[ad_1]

adventtr

Funding Thesis

The continuing market circumstances considerably restricted Alpine Earnings Property Belief’s (NYSE:PINE) means to develop acquisition-wise throughout the 2023 – 2024 YTD interval. The administration offered a coherent funding technique mirrored in PINE’s enterprise choices that the Firm intends to comply with till the market circumstances enhance or the hole between patrons’ and sellers’ expectations narrows.

Whereas the Firm presents a sexy dividend yield and has a seemingly opportunistic valuation a number of, there are additionally a number of elements limiting the upside potential and making a few of its opponents throughout the similar property sector or REITs from different niches noticeably extra interesting options with higher risk-to-reward ratios (I’ve offered some solutions throughout the later sections of the evaluation). These elements embody:

unfavourable debt maturity schedule stable however not elite enterprise metrics with room for enchancment excessive tenant focus incapacity to supply enticing property acquisition alternatives within the present market turbulence within the AFFO per share progress and a modest dividend progress

Nonetheless, PINE should still unlock some upside potential upon overcoming the headwinds ensuing from the present market circumstances. Furthermore, the dividend yield is enticing and supported by an inexpensive payout ratio, which can make PINE value holding for income-oriented buyers. Due to this fact, I’ve a impartial view of the Firm summarized with a “maintain” ranking.

Introduction

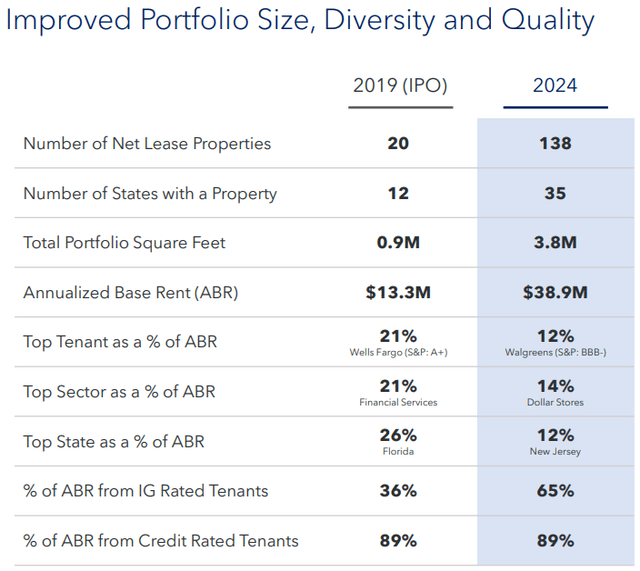

PINE is the smallest triple-net lease REIT analyzed inside Money Movement Venue. As of March 2024, the Firm owned 138 properties throughout 35 states with a complete sq. ft. of three.8m. It had its IPO in 2019, and since then, the Enterprise expanded its portfolio by virtually 120 properties and improved its key enterprise metrics.

PINE’s Investor Presentation

Focusing on the retail/service-oriented properties, PINE operates throughout the similar property sector as:

NETSTREIT (NTST) Agree Realty Company (ADC) Realty Earnings (O) NNN REIT (NNN)

Nevertheless, PINE is considerably smaller than every of the entities talked about. Please discuss with the desk under. On this article, I’ve analyzed PINE’s enterprise and steadiness sheet and offered its valuation outlook – with every part supported by a comparability to its bigger opponents (excl. O).

Desk 1: Variety of properties for chosen entities

PINE NTST ADC NNN Variety of properties 138 628 2 161 3 546 Click on to enlarge

PINE – Overview

Key enterprise metrics

Trying on the key enterprise metrics, together with occupancy fee, weighted common lease time period (WALT), and tenant construction could assist buyers consider the general high quality of a portfolio and the negotiating place of an analyzed REIT. Whereas PINE’s occupancy fee of 99.0% is effectively above the historic median for S&P 500 REITs equal to 94.8%, there’s nonetheless some room for enchancment as its noticeably bigger opponents uphold increased ranges of this metric. For reference:

NTST – 100% ADC – 99.6% NNN – 99.4%

Trying on the WALT standing at 6.9 years, whereas it ensures a sure diploma of money circulation predictability and security, it stands effectively under the degrees secured by the preferred triple-net lease REITs working throughout the similar phase of a retail/service-oriented property sector. For reference:

NTST – 9.2 ADC – 8.2 NNN – 10.0

PINE leases its properties on a triple-net lease foundation, which is a extremely beneficial kind of settlement to the owner. For readers unfamiliar with this time period, it’s a kind of settlement that entails the tenant masking a considerable quantity of prices associated to working and sustaining the property (together with taxes, insurance coverage, and repairs). These contracts additionally sometimes embody annual hire escalations, typically starting from 1% to 2%, which can not look like loads however they have an inclination so as to add up over time and fall straight into the underside line because of the triple-net lease construction.

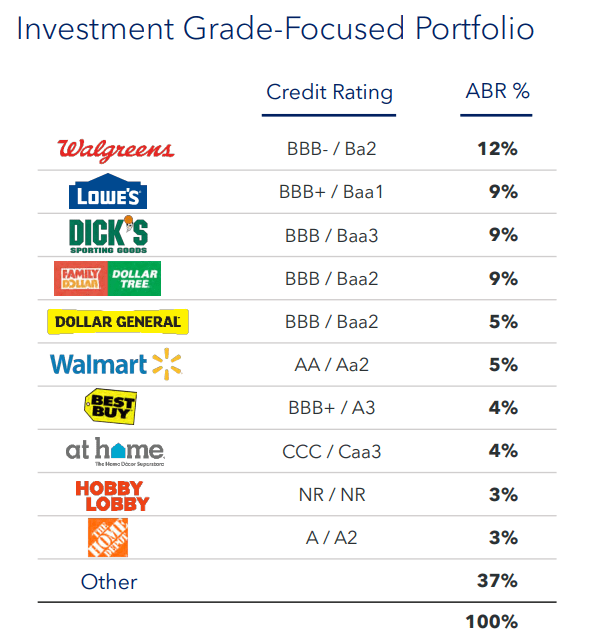

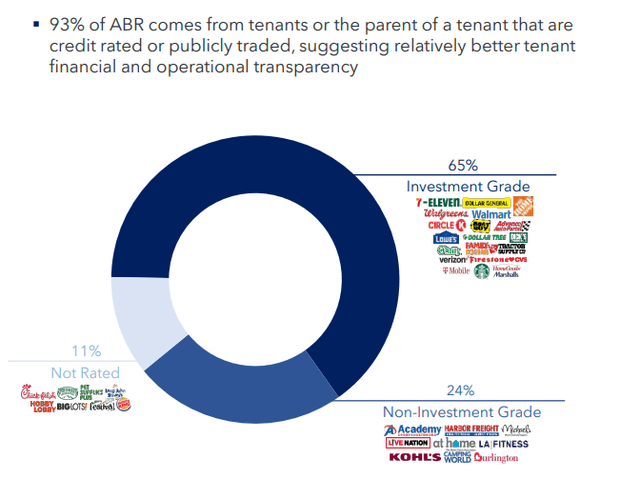

PINE has a comparatively excessive tenant focus with the Prime 10 tenants liable for ~63% of the ABR. PINE addresses this danger by concentrating on the investment-graded tenants that present common monetary stories, which helps the monitoring of their monetary well being. Nevertheless, that’s nonetheless a quantity considerably increased than what I want to see, because it will increase the magnitude of the potential affect of any tenant points on PINE’s monetary efficiency. For reference, the above metric stood at:

52.3% for NTST 37% for ADC

PINE’s Investor Presentation PINE’s Investor Presentation

Dividends & Progress

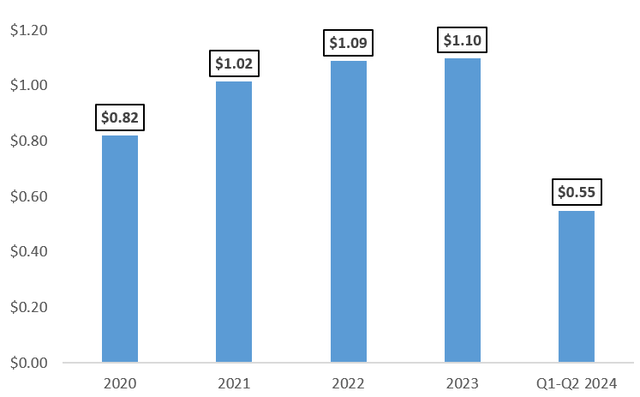

Throughout the 2021 – 2023 interval (with 2020 as a base yr) PINE delivered a stable AFFO per share CAGR of 12.7%. Nevertheless, it’s because of the dynamic improve year-over-year in 2021 amounting to 52.9%. It later slowed right down to 11.3% year-over-year in 2022. Furthermore, its AFFO per share declined 15.8% year-over-year in 2023. That’s the first y-o-y AFFO per share decline in a retail/service-oriented REIT talked about inside Money Movement Venue. Its opponents had been able to delivering stable progress with out such turbulence, which throughout the identical interval amounted to:

20.9% CAGR for NTST 7.3% CAGR for ADC 9.1% CAGR for NNN

Whereas PINE’s 2024 steerage assumes 4.4% AFFO per share progress y-o-y, the Firm has a historical past of falling under the low finish of its main steerage. For particulars, please discuss with the desk under.

Desk 2: AFFO per share of chosen entities

Entity 2020 2021 2022 2023 2024E (on midpoint) PINE $ 1.04 $ 1.59 $ 1.77 $ 1.49 $ 1.555 NTST $ 0.69 $ 0.94 $ 1.16 $ 1.22 $ 1.265 ADC $ 3.20 $ 3.51 $ 3.83 $ 3.95 $ 4.12 NNN $ 2.51 $ 3.06 $ 3.21 $ 3.26 $ 3.32 Click on to enlarge

PINE’s dividend presently yields ~7.1% with an inexpensive forward-looking AFFO payout ratio of ~69.6%. Whereas it might be interesting to some income-oriented buyers, the dividend progress has been negligible throughout the 2023 – 2024 YTD interval.

Chart 1: Dividend per share of PINE

Personal compilation based mostly on PINE

Funding technique

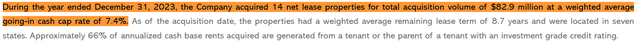

After buying a powerful 51 properties in 2022 for a complete of $187.4m with a weighted common cap fee equal to 7.1%, the Firm slowed down with property acquisitions shifting into 2023 and 2024.

PINE’s This fall 2022 outcomes press launch

Throughout the full yr 2023, PINE acquired 14 properties for a complete of $82.9m, with a weighted common preliminary cap fee equal to 7.4%.

PINE’s This fall 2023 outcomes press launch

Furthermore, throughout This fall of 2023, the Firm’s funding exercise was oriented round mortgage loans and share repurchases, as defined by PINE’s CEO, John Albright throughout the This fall 2023 Earnings Name:

Throughout the fourth quarter, nearly all of our funding exercise was concentrated within the first mortgage investments and share repurchases, and we imagine these funding alternatives present enticing risk-adjusted returns, in comparison with different alternatives obtainable available in the market.

Throughout the quarter, we originated practically $31 million of first mortgage mortgage investments and purchased two single-tenant internet lease properties for $3 million. The preliminary yield on our mortgage investments was 9.2% and the money cap fee of our property acquisitions was 7.3%. Our largest funding was a low leverage $24 million first mortgage secured, by 41 retail properties.

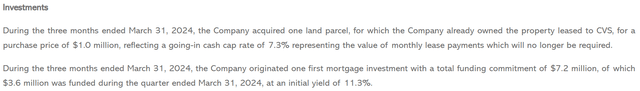

The above tendency continued throughout Q1 2024, as PINE dedicated $7.2m of a complete of $8.2m to mortgage investments.

PINE’s Q1 2024 outcomes press launch

PINE intends to maintain mortgage investments a comparatively small component of its technique. Nevertheless, they do present PINE with monetary and venture pipeline-related advantages, particularly throughout the present market circumstances underneath which buyer-to-seller expectations grew additional aside. As defined by the Firm’s CEO throughout the This fall 2023 Earnings Name:

Whereas we intend for our mortgage investments, to stay a comparatively small element of our general asset base and technique. They do present future buy choices for our acquisition pipeline and function catalysts for our future partnership alternatives with sponsors, and we imagine they provide compelling risk-adjusted yield supported by robust tenant credit and well-capitalized sponsors.

The Firm nonetheless observes such boundaries accompanying the standard acquisition market and introduced that it’ll uphold its loan-oriented funding technique in Q2 2024, as indicated inside its Q1 2024 Earnings Name:

On the property acquisition entrance, we noticed fewer enticing core funding alternatives because of the reluctant sellers. Nevertheless, we anticipate that because the market additional adjusts to increased for longer charges, the transaction market could change into extra productive for us. We’re seeing extra high-yielding and higher risk-adjusted mortgage alternatives, which we anticipate to pursue within the second quarter.

It’s value mentioning that whereas PINE appears to be unable to safe enticing offers on the standard acquisition entrance, a number of the hottest retail/service-oriented REITs carry on increasing their portfolio (e.g. ADC, NNN, Important Properties Realty Belief (EPRT)).

Stability sheet

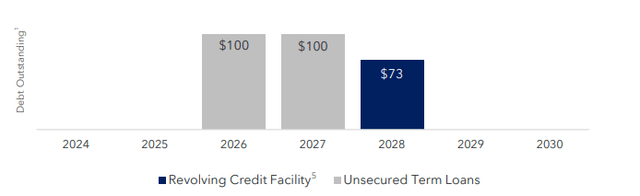

PINE has a comparatively short-term weighted common debt maturity time period, with its debt maturities concentrated throughout the 2026 – 2028 interval. Whereas the Firm has no debt maturities till Might 2026, its opponents have finished a a lot better job at laddering the maturity schedule. On the brilliant aspect, the Firm has no debt maturities till Might 2026 and has mounted the rate of interest on its excellent debt by 2026. Nonetheless, prolonging the excessive rate of interest atmosphere till at the very least Might 2026 may negatively affect PINE’s monetary efficiency by forcing it to refinance at a better value. For reference, the weighted common debt maturity time period amounted to:

3.9 for NTST 7 for ADC 11.8 for NNN

PINE’s Investor Presentation

PINE’s liquidity is supported by ~$185m ensuing from money, restricted money, and ~$177m of undrawn revolving credit score facility.

Valuation outlook

As an M&A advisor, I often depend on a a number of valuation technique that may be a main instrument in transaction processes, because it permits for accessible and market-driven benchmarking. Nevertheless, it’s essential for buyers to grasp the business-wise determinants of a given market valuation. Solely then could they have the ability to determine the market’s over/underestimations of a given enterprise.

That mentioned, please assessment the desk under with forward-looking P/FFO ratios of PINE and chosen REITs.

Desk 3: Ahead-looking P/FFO a number of

Click on to enlarge maintain ranking for NTST – NETSTREIT: There Are Extra Enticing Alternatives Given Its Valuation purchase ranking for ADC – Agree Realty Company: Elite-Degree Enterprise Metrics With Room To Additional Outperform purchase ranking for NNN – NNN: Nice Choose For Stability-Looking for Traders

I’m conscious that the above entities are noticeably/considerably bigger than PINE, nonetheless, I’ve chosen them as a reference level, as a result of:

every of them is a triple-net lease REIT every of them targets retail/service-oriented properties throughout the similar phase every of them is targeted on this particular area of interest

PINE has some weaknesses when in comparison with the important thing sector gamers, together with:

worse steadiness sheet stable however not elite enterprise metrics excessive tenant focus incapacity to supply enticing property acquisition alternatives within the present market turbulence within the AFFO per share progress and a modest dividend progress

That mentioned, I imagine that the Firm’s comparatively low 9.9x P/FFO a number of is justified. I do not see a lot upside potential ensuing from a number of appreciation, and given no main shifts available in the market atmosphere, in addition to no materials hostile adjustments, it’s going to stay throughout the 9.0x – 10.5x vary.

The underside line

There are extra enticing alternatives throughout the similar property sector, together with ADC, NNN, or shifting just a little bit additional concerning the goal property kind – EPRT. Trying on the REIT business as an entire, there are additionally much better alternatives inside different property sectors, together with VICI Properties (VICI), Prologis (PLD), or EPR Properties (EPR), which have thus far been the one firms to obtain a “robust purchase ranking” inside Money Movement Venue.

Nonetheless, enterprise choices are coherent with administration communication, buyers have been supplied with a proof for PINE’s present funding actions, and the Firm presents a high-yielding dividend at present costs. Supplied market circumstances shift, there’s potential for acceleration of progress and enchancment of the general enterprise scenario.

Whereas the potential for value appreciation is restricted, the dividend yield stays enticing, making PINE value contemplating for income-oriented buyers. There’s room for enchancment within the enterprise and worth potential. Nevertheless, higher options additionally stop me from contemplating PINE as a inventory value investing in. Due to this fact, that may be a “maintain” ranking.

[ad_2]

Source link