[ad_1]

ArtistGNDphotography

The clear vitality sector has grow to be one of many extra compelling funding choices for numerous causes. Agree with it or don’t agree with it, the deal with world warming and inexperienced vitality transition gained’t go away. And there’s cash to be made in that. That’s why the First Belief NASDAQ® Clear Edge® Inexperienced Vitality Index Fund ETF (NASDAQ:QCLN) is price a glance. This fund supplies traders with a diversified portfolio of the inexperienced vitality business’s foremost gamers. The fund does this by investing in a variety of various firms which might be on the forefront of the transition into clear vitality.

QCLN is designed to trace the efficiency of the NASDAQ® Clear Edge® Inexperienced Vitality Index, which is made up of a broad vary of firms on small-, mid-, and large-cap US shares which might be concerned in clear vitality sub-sectors. These sub-sectors vary from superior supplies, vitality intelligence, renewable electrical energy technology, renewable fuels, and vitality storage and conversion.

A Look At The Holdings

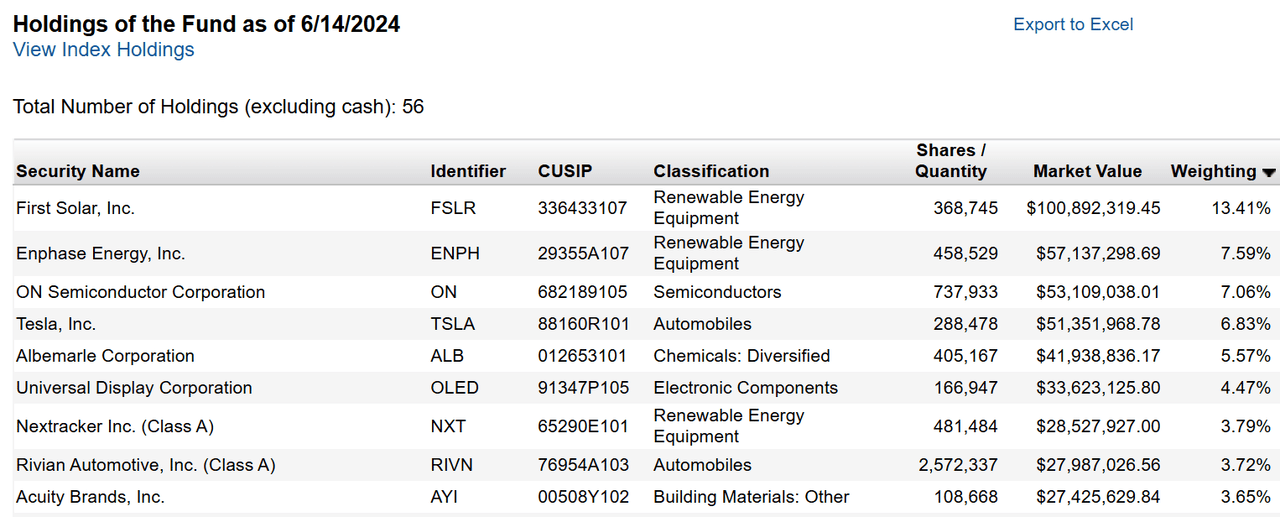

The portfolio is evenly diversified amongst development and worth shares. Having stated that, it’s concentrated, with the biggest place, First Photo voltaic (FSLR), making up 13.41% of the fund.

ftportfolios.com

So what are these firms? First Photo voltaic is a producer of photo voltaic modules and supplier of utility-scale photovoltaic (PV) energy crops. Its thin-film PV modules are acknowledged internationally for his or her high quality by the photo voltaic vitality business, making First Photo voltaic the world’s largest producer of thin-film photo voltaic modules and third-largest producer of PV modules total. Enphase Vitality, Inc (ENPH), alternatively, designs, develops, and sells software-driven vitality options for the house, together with photo voltaic microinverters, battery storage, and vitality administration know-how. What about ON Semiconductor? It’s a number one provider of semiconductor parts. As we are able to see from simply the highest 3 holdings right here, it’s an attention-grabbing mixture of firms that monitor the inexperienced vitality theme.

Having stated that – QCLN is top-heavy. The highest 5 positions make up over 40% of the fund. One thing to remember when you consider total danger mitigation.

Sector Composition and Weightings

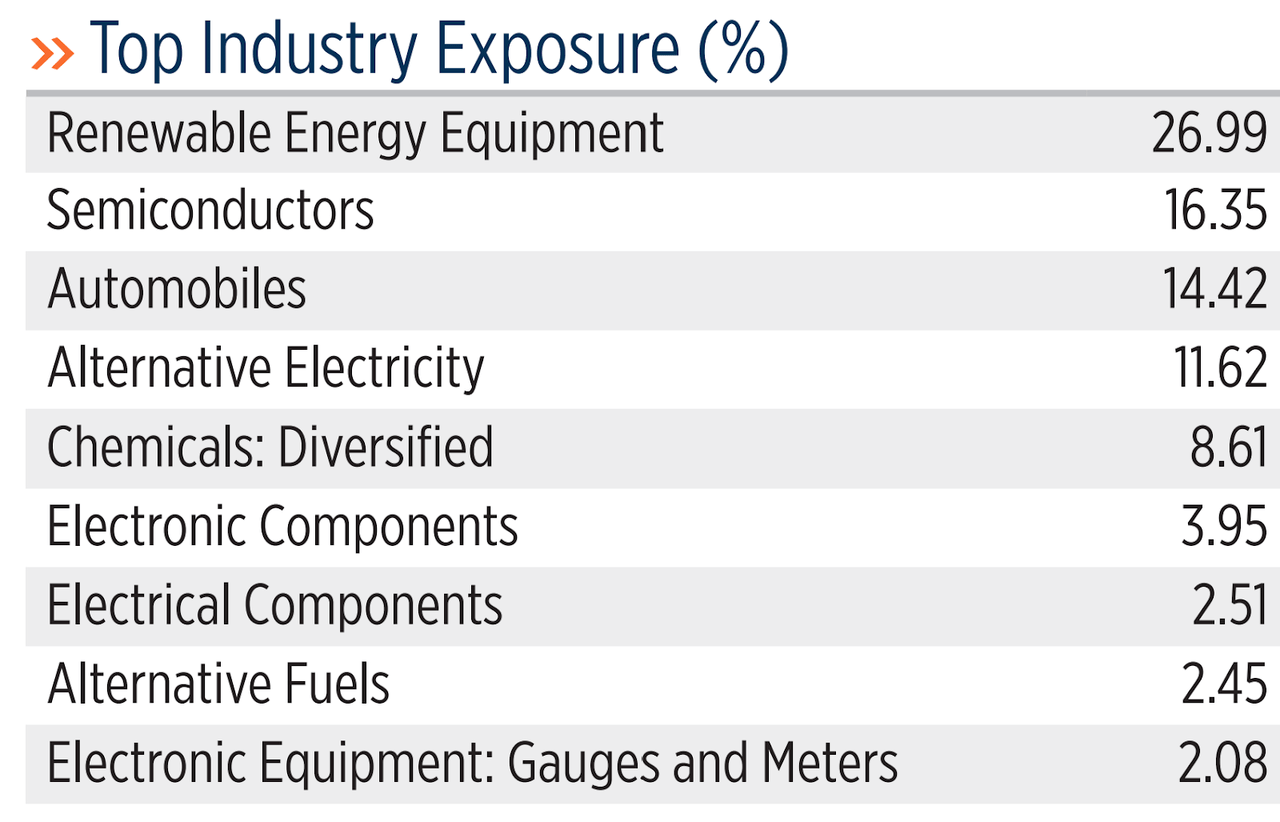

QCLN is diversified amongst completely different sectors inside clear vitality.

ftportfolios.com

Renewable Vitality Gear on the prime embody firms that make, design, distribute and set up renewable vitality applied sciences (e.g., photo voltaic photovoltaics, wind generators, geothermal methods). As to Semiconductors, these firms on this business present energy administration options, microcontrollers and different semiconductors driving the scalability of fresh vitality applied sciences. And don’t neglect about vehicles, that are more and more shifting in direction of being electrical and being drivers (pun supposed) of battery applied sciences.

Peer Comparability

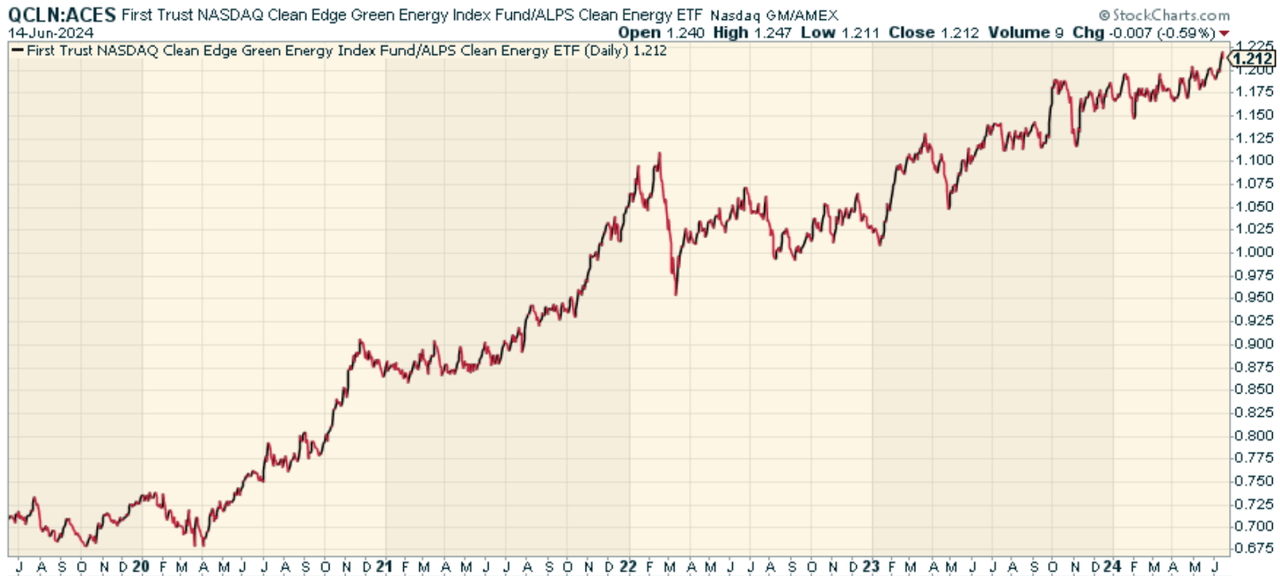

One fund price evaluating towards is the ALPS Clear Vitality ETF (ACES). This fund additionally invests in firms concerned within the manufacturing, distribution and facilitation of fresh vitality all over the world, however its focus is on US and Canadian firms. After we have a look at the worth ratio of QCLN or ACES, we discover that QCLN has completed miles higher, which suggests the composition of QCLN is considerably extra momentum pushed.

stockcharts.com

Execs and Cons

The positives right here? The worldwide shift away from fossil fuels and in direction of clear vitality is a long-term secular pressure, pushed by the surroundings motion, clever authorities regulation, and sustainable know-how that appears poised to propel persevering with development within the clear vitality sphere. QCLN supplies broad business publicity to this in a easy approach.

The draw back? Authorities insurance policies, subsidies and rules play vital roles in figuring out the industrial viability of fresh vitality companies and actions. Any adjustment to those insurance policies and guidelines could have an opposed, materials influence on the profitability and development prospects of those shares. As well as, the clear vitality sector extra typically is susceptible to volatility, which suggests in the event you purchase into the theme, be ready for loads of ups and downs.

Conclusion

I consider that the First Belief NASDAQ® Clear Edge® Inexperienced Vitality Index Fund affords traders robust worth. The fund supplies broad-based and concentrated publicity to revolutionary firms within the different vitality area which might be poised to play an important function in trendy vitality options and home energy technology within the U.S. and all over the world. I believe total it’s constructed properly, and value contemplating.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you bored with being a passive investor and able to take management of your monetary future? Introducing The Lead-Lag Report, an award-winning analysis instrument designed to offer you a aggressive edge.

The Lead-Lag Report is your every day supply for figuring out danger triggers, uncovering excessive yield concepts, and gaining priceless macro observations. Keep forward of the sport with essential insights into leaders, laggards, and the whole lot in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report in the present day.

Click on right here to realize entry and take a look at the Lead-Lag Report FREE for 14 days.

[ad_2]

Source link