[ad_1]

Robert Manner

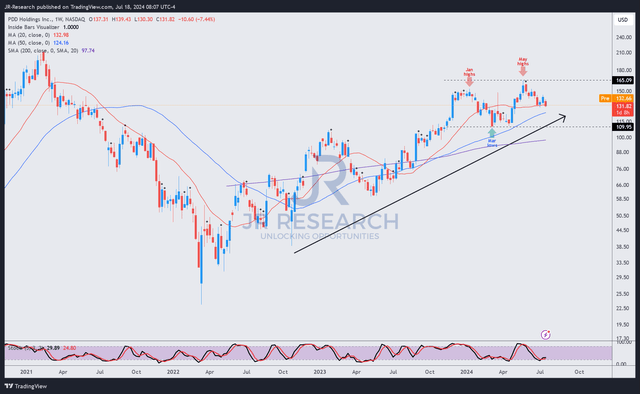

PDD Holdings (NASDAQ:PDD) traders have a lot to think about as its shopping for sentiment stuttered because it confronted vital resistance underneath the $165 stage. Because of this, the inventory’s upward momentum fizzled out as sellers took revenue. That stage additionally noticed traders equally take revenue on the finish of 2023 and early 2024 earlier than it bottomed in March.

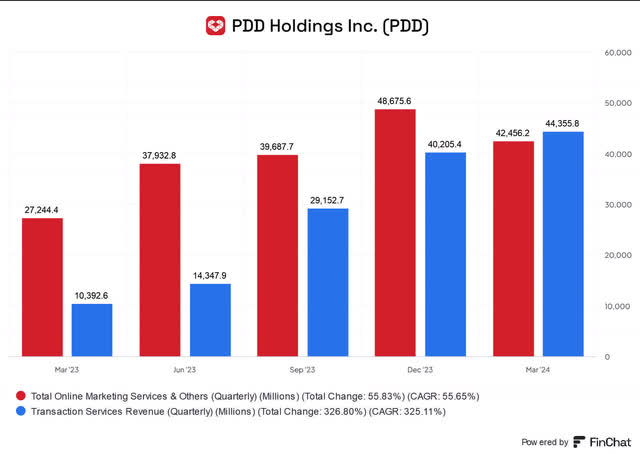

PDD income segments (FinChat)

In my earlier bullish PDD article in Might, I highlighted why I made a decision to improve my thesis on the corporate. PDD’s Q1 earnings launch in late Might underscores its capacity to proceed outpacing its rivals. As well as, the surge in Transaction Providers income over the previous yr justifies PDD inventory’s outperformance. The phase’s stellar efficiency is attributed to Temu’s success, which has helped the corporate broaden its foothold in worldwide e-commerce markets. However the current pullback, the inventory is up greater than 65% over the previous yr, demonstrating its resilience and the market’s confidence.

Subsequently, investing in China’s main social e-commerce platform chief has reaped vital rewards for traders over the previous two years. China’s financial malaise has benefited worth gamers like PDD, as shopper spending in China stays comparatively tepid. PDD’s capacity to attain sustainable profitability (“A+” profitability grade) has helped to maintain progress traders onside as the corporate continues its world enlargement plans.

However my optimism, traders should intently monitor developments regarding Amazon’s (AMZN) potential entry into Temu’s house. AMZN has doubtless studied the success of Temu and Shein intently, as they may threaten Amazon’s e-commerce dominance in its most important geographical markets.

Regardless of that, I assess that PDD has taken a number of years to develop its community results moat in China, amassing vital leverage with its direct gross sales enterprise. Subsequently, Amazon’s try to ascertain a complete and efficient cross-border e-commerce enterprise to outperform Temu and Shein is anticipated to be extremely difficult.

Moreover, Temu has additionally reportedly diversified its cross-border e-commerce technique with a extra “localized” strategy to competing with Amazon. Accordingly, Temu “is now enrolling Chinese language sellers with stock in US warehouses.” Because of this, it facilitates the power of US-based suppliers to “ship straight from US areas.”

Temu has reportedly lifted the GMV contribution from this phase to twenty% of its US GMV, underscoring the success of its technique. Consequently, I view Amazon’s determination to counter Temu’s success as doubtless essential to hinder Temu’s market share beneficial properties. Subsequently, traders are urged to pay shut consideration to those developments, as Temu is a essential progress pillar in PDD’s long-term recreation.

PDD Quant Grades (Searching for Alpha)

PDD’s bullish thesis has remained sturdy. Searching for Alpha Quant assigns “A” and “B” vary grades for the inventory, underpinning my conviction. Analysts have upgraded their estimates on PDD, bolstering the market’s confidence within the firm’s proposition.

Nonetheless, I have to warning traders that the present geopolitical local weather stays perilous because the US makes an attempt to crimp China’s capabilities additional. As well as, the US Congress may additionally transfer ahead to revise the De Minimis “loophole,” hampering Temu’s cross-border efforts. The surge in air freight attributed to Temu and Shein suggests the income publicity that could possibly be in danger attributable to potential regulatory headwinds.

As well as, traders should additionally think about the elevated prospects of a second Trump administration. Latest polls recommend Trump’s lead has widened, elevating the prospects of Trump’s return. Latest experiences recommend waning help for President Biden for a second time period have heightened the uncertainties within the US political local weather. These developments is probably not favorable for PDD, given its Chinese language roots. Because of this, I assess {that a} substantial valuation re-rating is probably not doubtless within the close to time period.

PDD worth chart (weekly, medium-term) (TradingView)

PDD’s uptrend bias continues to be intact. The inventory’s $110 essential help stage should be watched intently, as a decisive breakdown under that stage may result in a steeper selloff.

Nonetheless, that is not my base case for now, as PDD’s upward momentum stays strong. Its “B+” momentum grade undergirds my conviction, suggesting a buy-the-dip alternative continues to be acceptable.

Score: Keep Purchase.

Vital be aware: Traders are reminded to do their due diligence and never depend on the data offered as monetary recommendation. Think about this text as supplementing your required analysis. Please all the time apply unbiased pondering. Word that the score will not be meant to time a selected entry/exit on the level of writing, except in any other case specified.

I Need To Hear From You

Have constructive commentary to enhance our thesis? Noticed a essential hole in our view? Noticed one thing essential that we didn’t? Agree or disagree? Remark under with the purpose of serving to everybody locally to be taught higher!

[ad_2]

Source link