[ad_1]

littleclie

Abstract

Following my protection on MSCI (NYSE:MSCI) in Apr’24, which I really useful a purchase score as I believed the valuation was low cost (inventory was oversold) and that the expansion outlook was not structurally impaired, this submit is to supply an replace on my ideas on the enterprise and inventory. MSCI continues to obtain a purchase score from me as varied indicators counsel progress will proceed to be sturdy. Any slowdown in progress is just about as a result of unsure macro setting, which ought to get higher as we get extra readability on the Fed’s resolution to chop charges and the US election involves an finish. Valuation can also be nonetheless low cost when in comparison with the market.

Funding thesis

On 23-07-2024, MSCI launched its 2Q24 earnings, which noticed income progress of 14% (natural progress was 9.7%), driving complete income to $707.9 million, beating the road’s estimate for ~12% y/y progress. Each phase contributed to this progress on an natural foundation, the place index income grew 9.8% y/y; analytics income grew 11.2%; ESG & Local weather income grew 10%; and personal belongings income grew 1.3%. By income sort, recurring subscription income grew 14.4%, trending increased than the consolidated stage as non-recurring income modestly dragged down progress efficiency (down 15% in 2Q24). EBITDA margins have been flat vs. 2Q23 at 60.7%, leading to an EPS of $3.64, beating consensus estimates of $3.55.

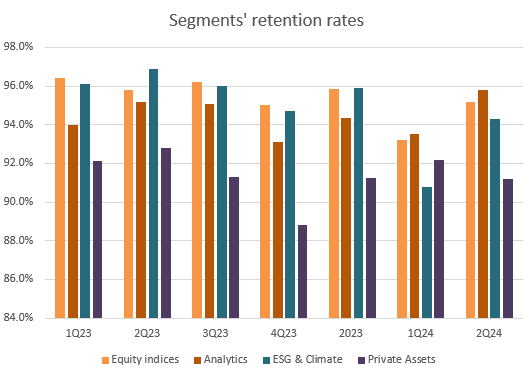

The principle detrimental narrative, I consider, that’s stopping the MSCI share worth from going increased might be the macro affect on lively asset managers (MSCI’s purchasers). There is no such thing as a doubt that MSCI is getting impacted because it results in purchasers tightening their budgets, longer gross sales cycles, and weak index recurring subscription income progress of 8% y/y (that is beneath the historic development of low-teens progress) on account of elevated cancellations. Nonetheless, I reiterate my view that progress is being delayed and never structurally impaired. If it was certainly a structural impairment to demand, the MSCI retention fee ought to see successful as purchasers churn. Nonetheless, that isn’t the case. In truth, retention charges rose throughout all segments besides ESG & Local weather (which I additionally assume is momentary as a result of US election, as mentioned beneath).

Personal calculation

2Q24 outcomes proceed to show that MSCI can proceed to develop healthily. A number of main indicators help my view. Primary, AUM in ETFs linked to MSCI indexes grew very strongly at 19% to a complete of $1.63 billion, and this translated straight into index asset-based charge progress of 18% within the quarter, accelerating from 13% in 1Q24. On condition that the market (utilizing S&P as a benchmark) is up so strongly on a year-to-date foundation (about 16%), this could proceed to drive sturdy fund inflows into ETFs and non-listed merchandise linked to MSCI indices.

Quantity two, the strong efficiency seen in MSCI’s Analytics phase (11% progress in 2Q24) exhibits that MSCI can also be benefiting from the unsure macro setting. Particularly, MSCI addresses funding managers want for analytical instruments to raised facilitate credit score and liquidity threat within the present financial setting. My expectations are that the macro state of affairs will keep unsure not less than till the tip of this yr, because the Fed has not particularly known as out when they’re chopping charges and the US election is in November. As such, Analytics phase progress ought to stay elevated.

Quantity three, to enhance its personal firm ESG protection, MSCI has entered right into a partnership with Moody’s [MCO] personal firm database, Orbis. In return, MSCI will present MCO with knowledge on its ESG scores. This partnership would not appear to be short-term as in 2025, each events agreed to broaden the partnership into personal credit score. It is a huge win for MSCI as a result of it considerably enhances the worth proposition of its ESG & Local weather providing immediately to purchasers – which additionally makes MSCI stickier. Buyers may be involved that this phase’s progress has slowed by 100bps to 10% vs 1Q24, however I don’t assume that is an space of concern. The rationale for the slowdown is probably going on account of US purchasers pulling again their investments in the intervening time as they’re unsure in regards to the upcoming US election – which is able to affect insurance policies associated to ESG. There is no such thing as a structural impairment to progress in any respect, as different areas like EMEA grew 17% and APAC grew 20%. My view is that this phase progress will recuperate submit the election, and total phase progress will inflect upward once more.

Valuation

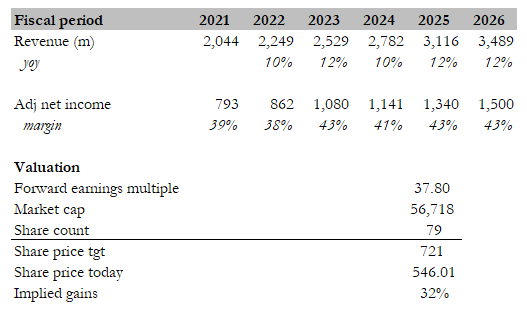

Personal calculation

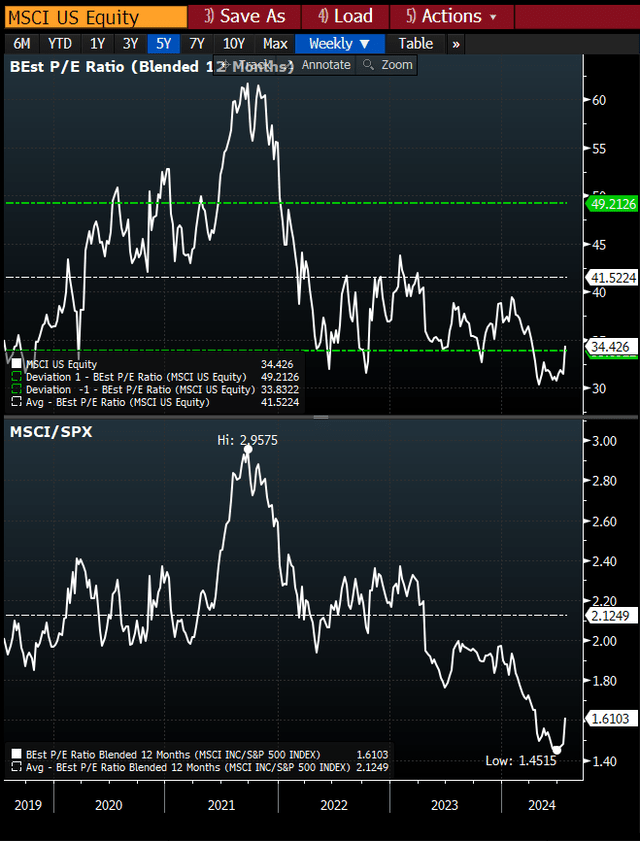

Even after the sharp improve within the share worth, I nonetheless consider there may be a pretty upside to the share worth. My revisited worth goal is now $721 primarily based on FY26e estimates (my earlier worth goal was $552 primarily based on FY25e estimates). On this revised mannequin, I’ve introduced down my FY24 estimates as I acknowledge the present unsure macro state of affairs will probably persist till the tip of the yr. Nonetheless, submit FY24, I’m anticipating MSCI to revert again to its normalized progress and margin profile (12% progress and 43% web margin). The variable here’s what a number of MSCI ought to commerce at, and I believe the easiest way continues to be to anchor expectations towards the S&P500 a number of. My earlier view was that MSCI would commerce again to ~1.8x of S&P’s common PE a number of, and this ratio has moved in my anticipated route after the market acknowledged MSCI’s sturdy 2Q24 outcomes. In a normalized setting, I consider this ratio will proceed to development again to the typical stage of two.1x. Doing the identical math and attaching 2.1x to the S&P common a number of of 18x, I consider MSCI will commerce as much as 38x ahead PE. That is roughly the typical the MSCI has been buying and selling at over the previous 5 years if we take away the COVID interval the place multiples went above 41x.

Bloomberg

Threat

The US business actual property business is liable to falling even additional, and thus far, the affect has been outstanding in MSCI’s outcomes, the place personal belongings natural income progress got here in weak at 1% y/y in 2Q on account of a business actual property slowdown, which impacted demand for MSCI’s transaction knowledge merchandise. If the business blows up, it may drag down total topline efficiency for MSCI. This might put a ceiling on how excessive valuations may probably rerate within the close to time period.

Conclusion

In conclusion, I reiterate my purchase score for MSCI. Whereas the macro setting is impacting lively asset managers, my view is that MSCI’s progress is delayed, not impaired, as evidenced by rising AUM in ETFs and shopper retention. The unsure setting till the US election additionally advantages MSCI’s Analytics phase. As for the slight weak point in ESG & Local weather, it’s probably momentary on account of traders’ considerations about how insurance policies associated to ESG could change after the election. Lastly, valuation stays enticing with upside potential.

[ad_2]

Source link