[ad_1]

Rental progress slows as market stabilises | Australian Dealer Information

Information

Rental progress slows as market stabilises

Submit-pandemic surge begins to wane

Australia’s once-explosive rental progress is lastly displaying indicators of easing, with new knowledge revealing that capital cities have reached their peak progress charges and at the moment are decelerating, in keeping with Area’s newest Hire Report for the September Quarter 2024.

Rental progress peaks throughout capital cities

After enduring one of many longest durations of rental value will increase, all main Australian cities at the moment are experiencing a pointy slowdown.

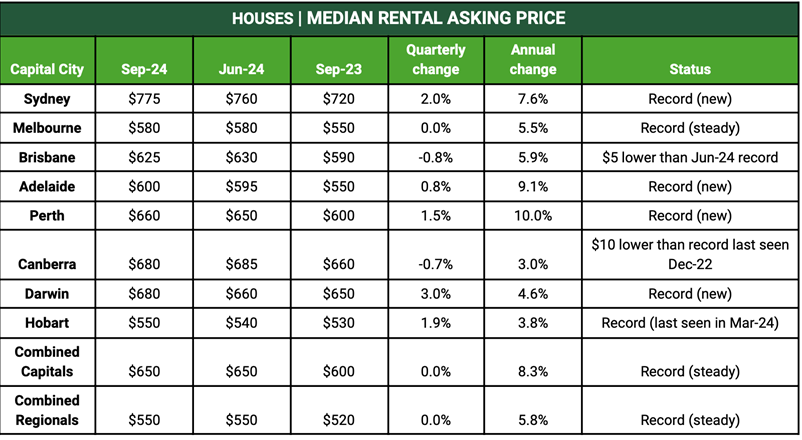

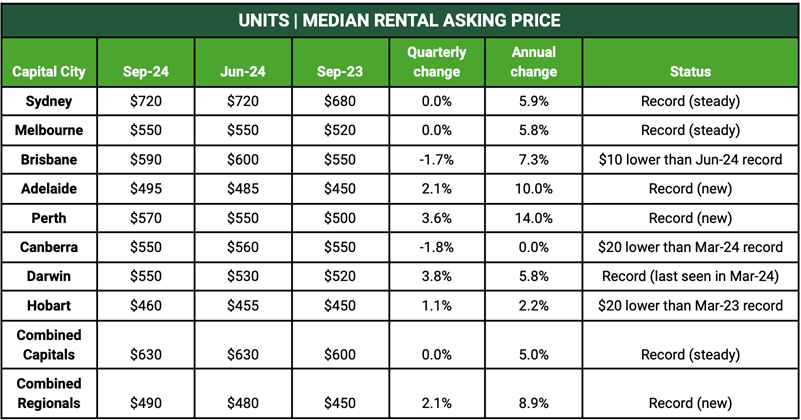

Quarterly rental progress for each homes and models has stalled for the primary time in 9 months, marking the weakest September quarter for homes since 2019 and for models since 2020.

“All capital cities have handed their peak in progress charges and at the moment are decelerating quickly, with some cities already in decline,” stated Nicola Powell (pictured above), Area’s chief of analysis and economics.

Combined traits in metropolis efficiency

When it comes to city-by-city efficiency, Brisbane skilled its first rental value decline for homes in over 4 years, whereas Melbourne noticed a stabilisation of home rents after a nine-month interval of fluctuations. Then again, Sydney, Adelaide, and Perth recorded modest progress.

For models, Brisbane and Canberra noticed declines, whereas Sydney and Melbourne remained steady after extended will increase, with smaller cities like Hobart and Darwin registering progress, Area reported.

Annual positive aspects present indicators of weak spot

Annual hire will increase have additionally hit multi-year lows, notably in cities like Brisbane and Adelaide, the place progress has slowed to its lowest level in 3.5 years.

Sydney and Melbourne have additionally seen deceleration, with annual positive aspects now at their weakest since 2021.

Nevertheless, beforehand weaker markets like Hobart and Darwin are displaying some slight acceleration in yearly progress, Area reported.

Affordability pressures pressure market shift

Regardless of the easing rental progress, rents stay at record-high ranges in lots of cities, with tenants nonetheless struggling to maintain up with prices.

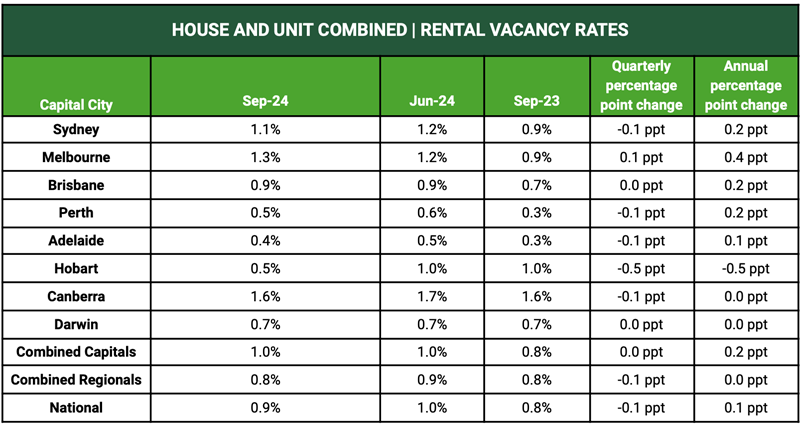

Rental emptiness charges throughout the capital cities are uniformly under 2%, retaining the market firmly in favor of landlords.

The affordability disaster, pushed by hire will increase far outpacing wage progress, is now enjoying a serious position in slowing down additional progress.

“Affordability is a big issue contributing to this slowdown and can possible proceed to limit additional progress,” Powell stated.

Provide and demand realignment

A number of components are contributing to the cooling market, together with a decline in rental demand as extra tenants share properties or go for multi-generational dwelling. Moreover, web abroad migration has dropped by 19% since March 2023, easing demand-side pressures.

On the provision facet, investor exercise is rising, with buyers accounting for 38% of latest residence loans, which has helped enhance obtainable rental inventory.

Outlook for the Rental Market

As Australia’s rental market transitions from its post-pandemic surge, tenants can anticipate some reduction, though affordability challenges stay.

With hire progress decelerating and emptiness charges slowly rising, the market is starting to steadiness, providing cautious optimism for renters within the coming months.

Get the most popular and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE every day e-newsletter.

Associated Tales

Sustain with the newest information and occasions

Be a part of our mailing listing, it’s free!

[ad_2]

Source link