[ad_1]

allanswart

Platinum Group Metals Ltd. (NYSE:PLG) is an fascinating growth stage PGM play that may be valued on an NAV foundation because of the Stantec technical research, albeit from 2019. Adjusting the assumptions from that research to at this time’s new macroeconomic context, we have issues round NPVs given the declines in Palladium costs specifically, particularly as unfavorable narratives round PGMs solidify within the wake of the BHP Group Restricted (BHP) provide for Anglo American plc (OTCQX:NGLOY). In comparison with then, it is unclear whether or not the proposition appears much less or extra interesting. It could appear that the excellent efficiency of a few of the extra marginal merchandise, particularly gold and nickel would possibly offset the weak point because the 2019 evaluation of palladium particularly in greenback phrases, even taking into consideration post-2019 inflation assumptions, low cost charge assumptions, and so forth. Nonetheless, we do not assume the valuation is healthier than honest primarily based on a crude evaluation of a really delicate mannequin, contemplating additionally Lion Battery Applied sciences. Directionally, we’re additionally not that eager on PGMs as a result of buying and selling narrative across the commodities.

PLG Transient

PLG has a majority curiosity within the Waterberg JV, which is their solely mining challenge within the growth stage. They’re pre-revenue.

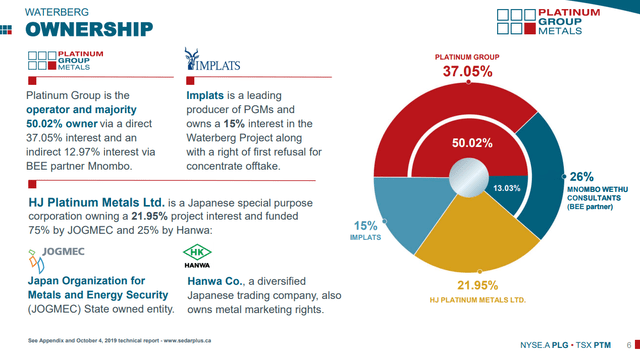

Possession in Waterberg (Featured Presentation)

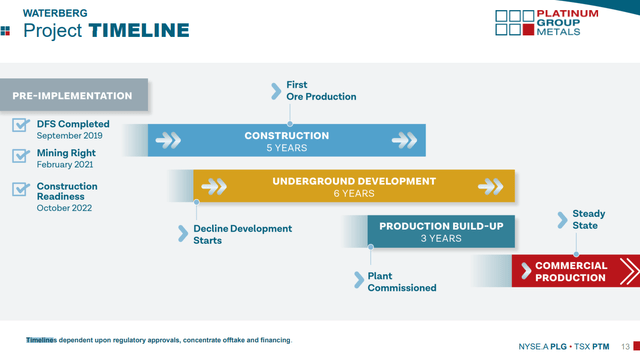

The technical research are largely completed, and they’re coming to the top of the pre-construction stage, which is able to then result in the development stage which is predicted to final 5 years. It is likely to be round seven years after that till they’re at a industrial scale.

Timeline (Featured Presentation)

They’re in a low-cost area for mining PGMs, in South Africa, and the money prices needs to be comparatively aggressive, fairly consistent with Anglo American Platinum Restricted (OTCPK:ANGPY). There should not too many main excellent choices within the firm, both by different pursuits like Impala Platinum Holdings Restricted (OTCQX:IMPUY) or throughout the government compensation schemes. Dilution excellent at this level is barely round 5%.

Supplied NPV Mannequin

We are able to bounce proper to the NPV mannequin which is the meat of the case and helps us perceive the EV of the Waterberg Venture.

After all, it is an space that’s fairly wealthy with PGM sources, which means platinum, palladium, rhodium, and others which are important to be used in catalytic converters used to restrict exhaust in automobiles. Most of those minerals, excluding platinum, have greater than 70-80% of their finish markets simply in catalytic converters. Platinum is extra like 40%. Gold, nickel, and copper additionally seem from the mine as co-products.

These automotive finish markets are theoretically in decline as EV is meant to take over. We’re much less sure than many of those info, however it’s the purpose additionally for Amplats being snubbed a little bit within the Anglo American bid. It’s also the rationale Anglo American is taken with spinning off Amplats, bid apart. Nonetheless, a transparent precedent for these belongings not being needed is one thing that we’re taking into account for the buying and selling case.

The unbiased technical research has all the knowledge an investor would want to construct a mannequin. They’ve really constructed the mannequin themselves, so we are going to use the outputs to come back to some conclusions. They’re DCF fashions, so extraordinarily delicate to inputs. All evaluation is subsequently fairly tentative, which is to be anticipated anyway for a growth stage firm. The important thing to know is that the research was finalised in 2019. Due to this fact, the inputs mirror 2019 assumptions about price, commodity costs, and in addition low cost charges, that are among the many most necessary parts.

They’ve made two assumptions so far as costs go for the commodities inside their NPV mannequin, which we have to get to a NAV determine. They’ve taken spot costs from then and one other situation primarily based on trailing averages. We’ll evaluate the assumptions then with spot costs now to get an concept of how off their NPV calculations may need been. Notice additionally that the ZAR/USD change charge can be completely different.

After-tax web current worth of R5.62 billion (US$333 million) at an 8% low cost charge [three-year average price US$931 per oz Pt, US$1 055 per oz Pd, US$1 930 per oz Rh, US$1 318 oz Au, US$2.87 per pound Cu and US$5.56 per pound Ni, US$/South African Rand (ZAR) 15.95]. • After-tax NPV of R14.7 billion (US$982 million) at an 8% low cost charge (spot costs 04 September 2019 – US$980 per oz Pt, US$1 546 per oz Pd, US$5 036 per oz Rh, US$1 548 per oz Au, US$2.56 per pound Cu and US$8.10 per pound Ni, US$/ZAR 15.00). • After-tax inner charge of return (IRR) of 13.3% (three-year trailing common value). • After-tax IRR of 20.7% (Spot Costs 04 September 2019).

2019 Stantec Technical Examine

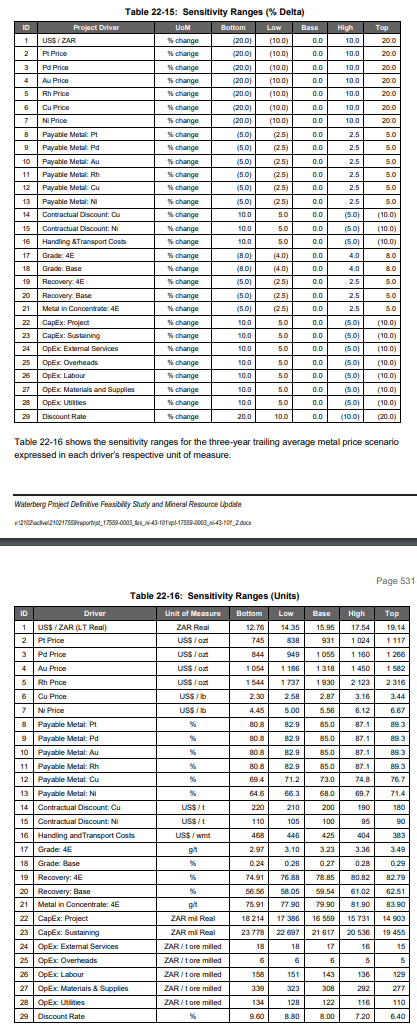

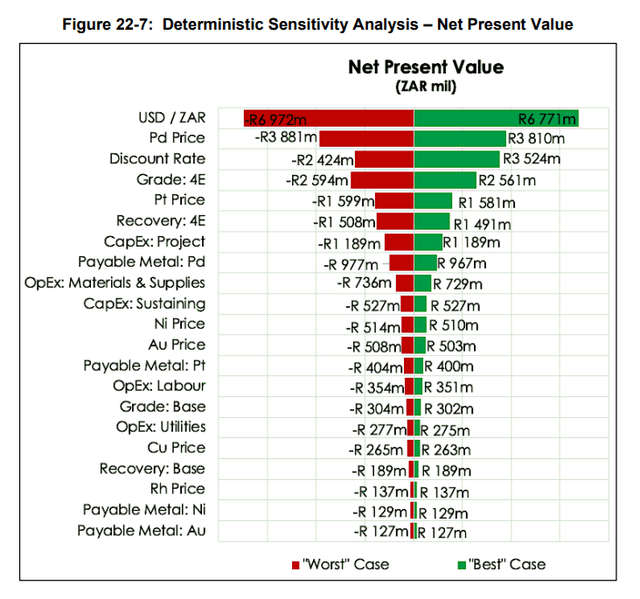

The sensitivity evaluation will get us the place we have to go. Under are the ranges they used.

Inputs and Eventualities (2019 Technical Evaluation)

We’re going to evaluate to the trailing common assumption. Under exhibits the sensitivity to the various factors. Pd costs are down in comparison with then, by round 12% from the assumed values. Platinum is up by 5%. Gold has virtually doubled. Nickel is up by roughly 50%. Platinum and palladium matter essentially the most for the sensitivity evaluation.

The opposite necessary issue is the low cost charge. A gold challenge from extra just lately simply used a 5% charge. A rustic danger premium for South Africa is likely to be round 4.4%. Used within the evaluation right here was an 8% low cost charge. Within the new charge surroundings, one thing like 9.4% could be extra applicable, equal to 4.4%+5%, and near the worst-case situation of 9.6%, which is the low cost charge we might wish to use for the challenge. That is round a 20% improve from the earlier assumptions. Lastly, the US$/ZAR charge is across the “excessive” case as offered by PLG.

Ranging from 5.62 billion ZAR, crudely we’ve round a -1.4 billion ZAR impact from the brand new palladium actuality. Low cost charge the complete -2.42 billion ZAR affect from the worst-case situation. Nickel and Gold may need round a 3.5 billion optimistic impact although they’d have been anticipated to be extra marginal, additionally due to simply how a lot they’ve each risen. Copper which has additionally virtually doubled could also be, generously, a 1 billion ZAR impact to NPV. The difficulty is issues just like the challenge CAPEX, and the sustaining CAPEX, each of that are doubtless larger with inflation which has picked up. Then there are issues in OPEX like utilities, labour, and supplies. These are all areas to which the mannequin is delicate. Whereas there could even be a web optimistic impact from commodities, clear inflation since 2019 probably means worst-case eventualities for CAPEX and OPEX so far as the offered NPV mannequin goes. We expect it is possibly a web -3 billion ZAR impact from CAPEX and OPEX taking full international inflation results under consideration. Then the ZAR depreciation has been good for the mannequin since all of the commodities are USD denominated, one other +3.2 billion ZAR or so. The online impact, near 1 billion ZAR higher than the offered determine together with inflation, and primarily based on what has occurred since then. In USD, by which the denomination of PLG, the NPV is extra like $310 million, so a slight decline in greenback phrases.

Sensitivity Evaluation (2019 Technical Examine)

Backside Line

Whereas it was a crude evaluation, a good a number of is one thing round a 0.6-0.3x for development-stage belongings. 1x is nearer to what already operational mines would possibly commerce at. Since Waterberg is a JV, additionally there’s not sufficient debt to take care of, it could seem like the P/NAV right here is nearer to 1x.

In the end, it is a delicate mannequin because it’s DCF, though there’s a clear margin to say that the challenge might be going to be optimistic NPV which is nice sufficient to be worth accretive for shareholders. We’d have even been beneficiant although, relying on how commodity costs develop. We have at all times preferred the hydrogen angle however when there may be speak of provide cuts at Amplats, we’re simply not that positive of the buying and selling dynamics for the inventory or for the commodities, which may pattern down over time.

There’s the matter of Lion Battery Applied sciences, which is their different enterprise. The presence of this is the reason we might say that the PLG valuation appears a little bit extra honest. Lion is collectively managed by Amplats. The e book worth is barely within the a number of tens of millions from contributions to speed up investments into lithium battery expertise utilizing palladium and platinum. There’s some information supporting that batteries utilizing Lion’s patents degrade slower. This in all probability all has some worth, we simply aren’t positive what, so it is a fudge issue, but it surely is likely to be sufficient to get PLG to an unexciting honest worth.

[ad_2]

Source link