[ad_1]

Nataly Hanin

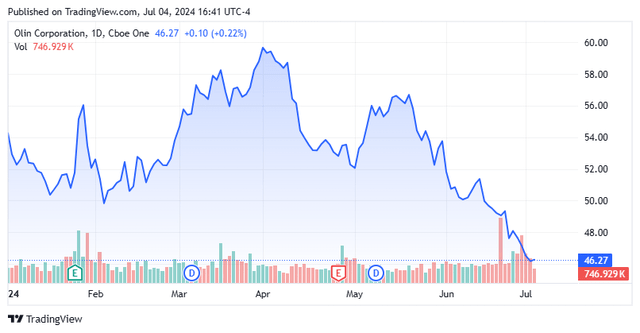

At the moment, we’re going to put chemical producer Olin Company (NYSE:OLN) within the highlight. The inventory is promoting at a greater than affordable valuation primarily based on FY2025 earnings estimates. Nonetheless, the corporate may discover itself a “goal” in what appears to be like like one other contentious election season, given its position in producing ammunition by way of its well-known Winchester model. As well as, analyst corporations give a variety of revenue estimates for the corporate’s subsequent fiscal 12 months. The shares are down almost 15% 12 months thus far. Purchase, Promote, or Maintain? An evaluation follows under.

Looking for Alpha

Olin Company is headquartered in the course of heartland in Clayton, MO. The corporate manufactures and distributes chemical merchandise each in the US and globally. Olin Company has three principal enterprise segments: Chlor Alkali Merchandise and Vinyls; Epoxy; and Winchester. The inventory at the moment trades round $46.00 a share and sports activities an approximate market capitalization of $5.5 billion.

Clearly, the corporate’s Winchester division all the time makes election years tougher, given the rhetoric round “gun management” all the time ratchets up by way of election day in early November. Issues look no totally different in 2024 because the U.S. Surgeon Normal declared gun violence a ‘public well being disaster’ on the finish of June.

Current Outcomes:

Olin Company posted its Q1 numbers on April twenty fifth. The corporate delivered GAAP earnings of 40 cents a share. Revenues fell simply over 11% on a year-over-year foundation to $1.63 billion. Each the highest and the underside line barely missed consensus analyst estimates.

April 2024 Firm Presentation

Revenues have been down two p.c within the firm’s Chlor Alkali Merchandise and Vinyl division. Nonetheless, Adjusted EBITDA was up seven p.c as a consequence of decrease materials prices and working efficiencies.

April 2024 Firm Presentation

Revenues rose 9 p.c in Olin’s Epoxy enterprise section. This division administration to put up barely optimistic Adjusted EBITDA, a turnaround from the unfavourable efficiency in 1Q2023.

April 2024 Firm Presentation

Lastly, the corporate’s Winchester enterprise noticed gross sales rise 4 p.c because the division is getting a pleasant enhance from army gross sales. Adjusted EBITDA rose 9 p.c because of the identical components as its Chlor Alkali Merchandise and Vinyl division. The section’s gross sales benefited from White Flyer Targets. This small acquisition was funded by money available and was accomplished final October. White Flyer manufactures and sells leisure entice, skeet, worldwide and sporting clay targets and was a strategic “bolt on” buy. The corporate additionally simply opened the Military’s next-generation squad weapon ammunition plant. This small caliber ammunition plant can be operated by Winchester however owned and funded by the military.

Administration supplied the next value targets for FY2024 as nicely.

April 2024 Firm Presentation

Analyst Commentary & Steadiness Sheet:

The analyst neighborhood has blended views on Olin Company at the moment. Since first quarter outcomes hit the wires, seven analyst corporations, together with Citigroup, Piper Sandler and Stifel Nicolaus have reissued/assigned Purchase/Outperform scores on the inventory. Worth targets proffered vary from $54 to $75 a share. Wells Fargo ($60 worth goal), Barclays ($59 worth goal) and Deutsche Numis ($57 worth goal) have maintained Maintain scores on the inventory

Two insiders disposed of almost $5 million value of shares in late February, collectively at a median of close to $53.00 a share. That’s the solely insider exercise within the shares up to now in 2024. In keeping with the 10-Q filed for the primary quarter, Olin has roughly $151 million value of money and marketable securities on its steadiness sheet towards almost $2.7 billion value of long-term debt. Roughly one third of that are variable fee liabilities.

April 2024 Firm Presentation

That stated, the corporate has decreased debt by some $1.2 billion from FY2021-FY2023, even whereas shopping for again a formidable $2.3 billion value of its personal inventory. Its Web Debt/Adjusted EBITDA ratio is round two, and Olin has no important debt maturities till 2027. Web curiosity expense was $43.8 million within the first quarter, a slight rise from $41.3 million in the identical interval a 12 months in the past.

Conclusion:

Olin Company made $3.89 a share in FY2023 on $6.83 billion in income. The present analyst agency consensus has earnings dropping a bit to $3.51 a share in FY2024, at the same time as gross sales rise barely to $6.98 billion. They mission income to rebound to only over $5.75 a share in FY2025 on 10% income development. It must be famous that revenue estimates vary from $3.94 to $8.45 a share for the 2025 fiscal from the 16 analyst corporations which have supplied up projections.

OLN at the moment trades at eight occasions FY2025E EPS and sports activities a simply over 1.7% dividend yield. The shares are lower than 10% away from the lows they hit within the again half of October on the tail finish of the market swoon final summer season. Now, chemical firms virtually all the time commerce at strong reductions to the general market, because of the cyclicality of the business. Nonetheless, Olin Company inventory appears to be entering into cut price territory.

Enormous chemical concern Dow, Inc. (DOW) is projected to have flat gross sales this 12 months however is buying and selling at 13 occasions FY2025E EPS. It must be famous that Dow has a simply over 5 p.c dividend yield, which accounts for a giant chunk of the valuation distinction. Olin prefers to return money to shareholders by way of inventory repurchases.

Subsequently, whereas the inventory isn’t a screaming purchase, there may be sufficient worth right here to begin to accumulate a place in entrance of what appears to be like to be a rebound 12 months in 2025. Choices can be found towards this fairness, making a lined name technique viable, and that’s how I plan to provoke a small starter place in Olin.

[ad_2]

Source link