[ad_1]

Michael Vi

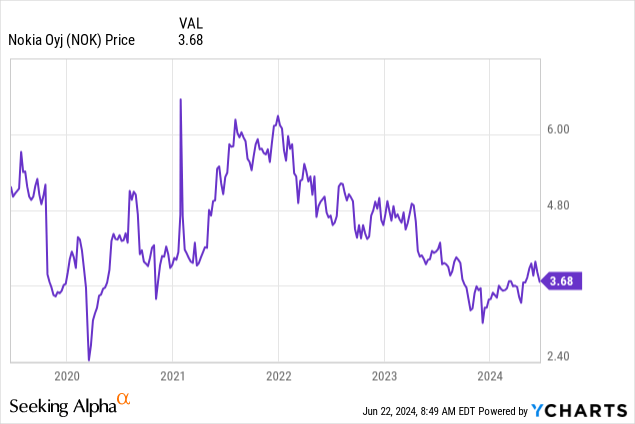

Nokia Oyj (NYSE:NOK) traders have been rightfully upset by the corporate’s efficiency lately. Each time I learn feedback below articles on NOK right here on Searching for Alpha, I see many individuals who had as soon as believed in a turnaround however have given up their hope. Even since my final article on NOK from September 2023, during which I reviewed the potential of a restoration in 2024, the inventory has declined one other 9%, not contemplating dividends. Virtually one 12 months later, the state of affairs has seemingly worsened as Nokia’s income has been declining by double digits over the past three quarters.

Whereas I nonetheless do not discover NOK to be a sensible funding for the time being, I do preserve the inventory on my watchlist, and there have been some constructive information these days concerning Nokia’s new promising partnerships within the areas of AI, 5G, and personal networks. If the corporate manages to revenue from these offers, it’d lastly return to income progress within the coming years. Coupled with anticipated margin growth, this makes the inventory fascinating to observe within the subsequent quarters.

Nokia’s partnership base is rising and now contains outstanding AI names like Nvidia, Dell, and Google

Over the previous few months, Nokia has been making an elevated variety of headlines by increasing its partnership community. It appears that evidently the corporate is actively attempting to show itself round by exploring alternatives particularly within the areas of AI and 5G.

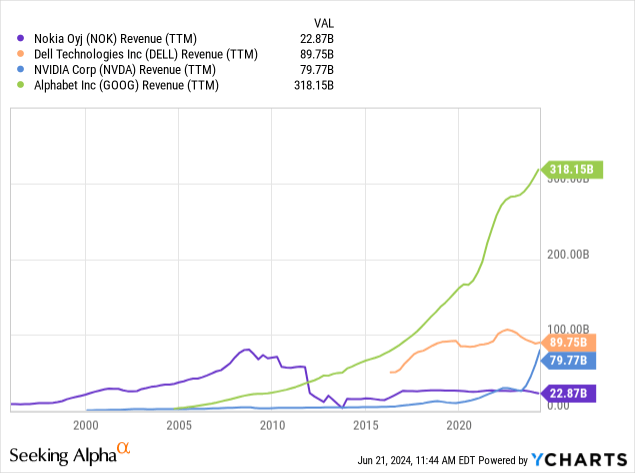

Again in February this 12 months, Nokia unveiled a brand new cope with Nvidia (NVDA) and an prolonged partnership with Dell (DELL); the 2 firms are on the forefront of AI-focused {hardware}.

The partnership with Nvidia focuses on “AI-ready radio entry community options,” which is a means of claiming that Nokia will use Nvidia tech in its RAN (Radio Entry Community) and Cloud RAN options; the latter is a crucial expertise for edge computing, which is commonly thought to be important for AI improvement.

In accordance with the corporate, this can be a continuation of their anyRAN method which lets prospects construct communications infrastructure quick, utilizing {hardware} and software program from varied distributors interchangeably. Tommi Uitto, President of Cell Networks at Nokia:

This is a crucial collaboration with NVIDIA that can discover how synthetic intelligence can play a transformative function in the way forward for our business. It’s a additional instance of our anyRAN method that’s serving to to make Cloud RAN a industrial actuality.

The partnership with Dell is reported to work each methods: Nokia will use infrastructure options from Dell whereas the latter will make Nokia its most well-liked non-public wi-fi companion for enterprise edge use circumstances. From what I learn, this deal is once more centered on high-scale edge computing options, which suggests Nokia seemingly goals to extend its AI publicity right here.

Extra lately, Nokia introduced it would workforce up with one other AI participant, Alphabet (GOOG)(GOOGL). In accordance with the corporate, Google’s options like Vertex AI and Gemini 1.5 Professional will turn into obtainable in its Community as Code platform, which is able to run on Google Cloud. This could allow builders to “create new 5G enterprise and shopper purposes sooner for his or her prospects,” enabling entry to widespread AI fashions of their purposes. In flip, Google Cloud customers ought to achieve entry to standardised 5G community capabilities by Nokia’s platform.

There have been loads of network-focused partnerships unveiled within the current months as properly:

Telefónica’s (TEF) German unit, O2, will use software program from Nokia to shift its 5G prospects to Amazon (AMZN) Internet Providers cloud. Ned Zealand-based communication supplier 2degrees chosen Nokia’s 5G core Registers and Shared Information Layer software program. Japan-based Rakuten Cell chosen Nokia to produce RAN options supporting the low 700MHz spectrum band, which Rakuten obtained approval for in October 2023. Wipro (WIT) introduced it would type a joint 5G non-public wi-fi resolution with Nokia.

So general, Nokia appears to be working onerous on increasing its foothold in AI and personal 5G community options, clearly attempting to safe its future in these promising applied sciences.

The partnership community growth would possibly lastly give Nokia a lift

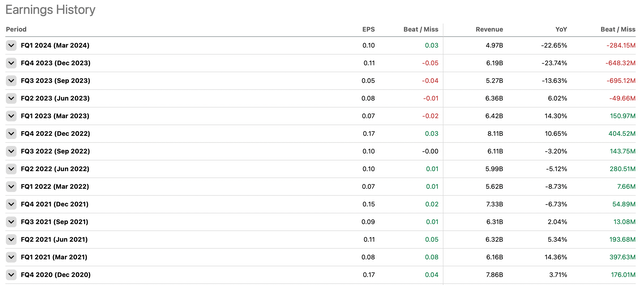

Pushed by its enterprise missteps, Nokia’s monetary efficiency has been in decline over the current quarters. Notably, earlier than the September 2023 quarter (FQ3 2023), the corporate had been on a comparatively strong monitor by way of income progress and constructive earnings. As I discussed in my earlier article in regards to the firm, Nokia’s administration confirmed prudent monetary administration with steadily growing margins and an honest internet money place.

Searching for Alpha

Nevertheless, the state of affairs began to alter in FQ3 2023, when the corporate didn’t meet income expectations regardless of doubling gross sales in India because of the low demand in North America. The issue solely exacerbated in FQ4 2023 when the corporate misplaced its contract with AT&T (T) to Ericsson (ERIC). It’s reported AT&T plans to spend about $3 billion a 12 months over its five-year contract with Ericsson, which may have been about 15% of Nokia’s yearly income.

From there, it’s evident Nokia’s new partnerships are essential for the company’s future efficiency. The mixed TTM income of the three AI firms Nokia made partnerships with is about $489 billion. If Nokia manages to seize simply half a p.c of that income, it may lead to an extra $2.5 billion per 12 months for the corporate, resulting in a greater than 10% enhance in gross sales. Clearly, that is simply an excessively optimistic guesstimate, however it nonetheless exhibits the numerous potential Nokia’s new partnerships maintain. Together with a number of new community offers, Nokia would possibly surpass the negligible 1% income progress estimate that the market tasks for the subsequent 3 years.

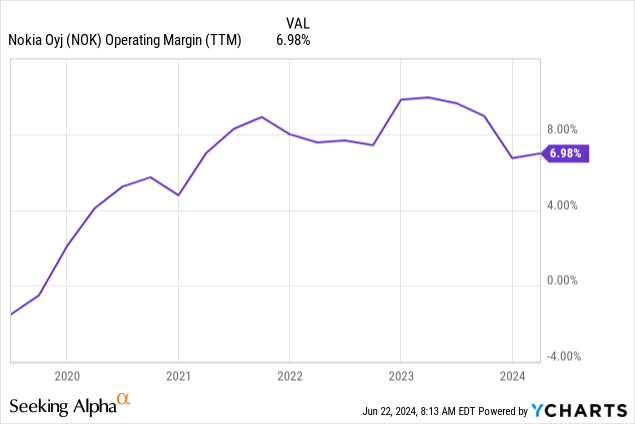

At the moment, the inventory is valued at round 12.6 occasions working revenue, with about 7% TTM working margin. In accordance with the administration, Nokia is on monitor to succeed in 13% working margin by 2026. Now, if the corporate grows its income nearer to high-end estimates for 2026, which is about $25.3 billion, and certainly reaches 13% working margin, NOK would possibly attain $41 billion market capitalization, utilizing the present a number of. That is about two occasions larger than the present quantity.

Once more, this can be a notably optimistic situation. Nevertheless, given the significantly low expectations set for the corporate, Nokia would possibly nonetheless shock the market because of the brand new offers and potential AI/5G developments. With about $4.5 billion in annual R&D spend, Nokia has the assets to leap on the technological prepare right here.

Key takeaways

To sum up, NOK has been a disappointing inventory over the past years other than some quick-lasting jumps fuelled by speculative buying and selling. The corporate has been constantly underperforming within the current years, from not assembly its personal income outlooks to shedding outstanding prospects like AT&T. Now, with a plethora of promising partnerships with such AI-driven firms like Nvidia, Google, or Dell and community offers with Wipro, Rakuten Cell, and O2, Nokia tries to revitalize its progress as soon as once more.

The efforts would possibly take a while to really begin impacting the corporate’s financials. Nevertheless, the brand new partnerships maintain vital potential for income and margin expansions, and below an optimistic situation, the inventory would possibly probably double by 2026. This makes the upcoming quarters fascinating to observe for early indicators of a return to progress. Till these indicators are evident, I nonetheless discover it wiser to observe NOK from the sidelines.

[ad_2]

Source link