[ad_1]

Sergei Dubrovskii

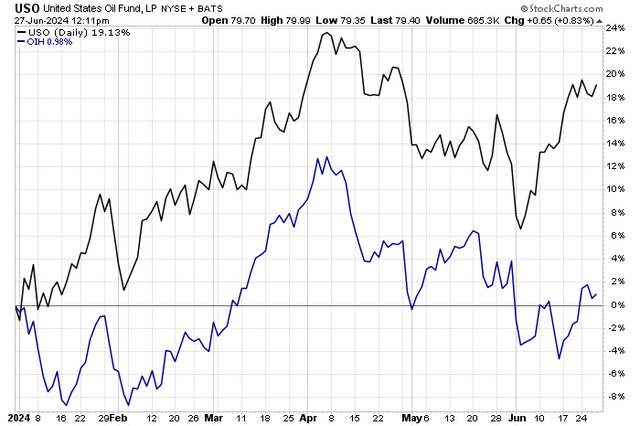

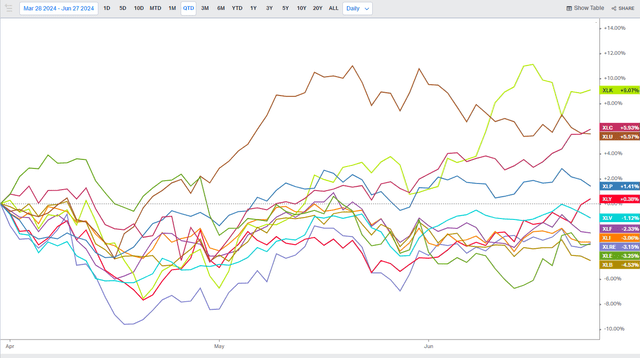

Oil costs have been marching greater because the summer time driving season will get into full swing. Whereas each WTI and Brent are in rally mode, Power-sector shares are lagging. For the second quarter, the Power SPDR Choose Sector ETF (XLE) is poised to print a damaging return. So too are shares of oil and fuel corporations within the providers area of interest of the vitality house.

I reiterate a maintain ranking on the VanEck Oil Providers ETF (NYSEARCA:OIH). I see the fund as fairly valued, however its momentum continues to run mushy forward of a considerably bearish seasonal stretch. Since I final reported on OIH, shares are about flat in comparison with an S&P 500 whole return of greater than 20%.

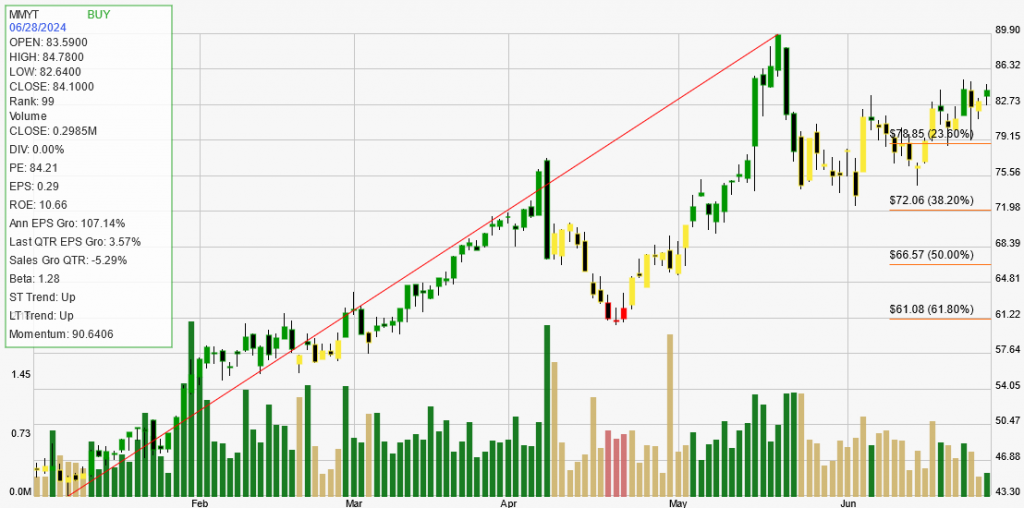

OIH ETF Underperforming the SPX & Crude Oil ETF

Stockcharts.com

Power Sector Pink in Q2

Koyfin Charts

In accordance to the issuer, OIH seeks to copy as intently as doable, earlier than charges and bills, the value and yield efficiency of the MVIS US Listed Oil Providers 25 Index, which follows the general efficiency of US-listed corporations concerned in oil providers to the upstream oil sector, which embrace oil tools, oil providers, or oil drilling. The index contains probably the most liquid corporations within the business based mostly on market capitalization and buying and selling quantity, and can usually personal the biggest oil drillers and oil providers corporations. The ETF might maintain each US and international shares.

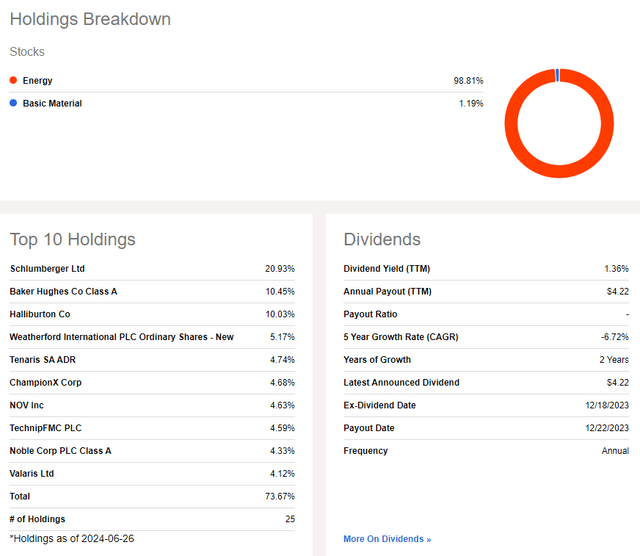

OIH has misplaced belongings up to now seven months. Complete belongings beneath administration is now simply $1.8 billion in contrast with greater than $2 billion final November. The fund includes a cheap annual expense ratio of simply 0.30% whereas its trailing 12-month dividend yield is about on par with that of the SPX at 1.36% as of June 26, 2024.

Looking for Alpha charges OIH properly in the case of its share-price momentum developments, however I’ll spotlight a differentiated stance later within the article. The ETF can be thought of dangerous given its excessive historic normal deviation developments and a portfolio that’s concentrated in only a few main oil & fuel providers shares. Nonetheless, liquidity metrics are wholesome given the fund’s common every day quantity which is north of 350,000 shares, and a median 30-day bid/ask unfold of seven foundation factors.

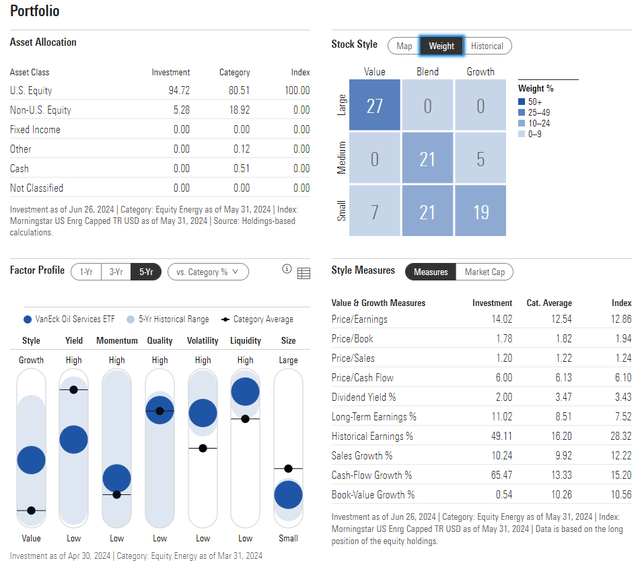

Digging into the fund’s fundamentals, the 1-star, Impartial-rated ETF by Morningstar has combined publicity throughout the fashion field. The plurality of OIH is taken into account large-cap worth, however there’s ample SMID cap entry, which is a threat ought to financial circumstances deteriorate over the approaching quarters. OIH has additionally turned a bit costlier in comparison with the price-to-earnings ratio from This fall 2023. Its 14.0x earnings a number of is affordable given a long-term EPS development charge above 11%, leading to a good PEG of 1.27, under that of the S&P 500.

OIH: Portfolio & Issue Profiles

Morningstar

Potential traders ought to pay attention to OIH’s elevated publicity to a few shares: SLB (SLB) (previously Schlumberger), Baker Hughes (BKR), and Halliburton (HAL). These names are extremely delicate to cost modifications in oil. General, the highest 10 positions account for nearly three-quarters of OIH.

OIH: A Concentrated Allocation

Looking for Alpha

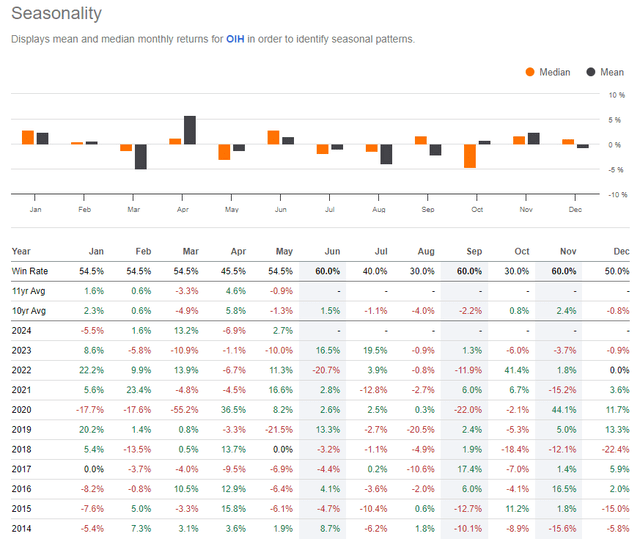

Whereas an energetic hurricane season is probably going in retailer, the July via October interval has traditionally been a weak stretch for OIH. The beginning of the second half can function volatility, so potential traders must be significantly cautious when recognizing entry factors. However let’s assess the chart scenario to see the place there could possibly be a good shopping for zone.

OIH: Bearish July-September Seasonals

Looking for Alpha

The Technical Take

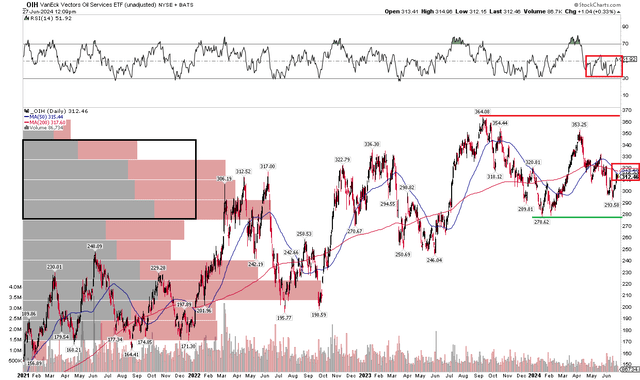

Together with a steeper valuation at present, OIH’s technical chart has turned much less spectacular. Discover within the graph under {that a} broad uptrend was in place from the second half of 2020 via a lot of the third quarter of final yr. However the Power ETF did not notch a brand new excessive on a rally try through the first few months of 2024. I see an rising buying and selling vary with resistance within the mid-$300s and help within the excessive $200s.

Additionally check out the long-term 200-day shifting common – it is now negatively sloped after many quarters of trending up. That tells me that the bears are grabbing maintain of the first development. And with a excessive quantity of quantity by worth within the $280 to $340 zone, that solely serves as additional proof of a worth consolidation. Furthermore, the RSI momentum oscillator on the high of the graphs exhibits mushy momentum developments all through the second quarter.

General, OIH’s chart is lower than spectacular contemplating the broader market’s advance this yr.

OIH: An Rising Buying and selling Vary

Stockcharts.com

The Backside Line

I reiterate a maintain ranking on OIH. The fund has really turned a contact costlier whereas technical momentum developments are usually not all that encouraging as we enter a dicey seasonal stretch.

[ad_2]

Source link