[ad_1]

franckreporter

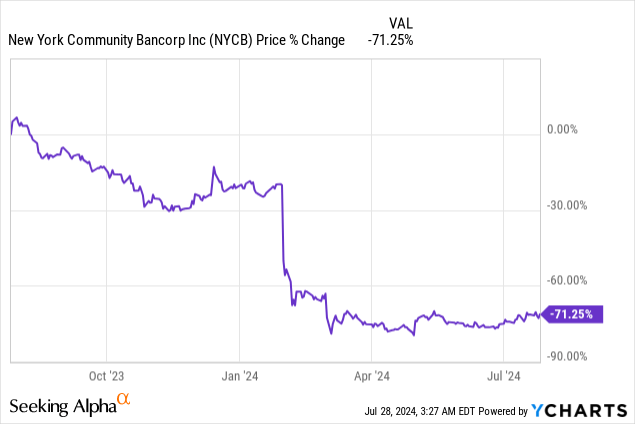

New York Neighborhood Bancorp (NYSE:NYCB) made information earlier this yr when it was pressured to lift fairness and lower its dividend as a result of issues creeping up in its industrial mortgage ebook. The regional lender’s second-quarter outcomes confirmed strain on internet revenue in addition to regularly unfavorable credit score developments, together with within the multi-family enterprise. Nevertheless, the financial institution is making progress in promoting non-strategic property as a way to reorganize its enterprise and enhance its liquidity place. NYCB can be conducting an in-depth evaluation of its mortgage publicity, and traders can anticipate New York Neighborhood Financial institution to promote extra property sooner or later. I imagine the chance profile remains to be very a lot skewed to the upside, on condition that New York Neighborhood Financial institution is buying and selling at a steep low cost to its tangible ebook worth.

Earlier ranking

I really helpful shares as a purchase of New York Neighborhood Financial institution in February — Why I Am Shopping for The 70% Dividend Lower — and confirmed my ranking after the regional lender secured a $1.0B strategic fairness funding in March. Though the financial institution reported a drastic enhance in credit score provisions once more within the second-quarter, the deterioration in credit score high quality was broadly anticipated, which explains why shares hardly moved after earnings. I imagine strategic measures, such because the sale of non-core property, assist scale back steadiness sheet dangers and enhance liquidity, and the regional lender may return to development in FY 2025.

NYCB’s second-quarter outcomes, non-core asset gross sales, unfavorable credit score developments

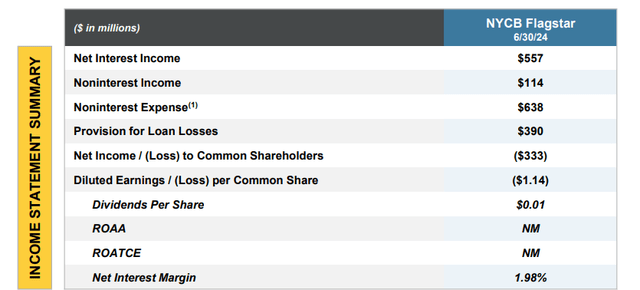

New York Neighborhood Financial institution reported total weak outcomes for the second quarter as a result of continuous mortgage issues within the financial institution’s CRE portfolio. The regional lender reported a internet lack of $333M or $1.14 per share, in comparison with a revenue of $405M or $1.66 per share within the year-earlier interval. The decline in earnings was pushed mainly by declining credit score high quality in New York Neighborhood Financial institution’s mortgage industrial actual property mortgage portfolio.

NYCB

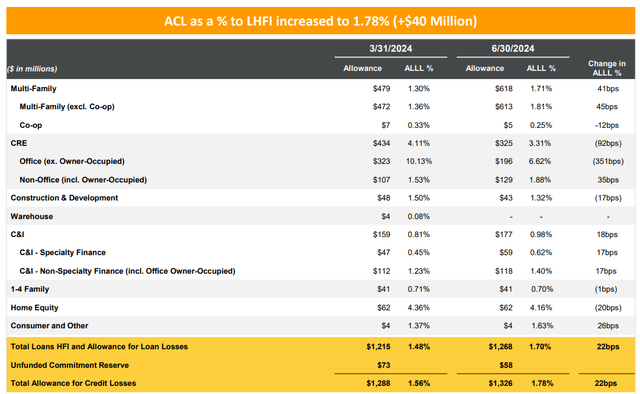

New York Neighborhood Financial institution’s outcomes had been primarily impacted by an nearly 700% year-over-year enhance in credit score provisions: within the second quarter, the lender’s credit score loss provisions amounted to $390M, in comparison with simply $49M final yr. Consequently, the financial institution’s complete allowance for credit score losses additionally elevated, from 1.56% in Q1’24 to 1.70% in Q2’24, primarily as a result of weak point in multi-family loans. On this section, the allowance for mortgage losses elevated by 0.41 PP quarter over quarter to 1.71%.

New York Neighborhood Corp

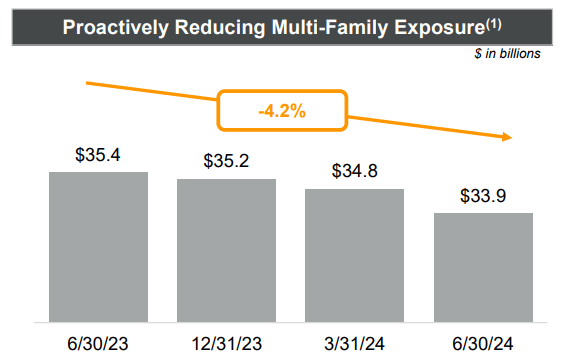

New York Neighborhood Financial institution has initiated a complete evaluation of its multi-family loans and acknowledged that it needs to shrink its portfolio. As of the tip of the June quarter, NYCB had $33.9B in multi-family publicity, displaying a decline of 4.2% yr over yr. The sale of multi-family mortgage property is about to cut back the financial institution’s steadiness sheet dangers in addition to enhance NYCB’s liquidity profile.

New York Neighborhood Corp

New York Neighborhood Financial institution has already made some progress in bettering its liquidity profile and introduced final week that it divested extra non-strategic property these days: it offered its residential mortgage servicing enterprise for $1.4B to Mr. Cooper, a mortgage originator and servicer. The lender additionally closed the sale of its $6.1B mortgage warehouse portfolio to JPMorgan & Chase this month, and each gross sales are optimistic developments for the financial institution. NYCB had complete liquidity of $33B in Q2’24 (not together with the sale of the mortgage warehouse portfolio), displaying a rise of $5B quarter over quarter.

I anticipate extra non-strategic asset gross sales for New York Neighborhood Financial institution within the the rest of the yr, mainly to dump mortgage dangers and shore up the lender’s steadiness sheet. Multi-family loans are one space the place I can see elevated sale exercise. New York Neighborhood Financial institution can be making use of a strict value discount focus to its banking operations, which may assist decrease working bills going ahead.

NYCB’s valuation

New York Neighborhood Financial institution nonetheless very a lot has a distressed valuation. Nevertheless, I imagine the rise in credit score loss provisions was not that a lot of a shock given the surge in credit score provisions in Q1’24, which additionally explains why traders barely reacted to the lender’s second-quarter earnings report.

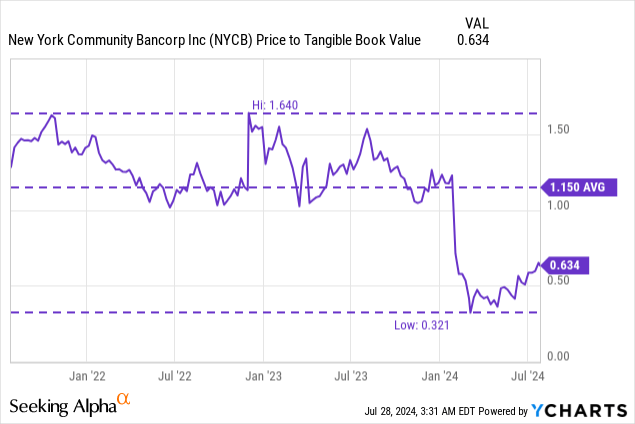

Shares of New York Neighborhood Financial institution At the moment are priced at a 37% low cost to the lender’s tangible ebook worth which displays deep issues in regards to the financial institution’s portfolio high quality, but in addition, in my view, alerts a excessive margin of security on condition that NYCB is shoring up its steadiness sheet and making progress in boosting its liquidity profile. The three-year common P/TBV ratio was 1.15X, considerably larger in comparison with the place the valuation of NYCB stands at present.

In the long run, I imagine it’s not unreasonable to anticipate New York Neighborhood Financial institution’s shares to return to not less than a 1.0X price-to-TBV ratio, though that is seemingly solely going to occur if the financial institution will get a grip on its credit score points, particularly within the multi-family section, and avoids a deterioration within the financial institution’s total credit score development. The financial institution’s tangible ebook as of June 30, 2024 was $20.89 which I see as my long-term revaluation goal for NYCB. If New York Neighborhood Financial institution continues to restructure its operations, down-sizes its (multi-family) mortgage ebook, and returns to development in its core banking enterprise in FY 2025, I positively can see shares of NYCB commerce at 1.0X tangible ebook worth.

Dangers with valuation

Crucial development that traders have to observe right here is the development in portfolio high quality, particularly in multi-family. The Q2’24 enhance in credit score provisions was type of anticipated, and it’s broadly accepted that the financial institution’s full-year 2024 outcomes will not be going to be nice. Nevertheless, because the financial institution restructures and focuses on promoting extra non-strategic property and elevating capital, I imagine NYCB may have a much-improved danger profile in FY 2025. What would change my thoughts about NYCB is that if the financial institution’s credit score loss provisions stored surging all through the second half of the yr or if the financial institution did not shrink its multi-family portfolio.

Ultimate ideas

All issues thought of, Q2’24 was not a completely dangerous quarter for New York Neighborhood Financial institution. The credit score development remained weak, as a result of points within the multi-family mortgage portfolio, however the financial institution has been profitable in promoting non-core property and elevating money, which matches a great distance in lowering steadiness sheet dangers. The regional lender simply earlier than earnings introduced that it additionally offered its residential mortgage servicing enterprise for $1.4B. What retains my purchase ranking in place is that the financial institution’s shares proceed to promote at a really giant low cost to tangible ebook worth. If New York Neighborhood Financial institution can keep away from an escalation of credit score issues within the second half of the yr and return to earnings development in FY 2025, I imagine traders may see a severe try at a share value revaluation!

[ad_2]

Source link