[ad_1]

Tom Penpark/DigitalVision by way of Getty Photographs

Scottish Mortgage (STMZF) is up 76% over the previous 5 years. But it surely stays 41% under its 2021 peak. That’s not a shock to me: the belief has fallen 35% since my 2021 “promote” piece Scottish Mortgage Funding Belief: Tech Hassle Forward.

Partly that displays falls in costs of key holdings resembling Tesla (TSLA). However I believe the belief’s funding technique continues to bode nicely for its future efficiency.

Extra lately, although, I final lined the belief in my March “purchase” observe Scottish Mortgage: Nonetheless Low-cost, However A Shift In Gear, since when the shares have moved up 10% – a formidable return on that timeframe, in my opinion. I keep my “purchase” ranking.

Since my final piece, the belief has launched its annual report.

Portfolio Continues to Look Engaging

A part of the bear case since 2021 was the corporate’s heavy give attention to tech names, then declining.

Tesla stays a prime 10 holding and is down 29% over a 12 months. However take a look at the remainder of the highest 10, which account in whole for 55.8% of Scottish Mortgage’s portfolio:

% of SMT portfolio

1-year share worth change

NVIDIA (NVDA)

8%

+154%

ASML (ASML)

7.6%

+46%

Moderna (MRNA)

5.9%

+19%

Amazon (AMZN)

5.4%

+49%

MercadoLibre (MELI)

4.8%

+28%

SpaceX

4.2%

unlisted

PDD (PDD) (Pinduoduo)

3.7%

+97%

Tesla

3.3%

-29%

Ferrari (RACE)

3.2%

+42%

Northvolt

2.7%

unlisted

Click on to enlarge

Chart calculated and compiled by creator utilizing information from SMT web site and pricing information

There’s a survivorship bias right here: as shares like NVIDIA have soared, their relative function within the portfolio has elevated by advantage of that. The desk exhibits one-year returns, however these could be completely different to the return for Scottish Mortgage, relying on what its holding interval to this point has been.

Nonetheless, the general image right here couldn’t be clearer. Because it has prior to now, Scottish Mortgage has continued to remain forward of the curve on the subject of figuring out compelling progress alternatives.

Why I Imagine it Can Maintain Going

That helps present {that a} change of administration has not meant the tip of the belief’s glory years, for now a minimum of.

But it surely additionally issues what’s coming down the road, because the belief continues to maintain its portfolio up to date.

Because the belief says in explaining its funding philosophy, it goals to search out outliers. “The core of what we do is attempt to establish these huge drivers of change and exploit these alternatives… Solely a small variety of corporations matter, what we intention to do is locate the few that generate these excessive returns.”

Present efficiency means that it continues to execute that method efficiently.

Dividend Appears to be like Set to Maintain Rising

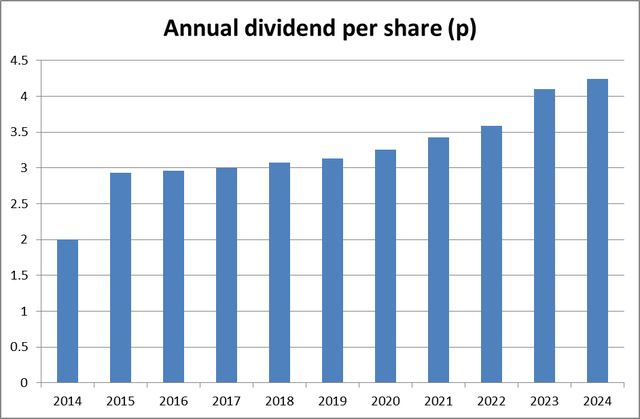

The corporate maintained its dividend aristocrat standing, notching up the forty first annual improve in its dividend final 12 months (it’s not been reduce in near a century at this level).

That improve within the annual dividend was 3.4%, to 4.240 per share. In most years, the belief has been modest in elevating the payout, nevertheless it has added up and the dividend per share has greater than doubled in 11 years.

Chart compiled by creator utilizing information from firm annual studies (monetary 12 months not calendar 12 months)

I anticipate the belief to proceed elevating the dividend yearly. It explicitly recognises the significance of the dividend to a few of its investor base and the fee is reasonably priced. Final 12 months’s dividend value the belief £58m, towards a pre-tax web return of £1.4bn.

Regardless of that, the share worth has risen over the long run, not simply the dividend, so the present yield is a paltry 0.5%. The dividend consistency attracts me, however I believe the funding case right here is primarily across the share’s progress not earnings prospects.

Why I believe The Valuation Nonetheless has Upside

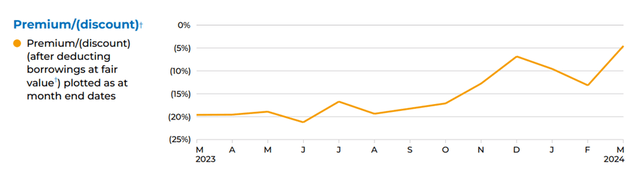

A few of the 30% worth enchancment over the previous 12 months merely displays the closing of the low cost hole.

Firm annual report

It nonetheless trades at a 9% low cost to web asset worth. I see that as a very good alternative, though the web asset worth does replicate a portfolio that features some illiquid holdings and not using a broad market valuation.

However I believe that worth improve largely displays the truth that the belief’s portfolio is performing nicely, reflecting the continued success of its funding technique. There may be an ongoing danger of tech focus: if ASML and NVIDIA slide, for instance, so too might Scottish Mortgage.

On stability, although, I proceed to see upside to the shares not simply due to the low cost to web asset worth, however the long-term potential of its chosen portfolio of dozens of promising corporations in tech and certainly different elements of the economic system.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.

[ad_2]

Source link