[ad_1]

ugurhan

Obsidian Vitality’s (NYSE:OBE)(TSX:OBE:CA) Q2 2024 outcomes had been strong, with manufacturing averaging 35,773 BOEPD regardless of a unfavourable affect of 1,550 BOEPD from blockades.

Obsidian’s dispute with the Woodland Cree First Nation has been resolved with an settlement that lasts till the tip of 2025. This clears Obsidian to attain important heavy oil manufacturing progress throughout the second half of the 12 months, though weaker oil costs could restrict its free money movement.

Obsidian seems to be a fairly strong worth now, with estimated upside to US$8.50 per share in a longer-term US$75 oil situation. Dangers embrace the diminished near-term free money movement (as a consequence of weaker oil costs) and comparatively excessive credit score facility utilization after its Peace River acquisition.

This report makes use of US {dollars} until in any other case famous, together with an alternate fee of US$1.00 to CAD$1.35.

Dispute Decision

Obsidian was in a dispute with the Woodland Cree First Nation, however ended up reaching an settlement in early-to-mid June with the help of a mediator. The phrases of the settlement weren’t launched, however the settlement ended the blockades and allowed Obsidian to restart the affected Peace River manufacturing. The settlement runs till the tip of 2025.

The blockades ended up decreasing Obsidian’s Q2 2024 manufacturing by round 1,550 BOEPD, which interprets into roughly 385 BOEPD of full-year affect.

Obsidian had beforehand included a 200 BOEPD full-year affect from the blockades in its manufacturing steering. I had famous that the blockades would should be lifted by the tip of Could to restrict the affect to 200 BOEPD and that there was a threat of a larger affect to full-year manufacturing.

2H 2024 Outlook

Obsidian averaged 35,773 BOEPD in Q2 2024 regardless of the affect of the blockades. I’m presently modeling its 2H 2024 manufacturing at 37,400 BOEPD, which might get it to close 200 BOEPD under the mid-point of its full-year steering. That 200 BOEPD distinction displays the extra affect of the blockades lasting into early-to-mid June.

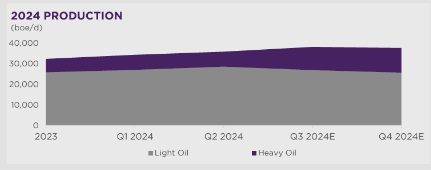

2024 Manufacturing (obsidianenergy.com (August 2024 Presentation))

Obsidian’s manufacturing progress is being fueled by heavy oil, which can develop to round 11,400 barrels per day in 2H 2024 as a consequence of its Peace River acquisition plus improvement efforts.

The present strip for 2H 2024 is roughly $71 to $72 WTI oil. At that oil value, Obsidian could possibly generate round US$291 million in 2H 2024 revenues after hedges. Obsidian was unhedged on oil after August, however has some AECO hedges till March 2025.

Kind

Models

$ US/Unit

$ Million US

Mild Oil And NGLs [BBLs]

2,774,720

$60.00

$166

Heavy Oil [BBLs]

2,097,600

$49.00

$103

Pure Gasoline [MCF]

12,055,680

$1.20

$14

Hedge Worth

$8

Complete Income

$291

Click on to enlarge

This leads to a projection of US$155 million in 2H 2024 EBITDAX for Obsidian.

$ Million US

Income

$291

Much less: Working Expense

$72

Much less: Transportation

$19

Much less: Royalties

$37

Much less: Money G&A

$8

EBITDAX

$155

Click on to enlarge

Primarily based on Obsidian’s full-year capex price range, it expects round US$120 million in 2H 2024 capex. Obsidian additionally expects roughly US$20 million in mixed decommission bills and curiosity prices for 2H 2024.

Thus Obsidian could possibly generate round US$15 million in 2H 2024 free money movement. It had round US$320 million in internet debt on the finish of Q2 2024, so the free money movement might scale back its internet debt to round US$305 million by the tip of 2024. This doesn’t take note of potential spending to repurchase extra shares.

Obsidian’s internet debt on the finish of 2024 is anticipated to be round 1.0x annualized 2H 2024 EBITDAX, which seems affordable. Nevertheless, Obsidian had over 80% utilization of its credit score facility on the finish of Q2 2024 after paying for its Peace River acquisition, so it’ll seemingly wish to scale back that u.

Estimated Valuation

I now estimate Obsidian’s worth at roughly US$8.50 per share. That is primarily based on US$75 WTI oil after 2025 and a roughly 3.0x EV/EBITDAX a number of at Obsidian’s 2H 2024 manufacturing ranges.

This additionally assumes present strip (of about US$66 WTI oil in 2025), with Obsidian’s worth adjusted for the comparatively decrease projected free money movement subsequent 12 months.

At 2H 2024 manufacturing ranges, Obsidian ought to be capable of generate round US$340 million EBITDAX over a full 12 months at US$75 oil.

Obsidian had mentioned ramping up manufacturing to 42,000 BOEPD in 2025 and 50,000 BOEPD in 2026, however because of the decrease strip costs I’ve assumed that it’ll reduces its progress plans in favor of extra free money movement technology.

Obsidian’s Peace River outcomes proceed to be encouraging, with its Dawson 5-27 Pad averaging an IP-30 of 293 barrels of oil per day per effectively (over two wells). Early outcomes for its three effectively Dawson 13-13 Pad concerned IP-15 of 336 barrels of oil per day per effectively.

Conclusion

Obsidian Vitality is anticipated to develop its heavy oil manufacturing to round 12,000 barrels per day by This autumn 2024. It beforehand anticipated to develop heavy oil to 24,000 barrels per day by 2026, however could scale back its progress expectations to prioritize free money movement technology if oil costs stay weak. At present 2025 strip of round US$66 WTI oil, Obsidian could notice within the mid-$40s (US {dollars}) for its heavy oil.

Obsidian’s inventory ought to have first rate upside even with out important manufacturing progress although. I estimate its worth at US$8.50 per share in a long-term US$75 WTI oil situation primarily based on 2H 2024 manufacturing ranges.

[ad_2]

Source link