[ad_1]

steinphoto

This previous week, I heard an interview with President Trump, throughout which he postulated that “this nation will go right into a despair if she wins the presidency.” So, I simply should current my perspective that I don’t consider this declare to be true. Reasonably, I feel that whomever would be the subsequent resident of the White Home will seemingly preside over the beginning of what could develop into often known as the “Nice-er Melancholy.”

Now, earlier than you begin slinging these arrows, I would like everybody to recollect again in 2016, when the world was so positive that the market was going to crash if Trump was elected. But, on the time, I used to be telling our shoppers that we have been on our technique to 2600+ (we have been at 2100SPX on the time) as we seemed to 2017 “regardless of who was elected.” As we now know, the market even exceeded my goal and topped out in early 2018 within the 2880SPX area, after which started a correction till we dropped right down to the 2300SPX area in late 2018, as per our expectations on the time.

I do know that is going to ruffle some feathers after I say it, however it actually doesn’t matter who the president is with regards to the inventory market. I do know most of you studying this text suppose that is merely preposterous, but the empirical proof helps my proposition.

Furthermore, within the autumn of 2007, when Alan Greenspan, the previous chair of the US Federal Reserve, was requested by a Swiss newspaper which candidate he was supporting within the forthcoming US presidential election, he surprisingly famous that “it hardly makes any distinction who would be the subsequent president. The world is ruled by market forces.”

The truth is, as an increasing number of research are carried out about what drives the inventory market, we’re studying that exogenous elements don’t have the impact upon the market as many consider. Let me provide you with a couple of examples, which you’ve gotten seemingly seen from me earlier than, most of which have been cited in a guide I strongly recommend – The Socionomic Idea of Finance by Robert Prechter.

In a 1988 examine carried out by Cutler, Poterba, and Summers entitled “What Strikes Inventory Costs,” they reviewed inventory market value motion after main financial or different kind of reports (together with main political occasions) as a way to develop a mannequin by which one would be capable to predict market strikes retrospectively. Sure, you heard me proper. They weren’t even on the stage but of growing a potential prediction mannequin.

Nevertheless, the examine concluded that “[m]acroeconomic information . . . explains solely about one fifth of the actions in inventory market costs.” The truth is, they even famous that “most of the largest market actions lately have occurred on days when there have been no main information occasions.” In addition they concluded that “[t]right here is surprisingly small impact [from] huge information [of] political developments… and worldwide occasions.” In addition they recommend that:

“The comparatively small market responses to such information, together with proof that giant market strikes usually happen on days with none identifiable main information releases casts doubt on the view that inventory value actions are totally explicable by information…“

In August 1998, the Atlanta Journal-Structure revealed an article by Tom Walker who carried out his personal examine of 42 years’ price of “shock” information occasions and the inventory market’s corresponding reactions. His conclusion, which can be shocking to most, was that it was exceptionally tough to establish a connection between market buying and selling and dramatic shock information. Primarily based upon Walker’s examine and conclusions, even in the event you had the information beforehand, you’d nonetheless not be capable to decide the route of the market solely primarily based upon such information.

In 2008, one other examine was carried out, wherein they reviewed greater than 90,000 information objects related to tons of of shares over a two-year interval. They concluded that giant actions within the shares have been NOT linked to any information objects:

“Most such jumps weren’t instantly related to any information in any respect, and most information objects didn’t trigger any jumps.”

Now, let me current you a examine which may put all of this into correct context and clarify why exogenous elements should not as crucial as most consider. In a paper entitled “Massive Monetary Crashes,” revealed in 1997 in Physica A., a publication of the European Bodily Society, the authors, inside their conclusions, current a pleasant summation for the general herding phenomena inside monetary markets:

“Inventory markets are fascinating buildings with analogies to what’s arguably essentially the most advanced dynamical system present in pure sciences, i.e., the human thoughts. As a substitute of the same old interpretation of the Environment friendly Market Speculation wherein merchants extract and incorporate consciously (by their motion) all info contained in market costs, we suggest that the market as an entire can exhibit an “emergent” conduct not shared by any of its constituents. In different phrases, we take note of the method of the emergence of clever conduct at a macroscopic scale that people on the microscopic scales don’t know of. This course of has been mentioned in biology as an illustration within the animal populations akin to ant colonies or in reference to the emergence of consciousness.”

Additional research have recognized that we’re actually coping with organic responses that originate in essentially the most primitive phase of the human mind, the limbic area or reptilian/primitive area, which drives the unconscious, non-rational herding we see within the monetary markets.

So, possibly now you can start to know why Alan Greenspan commented as he did. Much more surprisingly, and alongside the strains of our dialogue above, he additionally famous the next:

“I at all times believed in animal spirits. It isn’t their existence that’s new. It is the truth that they don’t seem to be random occasions, however really replicate in-bred qualities of human nature which create these animal spirits.”

I need to now introduce the work of Ralph Nelson Elliott, who recognized that these unconscious, non-rational reactions within the finance markets really observe a repeating fractal sample, which suggests they transfer in variably self-similar patterns. This repeating fractal represents general societal sentiment, which is ruled by the pure regulation of the universe as represented by Fibonacci Arithmetic.

To be clear, it’s not the patterns that drive society, however reasonably the social temper of society en masse is displayed by these fractal patterns we see out there.

As Elliott famous:

“Very in depth analysis in reference to… human actions signifies that virtually all developments which outcome from our social-economic processes observe a regulation that causes them to repeat themselves in related and consistently recurring sequence of waves or impulses of particular quantity and sample.”

He additional acknowledged:

“The causes of those cyclical modifications appear clearly to have their origin within the immutable pure regulation that governs all issues, together with the assorted moods of human conduct. Causes, due to this fact, are inclined to develop into comparatively unimportant within the long-term progress of the cycle. This basic regulation can’t be subverted or put aside by statutes or restrictions. Present information and political developments are of solely incidental significance, quickly forgotten; their presumed affect on market traits is just not as weighty as is usually believed.”

Furthermore, when Elliott tied these actions to Fibonacci ratios, he famous:

“These [Fibonacci] ratios and sequence have been controlling and restricted the extent and period of value traits, no matter wars, politics, manufacturing indices, the availability of cash, normal buying energy, and different usually accepted strategies of figuring out inventory values.”

Most particularly, Elliott theorized that public sentiment and mass psychology transfer in 5 waves inside a major pattern, and three waves inside a counter-trend. As soon as a 5 wave transfer in public sentiment has accomplished, then it is time for the unconscious sentiment of the general public to shift in the wrong way, which is solely the pure cycle inside the human psyche, and never the operative impact of some type of “information.”

Now, with all that being stated, possibly now you can perceive why I acknowledged at the beginning that it actually makes no distinction to the inventory market who wins in November. Reasonably, evidently the market is finishing a really massive multi-decade bull market, and can quickly be transitioning into a really long-term bear market.

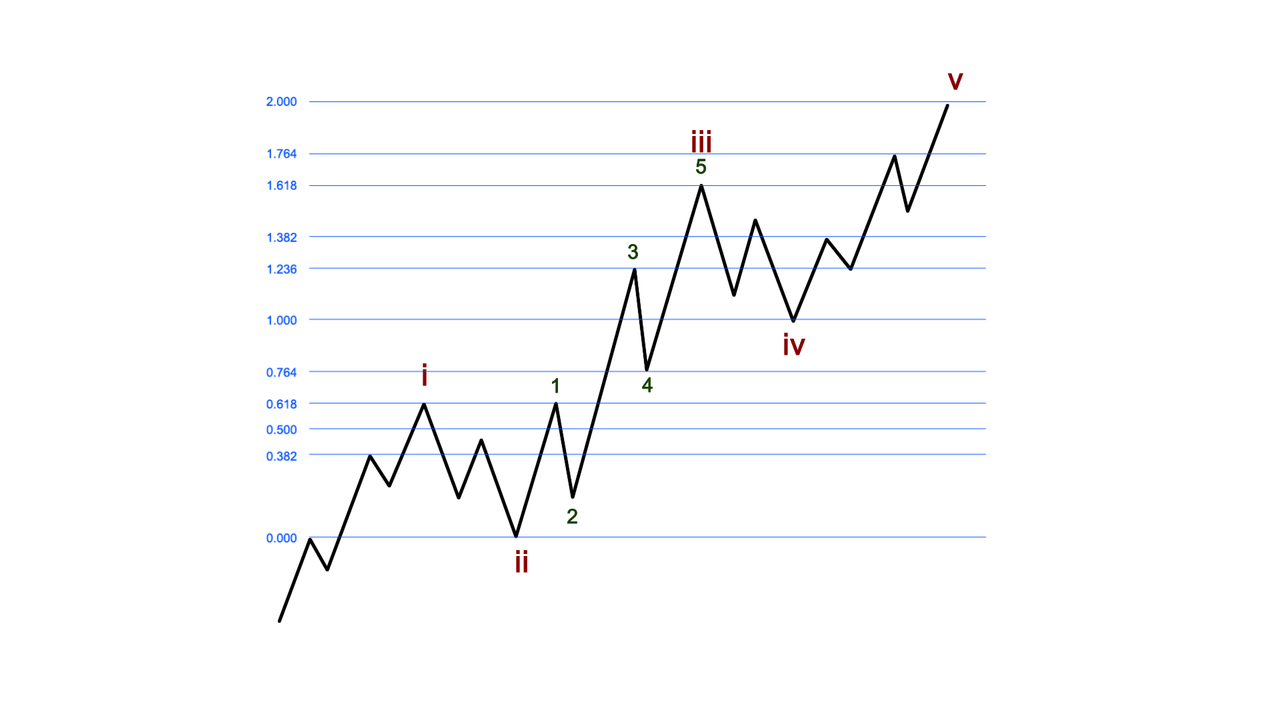

You possibly can see an instance of a regular Elliott Wave fractal sample on this chart under.

Elliottwavetrader.web

Take notice that waves 1, 3 and 5 transfer within the route of the final pattern, and waves 2 and 4 are counter-trend strikes. Furthermore, take notice that waves 1, 3 and 5 additional break down into 5-wave buildings, whereas the corrective, counter-trend strikes of waves 2 and 4 break down into 3-wave buildings.

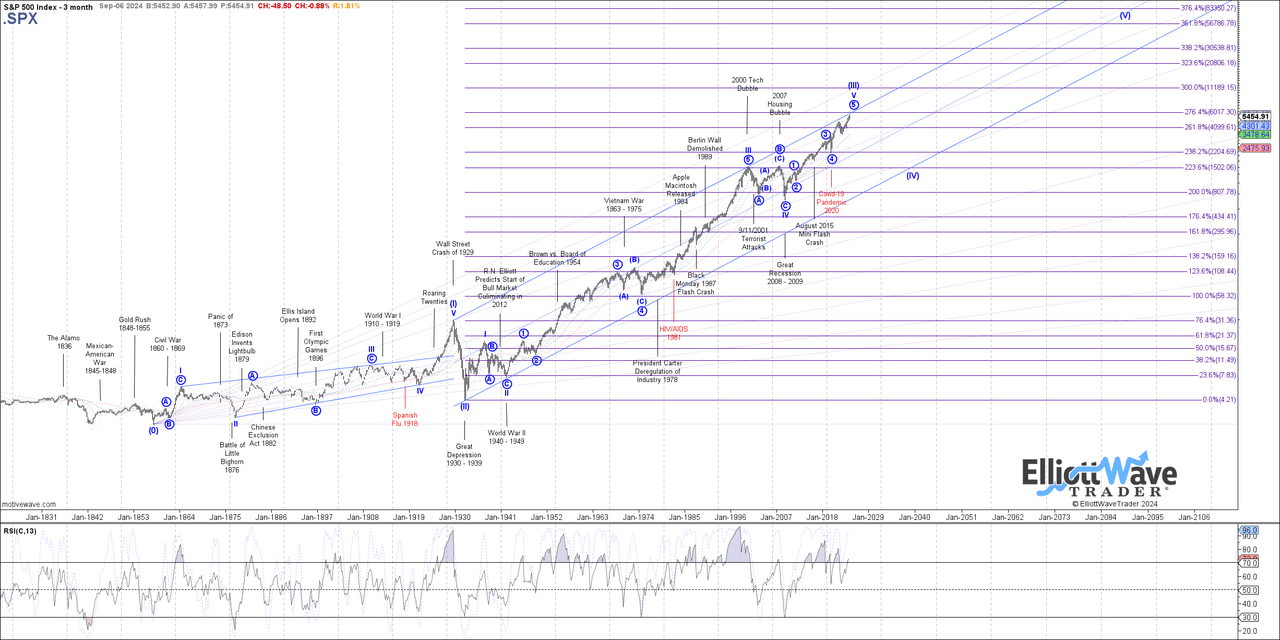

The rally I am monitoring as nearing completion is one which started on the lows struck after the 1929 inventory market crash. That was the bigger diploma 2nd wave low, which, when struck, noticed the market flip up within the begin of a multi-decade bull market representing a third wave, which is what I’m seeing nearing completion.

You possibly can see the larger image on this chart, which was put collectively by Garrett Patten at Elliottwavetrader.web.

Elliottwavetrader.web

Since I used to be educated as a CPA and tax lawyer, that implies that certainly one of my skills consists of the power to depend to five. Subsequently, I do know fairly effectively what comes after we full this third wave. Sure, my mates, that is the explanation I’m anticipating a big 4th wave counter-trend correction inside the bigger cycle.

I cannot bore you with the numerous technical causes we view the 4th wave construction and decline as we’ve got offered on the 100-year chart above, however we count on it to take between 13-21 years, and doubtlessly take the S&P 500 again right down to the 1000 area if we see it develop to its customary maturity. And, in contrast to the 1929 correction, it won’t seemingly be a straight line, single crash-like transfer down over a comparatively quick time frame. Reasonably, it should take a for much longer time frame, and see many smaller “crashes” together with many multi-year corrective rallies in between the smaller crashes, fairly much like a number of durations akin to that seen throughout 2000-2009.

So, sure, girls and gents, this may be the longest correction we’ve got seen within the inventory market in additional than 100 years. And that is why I feel we could hear this referred to as the “Nice-er Melancholy” by the point it reaches its conclusion.

And, as I began this text, this won’t be primarily based upon who can be shifting into the White Home in January 2025.

For individuals who doubt our potential to establish these bigger diploma strikes within the inventory market, enable me to offer you only a few examples of our previous bigger diploma evaluation. As there are a lot of to select from, I am posting those cited by our shoppers as a few of our most astounding multi-year market calls throughout many markets:

July 2011: Referred to as for a rally in DXY from 73 with a goal of 103.53 whereas the Fed was pumping QE into the market and everybody was anticipating a greenback crash. The market rallied initially to a excessive of 103.82 earlier than a multi-year pullback, as we anticipated. August 2011: Referred to as for a serious prime to the gold market at $1,916 whereas gold was nonetheless inside its parabolic rally that summer season. We additionally famous our draw back expectation of $1,000. As we now know, gold topped inside $6 of our goal, after which dropped to $1,050 on the finish of 2015, the place we informed our shoppers it was time to get again in. December 2015: Referred to as for a market prime within the 2100SPX area, to be adopted by a pullback towards 1800, and adopted by a “world melt-up” to a minimum of 2600SPX “regardless of who will get elected” in 2016. The market bottomed at 1810, and commenced a powerful rally to 2872. November/December 2019: Referred to as for a 30% correction to start within the first quarter of 2020 earlier than anybody even heard the phrase “COVID.” We started the “COVID Crash” in February 2020. We have been then on the lookout for a serious market backside at 2200SPX, with an expectation of a rally to a minimum of 4000SPX (with our long-term goal being 5350-6000) – regardless of the world being in financial lockdown on the time. The market bottomed inside 13 factors of our goal and we all know the place we are actually.

And, as I famous above, there are a lot of extra such examples, however I didn’t need to overwhelm you. Evidently, none of our market calls have been primarily based upon who was operating the nation on the time, nor was it primarily based upon any exogenous elements in any way. Reasonably, they have been primarily based upon the evaluation methodology offered to us by Mr. Elliott, upon which we improved with a extra goal framework we developed referred to as Fibonacci Pinball. On the finish of the day, we’re monitoring societal sentiment using an goal mathematical methodology, which has offered a way more correct method of monitoring monetary markets than any exogenous issue evaluation.

Now, I do know a few of you should still have questions on how these exogenous elements “appear” to be driving the market at occasions. Nicely, we view these elements as merely potential catalysts to the strikes which might be pushed by sentiment, however the substance of those catalysts is just not determinative of the route of the market transfer. Now, if you wish to query whether or not they’re the precise trigger reasonably than a catalyst, take into account what number of occasions you’ve gotten seen the market transfer within the actual reverse method you’d have anticipated primarily based upon some exogenous elements akin to earnings, financial information, the Fed, geopolitical information, and so forth.

Let me provide you with two pretty current examples.

In October 2022, the market was awaiting the announcement of a CPI report, which everybody believed was going to drive the subsequent 5%+ transfer out there. After all, if it got here in worse than anticipated, everybody was sure it could drive the market 5%+ decrease. Our evaluation advised on the time that we have been putting at backside at 3500SPX, with an expectation for a rally to a minimum of the 4350+ area “it doesn’t matter what the report stated.” Nicely, everyone knows the report got here in worse than anticipated, and triggered a 6% rally that day alone off the intraday low, which additionally kicked off the multi-year rally we nonetheless discover ourselves having fun with.

One other instance was when Russia invaded Ukraine on Feb. 24, 2022. Whereas most have been anticipating the market to crash upon this information, we have been anticipating the market to backside. And, in the event you have a look at a chart, you will notice the market struck a near-term backside on that actual day, and commenced a 13% counter-trend rally.

Once more, I can present many extra examples by historical past, however I feel these must be enough to stipulate my level.

On the finish of the day, I consider that whoever is heading america over the approaching years will seemingly be seen as an ineffective president since they are going to be preventing the general social sentiment which can seemingly flip fairly detrimental, and can seemingly trigger a powerful downturn which can start a multi-year, and doubtlessly multi-decade, bear market.

Word: This text was initially revealed on Sept. 6.

Housekeeping Issues

When you intend on commenting on this text, please don’t present any political commentary, because it won’t be revealed.

If you need notifications as to when my new articles are revealed, please hit the button on the backside of the web page to “Comply with” me.

For individuals who are questioning why all feedback (together with mine) undergo moderation, you may learn right here: Haters Are Gonna Hate – Till They Study.

[ad_2]

Source link