[ad_1]

Whereas the market has rebounded following a poor begin to the month in September, some altcoins are nonetheless scuffling with the leftover bearishness. NEAR continues with the checklist of altcoins that sustain their losses even because the majors, together with Bitcoin and Ethereum, recuperate from their respective slumps. In keeping with CoinGecko, the token fell by 21% since final week regardless of the market’s 3percentuptick right this moment.

Though NEAR is underperforming, developments on-chain proceed to offset the market’s bearishness. One of the notable developments on NEAR is Libre Capital providing tokenized real-world property (RWAs) on chain, bringing institutional curiosity to the platform

RWAs Create Buzz For The Protocol

Libre Capital is a brand new crypto asset administration agency supported by market giants like Brevan Howard, Hamilton Lane, and Nomura’s Laser Digital. It was based 4 months in the past and has since skilled large upward momentum. In keeping with Libre Capital Founder and CEO Avtar Sehra, Libre surpassed the $100 million asset below administration mark, cementing the agency as one of many fastest-rising crypto asset administration firms available on the market.

Libre has achieved many milestones since our MVP launch 4 months in the past, surpassing our $100 million aum goal and increasing to a number of chains.

Launch on @NEARProtocol marks an important step in direction of our multichain wealth technique. Be taught extra right here: https://t.co/dGCqKENTXu

— Avtar Sehra (@avtarsehra) September 2, 2024

NEAR and Libre’s partnership will allow NEAR customers to entry tokenized variations of RWAs. As of writing, customers have entry to Hamilton Lane’s credit score Fund, Brevan Howard’s Grasp Fund, and Blackrock’s ICS Cash Market Fund, bridging the hole between crypto and the normal finance area.

In keeping with Sehra, the launch of Libre on NEAR is “an important step in direction of our multichain wealth technique” which hints at future assist for extra blockchains aside from NEAR. However for now, this improvement may assist carry in additional institutional traders on the platform.

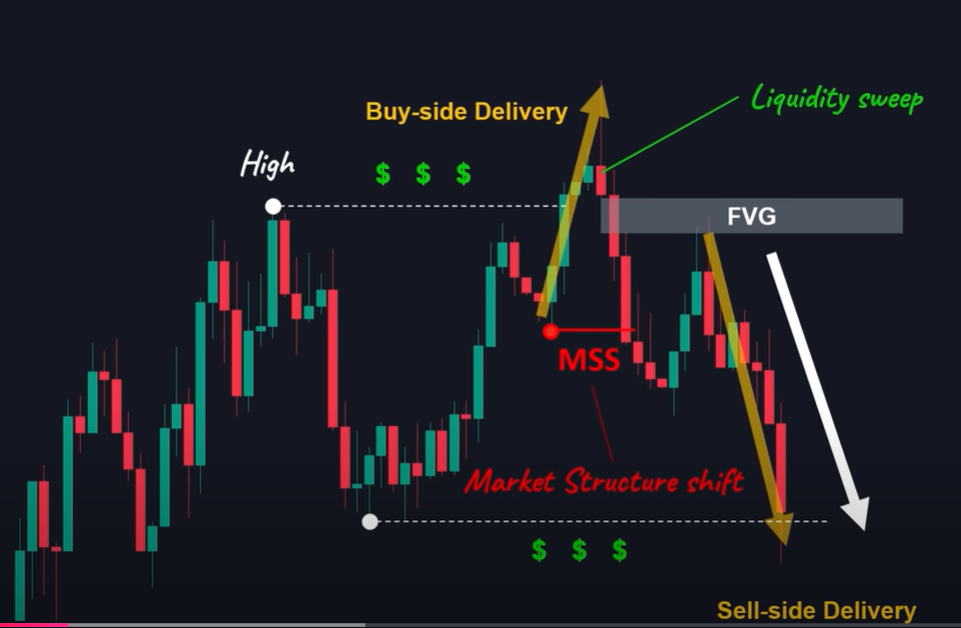

NEAR On Goldilocks Zone Buying and selling Vary

As of writing, the bears skilled a powerful rejection on the $3.8 worth flooring giving the bulls time to regroup and bounce. NEAR is now making an attempt to stabilize between the $3.8-$4.3 buying and selling vary, permitting traders and merchants to focus on $5.2 in the long run.

NEAR continues to expertise a powerful bearish momentum within the brief time period, however the bulls have since gathered sufficient momentum to cancel out the token’s decline. The issue now’s when will NEAR have sufficient push to interrupt by means of $4.3 within the medium time period.

The relative power index (RSI) means that the token may expertise a interval of low volatility the place the bears and the bulls could have an equally sturdy momentum. However after this, NEAR could have sufficient push to drive the bears out of the market, breaking by means of $4.3 within the medium time period earlier than deciding on the $4.3-$4.7 buying and selling vary.

Nevertheless, this worth motion is totally depending on the broader market momentum. If Bitcoin and Ethereum proceed to battle, NEAR could have a variety of floor to retake if the bears achieve breaking by means of $3.8.

Featured picture from Electromechanical Contractor Philippines, chart from TradingView

[ad_2]

Source link