[ad_1]

RobsonPL/iStock Editorial by way of Getty Photographs

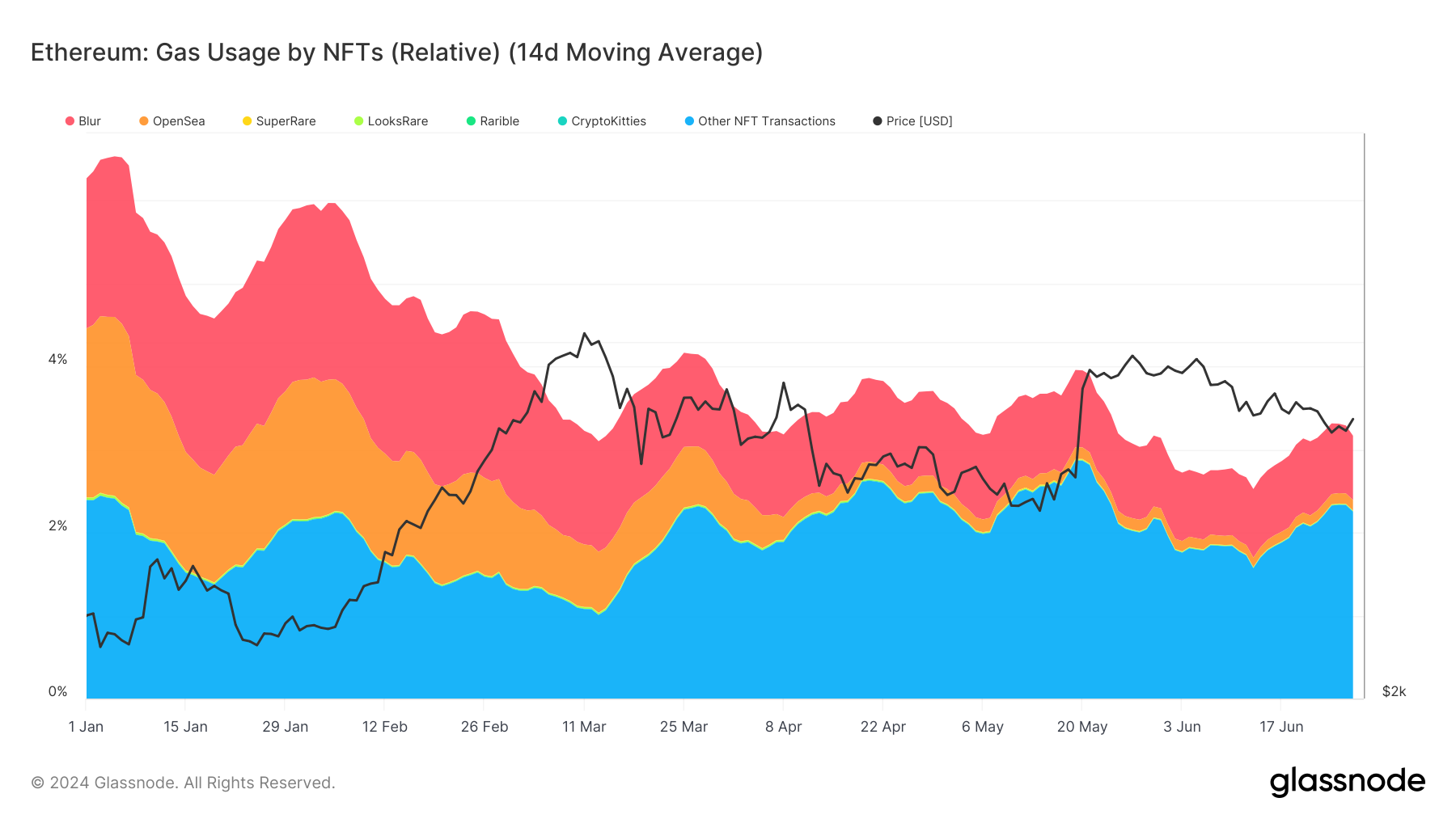

Client Staples shares have quietly produced features up to now this quarter, practically conserving tempo with the tech-dominated S&P 500. Whereas there was an uptick only in the near past in Client Discretionary shares, specifically a recent excessive in shares of Amazon (AMZN), many blue-chip Staples proceed to commerce at premium valuation multiples within the face of a booming broader market. I imagine that may typically persist.

I’m upgrading The Procter & Gamble Firm (NYSE:PG) from a promote to a maintain. I questioned its valuation and identified technical dangers early final 12 months, however failed to understand the sturdiness of the corporate and its administration’s execution. Whereas I don’t see the inventory as a discount as we speak, dangers seem balanced. Shares have returned 23% for the reason that unique evaluation in comparison with a 35% S&P 500 efficiency.

QTD S&P 500 Sector Performances: Staples Holding Up Properly

Koyfin Charts

In response to Financial institution of America World Analysis, Procter & Gamble, one of many world’s largest client merchandise corporations, operates beneath 5 segments: Magnificence, Grooming, Well being Care, Cloth & Dwelling Care, and Child & Household Care. Manufacturers embrace Pampers, Tide, Bounty, Charmin, Gillette, Oral B, Crest, Olay, Pantene, Head & Shoulders, Ariel, Acquire, At all times, Tampax, Downy, and Daybreak.

Again in April, PG reported a combined set of quarterly outcomes. Q3 non-GAAP EPS of $1.52 beat the Wall Avenue consensus forecast of $1.41 whereas gross sales of $20.2 billion, up simply 0.6% from year-ago ranges, was a $240 million miss. However the firm raised its FY 2024 diluted web EPS development charge from a spread of –1% to flat to +1% to +2% in contrast with the earlier 12 months’s $5.90 complete. Core web EPS development was additionally elevated to the ten% to 11% vary y/y. The agency expects to reward shareholders with greater than $9 billion in dividends whereas it buys again $5 to $6 billion in inventory this 12 months.

After registering 3% y/y natural income development in Q3, all eyes are on the upcoming quarter which featured the next US Greenback Index and certain extra comfortable numbers out of China and the Center East. North America gross sales could also be regular within the low-to-mid single-digit vary and one other sturdy exhibiting from Europe, which was +7% within the earlier quarter, could be a big tailwind.

Commodities have been held in verify for probably the most half this 12 months, however any additional rise within the value of oil, maybe towards the $90 mark later this summer season, could be a problem for PG. Forward of the July 30 This fall report, the choices market has priced in a small 2.2% earnings-related inventory value swing when analyzing the at-the-money straddle expiring soonest after the report, in response to knowledge from Choice Analysis & Expertise Providers.

Key dangers for the corporate embrace weaker-than-expected gross sales development within the quarters forward, probably attributable to elevated competitors from personal label manufacturers and a broader market upturn which can end in extra cyclical areas of the market outperforming. Moreover, extra power within the US greenback could be a minimum of a short lived hit to earnings.

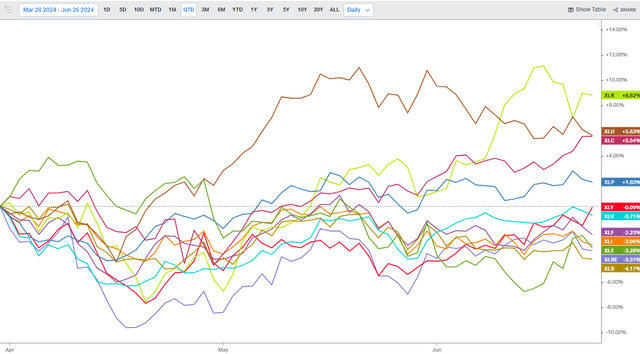

On earnings, analysts at BofA see working EPS rising sharply this 12 months with continued sturdy development by the out 12 months and 2026. The present Searching for Alpha consensus forecast exhibits comparable non-GAAP per-share earnings development within the coming years whereas PG’s high line is seen rising at a gentle tempo between 2.9% and three.9%.

Dividends, in the meantime, are anticipated to extend from $3.83 this 12 months to probably above $4.25 by year-end 2026, leading to a dividend yield that would develop to be greater than twice that of the S&P 500. Whereas the corporate’s free money circulation yield just isn’t extraordinarily excessive, the agency is executing properly after shedding some non-core companies lately.

PG: Earnings, Valuation, Dividend Yield, Free Money Stream Yield Forecasts

BofA World Analysis

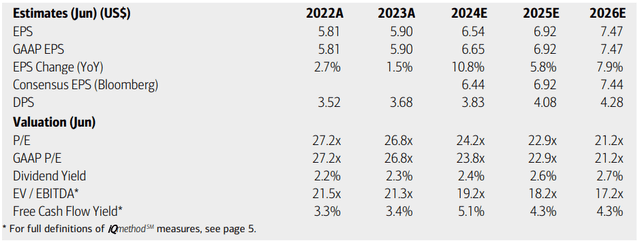

On valuation, PG has traditionally traded with a big P/E premium attributable to its stability even during times of financial stress. Nonetheless, the present earnings a number of is a full flip above its 5-year common. If we assume normalized non-GAAP EPS of $6.70 over the following 12 months, very near the present consensus, and apply a 5-year common ahead P/E, then shares ought to commerce close to $164, placing the inventory about pretty valued. PG shares are additionally modestly costly on a price-to-sales foundation.

PG: Shares Commerce Close to the Historic P/E, Barely Elevated P/S

Searching for Alpha

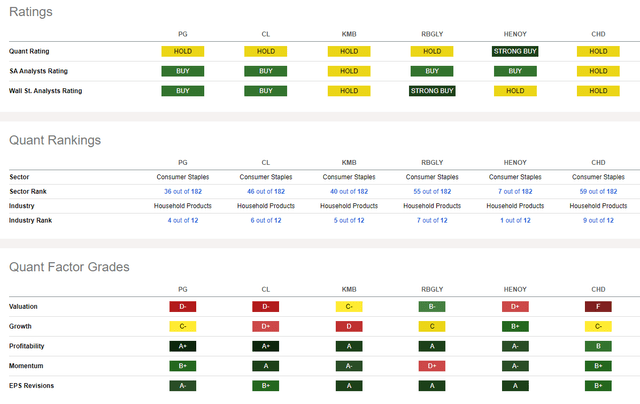

In comparison with its friends, PG contains a weak valuation score, however that’s widespread among the many steadiest large-cap Staples shares. With a lukewarm development trajectory, PG’s profitability metrics are about one of the best you’ll discover throughout the sector. What’s extra, PG has topped EPS estimates repeatedly, resulting in sturdy sellside EPS revisions over the previous 90 days. Lastly, share-price momentum continues to run sturdy with the inventory close to all-time highs.

Competitor Evaluation

Searching for Alpha

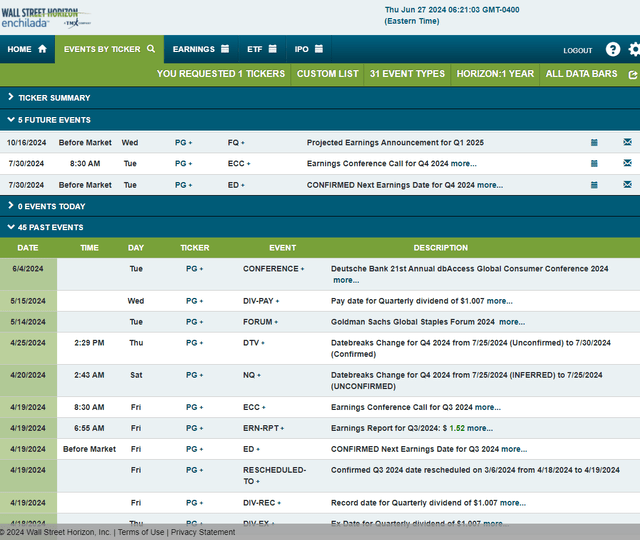

Trying forward, company occasion knowledge supplied by Wall Avenue Horizon present a confirmed This fall 2024 earnings date of Tuesday, July 30 BMO with a convention name instantly after the numbers hit the tape. You’ll be able to hear dwell right here. No different volatility catalysts are seen on the calendar.

Company Occasion Threat Calendar

Wall Avenue Horizon

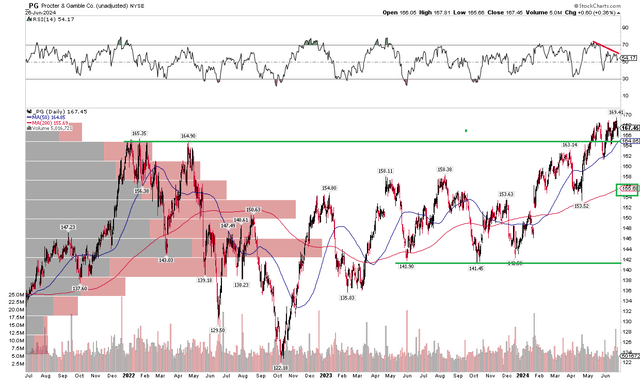

The Technical Take

I used to be bearish on PG early final 12 months at exactly the flawed time. Mea culpa. Shares had been consolidating after transferring decrease from a January 2023 peak close to $155. Regardless of a dip beneath the 200-day transferring common, the bulls took cost and a broad uptrend was underway. Bounce forward to as we speak, and the inventory may be very near all-time highs, rising above the January 2022 earlier peak above $165. Furthermore, the 200dma stays upward-sloping, suggesting that the bulls management the first pattern.

I’m mildly involved that shares aren’t transferring decisively above the earlier all-time excessive amid destructive RSI divergence. Nonetheless, given a earlier vary between $141 and $158, there’s a near-term upside goal to $175 based mostly on the $17 top of that previous vary. I see present help on the 200dma round $156 and the Q2 low of $153.52. Lastly, there’s now a excessive quantity of quantity by value from $165 right down to $140 given the congestion zone over the previous few years, which ought to provide cushion on any important draw back strikes.

Total, PG’s chart is wholesome with shares hovering close to all-time highs.

PG: Bullish Advance to All-Time Highs

Stockcharts.com

The Backside Line

I’m upgrading PG from a promote to a maintain. I used to be too bearish on the valuation final 12 months whereas bulls defended the inventory throughout an early 2023 pullback. Going ahead, strong gross sales development, sturdy margins, and stabilizing commodity costs needs to be supportive of future earnings will increase.

[ad_2]

Source link