[ad_1]

Jeremy Poland

When it comes time for Paramount Sources (OTCPK:PRMRF) (TSX:POU:CA) to rake within the cash, this firm wants a really huge rake. If issues hold going the way in which they’re now, the corporate might have two within the future. This can be a firm that acquired Apache Canada and has turned these leases right into a moneymaker at a degree that few firms can evaluate to. The reason being that this previously dry fuel producer has now centered on wealthy fuel, the place the “wealthy” half may be very high-value condensate.

The dividend was raised 20% when the final article got here out. Nonetheless, when condensate is a big a part of the manufacturing combine, then the corporate “has a license to print cash” even when pure fuel costs decline. That is yet one more firm that manages to develop manufacturing, pay a dividend, and typically throw in an additional dividend for good measure. Even doing all that, the financial institution line stays vast open.

Earnings

Whereas a lot of the pure fuel business is struggling to get previous breakeven, this firm had a “comparatively” low quarter that many rivals dream of through the growth occasions.

(Word: Paramount Sources Is A Canadian Firm That Experiences Utilizing Canadian {Dollars} Until In any other case Said.)

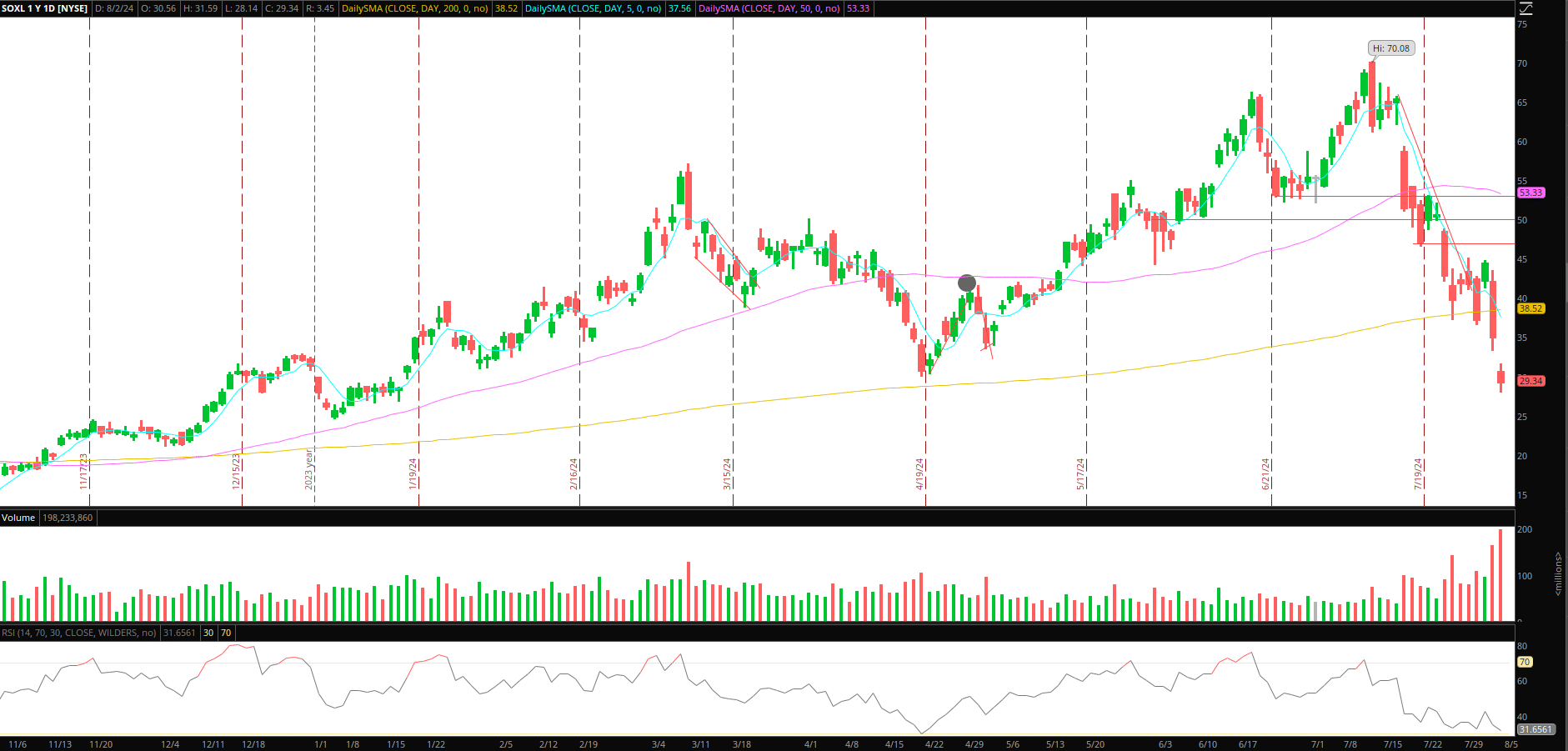

Paramount Sources Abstract Of Operations Development Second Quarter 2024 (Paramount Sources Supplemental Monetary Statements Second Quarter 2024)

Word that web revenue is sort of 19% of income. That is occurring when a lot of the business is ready for a pure fuel pricing restoration. When that occurs, that web revenue proportion will broaden as properly. Needless to say the common company studies web revenue of roughly 5% of gross sales, and most pure fuel firms are struggling to carry the losses down. This firm is in a category all its personal.

Similar to that vast web revenue proportion is the truth that money move is sort of 50% of revenues. By now, it ought to be dawning on the reader that the wells drilled listed below are extraordinarily worthwhile. That is true even when pure fuel costs are comparatively weak, as they’re now.

This can be a firm that bought to a whole lot of locations first earlier than anybody else discovered that the brand new expertise would allow completely different areas to profitably recuperate oil and fuel. As a result of it bought there first, it has among the finest acreage in North America.

Netback Calculation

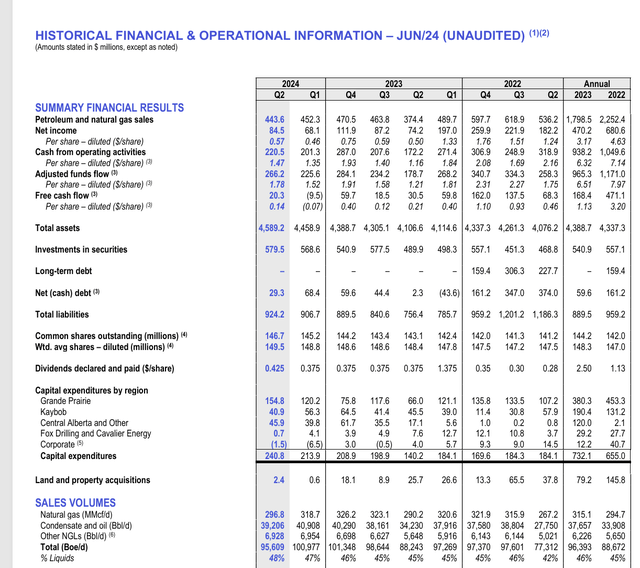

The netback stays an enormous proportion of income as a result of condensate is a premium product in Canada that’s price greater than gentle oil.

Paramount Sources Gross sales Value Development And Netback Calculation (Paramount Sources Supplemental Monetary Statements Second Quarter 2024)

Although the condensate is way lower than half of the manufacturing, it has a clearly outsized impact on the common gross sales worth. Mix that with the per barrel prices which might be a lot nearer to a dry fuel producer than an oil producer, and the corporate has a fantastically worthwhile mixture.

Whereas the development is clearly decrease for netback, it’s nonetheless in an amazing place in comparison with many rivals. The money flood is decrease, however it’s nonetheless a relative money flood.

Free Money Circulation

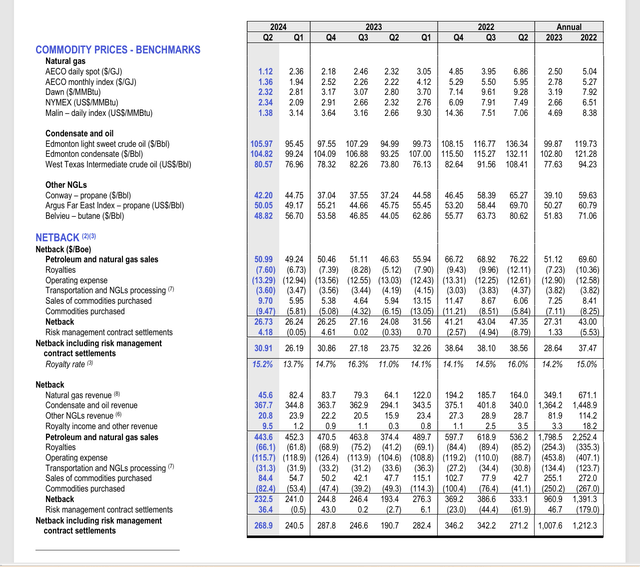

Because the firm does select to develop manufacturing, that does have an effect on free money move. Free money move would possible be increased if administration elected to only keep manufacturing.

Paramount Sources Free Money Circulation Calculation (Paramount Sources Supplemental Monetary Statements Second Quarter 2024)

This is among the few firms which might be financially in a position to subtract the capital funds from the adjusted funds move and nonetheless has free money move even when administration decides to spend some huge cash, as they clearly did within the newest quarter.

On the identical time, administration has famous that they’re withholding some dry fuel manufacturing from the market till pure fuel costs recuperate. That can have an effect on the manufacturing reported for the fiscal 12 months. Administration has chosen to drill worthwhile wells whereas shutting down unprofitable manufacturing. If all the things that is ready to produce is actively produced, then manufacturing will develop. In any other case, the manufacturing will are available on the low finish of steering and when pure fuel costs recuperate, there can be an uptick in manufacturing.

Effectively Efficiency

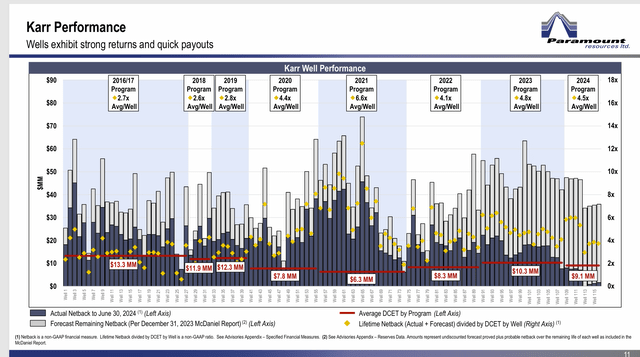

The Karr properly efficiency is proven under. The factor to notice is that lots of the 2024 wells are already close to payback regardless that that is the second quarter report.

Paramount Sources Karr Effectively Efficiency Historical past (Paramount Sources Company Presentation August 2024)

One other factor to notice is all of the paybacks that this firm is getting from these wells. In america, probably the most worthwhile basin is probably going the Permian. However the paybacks related to what’s seen right here can be a choose a part of the Permian acreage that an organization like Occidental Petroleum (OXY) possible already has underneath management.

Wapiti

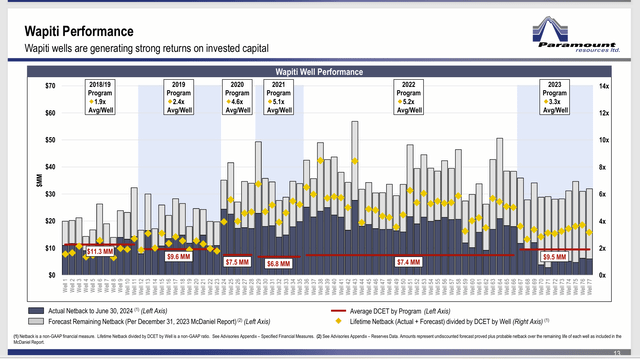

The Wapiti and Karr characterize greater than half of the corporate’s manufacturing. This offers the investor an concept as to the acreage benefit that this firm has over many firms that I observe.

Paramount Sources Wapiti Effectively Efficiency Historical past Development (Paramount Sources Company Presentation August 2024)

Clearly this space plus the one earlier than level to some superb properly outcomes. This will evaluate with among the business giants in profitability. Very seldom does an organization of this dimension reveal wells which might be this worthwhile.

Different Holdings

In addition to the apparent operations, this firm has holdings in different non-public and public firms. Generally the corporate will supply to merge with one in every of these firms. Different occasions administration elects to promote half or all the holdings. However there’s a “form of” mutual fund operation along with the upstream operations.

Abstract

By any measure, this firm had an amazing quarter, even when that quarter was decrease than some latest earnings studies. Paramount Sources operates at a really completely different degree from many of the upstream firms I observe. It will take fairly a downturn for this firm to lose cash. The remainder of the business can be in far worse form.

The shocking factor about that is administration continues to search out new areas that can possible hold the longer term profitability very excessive. Paramount Sources continues to be a powerful purchase. Even when United States traders should pay the withholding tax (as a result of it’s not in a retirement account) this explicit firm is probably going to offer not solely good revenue but additionally capital beneficial properties properly into the longer term.

That is one in every of only a few debt-free firms that I observe that may develop manufacturing whereas paying a dividend. A particular dividend and probably share repurchases could also be future concerns. As it’s now, the month-to-month dividend alone is near yielding what many traders report as a complete return.

As a debt-free firm, this upstream producer would possibly enchantment to conservative traders, regardless of the volatility of the upstream enterprise typically. Not often do debt-free firms get into severe hassle. In actual fact, finally, this sort of firm will usually command a premium to many within the business because the conservatism turns into recognized.

The business is topic to extraordinarily fast-moving and risky situations. Subsequently, the street forward might be very bumpy. However the regular progress and the dividend will possible not less than double the worth of your shares each 5 years on common.

Oil and fuel has been out of favor for a while. That can change down the street. When it does, the price-earnings ratio enlargement may supply extra capital appreciation. Sometimes, firms like this commerce for ten to fifteen occasions earnings in regular (typically even growth) occasions. However the inventory is now buying and selling in that vary regardless that earnings are depressed by decrease pure fuel costs.

With extra regular pure fuel costs, it is a firm that may earn not less than C$1 per quarter and as much as $1.50 per quarter relying upon the liquids pricing on the identical time. The regular manufacturing progress will likewise affect that chance for the higher as time advances.

Dangers

This can be a family-run firm that tends to be financially conservative. The founder (who handed away a while in the past) was undoubtedly not as conservative. Nonetheless, ought to this technique change, it may change the danger degree of the funding.

Any upstream firm is topic to the volatility and low visibility of upstream costs. A extreme and sustained commodity worth decline can change the corporate’s outlook. The robust funds make sure that this firm can shut down unprofitable manufacturing whereas cashing checks for no matter manufacturing is bought. Administration would then have the choice of borrowing to revive manufacturing ranges ought to that change into obligatory.

The household does management sufficient inventory to manage the board of administrators and the course of the corporate. Some public shareholders really feel that may be a drawback. Others just like the household management. It’s actually a private analysis.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.

[ad_2]

Source link