Jewelers Restricted (NYSE:SIG) has been on my watchlist for a few months, and following the numerous correction skilled by the inventory after the final incomes launch, I used to be very near opening a place because it requires very conservative mid/long-term assumptions to underwrite an funding case.

However the Outlook offered by administration on the time was and continues to be the rationale that prevented me from doing so, and that would be the focus of this text.

There are various points that may be highlighted and additional scrutinized when analysing this Jewelry retailer that serves primarily the US with smaller operations in Canada and the UK. Most of these I might placed on the dangers class; like the worth of its manufacturers when in comparison with those marketed by LVMH (OTCPK:LVMUY) or Pandora (OTCPK:PANDY), the influence of lab grown diamonds on its income sustainability or a number of the extra operational points that the corporate has confronted in recent times.

In a future article I’d deal with these points, however first I needed to put up this narrower piece to spotlight the extra quick danger of a possible steerage minimize within the subsequent incomes launch that’s just some days away (September 12), because the implications of the materialization of that end result could possibly be vital for the short-term efficiency of the inventory.

Final Quarter Outcomes and Outlook

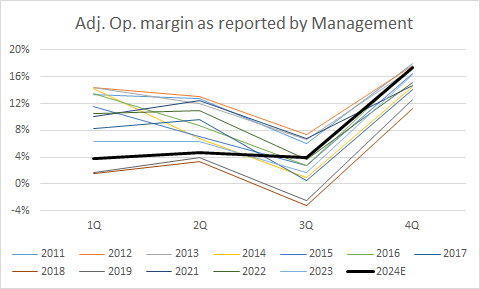

Final quarter outcomes had been gentle however comparatively in keeping with expectations. Adjusted working margin got here 256 bp under the identical quarter of final yr and on the identical time their steerage for the second quarter implies on the midpoint one other margin discount, this time of 167bp vs the earlier yr.

However regardless of these two necessary destructive datapoint, administration determined to maintain FY steerage unchanged at $6,840 million and $633 million for revenues and adjusted working earnings respectively, on the midpoint.

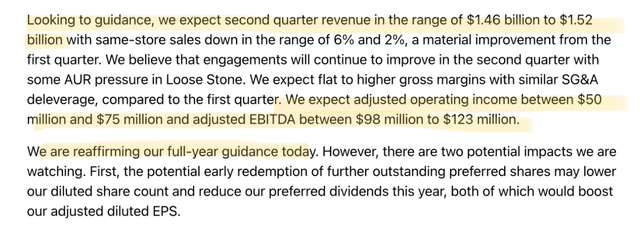

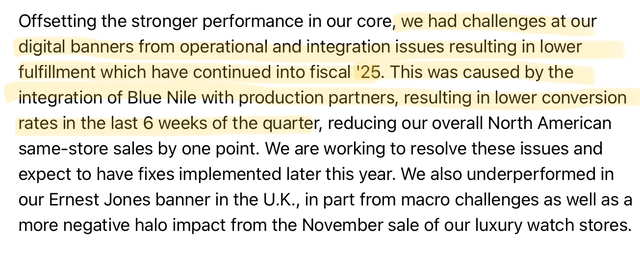

1Q Fiscal 12 months 2025 Signet incomes name transcript

This suggests a full yr adjusted working margin of 9.2%, 20bp increased than the 9% achieved final yr, one thing that may require a particularly improved second half as the primary 6 months are already anticipated to be 211bp decrease. And this discrepancy was the theme of the primary query within the final incomes name.

1Q Fiscal 12 months 2025 Signet incomes name transcript

That reply didn’t appear convincing sufficient to me for the extent of enchancment required within the second half, so let’s attempt to see, based mostly on the corporate’s seasonality and from an historic perspective how sensible is that second half outlook.

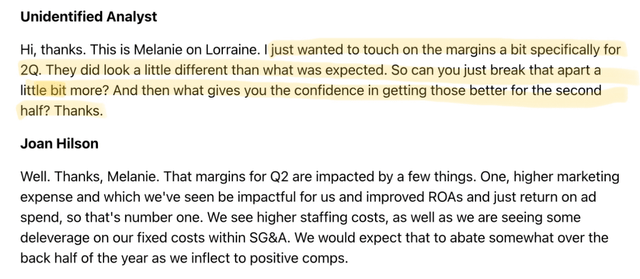

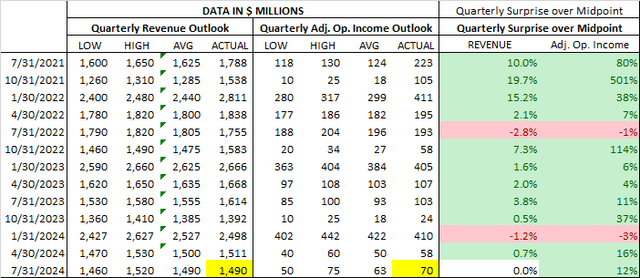

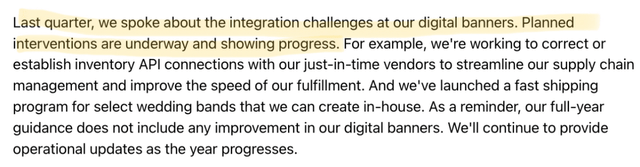

SIG monetary disclosures (offered on a calendar yr foundation as a substitute of fiscal yr foundation)

As you possibly can, the sample of seasonality (I overlooked 2020 for apparent causes) could be very secure, and there are a number of observations that we are able to make:

Second quarter margins are normally higher than the one for the primary quarter. Third quarter margin is at all times the bottom one of many yr. Fourth quarter margin is at all times the very best of the yr.

These days the corporate has been in a position to overdeliver by way of Adjusted Working Revenue and to a decrease extent in time period of revenues, however these surprises have grow to be smaller as we acquired away from the put up pandemic consumption growth years. So, I might assume zero shock for the 2nd quarter by way of revenues and a gentle constructive one by way of adjusted working earnings (The figures marked in yellow within the subsequent desk).

SIG monetary disclosures & creator assumptions (offered on a calendar yr foundation as a substitute of fiscal yr foundation)

Primarily based on these assumptions, the second half of the yr ought to ship at the very least $3.839 million and $505 million respectively in revenues and adjusted working Revenue to perform the guided outcomes.

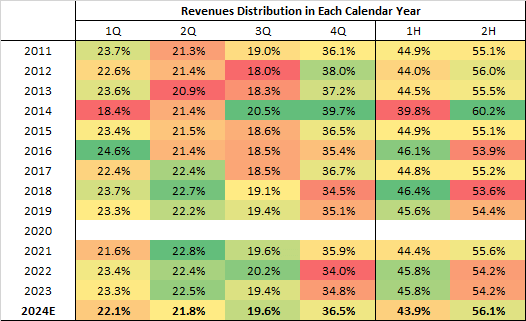

I might divide these quantities between the third and 4th quarters based mostly on historic seasonality, to point out within the following tables, what are the implications for the total yr distribution of each figures alongside the quarters and between the first and 2nd half of the yr.

SIG monetary disclosures & creator assumptions (offered on a calendar yr foundation as a substitute of fiscal yr foundation)

By way of revenues, administration’s outlook would suggest a really strong second half when in comparison with the primary, however whereas higher than the typical second half, it is inside the ranges of what has occurred up to now, so it appears difficult however doable.

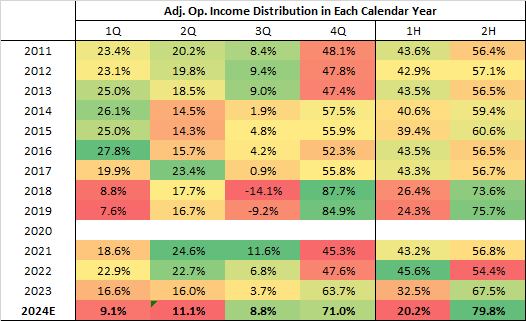

However once we repeat the identical train for the outlook given for adjusted working earnings, the state of affairs is totally different.

SIG monetary disclosures & creator assumptions (offered on a calendar yr foundation as a substitute of fiscal yr foundation)

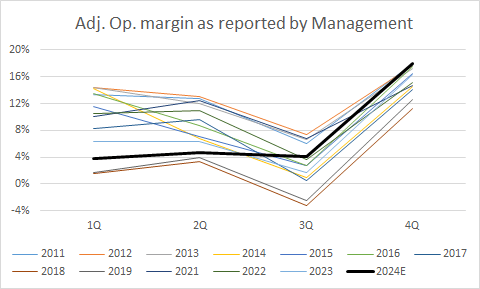

Right here we are able to see that in comparison with first half of the yr, present FY steerage would require the very best relative second half in 14 years. And by way of margins, it might appear to be this.

SIG monetary disclosures & creator assumptions (offered on a calendar yr foundation as a substitute of fiscal yr foundation)

This outlook would require a 14-year file 4th quarter by way of margins and a greater third quarter margin than the typical for the primary half of the yr, one thing that has by no means occurred within the interval below evaluation.

It’s true that this evaluation has been based mostly completely on the historic seasonality of the enterprise however is necessary to know that such a secure and recurring sample doesn’t come out of nowhere however is the results of the underlying basic drivers of demand.

In the long run what I’m making an attempt to spotlight right here is that on the face of the second quarter outlook, the implied second half of the yr appears extremely inconceivable, however not unimaginable. The most effective instance of that’s the yr that I deliberately overlooked of the evaluation, a yr when each conditions that I characterize as not possible to happen this yr, occurred on the identical time. All of us know what befell in 2020, in very scientific language let’s say that there was a really vital disruption of the traditional patterns of demand within the type of lockdowns and financial stimulus.

So, at this level we must always attempt to suppose if there was something that may have negatively affected the primary half and/or quite the opposite would possibly positively have an effect on the second half. And importantly these results needs to be vital sufficient to take seasonal patterns away from its historic ranges.

Believable Explanations

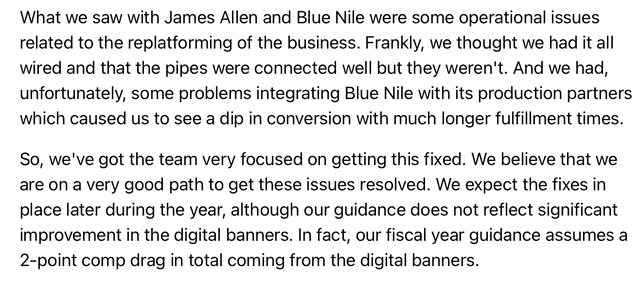

Because the 4th quarter of 2023 (4Q Fiscal 12 months 2024) the corporate has been experiencing integration issues of their digital banners which have of their phrases “affected conversion”. The subsequent two screenshots come from their 4Q Fiscal 12 months 2024 earnings name and the third one from the certainly one of 1Q Fiscal 12 months 2025.

4Q Fiscal 12 months 2024 Signet earnings name transcript

4Q Fiscal 12 months 2024 Signet earnings name transcript

1Q Fiscal 12 months 2025 Signet earnings name transcript

So although administration mentioned that their outlook doesn’t embody any restoration on their digital banners, let’s assume that’s that is their ace up their sleeve, they usually handle to totally get well their digital banners efficiency for the second half enhancing their implied 2H income by the 2 proportion factors which can be talked about within the second screenshot referring to this subject.

That will not change in any respect the not possible distribution of adjusted operation earnings between quarters and would make income distribution much more second half weighted:

SIG monetary disclosures & creator assumptions (offered on a calendar yr foundation as a substitute of fiscal yr foundation)

However on the identical time would considerably normalize calendar yr adjusted working margin seasonality, making it rather less inconceivable:

SIG monetary disclosures & creator assumptions (offered on a calendar yr foundation as a substitute of fiscal yr foundation)

My perspective is that these issued should not vital sufficient to elucidate the weird sample of seasonality in working earnings, as a result of to be so, the combination issues ought to have impacted not simply revenues however prices, and to a cloth diploma, as that may have at the very least partially defined the poor first half margins and would give credence to a cloth enchancment when the issue will get fastened as there is no such thing as a longer the necessity for these additional one-time prices.

Can I be 100% certain that that didn’t occur, after all not, however that’s the type of subject that administration groups normally spotlight, as is a lot better for the inventory to have a non-recurring clarification for a poor margin efficiency, than having the analyst neighborhood query whether or not there’s a extra basic downside that explains it. And there was not a peep about it of their name.

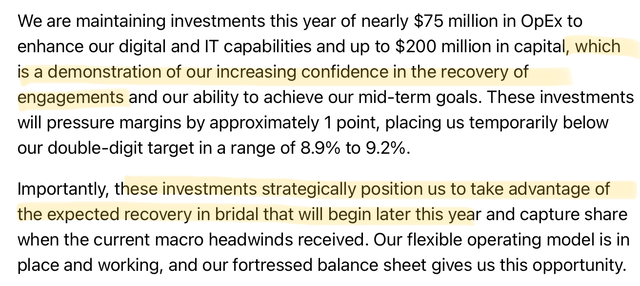

Other than that, by way of client demand, I don’t see any materials change in what could possibly be described as an total weak US client, and whereas it is true that administration is anticipating a restoration within the bridal class for the second half, they’ve been speaking about this for greater than yr, so coloration me skeptical on that one.

Signet 1Q Fiscal 12 months 2024 earnings name (Greater than a yr in the past)

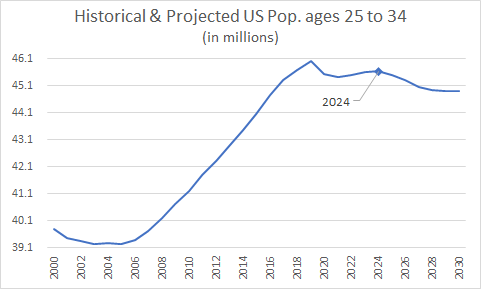

One other issue that must be thought of if we’re placing the hopes for such vital restoration within the second half on the again of the bridal class is demographics.

The US Census Bureau tracks the median age of the primary marriage within the US. In keeping with their newest launch, that statistic stands at 30.1 years for males and 28.2 years for girls.

With that in thoughts, we are able to use the demographic historic statistics and projections by nation offered by the OECD. These knowledge units are disaggregated in age brackets of 5 years every, so we’re going to deal with the 25 to 29 and 30 to 34 age brackets to attempt to get indication of the TAM for the bridal class in the USA.

OECD

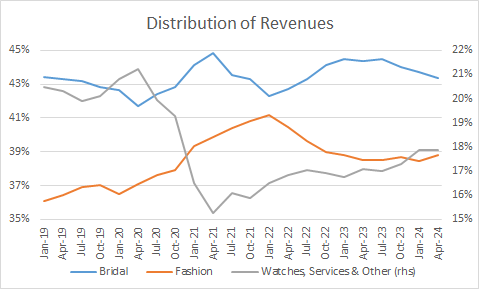

As you possibly can see, the age bracket extra prone to get married is anticipated to begin slowly lowering beginning in 2024. And other than that, it is necessary to notice that even with the underperformance of the bridal class in current quarters, TTM income distribution appears to face squarely in the course of its historic vary for this explicit class.

Signet monetary disclosures

One other Case of a Administration Crew Offering a Very Lopsided FY Outlook And its Final result

The chance that I’ve tried to flesh out jogs my memory of what not too long ago occurred with Fox Manufacturing facility (FOXF), an organization that I’ve been overlaying in current months.

It is completely true that FOXF is in a really totally different sector, but it surely’s additionally client dealing with and affected by the identical themes (low client confidence, excessive rates of interest, previous years accrued inflation, and many others.) which have translated into the present weak atmosphere of US consumption.

However extra essential than the variations and similarities between their respective industries, what I need to spotlight are the similarities within the construction of their respective FY steerage within the face of weak Q1 outcomes and poor expectations for Q2.

FOXF, reported a weak 1Q24 with a big hit to their working margins and on the identical time guided for an additional weak second quarter with implied expectations of one other materials hit to margins. And, in so many phrases, that is precisely what occurred with SIG of their newest incomes launch.

And like SIG, regardless of this two destructive datapoints, FOXF’s administration stubbornly select to offer solely very mildly decreased FY steerage that just about didn’t contact their anticipated implied working margins. One other clear similarity, however regretfully I’ve to say that SIG’s case is even a worse, as a result of they select to totally reaffirm FY steerage within the face of a weak reported Q1 and anticipated Q2.

Because the reader can see, this created for FOXF a really comparable sample to the one which I described for Signet, a FY steerage that very closely relied on a a lot improved second half, and one which generated a seasonal construction that had by no means occurred within the public historical past of the corporate.

And when got here time to launch 2nd quarter outcomes, administration was pressured to see the unrealism of their FY steerage, being pressured to chop anticipated FY revenues by 8% and adjusted EPS by 36% with the inventory cratering in a few days by nearly 20%.

If you wish to perceive this case in additional element and evaluate the construction of their steerage with the one offered by SIG, I put two articles (first & second) on the identify. These describe administration’s outlook intimately, disaggregating their conventional operations from the confounding results of a current acquisition and utilizing the identical sort of charts that I used for Signet on this article.

Dangers

Dangers to my thesis relate with the well being of the buyer and the conversion capabilities by Signet, as implied expectations for the 2nd half are for a moderated 3% YoY income contraction in comparison with the 8.6% that’s anticipated for the primary half. This might, opposite to my expectations, be achieved by the mixed results of a full decision of the combination points beforehand described of their digital banners and a robust arrival of the long-awaited restoration within the bridal class.

Conclusion

Funding is a matter of possibilities, and as such, the chance of a downgrade for the second half doesn’t translate right into a sure end result, however I believe there’s ample proof to say that the possibilities are on this facet of the argument.

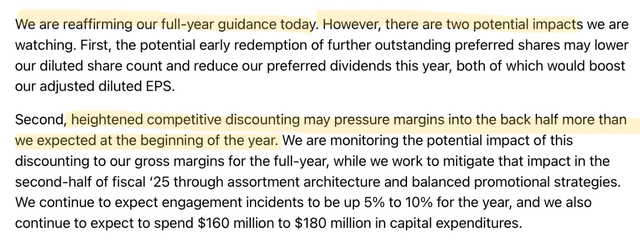

Even when administration reaffirmed their steerage on the final incomes name, they did it with a big caveat.

1Q Fiscal 12 months 2025 Signet incomes name transcript

As I mentioned initially of this text, Signet has been on my watchlist as its undemanding valuation requires very conservative assumptions to underwrite an funding case, so this piece shouldn’t be understood as a repudiation of Signet as a possible mid to long run funding. Quite the opposite, and the case of FOXF that I used earlier is an effective instance of this, as a result of as you noticed within the 2nd article, the truth that I used to be and nonetheless am patiently bullish from a basic perspective, didn’t preclude me from promoting my place earlier than the 2nd quarter earnings launch within the face of the quick danger of a possible steerage minimize.

In the long run, the target of this text is to be informative as all the info that I used for my evaluation is proven within the charts, hyperlinks and tables included right here, and the reader can attain his or her personal conclusion based mostly on the data. Possibly a few of you suppose that the combination points round their digital banners are a ample clarification for the weird sample implied of their steerage, or that the bridal class can expertise a sufficiently massive second half turnaround, and that may find yourself being appropriate.

Other than that, a few of you may need a discovered a distinct potential driver of a much-improved second half that I missed, and if that had been the case, I might welcome it within the feedback part.

As at all times, thanks for studying, at all times carry out your personal due diligence and better of luck together with your investments.

[ad_2]

Source link