[ad_1]

hikesterson/iStock through Getty Photos

Shares of Pool Company (NASDAQ:POOL) have been a weak performer over the previous yr, dropping 5% throughout a major bull market. Decrease building exercise, excessive charges, and modest disposable revenue progress have brought on customers to tug again on giant dwelling initiatives, like pool building. This concern led me to charge shares as a “promote” final October. Since then, they’ve considerably underperformed, gaining simply 6% vs the market’s 29% rally. On Monday, POOL considerably minimize steerage, which despatched shares down over 10% after hours, including to their underperformance and beneath my promote worth. That makes now a superb time to find out if POOL has much more draw back or if a beautiful entry level might be close to. I stay unfavorable.

Searching for Alpha

Monday afternoon’s steerage revision was significantly regarding. The corporate now expects to earn $11.04-$11.44 this yr reasonably than the $13.19-$14.19 it beforehand noticed. That is now effectively beneath the $13.50 I had anticipated the corporate to earn final yr. Q2 is an important quarter for the corporate as households get their swimming pools prepared for the beginning of the yr, and earnings can be simply $4.85-$4.95. Sadly, Q2 has been trending weaker than anticipated, and it now expects full yr gross sales to be down about 6.5%. After Q1, it anticipated gross sales to be “flat to barely up.” It is a dramatic shift in steerage.

POOL Corp operates a much less cyclical upkeep enterprise, promoting cleaners, chemical compounds, and so forth. This unit is pretty steady, given a lot of the spending is nondiscretionary. For those who personal a pool and plan to make use of it, there’s some important upkeep. Nonetheless, there’s positively some deferral exercise, as gross sales are anticipated to be down 2% this yr, although it is a bit higher than the three% decline registered in Q1.

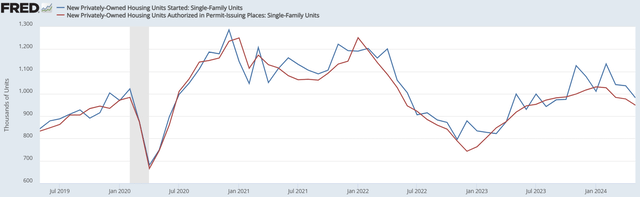

The larger problem is on newbuild and reworking work the place POOL has been pressured to chop steerage. It expects new models to be down 15-20% and reworking to be down 15% vs a previous information of flat to down 10%. Now in Q1, administration noticed permits down 15-20% however believed there could be enchancment, which merely has not materialized.

In hindsight, this steerage was clearly aggressive. On the identical earnings name, administration famous it takes about 60 days for allow traits to affect their building orders. As such, Q1 allowing ought to be a reasonably good indicator of Q2 exercise, and with Q2 an important quarter, this weak allowing ought to have set off extra issues that any rebound would come after its most important promoting season. Furthermore, with charges staying elevated, an acceleration in construction-related exercise does really feel bold.

In the end, whereas about 60% of its enterprise is ongoing, almost 40% is tied to building and is just too a lot of a headwind to beat. Within the firm’s first quarter, POOL EPS fell by 21% to $2.04 as gross sales fell by 7% and the corporate misplaced working leverage. Adjusted EBITDA fell by 22% to $125 million, and gross margins fell by 40bp to 30.2%, regardless of a one-time 110bp tax profit. Past decrease gross margins, working bills rose to twenty.5% of gross sales from 18.6% because it spreads the identical mounted price (like hire for shops) throughout a slower gross sales base.

With Q1 sometimes representing lower than 20% of the yr, these pressures could be manageable, just like how a retailer can afford a sluggish February greater than a sluggish December. Sadly, we’re not more likely to see margin recapture given weaker gross sales in its peak season. Certainly, its ~7% slower gross sales outlook led to an 18% decline in its EPS steerage. I might anticipate margins to remain beneath stress, and POOL might want to start lowering SG&A the place attainable to protect margin.

The lone optimistic is that POOL had minimize stock by 11% to $1.5 billion over the previous yr, a sharper lower than its gross sales drop, which ought to permit it to keep up pricing. It additionally has a pristine stability sheet with simply $979 million of debt. Because of working capital releases, it generated $145 million of money from operations in Q1, and even at steerage, it ought to generate over $450 million in free money circulation.

In Might, POOL elevated its dividend by 9% to $1.20 and likewise boosted its buyback authorization from $284 million to $600 million. Given its robust stability sheet and strong money circulation, even in a downturn, I view its dividend as safe, although it solely supplies a couple of 1.5% yield for shareholders. Furthermore, I might be aware its buyback program is open-ended, and its share depend is down a modest 1.5% over the previous yr. I might not anticipate a share depend discount of greater than 2% over the following yr.

POOL administration more and more faces a credibility problem, given the sharp change in steerage after providing a reasonably optimistic image of Q2 acceleration, regardless of weaker permits in Q1. Certainly, I see ongoing pressures that may restrict restoration. First, at a excessive degree, new dwelling building and permits have been falling in latest months as builders react to rates of interest staying larger for longer. This weaker tempo of building exercise is more likely to result in much less new potential pool building all else equal. Certainly, with constructing permits at a multi-month low, we’re more likely to see enhance weak point, not enchancment within the near-term.

St. Louis Federal Reserve

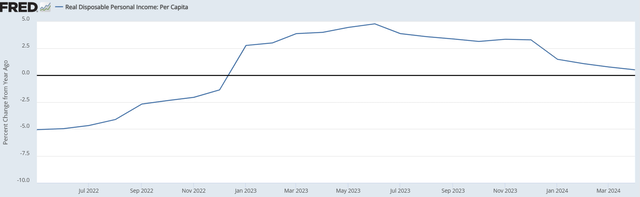

On prime of this, a development I’m more and more targeted on is the slowdown in actual disposable per capita revenue. The inflation shock of 2022 pushed incomes decrease, after which they recovered in 2023 as inflation started to reasonable and wages stayed robust. Nevertheless, with inflation proving a bit stickier than hoped and the job market normalizing, we’re seeing actual disposable revenue progress sluggish beneath 1%. That is seemingly a purpose why even in Q1 POOL famous weak point beneath the luxury-end of the market.

St. Louis Federal Reserve

Now, incomes are nonetheless rising, so a recession is unlikely. Nevertheless, sluggish revenue progress and a comparatively low financial savings charge means we’re unlikely to see a burst of exercise both. Optimistic revenue progress means clients ought to proceed with nondiscretionary upkeep. Nevertheless, sluggish revenue progress and elevated charges will not be a recipe for a brand new wave of building of swimming pools. More and more, the 2024 summer season season seems misplaced for POOL, however this doesn’t bode significantly effectively for 2025 both.

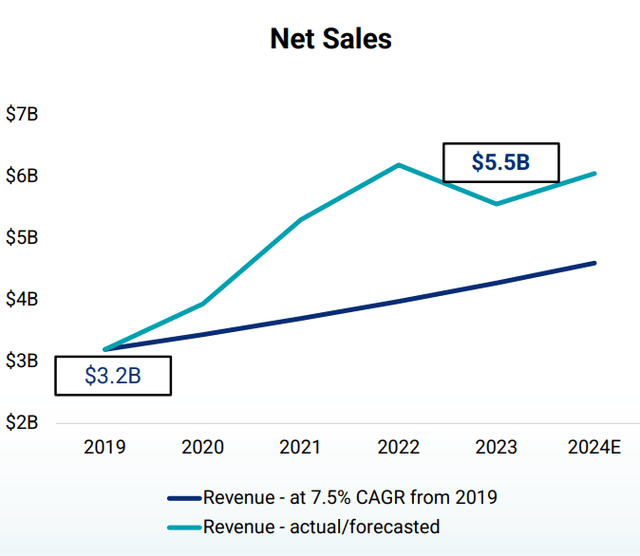

Lastly, there’s the larger query of how a lot demand for swimming pools stays. As you may see beneath, pool building spiked post-COVID, and now we’re solely barely beneath pre-COVID ranges. It might be that 2021-2022 represented an amazing pull-forward in demand and that 2024-2026 should run beneath long-term development till we normalize again to the pre-COVID development. In different phrases, COVID didn’t completely enhance the quantity of people that need swimming pools; reasonably time at dwelling led individuals who would finally have constructed a pool to take action sooner, and now there’s restricted demand.

Pool Company

Certainly, as you may see, POOL has been a implausible progress story. Nevertheless, it might be that gross sales are working too far above development, and that the extent of consumption seen in 2022 simply will not be sustainable. Even down 6%, gross sales are nonetheless greater than 10% above development. This could argue for an additional flattish 12-18 months after this yr. Absent a recession, I’m not positive we are going to see an additional downturn in gross sales, reasonably POOL may see outcomes “bounce across the backside” for a while.

Pool Company

Lastly, POOL shares nonetheless don’t seem low cost. Its file yr of 2022 resulted in $18.70 in EPS. At at present’s share depend, that’s about $19.18 per share. Nevertheless, as mentioned, 2022 outcomes have been seemingly unsustainably robust, given COVID-related demand, authorities stimulus, and very low charges. Even at ~$300 after hours, shares are 15.6x peak earnings, which it is not going to seemingly return to for years. That’s not an inexpensive “peak a number of.” On the mid-point of steerage, shares are 26.6x.

For a corporation not more likely to see a fast restoration in shares, that’s costly. Moreover, its outcomes are proving extra rate of interest delicate than its 60% maintenance-related combine would counsel. Plus, there’s the danger the pool market grow to be a bit over-supplied. I might reasonably personal a homebuilder like Toll Brothers (TOL) at 10x earnings in what’s an under-supplied market, if an investor goes to take rate of interest threat.

Now with some upkeep work, POOL can commerce at a better a number of than a homebuilder, however I nonetheless imagine about 20x upkeep and 10x building is extra acceptable or a blended a number of of 16-17x, leaving shares with a good worth nearer to $190. With its robust market share and clear stability sheet, shares could not fall that far. Nonetheless, at $300, POOL is pricey, given demand is unlikely to recuperate within the close to future. I might nonetheless promote shares and see them transferring towards $200-225, or about 20x earnings.

[ad_2]

Source link