[ad_1]

First-time homebuyers in Canada stay closely reliant on monetary items for down funds, whilst financial situations have tightened.

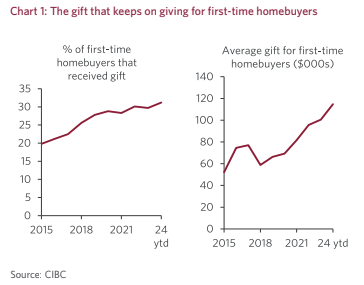

In keeping with a current examine by CIBC, 31% of first-time patrons obtained household assist for his or her down fee, a big enhance from 20% in 2015.

Regardless of a cooling housing market post-COVID, the common reward quantity has risen to $115,000, up 73% since 2019. This highlights the continued important function of household wealth in house buying, which helps mitigate housing inflation, however can also be widening the wealth hole, CIBC notes.

For these upgrading to bigger houses, referred to as “mover-uppers,” 12% obtained items, with a mean quantity of $167,000, in keeping with CIBC.

The correlation between reward quantities and residential costs stays robust, with items persevering with to extend whilst house costs have fallen 14% from their COVID-era peak. This enhance in reward sizes is probably going facilitated by mother and father downsizing and benefiting from excessive house costs when promoting their major residences, in keeping with the report.

In Ontario and British Columbia, the place housing affordability is especially stretched, 36% of first-time homebuyers obtained items, in comparison with the nationwide common of 31%. The common reward quantity in B.C. is $204,000, whereas in Ontario it’s $128,000.

Since 2019, reward quantities have elevated by 90% in B.C. and 52% in Ontario, reflecting the excessive price of homeownership in these areas.

Apparently, mover-uppers in Ontario and B.C. are usually not extra seemingly than the nationwide common to obtain items, however the quantities they obtain are greater. In Ontario, the common reward is $189,000, and in B.C., it’s $230,000, in comparison with the nationwide common of $167,000.

This phenomenon helps mitigate the affect of housing inflation for patrons but additionally contributes to the widening wealth hole in Canada. As house costs stay excessive, the pattern of counting on household items for down funds is more likely to proceed, highlighting the continued challenges of housing affordability in Canada.

OSFI achieves 85% efficiency score

The Workplace of the Superintendent of Monetary Establishments (OSFI) just lately launched its 2023-24 Monetary Establishments Survey, offering insights into its efficiency from the attitude of assorted stakeholders, together with banks and insurance coverage firms.

The survey revealed an total satisfaction fee of 85% with OSFI’s efforts to make sure monetary system stability. Respondents praised OSFI for its clear regulatory steering, with 78% discovering it useful. A full 80% of establishments expressed satisfaction with OSFI’s supervisory actions, indicating confidence in its oversight capabilities.

Timeliness and responsiveness had been additionally highlighted, with 75% of respondents appreciating OSFI’s immediate communication and regulatory actions.

Nevertheless, there are areas for enchancment, with 28% of respondents recommending OSFI “streamline numerous initiatives” and/or “keep away from duplication.” One other 28% instructed the company “scale back the tempo of latest and up to date tips” or enable for extra time for the implementation of latest tips.

Six % of respondents requested “higher communication/transparency/clarifications” in any future OSFI tips.

Shopper spending down as Canadians “tighten their belts”

Summer season climate in June did not result in a rise in client spending, in keeping with RBC’s newest Shopper Spending Tracker.

The evaluation of current information discovered the current soar in client spending on discretionary items and providers in April and Might reversed in June as shoppers “tightened their belts.”

“On a per capita foundation, actual spending on client items declined for the primary time since Q3 final 12 months, and we don’t anticipate a turnaround within the close to time period,” report writer Carrie Freestone wrote.

“Whereas the Financial institution of Canada’s slicing cycle is underway after an preliminary 25 foundation level lower in June, rates of interest are nonetheless very restrictive as householders grapple with the affect of mortgage renewals,” she added. “It should take time for the affect of BoC cuts to ease client ache.”

Shopper behaviour has shifted notably with Canadians prioritizing important bills over luxurious objects. This pattern was evident within the decreased expenditures on eating out, leisure and journey, sectors that normally thrive throughout the summer time months.

The sluggish housing market additionally additional dampened client spending, with fewer house gross sales and a slowdown in new house building affecting associated purchases.

Shopper spending on housing building has been persistently declining since spring 2022, coinciding with the preliminary rise in rates of interest, as illustrated within the following chart:

RBC doesn’t foresee a turnaround in client spending till the fourth quarter of this 12 months, contingent on additional anticipated fee cuts from the Financial institution of Canada.

“Rates of interest stay excessive regardless of the Financial institution of Canada initiating an easing cycle earlier this month,” Freestone famous. “Consequently, common debt servicing prices as a share of family revenue are anticipated to remain elevated for a while.”

US GDP is available in scorching

U.S. financial development shocked to the upside late final week, giving markets motive for pause regarding the present rate-cut expectations which might be priced in for the U.S. Federal Reserve.

Actual GDP development south of the border got here in at a scorching 2.8% quarter-over-quarter, up from 1.4% in Q1 and properly above the two% that was anticipated for Q2. This was pushed by a 2.3% enhance in client spending, whereas sturdy items spending was up 4.7% within the quarter.

Core inflation measures eased to an annualized 2.9% from 3.7% within the first quarter, balancing out the hotter-than-expected headline studying.

“The financial system seems to have carried out at (or considerably above) potential development within the first half of 2024, making it troublesome to establish if client inflation is presently on a sustainable path to 2.0%,” famous BMO Chief U.S. economist Scott Anderson.

The info is available in only a week forward of the following Federal Open Market Committee (FOMC) assembly on July 30-31, wherein markets are presently anticipating one more fee maintain.

As a substitute, markets anticipate the Fed will seemingly lower charges by 25 bps at its September assembly, with Scotia Economics suggesting one other one to 2 extra cuts are doable by the tip of the 12 months.

A recap of final week’s headlines:

Will the Financial institution of Canada ship one other 175 bps in fee cuts? TD and CIBC say sure

Learn extra

Overwhelming majority of Higher Toronto new condominium buyers dropping cash each month: report

Learn extra

Prime fee falls to six.70%, making variable fee mortgages extra engaging

Learn extra

Following Financial institution of Canada fee lower, Macklem says it’s “cheap” to anticipate extra

Learn extra

Right here’s why markets are betting on a Financial institution of Canada fee lower

Learn extra

90% of B.C. communities undertake province’s plans for extra small-scale housing

Learn extra

Visited 136 occasions, 136 go to(s) in the present day

downpayments newest mortgage information Workplace of the Superintendent of Monetary Establishments OSFI rbc US GDP

Final modified: July 29, 2024

[ad_2]

Source link