[ad_1]

JHVEPhoto/iStock Editorial through Getty Photographs

I have been watching Nike (NYSE:NKE) shares for fairly some time, however I may by no means get sufficient to purchase any shares due to the valuation. I’m nonetheless not loopy in regards to the valuation, however I lastly did determine to begin shopping for some shares because of the large latest decline. The valuation remains to be not low cost, however Nike traditionally just isn’t a cheap inventory. Nevertheless, I do see some strategic plans being applied by Nike that would find yourself making this inventory look cheap in hindsight, however it’s too early to inform. I believe it is sensible to begin averaging into this inventory now and construct up a place over time. It’s onerous to say the place the precise backside is likely to be when a inventory plunges, and there are challenges remaining for Nike, so that’s the reason I’m planning to scale into this inventory. Let’s take a better have a look at Nike, which additionally owns Converse and Jordan manufacturers:

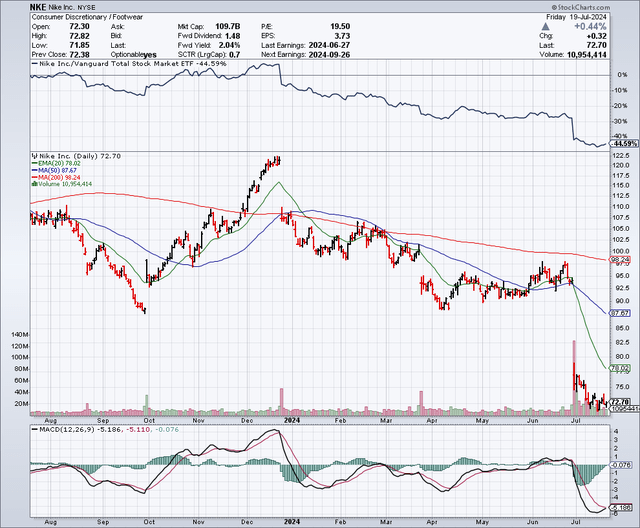

The Chart

Because the chart under exhibits, Nike shares rallied as much as round $120, late final 12 months. However the inventory trended decrease for many of 2024, and extra just lately it plunged all the way down to the low $70 degree. The 50-day shifting common is round $88 and the 200-day shifting common is simply over $98. It seems like Nike shares are beginning to backside out within the low $70 vary, and that is one motive why I’ve began to build up shares.

StockCharts.com

Earnings Estimates And The Steadiness Sheet

The consensus earnings and gross sales estimates proven under are sourced from In search of Alpha, and it exhibits stable earnings development potential within the subsequent couple of years. Nike shares typically commerce for about 30 occasions earnings, so it seems that the inventory is presently undervalued when contemplating historic averages.

Earnings Estimates

FY

EPS

YoY

PE

Gross sales

YoY

2025

3.16

-20.09%

23.15

$49.01B

-4.57%

2026

3.61

+14.42%

20.23

$51.85B

+5.79%

2027

3.97

+9.82%

18.42

$54.04B

+4.22%

Click on to enlarge

Nike has a really robust stability sheet with round $11.95 billion in debt and $11.58 billion in money. I see this stability sheet energy as an enormous useful resource for the corporate which permits it to extend the R&D funds in order that it could innovate, and it may additionally use among the money on the stability sheet to accumulate promising firms.

The Dividend

Nike pays a dividend of $0.37 per share on a quarterly foundation, and this totals $1.48 per share in dividends on an annual foundation. This affords a yield of simply over 2% and the payout ratio is about 36%, so it seems very safe and there’s loads of room to extend it. Nike has been persistently elevating the dividend annually for a few years, and I imagine it should proceed to take action.

Everybody Is Carrying Hoka

Once I exit, I discover that everybody appears to be sporting Hoka sneakers, which is owned by Deckers (DECK). Whether or not I’m on the native mall or throughout a latest journey to Disneyland with my household I see Hoka sneakers in every single place and I see them on a whole vary of individuals from younger to previous and in between. I really purchased a pair of Hoka sneakers and at first I didn’t like them as I felt they had been too squishy, however I attempted them once more after they sat round for a number of months, and now I put on them typically.

On Holding (ONON) can be making well-liked sneakers and that is yet one more instance whereby Nike appears to be falling behind newer manufacturers which can be revolutionary. I’m now feeling like Nike is the Intel (INTC) of the sportswear and shoe enterprise since Intel has been falling behind newer and smaller firms which have now leapfrogged Intel in some ways. However, Intel and Nike have an opportunity to show round, and this might result in massive good points, though it should probably take endurance for traders to reap potential rewards.

The China Drawback

China is a vital marketplace for Nike as a result of it generated about $7.5 billion from that nation in fiscal 2024, and this represents an space with long-term development prospects, as do different rising market nations. Nike is competing with different manufacturers in China together with “Li Ning” and “Anta” that are Chinese language sportswear firms. Along with being challenged with robust competitors from extra native Chinese language firms, it’s also experiencing challenges in China as a result of that nation is dealing with a slower financial system.

One other potential drawback is the rising commerce tensions between China and the U.S., which could get even worse going ahead. If further tariffs and protectionist measures are applied by China and the U.S., it may affect Nike’s monetary outcomes. This might additionally encourage Chinese language shoppers to purchase the aforementioned native manufacturers. A latest CNBC article states that President Biden is alleged to be contemplating extra restrictions on expertise exports to China and Donald Trump has mentioned he would put a 60% tariff on Chinese language items. This might result in China retaliating with tariffs on items from U.S. firms like Nike.

I See Girls’s Sports activities As A Large Potential Progress Driver For Nike

Nike is increasing sponsorships and endorsement offers, which has been essential and profitable for the corporate prior to now. The cope with Michael Jordan has been an enormous success and I see Nike is now pursuing offers with younger rising athletes. For instance, Nike just lately introduced that it signed ladies’s basketball star Caitlin Clark. Girls’s sports activities is getting extra well-liked and I see this as a wise transfer that would repay massive for Nike sooner or later. Many individuals are noticing this surge in reputation for girls’s sports activities and that features Bob Iger, the CEO of Disney (DIS), who just lately made a big funding within the Angel Metropolis Soccer Membership, which is probably the most priceless ladies’s skilled sports activities group. I see ladies’s sports activities as an enormous potential development driver for Nike going ahead, specifically as a result of this section of the sports activities world is rising and extra money than ever is being invested to advertise and increase ladies’s sports activities.

Right here Are Some Positives I See For Nike

1) The Paris Olympics: This world sporting occasion will begin in only a matter of days, and a serious world sports activities occasion like this tends to deliver out the athlete in all of us. Watching superb athletic talents on tv can be inspiring for a lot of followers world wide and that would result in robust gross sales of sportswear objects within the coming weeks and months. Nike is sponsoring many athletes within the Paris Olympics, so there would be the potential for a big quantity of display screen time displaying medal winners sporting Nike gear.

I can see that Nike goes “massive” with the Paris Olympic video games and there is a few explanation why I imagine they may see a lift in revenues from this occasion. Nike is sponsoring key athletes together with U.S. sprinter Sha’Carri Richardson and a Kenyan marathoner named Eliud Kipchoge, and it just lately launched 13 shoe prototypes that had been developed by athletes. Nike administration is spending some huge cash on the Paris video games, and I believe this is sensible as a result of that is the primary Summer time Olympic video games to happen after the height of Covid. The 2020 Tokyo video games had been deeply impacted by Covid, so firms like Nike are far more eager for the Paris video games. A latest article factors out the large media spend by Nike and it states:

“This Olympics can be our largest…it is going to be our largest media spend,” Heidi O’Neill, president of client, product and model at Nike mentioned in an interview. “This would be the most funding and the largest second for Nike in years,” she added, with out placing a determine on the quantity of spending deliberate.

2) Nike Has A Turnaround Technique: I’ve been studying by way of Nike’s press releases and monetary studies and I see indicators of renewed concentrate on the model, in addition to innovation and value slicing. This exhibits me that administration acknowledges that they’ve an issue and have fallen behind in some areas. I believe that is good to see as a result of it seems like firm administration is not resting on the laurels of the Nike model and it’s not in denial that some opponents have made massive strides. I believe the error some traders are making now’s that they’re promoting this inventory at or close to 52-week lows as a result of latest monetary outcomes and steerage weren’t thrilling. However this may very well be the purpose whereby administration has made and is making the strikes it must reignite development and pleasure across the model. Nevertheless, it’s simply too early for it to indicate up within the outcomes.

When studying the latest earnings name transcripts, I see that Nike is utilizing its robust stability sheet to extend funding in a number of areas so as to speed up new product cycles and to innovate as nicely. Nike is utilizing superior digital instruments to speed up the design of recent merchandise and they’re asking key product suppliers to hurry up product testing and manufacturing occasions. The corporate states it has kicked off a multi-year innovation cycle.

It is clearly not a provided that administration will succeed, however I see it as a horny danger/reward ratio as a result of you should purchase the inventory close to 52-week lows proper now and accumulate it on further weak point within the coming months. The present worth degree suggests expectations are low, and I imagine affected person traders who accumulate now may very well be rewarded if any of the administration initiatives are profitable and begin to present up within the monetary outcomes. I believe we may see some pleasure within the Nike model and stronger gross sales this summer season, for the reason that Paris Olympics will showcase so many Nike merchandise, however we must wait till subsequent quarter to see the affect, if any.

Past the Olympics, there are different catalysts and development drivers I see for Nike which may take a few quarters earlier than actually displaying up within the monetary outcomes. For instance:

Nike just lately rehired a senior government named Tom Peddie so as to enhance and enhance relationships with retailers. I imagine it may take one or two quarters for the rehiring of this high government to supply outcomes.

Nike is implementing a multi-year plan to cut back bills by $2 billion. This plan contains layoffs and different cost-cutting measures. I see this as having vital potential to spice up earnings within the subsequent 12 months or two. This is why: Nike has simply over 1.5 billion shares excellent, so if administration is profitable at slicing prices by $2 billion, this is able to probably be equal to including about $1.33 to earnings, if these price cuts efficiently drop all the way down to the underside line. That might probably be a big further supply of earnings development, particularly for the reason that earnings estimates for fiscal 12 months 2025 are simply over $3 per share.

3) Nike Investor Day This Fall: Nike hasn’t had an investor day for a number of years, however it’s planning one for this Fall. I believe that is one other signal that administration is stepping up and needs to get the corporate again to its former glory. I imagine the CEO will wish to show skeptics incorrect by introducing some revolutionary new merchandise this Fall, which can be an effective way to comply with up on the brand new product launches which can be coinciding with the Paris Olympics. In a latest article an analyst named Lorraine Hutchinson summed up this occasion which the CEO of Nike additionally appears to be enthusiastic about; the article states:

“Hutchinson additionally notes that Nike’s autumn Investor Day, the primary in seven years, ought to generate pleasure and demand for its new merchandise, a part of what CEO John Donahoe referred to as “a strong pipeline of innovation.”

Why The Present Valuation Metrics Intrigue Me

Traditionally, Nike shares have typically traded for about 30 occasions earnings, however it presently trades for a worth to earnings ratio that’s within the very low 20 vary. Moreover, I see present earnings estimates as being depressed in comparison with what I count on within the coming quarters and past. I additionally count on Nike to see a lift in earnings because of the $2 billion price financial savings plan, which as I calculated, may result in $1.33 per share to the underside line. Primarily based on my calculations, if Nike can deliver $1.33 per share to the underside line (by way of the $2 billion in price financial savings), and get again to a 30 occasions worth to earnings ratio, this alone may tack on practically $40 per share to the inventory worth ($1.33 in further potential earnings multiplied by a 30 worth to earnings ratio). I additionally imagine that Nike has an enormous alternative with rising ladies’s sports activities stars like Caitlin Clark, and the surging reputation in ladies’s sports activities.

I do count on a lift in revenues to happen throughout and after the Paris Olympics, which would be the first in a number of years to not be impacted considerably by Covid. Traditionally, Nike sees a big increase in revenues from the Olympic Video games and I imagine that would be the case right here as nicely. I imagine Nike goes all out now to reclaim its throne. It has just lately launched a line of sneakers that can retail for lower than $100, and this could enchantment to many shoppers. As one latest article states, Nike sometimes sees a virtually 10% gross sales enhance throughout an Olympic quarter, and it additionally mentioned that Nike goes to deliver again a purple, white and blue Air Jordan shoe on the finish of the Olympics, which has not been offered since 2000. I imagine this and different latest product launches could have a really optimistic affect and that’s the reason the present valuation of this inventory intrigues me.

Potential Draw back Dangers

I see plenty of company-specific dangers in addition to macro dangers that would result in potential draw back for Nike shares. Administration won’t reach preventing off a rising variety of youthful and really revolutionary firms. I believe it’s too early to say if shoe manufacturers like Hoka will stand the take a look at of time. Maybe the recognition of those newer manufacturers will diminish after which may very well be considered as a fad. But when these manufacturers proceed to develop, they may take extra market share away from Nike and that would result in decrease earnings and a cheaper price to earnings a number of.

I’m involved that the Federal Reserve goes to overlook the prospect to decrease charges earlier than inflicting a recession. There are already main warning indicators that the financial system is slowing down. Some shoppers are clearly strapped now and this may be seen by wanting on the rising delinquencies with auto loans in addition to file ranges of bank card debt. These shoppers may very well be slicing again on bills, simply as Nike is doing and that would lead to additional draw back, particularly if a full-blown recession develops within the coming months.

Additionally, China stays a possible draw back danger as a result of the financial system just isn’t as sturdy because it has been prior to now and due to a possible commerce conflict.

In Abstract

I imagine Nike has an extremely robust model that’s identified world wide. I additionally imagine that this inventory might need skilled the kind of capitulation that marks the underside in a inventory in addition to a shopping for alternative. Nevertheless, it’s by no means simple to get the precise backside and challenges lie forward for Nike, so I’m simply accumulating shares over time. By doing so I can make the most of any additional weak point.

I’m enthusiastic about plenty of catalysts for Nike and its inventory, which incorporates the Paris Olympics, in addition to different main sporting occasions in 2024, and the Fall Investor Day, which I see as an occasion that the CEO will wish to use to show skeptics incorrect. I’m additionally glad to be investing in an organization with such a terrific stability sheet, which I believe provides administration loads of sources to get innovation and different development drivers again on monitor.

No ensures or representations are made. Hawkinvest just isn’t a registered funding advisor and doesn’t present particular funding recommendation. The data is for informational functions solely. You must all the time seek the advice of a monetary advisor

[ad_2]

Source link