[ad_1]

miniseries/E+ by way of Getty Pictures

Let’s face it – put promoting would not have the perfect fame publicly amongst buyers. Between excessive profile blow-ups and people who argue the rewards do not pay for the dangers, it isn’t a preferred technique to put in writing or discuss.

Nevertheless, in our view, promoting put choices on high-quality shares is likely one of the greatest methods round. Whenever you promote a put possibility, you acquire a strong yield in your capital within the type of a money premium to your funding account.

Then, if the underlying inventory dips, it’s important to be prepared to purchase shares at a reduction to the place the market was while you offered them. In any other case, you retain the money free and clear.

If the underlying inventory is top quality, then it is exhausting to see promoting put choices as something aside from a win-win proposition.

The one actual draw back of promoting put choices is that it caps your returns by crystalizing potential appreciation into a direct money fee.

For top-growth shares, this generally is a difficult proposition. Nevertheless, for steady, high-quality shares that do not have explosive upside potential, this generally is a characteristic, not a bug.

On this article, we’re masking Procter & Gamble (NYSE:PG), the patron staples big.

Whereas the inventory is richly valued and the dividend payouts are fairly low, the corporate’s traces of enterprise are nicely protected towards financial cycles and different macro dangers.

Thus, you could possibly purchase the inventory, however we expect promoting put choices is one of the best ways to play it. With a completely baked valuation and a ~2.4% distribution, upside for holding PG seems minimal. Conversely, promoting put choices comes with a decrease stage of danger, and yields simply shy of 9% (annualized).

For our cash, this looks as if a greater possibility (no pun supposed).

Immediately, we’ll present you find out how to execute a easy possibility commerce like this to spice up portfolio yield whereas concurrently lowering your total danger.

Sound good? Let’s dive in.

PG’s Financials

Earlier than we clarify the commerce thought in additional element, let’s first check out PG’s financials and valuation to get a greater sense of the place the underlying inventory sits.

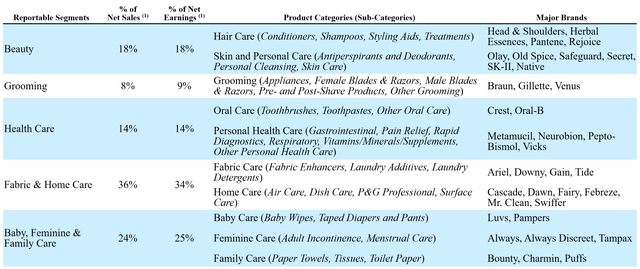

In brief, PG is a ‘SWAN’ – a ‘sleep nicely at night time’ firm. The buyer staples big manufactures a broad vary of fast-moving client items – every part from diapers to laundry detergent:

10K

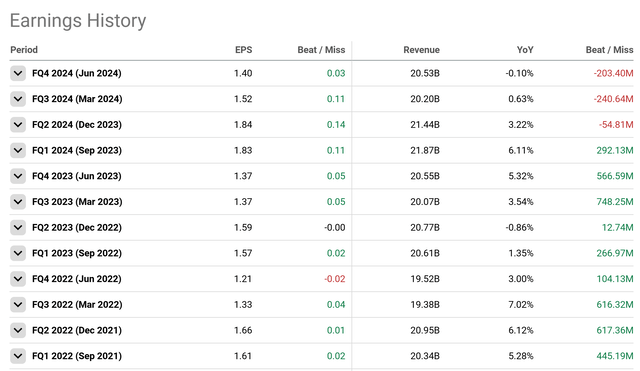

Latest earnings present the corporate’s profile nicely. Monetary outcomes have largely been steady, rising barely over time:

In search of Alpha

As you possibly can see, PG’s EPS has beat constantly over the previous couple of years, even with inflationary pressures, though current client weak point has triggered a number of prime line misses which have held YoY development flat.

All in all, it is largely what you’ll count on from an organization of this measurement and ‘form’.

Given PG’s a number of manufacturers, expansive working community, and large measurement, PG’s monetary outcomes are largely a results of world macro forces.

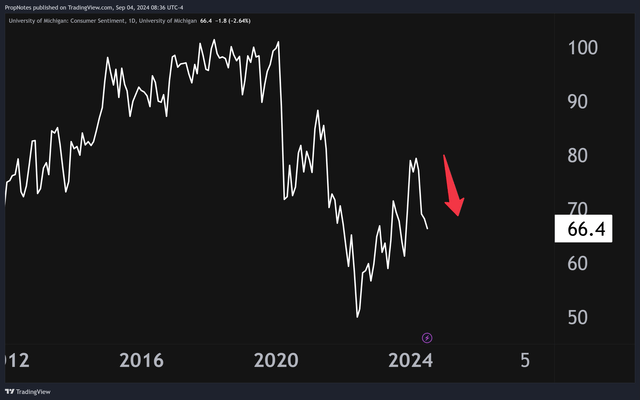

Positive, there’s administration and execution danger concerned right here as nicely, however given how saturated PG’s finish markets are, the true inputs to observe for within the quick and medium time period are Client Sentiment and Financial Well being.

On the Client Sentiment facet, numbers have been falling these days as recession fears start to creep in:

TradingView

Whereas one would possibly count on that worsening client sentiment can be unhealthy for a client staples firm, it is truly not an excessive amount of of a difficulty. Positive, folks have much less cash to spend, however usually, they are not reducing again on cleaning soap, diapers, and hygiene merchandise.

Consequently, barely weaker numbers right here could impression outcomes over the interim, however PG’s small losses will possible pale compared to these skilled by firms that promote merchandise with extra elastic demand profiles.

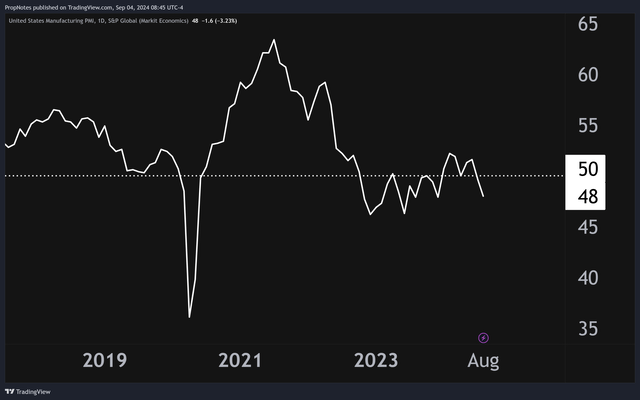

What about Financial Well being?

In brief, the financial system is not trying too scorching proper now. Except for weakening client sentiment, enterprise sentiment has additionally been sliding this 12 months:

TradingView

That is the PMI, which is a strong main financial indicator. It predicts S&P returns 6 months to 1-year out with a comparatively excessive stage of accuracy, and up to date strikes have despatched buyers ducking for canopy. Add it along with a weakening client, and we’re some uneven waters over the subsequent twelve months.

Once more, one might imagine that this might be a damaging for PG, however the important thing right here is relative efficiency.

Positive, there could also be tough seas forward, however what actually issues is the place buyers select to cover.

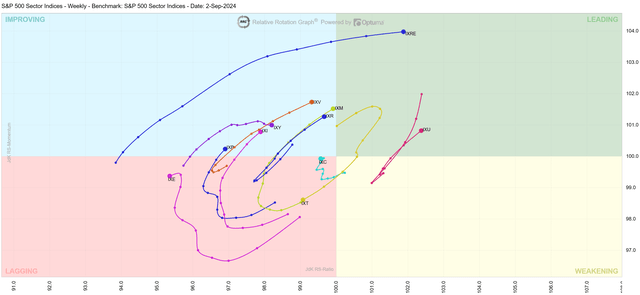

As you possibly can see from the RRG beneath, client staples shares are bettering considerably vs. the market, and particularly vs. tech:

RRG On-line

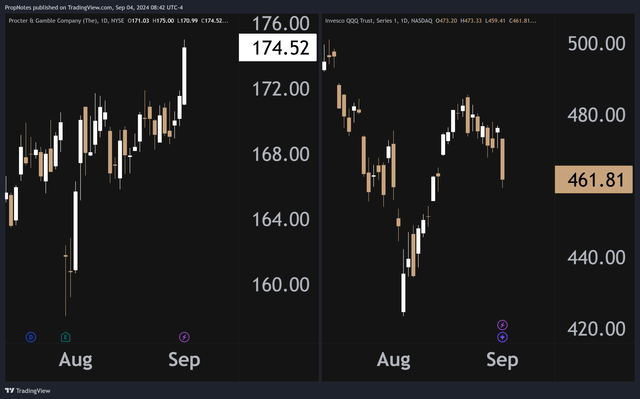

You possibly can see this dynamic enjoying out reside within the markets as nicely. Tuesday, the market largely offered off as buyers dumped excessive development tech publicity.

What did they purchase? Client Staples:

PG vs. QQQ (TradingView)

With these dynamics, together with PG’s scope, measurement, and inelastic buyer demand profile, we expect buyers will select the corporate as a hiding place because the financial image worsens, even when monetary outcomes dip a bit.

Thus, the draw back image seems muted, even with issues the place they’re.

On the similar time, as a client staples firm in a downturn, we do not assume the upside seems too thrilling, both.

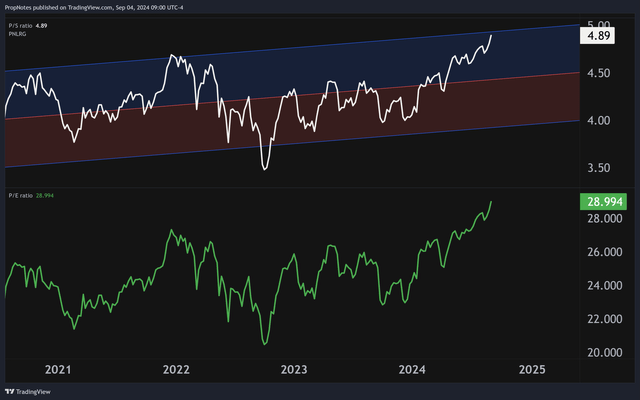

Tack on a comparatively stretched valuation – at round 4.89x gross sales and 29x EPS – and it is exhausting to see significant a number of appreciation in PG over the subsequent twelve months:

TradingView

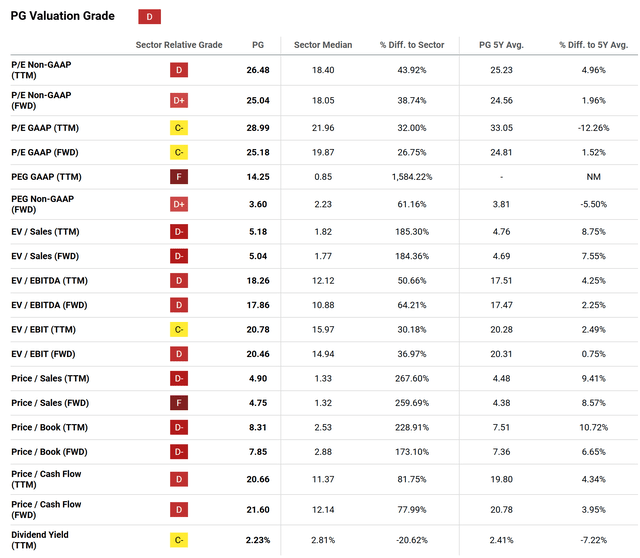

For its half, the SA Quant Score system additionally offers PG a ‘D’ on the valuation scorecard, which appears about proper to us:

In search of Alpha

PG’s P/E and PEG are significantly stretched because of the corporate’s weak development trajectory, and so we do not assume that there is a ton of room on the upside right here.

Add up the monetary outcomes, valuation, and relative rotation, and we expect Truthful Worth is optimistically someplace between $165 and $175 per share, which is true round the place shares are at the moment buying and selling.

The Commerce

Thus, we’re in a state of affairs the place we do not see a lot upside or draw back potential in PG over the approaching months.

What to do?

Positive, you could possibly purchase the inventory for a 2.5% yield and a tepid outlook – however in our view, this can be a nice alternative to promote put choices.

What does this entail?

It is easy: Whenever you promote a put possibility, you are agreeing to buy the underlying inventory at an agreed-upon value up till some level sooner or later. In return for committing to being a keen purchaser, you obtain a money payout.

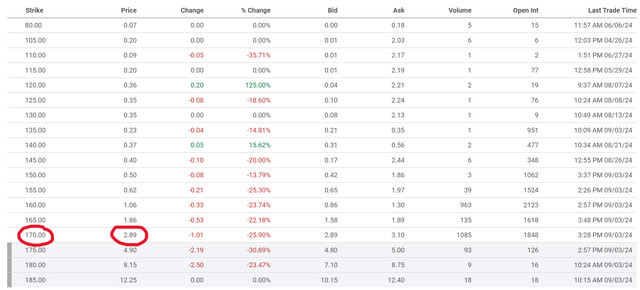

On this case, we just like the $170 strike, November fifteenth put choices:

In search of Alpha

These choices pay out $2.89 per share, or $289 per contract. This ends in a payout of 1.73% over the subsequent 73 days, which annualizes to an 8.7% return on capital.

After you promote the choice, considered one of two issues can occur – the inventory can end on the expiration date above the strike value, or beneath the strike value.

If the inventory closes on November fifteenth above $170 per share, you get to maintain the money free and clear. If the inventory closes beneath $170 per share, you then’ll must buy shares at $170 – however you continue to get to maintain the money.

On this approach, you are primarily getting paid 8.7% annualized to bid for PG at a reduction to the present market value, and deeper into our ‘Truthful Worth’ vary for the inventory.

On steadiness, this looks as if a win-win, and a better option than shopping for the inventory outright.

Dangers

There are some extra dangers to pay attention to if you happen to’re planning on taking this commerce, although.

First off, the financial system may worsen – rather a lot worse. As we talked about, that is the strongest enter to PG’s monetary ends in our view, and if indicators proceed to bitter, then it is exhausting to see how PG will not be impacted. We expect that the corporate is insulated from this when it comes to the share value, however over time, it may catch up.

Secondly, when promoting put choices, if one thing drastic occurs, you are still on the hook for purchasing shares at $170 between now and November. This is not a ‘danger’ per se, because it’s the identical danger profile as shopping for shares outright, nevertheless it’s one thing to pay attention to for many who have not offered places earlier than.

Lastly, PG will report earnings between now and mid-November, which is prone to trigger some volatility with the inventory value. If the market reacts poorly to this announcement, it may ship shares beneath $170, the place you then could also be assigned in your place.

Abstract

All in all, although, we like the danger/reward profile of this commerce.

Upside is improved vs. shopping for and holding the inventory, and dangers are mitigated by means of the discounted acquisition value (if shares do drop), sturdy firm margins, and probably sturdy relative efficiency if the macro state of affairs worsens.

Whereas the a number of appears a bit inflated, we’re joyful incomes yield by means of choices and ‘bidding’ for the inventory at a decrease stage.

Thus, our ‘Maintain’ score.

Good luck on the market!

[ad_2]

Source link