[ad_1]

Андрей Клеменков/iStock through Getty Photos

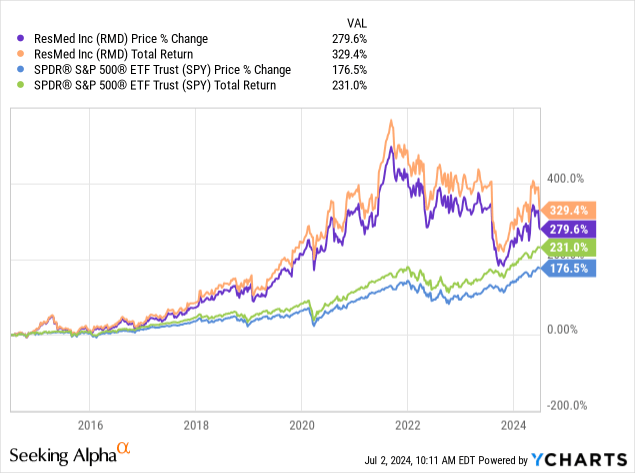

That is my first time protecting ResMed (NYSE:RMD), and I’m allocating a Purchase score to the inventory as a result of I presently contemplate it to be doubtlessly undervalued based mostly on the long-term outlook the firm is going through. I count on the funding to ship a excessive degree of short-term to medium-term alpha, and I forecast that it’ll beat the market over the subsequent 10 years. Whereas the corporate has confronted short-term progress price contractions, largely a results of provide chain disruptions and macroeconomic slowdowns, this has triggered market pessimism and opened up a chance the place the inventory is presently buying and selling 36.4% beneath its excessive after a 277.7% acquire in 10 years.

Operational Evaluation

ResMed is a world chief in digital well being and linked medical gadgets, specializing in sleep apnea and respiratory care options. The corporate holds roughly 55-62% of the market share in obstructive sleep apnea (‘OSA’) remedy. The corporate’s portfolio of merchandise contains CPAP machines, masks, ventilators, and diagnostic gadgets—for instance, the AirSense and AirCurve sequence for sleep apnea remedy. The corporate operates in over 140 international locations; roughly 60% of its income comes from america, and 40% comes from the remainder of the world.

ResMed’s USP is in its built-in method to sleep and respiratory care, the place it combines revolutionary {hardware} with superior software program. Administration has developed an ecosystem that improves affected person outcomes, enhances healthcare supplier effectivity, and generates priceless information insights. The corporate has over 9,500 issued or pending patents and designs. As well as, administration has established its popularity effectively in key markets, largely a results of the constructive suggestions it will get from prospects about its merchandise.

Trustpilot

There are an estimated 936 million adults worldwide who’ve obstructive sleep apnea. In america alone, over 30 million persons are believed to have sleep apnea, however roughly solely 6 million have been recognized. As well as, roughly 80-90% of OSA instances stay undiagnosed globally. One other supply suggests over 50 million individuals have OSA in america, however solely 15% use CPAP gadgets, which might imply there’s a potential market of roughly 40 million untreated sufferers. All of those components recommend an unlimited untapped marketplace for ResMed to proceed to broaden into, particularly because it already has the market lead. Untreated OSA was estimated to price $149.6 billion in america alone in 2015—by treating OSA early and with correct expertise, corresponding to that supplied by ResMed, there’s more likely to be a discount in whole healthcare utilization and prices.

In my view, given the info and ResMed’s market place, that is more likely to be a really robust long-term funding. Moreover, I feel additionally it is undervalued at present value, opening up the chance for important near-term value returns even when the medium time period to long-term future is met with slower traction towards world enlargement, consciousness, and adoption of superior sleep apnea options.

Monetary & Valuation Evaluation

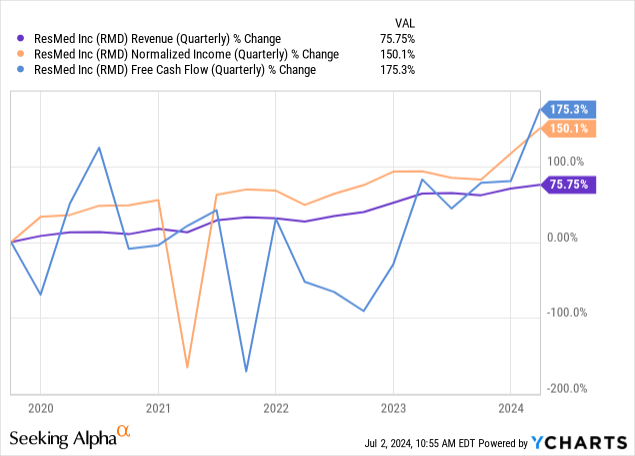

Buyers grew involved concerning the firm’s free money circulation and normalized earnings in 2021. There was a big surge in demand for ventilators in fiscal 2020 as a result of COVID-19 pandemic, however because the pandemic-related demand normalized in 2021, the absence of those extraordinary gross sales impacted the agency financially. Administration additionally considerably elevated its manufacturing capability over the interval, which elevated its working bills and contributed to the short-term contraction in free money circulation. In 2022, which was a interval of considerably excessive capex for ResMed, the corporate opened a brand new manufacturing hub in Singapore, dedicated €30 million to a brand new expertise R&D facility in Eire, and bought MEDIFOX DAN to broaden its SaaS choices and presence in Europe. This led to a internet capex of $134.8 million in 2022 versus $102.7 million in 2021 and $119.7 million in 2023.

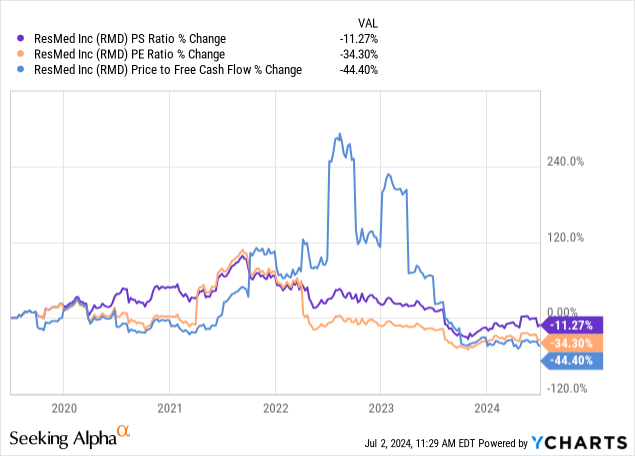

Nonetheless, these momentary contractions don’t point out any areas of serious long-term weak point, though Wall Avenue analysts expect the corporate’s progress to be extra reasonable shifting ahead in comparison with traditionally. The corporate has reported a 5Y common for diluted EPS progress of 23.28%, however the ahead estimate for normalized EPS is nineteen.82% for fiscal interval 2024, 11.57% for 2025, and 10.56% for 2026. Due to this fact, buyers could be clever to query whether or not the latest contraction within the firm’s value and valuation ratios is a results of dampened sentiment for the inventory on account of decrease future progress expectations.

In my view, some contraction within the value and valuation multiples has been warranted over the previous three years, however I consider the sell-off has been too extreme. As well as, I feel the current warning surrounding the subsequent few years’ outcomes will enhance if the corporate can elevate consciousness about OSA and faucet into the big parts of the market nonetheless not but penetrated. As a long-term investor who prefers to hunt alternatives that would outperform over 10+ years, I consider ResMed is a priceless candidate as a result of the long run progress trajectory stays intact, and the corporate is main in its discipline. Moreover, its operational resilience will likely be supported by its robust steadiness sheet, the place it has an equity-to-asset ratio of 0.68 and a debt-to-equity ratio, together with lease obligations, of simply 0.25. It will assist its capacity to amass different smaller and rising opponents and to solidify its moat.

ResMed inventory is buying and selling at a -31.65% low cost from its 5Y common in FWD P/E GAAP. It is usually promoting at a -27.29% low cost from its 5Y common in FWD P/S. If the corporate manages 15% annual diluted EPS progress over the subsequent 5 years, this can be a 35.58% discount from its 5Y common for YoY diluted EPS progress. Moreover, it’s cheap to imagine its income grows at 9% yearly over the subsequent 5 years, which is a 29.58% discount from its 5Y common for YoY income progress.

Nonetheless, I feel we’re more likely to see cyclicity from ResMed, which has been evidenced traditionally with intervals of excessive progress and intervals of low progress and even contraction. There are additionally more likely to be wider macroeconomic components that elevate consciousness about OSA options, driving prospects to ResMed, particularly if the difficulty of OSA inside america and different key markets intensifies, inflicting financial headwinds in federal, state, and worldwide governmental budgets.

I feel it’s cheap to count on the corporate to take care of a P/E ratio of round 25 on common over the subsequent 10 years as a base case. As well as, I feel 12.5% annual EPS progress is probably going over the subsequent decade. Consequently, my value goal for RMD inventory in 2034 is $529.25, contemplating the inventory value is presently $189.10 and fundamental EPS is $6.52. The implied CAGR of this over 10 years is 10.9%. Provided that there could also be bursts of traction in ResMed’s core market, the EPS annual progress price might hypothetically broaden to fifteen% over the subsequent decade, and the P/E ratio might rise to 30 on common. If this occurs, the inventory value could be $791.70, and the CAGR 15.2%. Alternatively, a decrease 10% EPS annual progress over the interval and a P/E ratio of 20 would lead to a inventory value of $338.20 and a CAGR of 5.9%. I feel the preliminary base case, with an implied 10.9% CAGR over the subsequent 10 years, is almost certainly, however the potential for outsized returns is extra probably than decreased sentiment and demand associated to OSA, inflicting contraction in ResMed’s elementary efficiency. Due to this fact, I count on the inventory to at the least meet my anticipated S&P 500 value CAGR of 10% over the subsequent 10 years, with the potential for ResMed to ship excessive outperformance based mostly on potential traction gained within the OSA options market in america and internationally. Due to this fact, my score is a Purchase reasonably than a Maintain.

Danger Evaluation

ResMed operates in a extremely aggressive market:

Philips Respironics is re-entering the market after a big recall in 2021 as a result of points with sound-insulating foam of their CPAP and BiPAP gadgets, which might degrade and penetrate the consumer’s airway. Its re-emergence within the discipline might erode ResMed’s market share. Fisher & Paykel Healthcare (OTCPK:FSPKF) is one other main competitor within the sleep apnea gadget market that has a presence in over 120 international locations. It has developed a popularity for innovation and high quality. Different opponents embrace Hillrom, DeVilbiss, and Apex Medical.

In my view, the re-emergence of Philips is more likely to be the very best menace to ResMed, though there are near-term inhibitions on Philips competing successfully, together with authorized challenges corresponding to class-action lawsuits to beat. Nonetheless, ResMed, with practically 60% market share by some estimates, is unlikely to be considerably detracted from over the long run if it maintains its focus with diligence.

As well as, new applied sciences, together with GLP-1 agonists used for weight reduction, have the potential to cut back the prevalence of sleep apnea by decreasing weight reduction. Weight problems is among the root causes of sleep apnea, and this modification might lower the demand for conventional CPAP gadgets. Moreover, present well being tendencies which can be gaining popularity with youthful generations might acquire extra traction and result in decreased world weight problems over the long run, contracting the entire addressable marketplace for ResMed. A 2018 examine by the Worldwide Meals Info Council reported that 80% of millennials contemplate well being advantages when selecting meals, in comparison with 64% of child boomers.

There are additionally low analysis charges for sleep apnea. Whereas the numerous portion of the worldwide inhabitants that continues to be undiagnosed is a possible alternative for ResMed, the problem lies in constructing consciousness and motivating analysis at scale. That is troublesome if many individuals reside with sleep apnea however don’t thoughts the uncomfortable side effects in lots of instances. Loud night breathing, daytime fatigue and additional signs of sleep apnea could also be attributed to different components or thought of regular. There are additionally price issues, and plenty of customers are more likely to really feel uneasy about utilizing gadgets over their face until signs are extreme. As such, I feel there are more likely to be challenges sooner or later for ResMed tapping into the huge market, and the TAM is likely to be smaller than administration presently presents as soon as the nuanced realities of public notion are clearer.

Conclusion

ResMed might presently be undervalued, relying on how the market reacts to the inventory over the subsequent 10 years and the basic progress charges that administration achieves. Nonetheless, there’s some uncertainty about how massive the TAM for ResMed actually is as a result of lots of potential prospects are unlikely to wish to search remedy. As well as, new well being tendencies and anti-obesity applied sciences are an actual menace. In my view, ResMed is more likely to at the least carry out in addition to the S&P 500 over the subsequent decade, however the potential for outsized returns is critical if sleep apnea turns into extra widely known and technological options are sought extra readily. This might broaden ResMed’s elementary progress and result in a a number of enlargement over the interval on common, permitting for a possible 15%+ value return CAGR.

[ad_2]

Source link